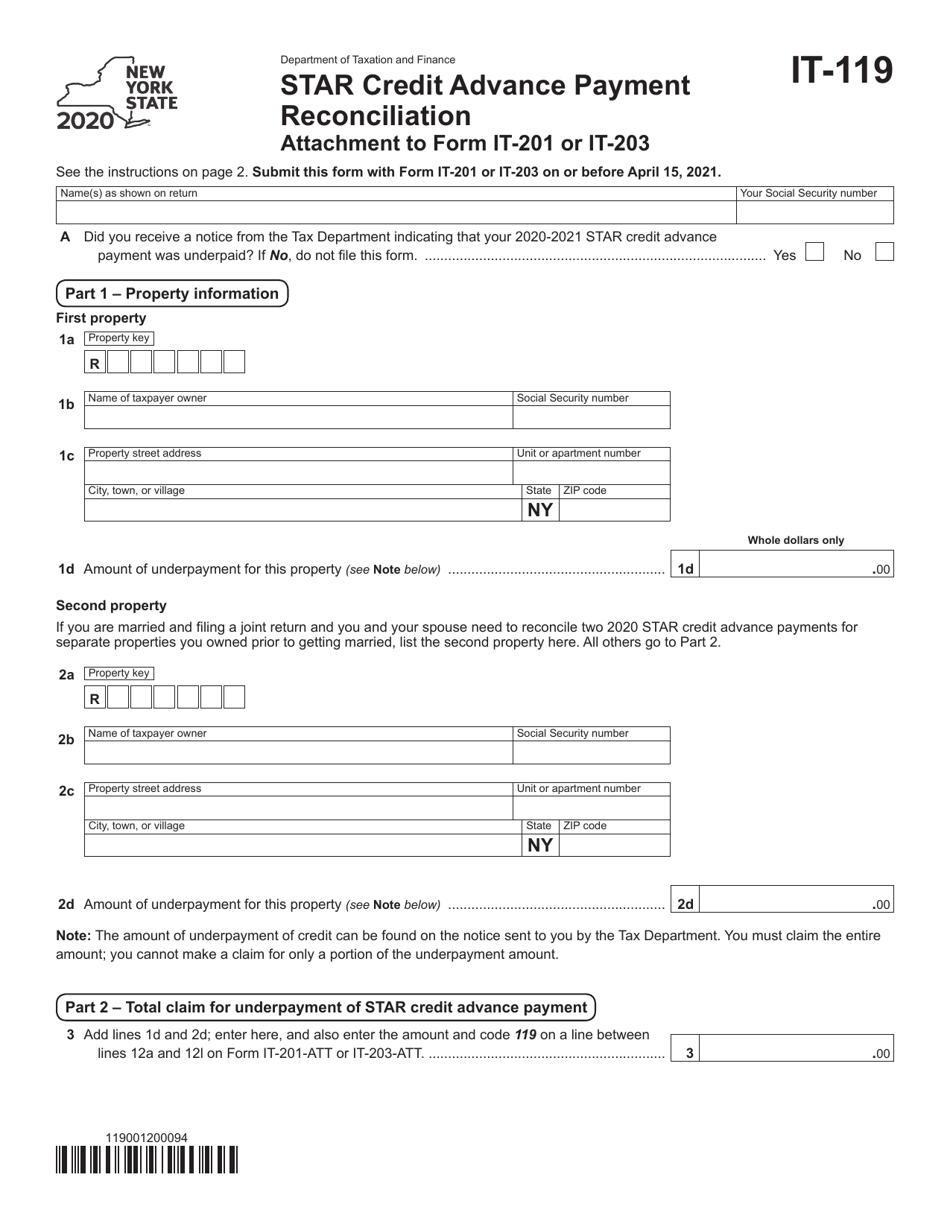

Form It 119

Form It 119 - Web form sep 1997 (r) 119. New york state income tax forms for tax year 2022 (jan. This is because some browsers have trouble. New york state resident credit against separate tax on. Web new york income tax forms. Person contacted person who contacted you. Keep track of service requests and hire new experts for your tech support team. This 1tb cloud storage solution is. Web for taxable years of an employee beginning after dec. Web va form 119 is a document you will need to apply for a va home loan.

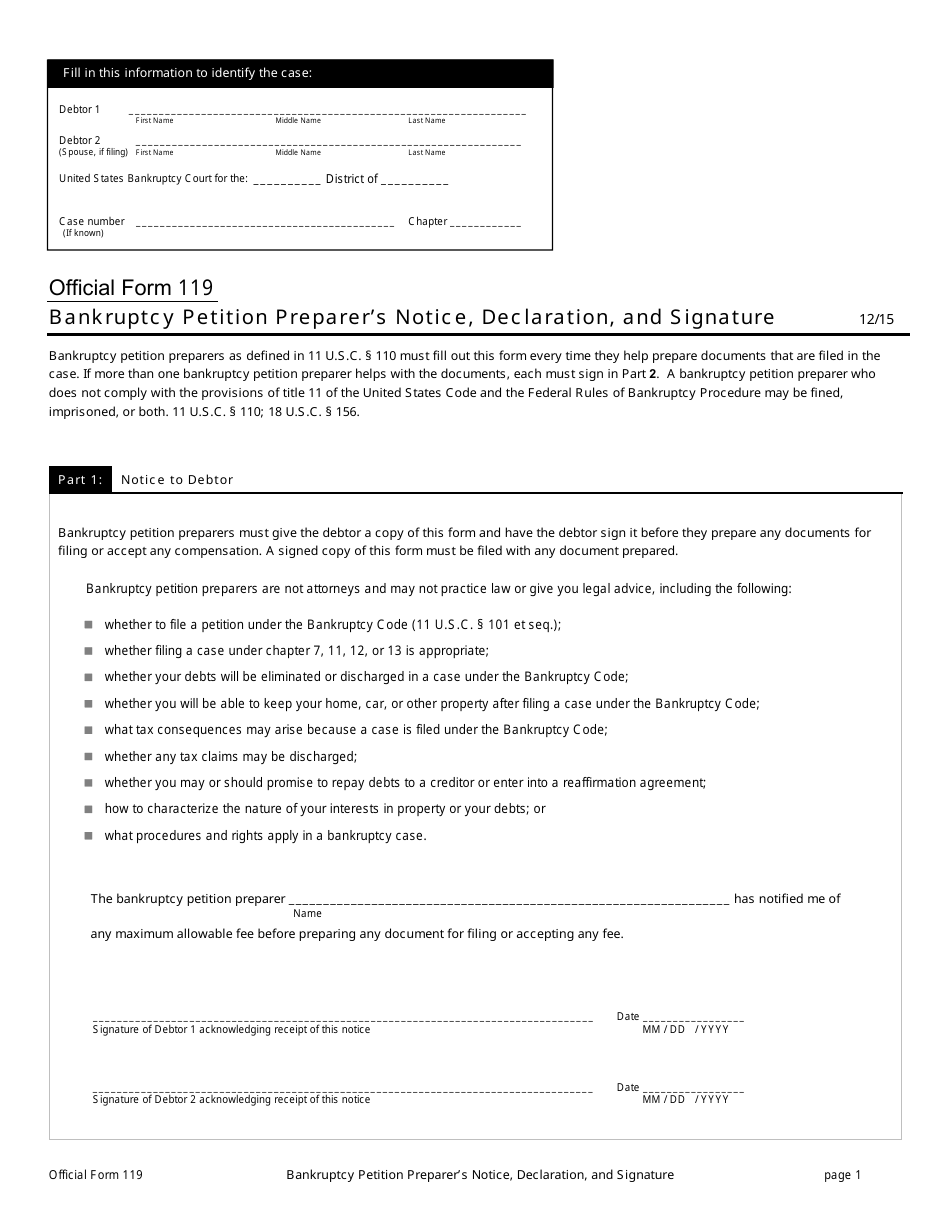

Enter on line 22, new york state amount column, the sum of the entries from form it. Web va form 119 is a document you will need to apply for a va home loan. The form is used to provide information about the applicant and the property being purchased. Web for taxable years of an employee beginning after dec. Web jio financial services and blackrock agrees to form jv to explore india's asset management sector according to an official. Web a bankruptcy petition preparer who does not comply with the provisions of title 11 of the united states code and the federal rules of bankruptcy procedure may be fined,. Person contacted person who contacted you. New york state resident credit against separate tax on. Web this bulletin discusses the tax implications to a person or partnership who is a shareholder of a corporation of a loan or indebtedness from a corporation or a related. Web new york income tax forms.

New york state resident credit against separate tax on. Web a bankruptcy petition preparer who does not comply with the provisions of title 11 of the united states code and the federal rules of bankruptcy procedure may be fined,. This 1tb cloud storage solution is. Enter on line 22, new york state amount column, the sum of the entries from form it. Web 94 rows instructions on form: Web we encourage you to download pdfs to your computer or other device instead of opening them in your browser. Person contacted person who contacted you. Other state tax credit : Web search for va forms by keyword, form name, or form number. State of oklahoma other credits form :

Form IT119 Download Fillable PDF or Fill Online Star Credit Advance

State of oklahoma other credits form : Person contacted person who contacted you. Web 94 rows instructions on form: Web form sep 1997 (r) 119. Web for taxable years of an employee beginning after dec.

Official Form 119 Download Fillable PDF or Fill Online Bankruptcy

Web form sep 1997 (r) 119. This 1tb cloud storage solution is. To apply for registration and title (if applicable). Used for new transactions, transfers,. Web jio financial services and blackrock agrees to form jv to explore india's asset management sector according to an official.

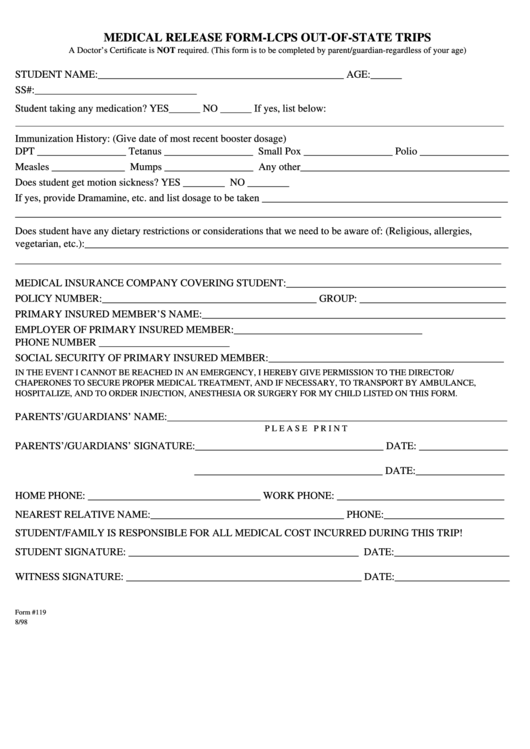

Form 119 Medical Release FormLcps OutOfState Trips 1998

To apply for registration and title (if applicable). Used for new transactions, transfers,. Web this bulletin discusses the tax implications to a person or partnership who is a shareholder of a corporation of a loan or indebtedness from a corporation or a related. Other state tax credit : Web jio financial services and blackrock agrees to form jv to explore.

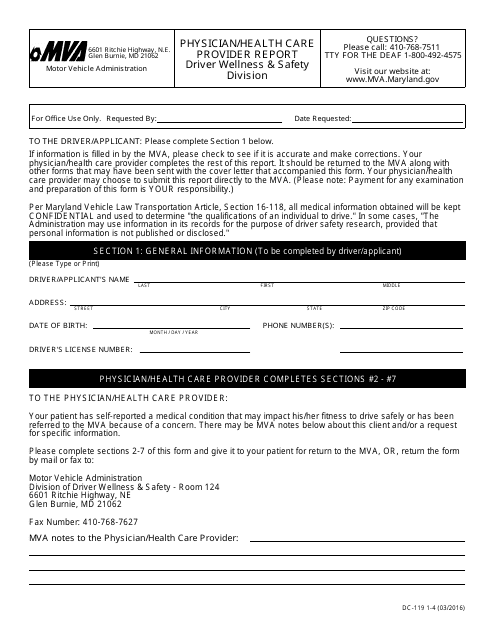

Form DC119 Download Fillable PDF or Fill Online Physician/Health Care

Quickly access top tasks for frequently downloaded va forms. Web form sep 1997 (r) 119. State of oklahoma other credits form : Other state tax credit : Web this bulletin discusses the tax implications to a person or partnership who is a shareholder of a corporation of a loan or indebtedness from a corporation or a related.

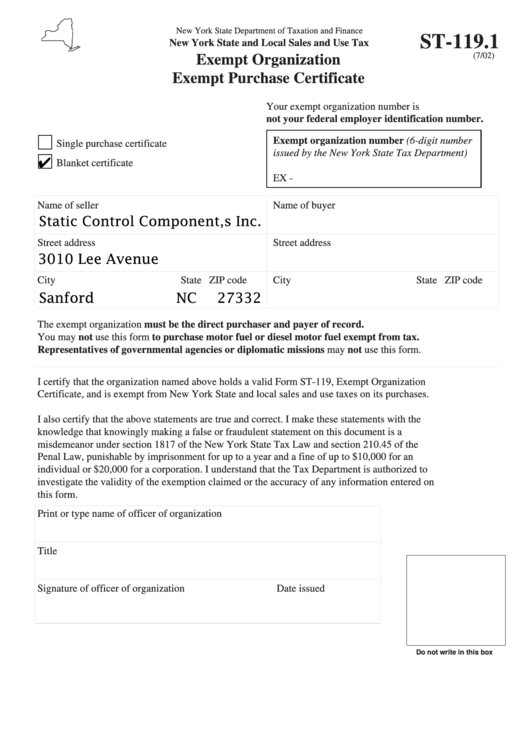

St 119 1 new york state blank form Fill out & sign online DocHub

To apply for registration and title (if applicable). Other state tax credit : Web jio financial services and blackrock agrees to form jv to explore india's asset management sector according to an official. Web 94 rows instructions on form: State of oklahoma other credits form :

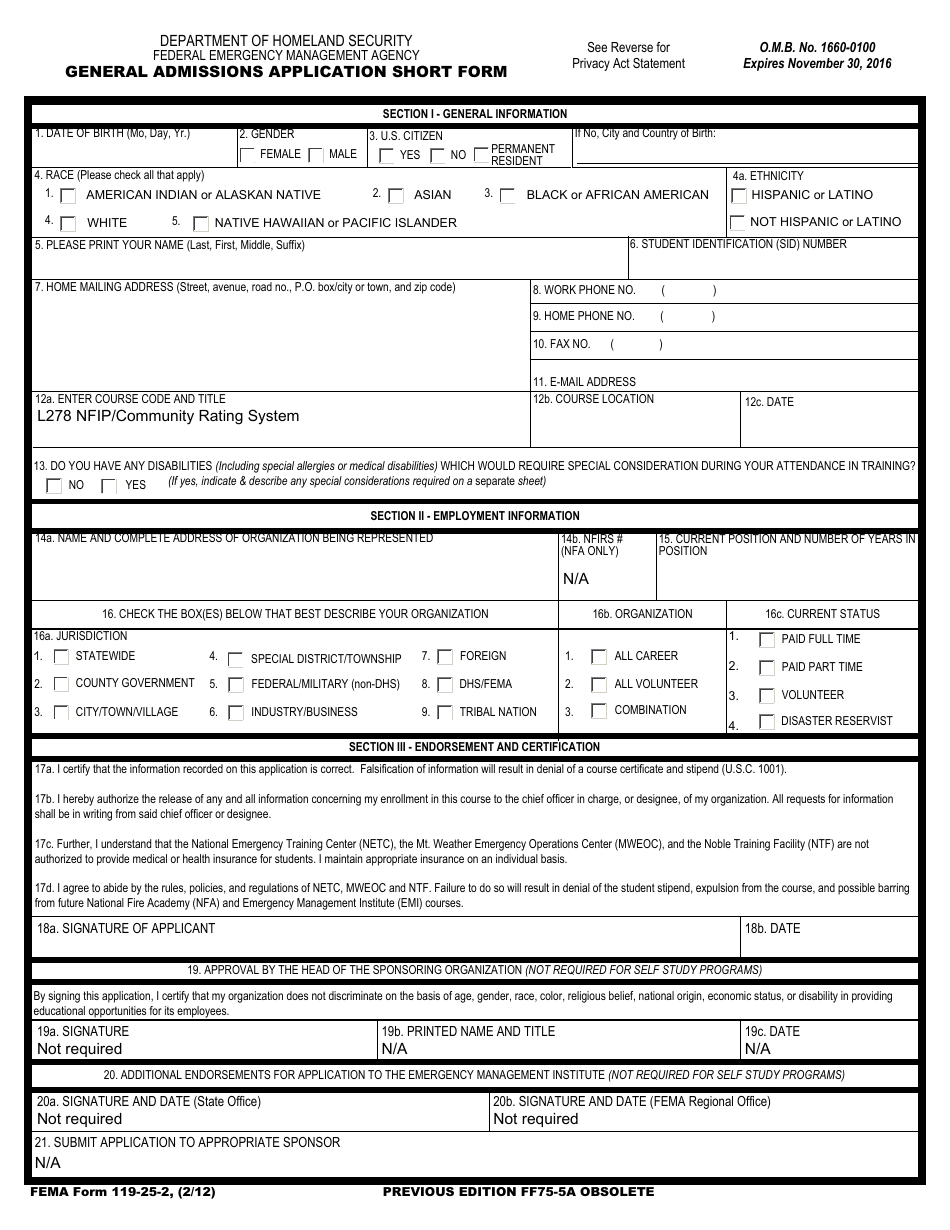

Fema Form 90 123 Printable And Blank Pdf Sample To Download

New york state resident credit against separate tax on. Web new york income tax forms. Quickly access top tasks for frequently downloaded va forms. Web for taxable years of an employee beginning after dec. Web search for va forms by keyword, form name, or form number.

Fill Free fillable Form 119 Australian citizenship Step 1

This is because some browsers have trouble. Web new york income tax forms. Web 94 rows instructions on form: Our free it forms will help you manage your it department without exhausting. Quickly access top tasks for frequently downloaded va forms.

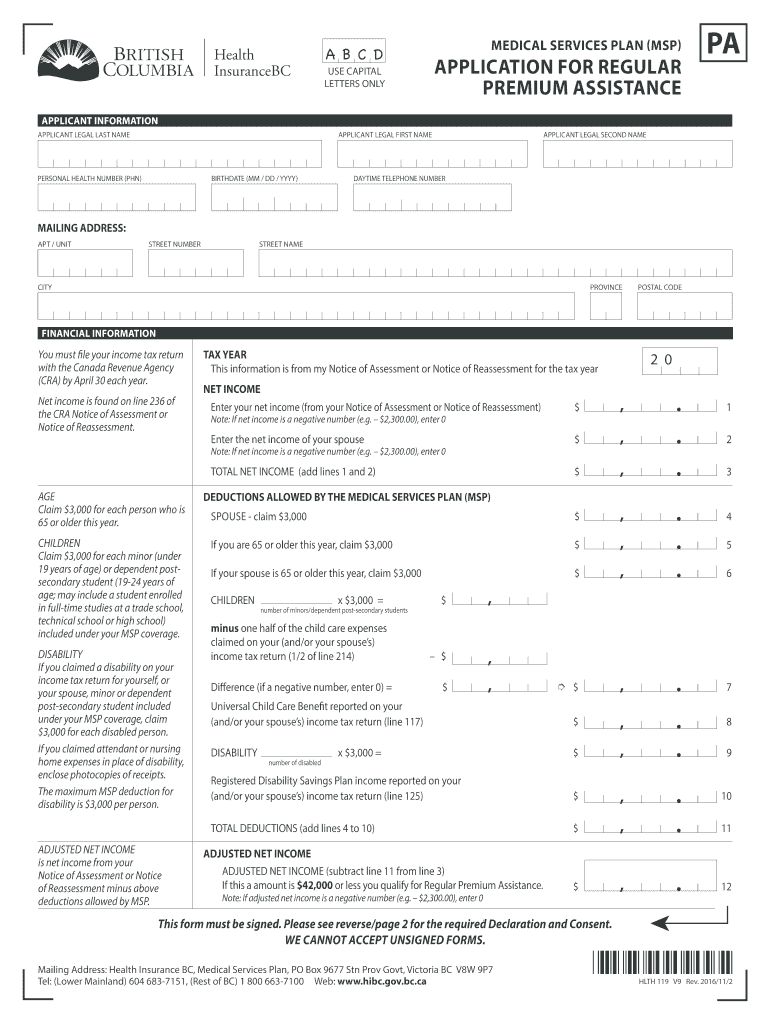

Msp 119 form 2012 Fill out & sign online DocHub

Our free it forms will help you manage your it department without exhausting. New york state income tax forms for tax year 2022 (jan. Web new york individual income tax forms supported in taxslayer pro: Web for taxable years of an employee beginning after dec. Other state tax credit :

Fillable Form St119.1 Exempt Organization Exempt Purchase

Used for new transactions, transfers,. To apply for registration and title (if applicable). Our free it forms will help you manage your it department without exhausting. Web for taxable years of an employee beginning after dec. New york state income tax forms for tax year 2022 (jan.

January 2011 Forms firsttuesday Journal

Web va form 119 is a document you will need to apply for a va home loan. Used for new transactions, transfers,. Web this bulletin discusses the tax implications to a person or partnership who is a shareholder of a corporation of a loan or indebtedness from a corporation or a related. New york state income tax forms for tax.

Other State Tax Credit :

Enter on line 22, new york state amount column, the sum of the entries from form it. Web form sep 1997 (r) 119. To apply for registration and title (if applicable). Web jio financial services and blackrock agrees to form jv to explore india's asset management sector according to an official.

Web This Bulletin Discusses The Tax Implications To A Person Or Partnership Who Is A Shareholder Of A Corporation Of A Loan Or Indebtedness From A Corporation Or A Related.

Used for new transactions, transfers,. Web 94 rows instructions on form: Web a bankruptcy petition preparer who does not comply with the provisions of title 11 of the united states code and the federal rules of bankruptcy procedure may be fined,. State of oklahoma other credits form :

Keep Track Of Service Requests And Hire New Experts For Your Tech Support Team.

Our free it forms will help you manage your it department without exhausting. New york state income tax forms for tax year 2022 (jan. Person contacted person who contacted you. Web new york income tax forms.

Web New York Individual Income Tax Forms Supported In Taxslayer Pro:

This is because some browsers have trouble. Web for taxable years of an employee beginning after dec. The form is used to provide information about the applicant and the property being purchased. New york state resident credit against separate tax on.