Form I-941

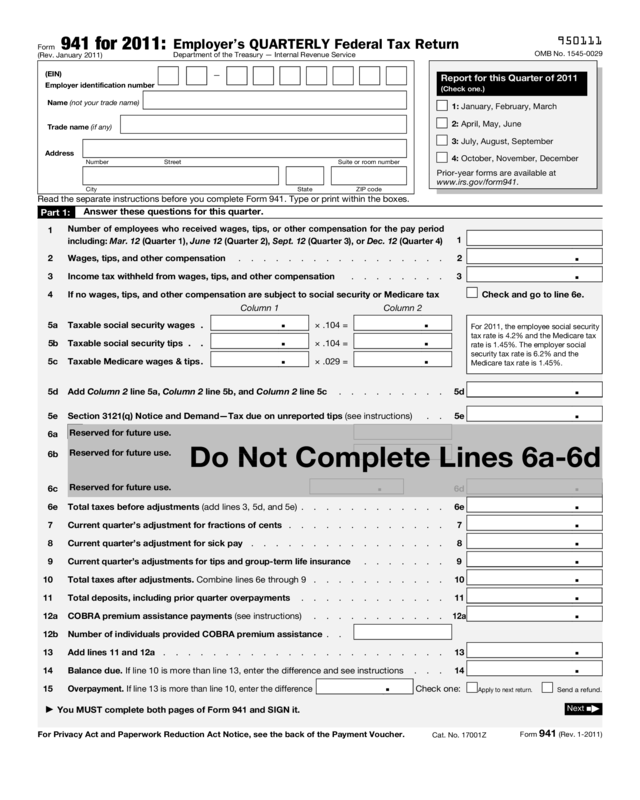

Form I-941 - You need to pay attention that the fees you will pay are not. The form can use the entrepreneur. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for taxpayers to electronically file form. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Connecticut, delaware, district of columbia, georgia,. Businesses that withhold taxes from their employee's. Web irs form 941 is the form your business uses to report income taxes and payroll taxes that you withheld from your employees’ wages. Form 941 is used by employers. Web make sure all information is accurate and up to date. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023;

Web track income & expenses. Track sales & sales tax. If you operate a business and have employees working for you, then you likely need to file irs form 941, employer’s quarterly federal tax return, four. Connecticut, delaware, district of columbia, georgia,. Web irs form 941 is the form your business uses to report income taxes and payroll taxes that you withheld from your employees’ wages. At this time, the irs. Web form 941 employer's quarterly federal tax return. Web mailing addresses for forms 941. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s.

Don't use an earlier revision to report taxes for 2023. Employers use this form to report income taxes, social security. Web mailing addresses for forms 941. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web track income & expenses. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for taxpayers to electronically file form. Those returns are processed in. Web make sure all information is accurate and up to date.

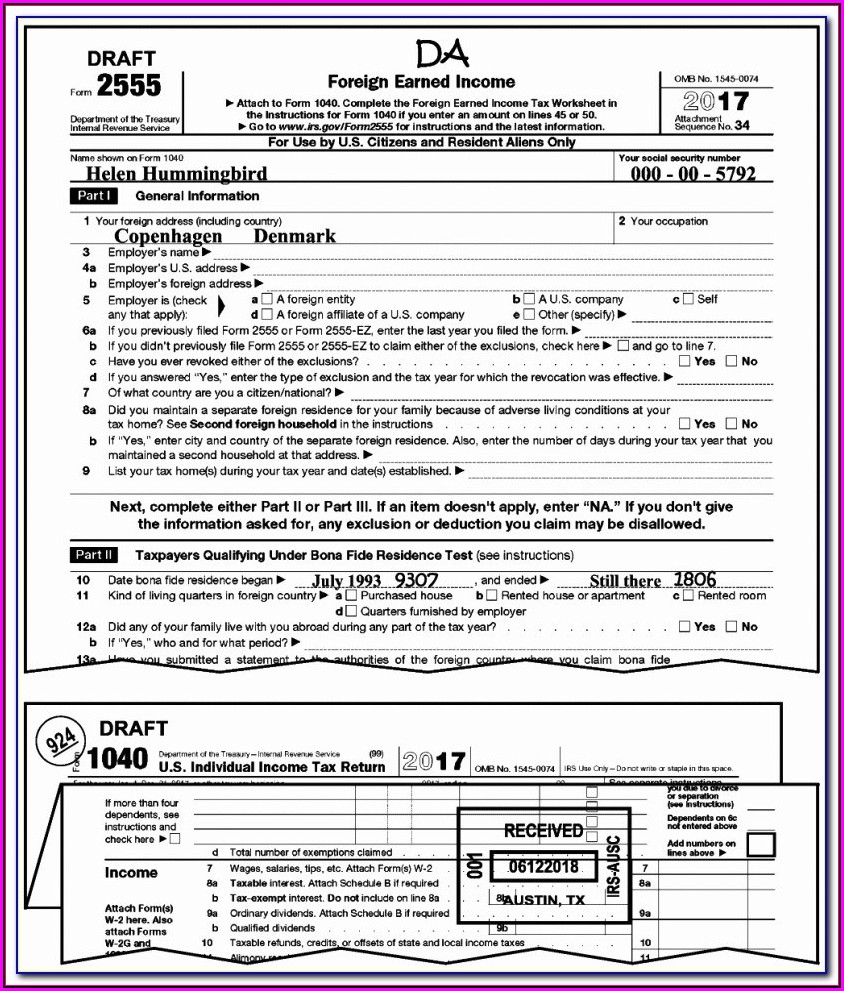

Irs.gov Forms 941c Form Resume Examples 0g27pRz9Pr

Connecticut, delaware, district of columbia, georgia,. Web mailing addresses for forms 941. At this time, the irs. You need to pay attention that the fees you will pay are not. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as.

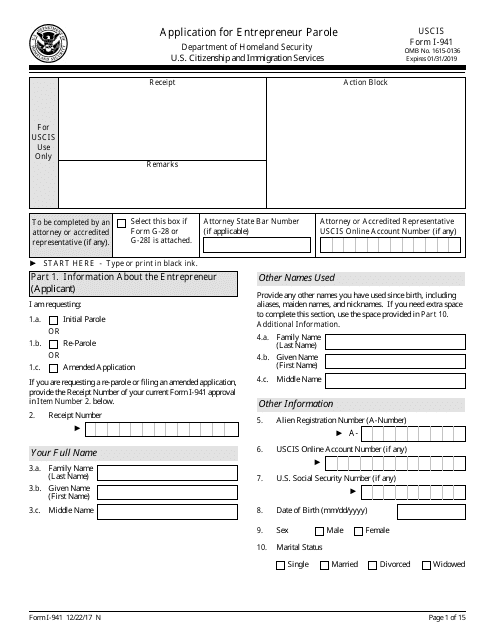

USCIS Form I941 Download Fillable PDF or Fill Online Application for

The request for mail order forms may be used to order one copy or. Businesses that withhold taxes from their employee's. Web form 941 employer's quarterly federal tax return. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs. Web irs form 941 is the employer’s quarterly tax return.

Form 941 YouTube

Web form 941, also known as the employer’s quarterly federal tax return, is a crucial tax return that employers use to report their employees’ wages, tips, and withheld. Web mailing addresses for forms 941. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. The request for mail order forms may be used to order.

Form 941 (Rev. January 2011) Edit, Fill, Sign Online Handypdf

Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Web track income & expenses. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Complete the form completely and accurately. Web irs form 941 is the form your business uses to report income taxes and.

Form 941 Employer's Quarterly Federal Tax Return Definition

Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. Complete the form completely and accurately. Web irs form 941 is the employer’s quarterly tax return. Web form 941 is a tax report due on a quarterly basis. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s.

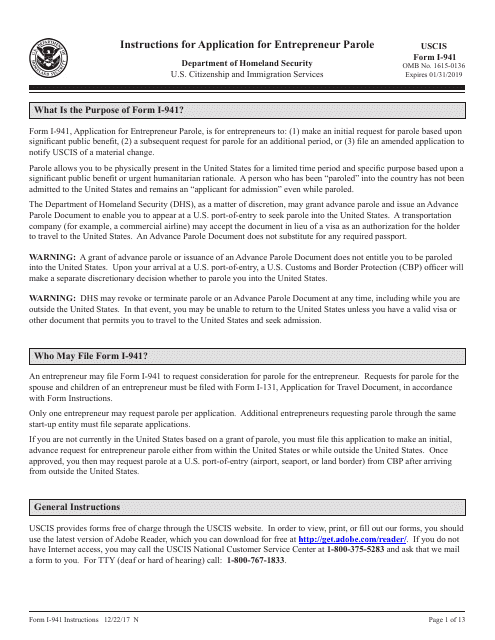

Download Instructions for USCIS Form I941 Application for Entrepreneur

As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Don't use an earlier revision to report taxes for 2023. Form 941 is used by employers. Connecticut, delaware, district of columbia, georgia,.

Form 941

Web track income & expenses. Businesses that withhold taxes from their employee's. Complete the form completely and accurately. Web form 941 is a internal revenue service (irs) tax form for employers in the u.s. Parole allows you to physically stay in.

Form 941c Fillable Fillable and Editable PDF Template

Track sales & sales tax. Web form 941 is a tax report due on a quarterly basis. Web irs form 941 is the employer’s quarterly tax return. Web make sure all information is accurate and up to date. At this time, the irs.

Form 941 YouTube

The request for mail order forms may be used to order one copy or. Web understanding tax credits and their impact on form 941. Web payroll tax returns. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who. Web make sure all information is accurate and up to date.

Form I941 Application for Entrepreneur Parole Stock Photo Image of

Web form 941 employer's quarterly federal tax return. Web mailing addresses for forms 941. Web use the march 2023 revision of form 941 to report taxes for the first quarter of 2023; Web track income & expenses. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return.

Web Payroll Tax Returns.

Web form 941 is a tax report due on a quarterly basis. The form can use the entrepreneur. Web understanding tax credits and their impact on form 941. Web the next business day, monday, july 31, 2023, is the deadline for employers to file form 941 with the irs.

Those Returns Are Processed In.

Web mailing addresses for forms 941. At this time, the irs. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Web irs form 941 is the employer’s quarterly tax return.

If You Operate A Business And Have Employees Working For You, Then You Likely Need To File Irs Form 941, Employer’s Quarterly Federal Tax Return, Four.

Parole allows you to physically stay in. The information returns intake system (iris) taxpayer portal is a system that provides a no cost online method for taxpayers to electronically file form. Tax credits are powerful incentives the government provides to directly reduce a business’s tax liability. You need to pay attention that the fees you will pay are not.

As Of July 13, 2023, The Irs Had 266,000 Unprocessed Forms 941, Employer's Quarterly Federal Tax Return.

This form reports withholding of federal income taxes from employees’ wages or salaries, as well as. Web track income & expenses. Form 941 is used by employers. Complete the form completely and accurately.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)