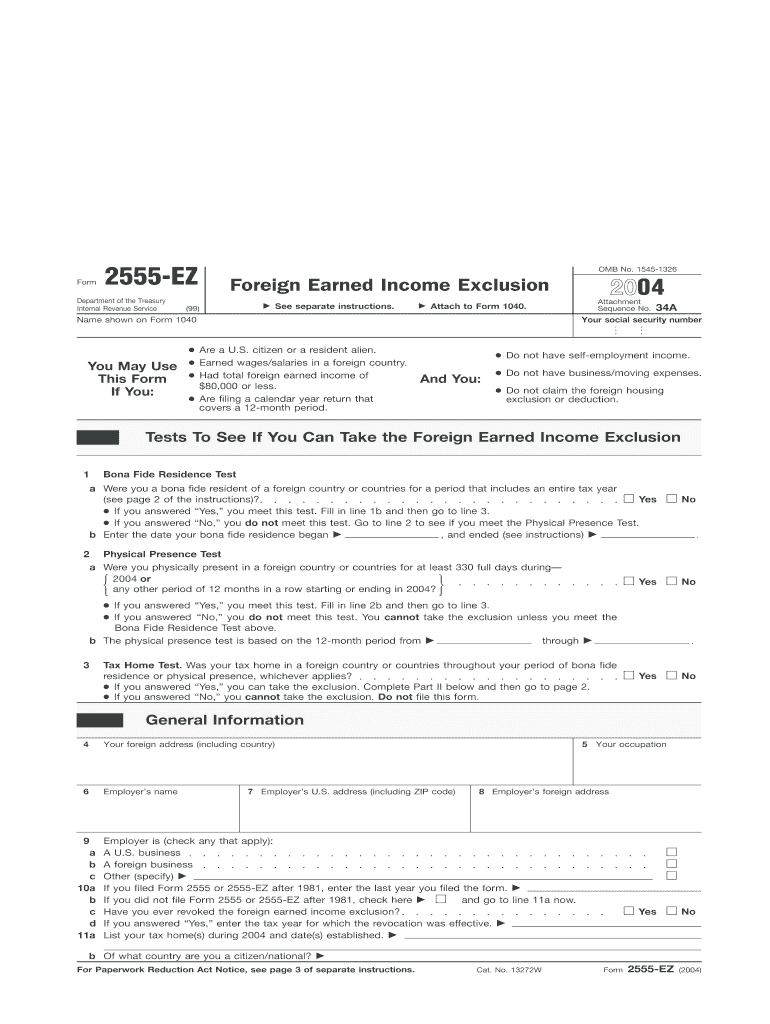

Form Ez 2555

Form Ez 2555 - Web the foreign earned income exclusion allows taxpayers to exclude their foreign earned income up to $100,800 in 2015 and $99,200 in 2014. Company e other (specify) 6 a if you previously filed form 2555 or. If you qualify, you can use form 2555 to figure your foreign. Ad access irs tax forms. Web what is form 2555? Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. You cannot exclude or deduct more than the. In screen 31, foreign income exclusion (2555), locate the employer subsection. Web form 2555 department of the treasury internal revenue service foreign earned income.

Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. In order to use the foreign earned. Since tax year 2019, the form is no longer used to claim the feie. In screen 31, foreign income exclusion (2555), locate the employer subsection. For filing irs form 2555 to take the foreign earned income exclusion in 2022 (tax year 2021), the limit is $108,700. Company c self any that apply): Web 235 rows purpose of form. Web the foreign earned income exclusion allows taxpayers to exclude their foreign earned income up to $100,800 in 2015 and $99,200 in 2014. Web 5 employer is (check a a foreign entity b a u.s. Earned wages/salaries in a foreign country.

It is used to claim the foreign earned income exclusion and/or the. Citizen or a resident alien. Since tax year 2019, the form is no longer used to claim the feie. In order to use the foreign earned. You cannot exclude or deduct more than the. If you qualify, you can use form. Web the exact limit changes each year. Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. D a foreign affiliate of a u.s. Get ready for tax season deadlines by completing any required tax forms today.

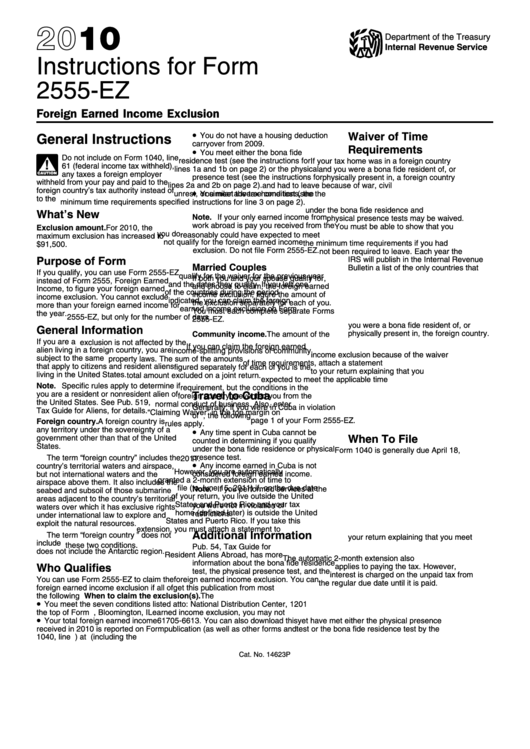

Instructions For Form 2555Ez Foreign Earned Exclusion

If you qualify, you can use form 2555 to figure your foreign. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Complete, edit or print tax forms instantly. Get ready for this year's tax season quickly and safely with pdffiller! Since tax year 2019, the form is no longer used.

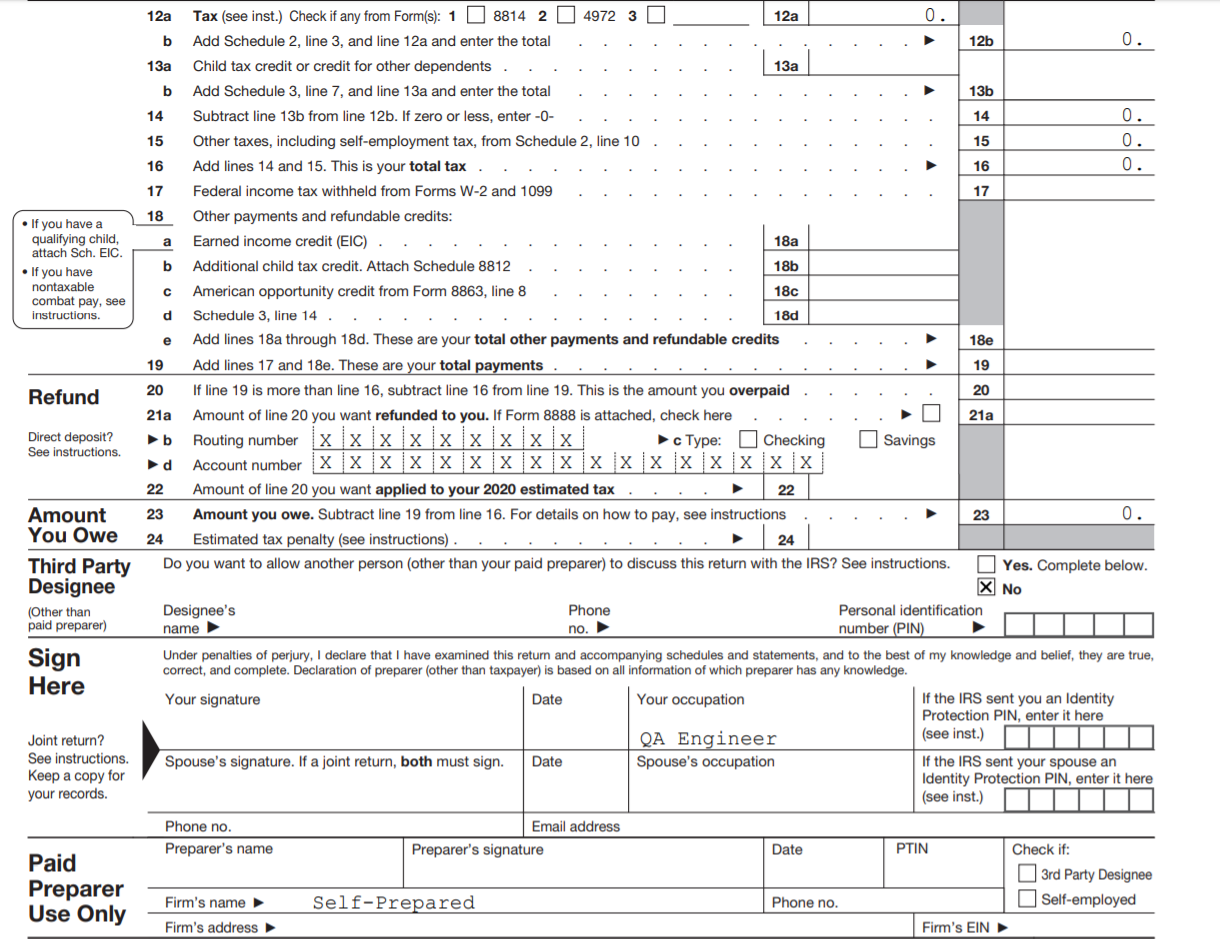

Irs Form Ez 2555 Universal Network

Web what is form 2555? Web form 2555 department of the treasury internal revenue service foreign earned income. Earned wages/salaries in a foreign country. Citizen or a resident alien. Ad access irs tax forms.

Ssurvivor Form 2555 Ez Instructions 2019

Web what is form 2555? Since tax year 2019, the form is no longer used to claim the feie. In order to use the foreign earned. Complete, edit or print tax forms instantly. Citizen or a resident alien.

Irs 2555 ez instructions 2014

Web form 2555 department of the treasury internal revenue service foreign earned income. For filing irs form 2555 to take the foreign earned income exclusion in 2022 (tax year 2021), the limit is $108,700. Web the exact limit changes each year. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can.

Breanna Form 2555 Ez Instructions 2019

Company e other (specify) 6 a if you previously filed form 2555 or. It is used to claim the foreign earned income exclusion and/or the. Web the exact limit changes each year. Citizen or a resident alien. If you qualify, you can use form.

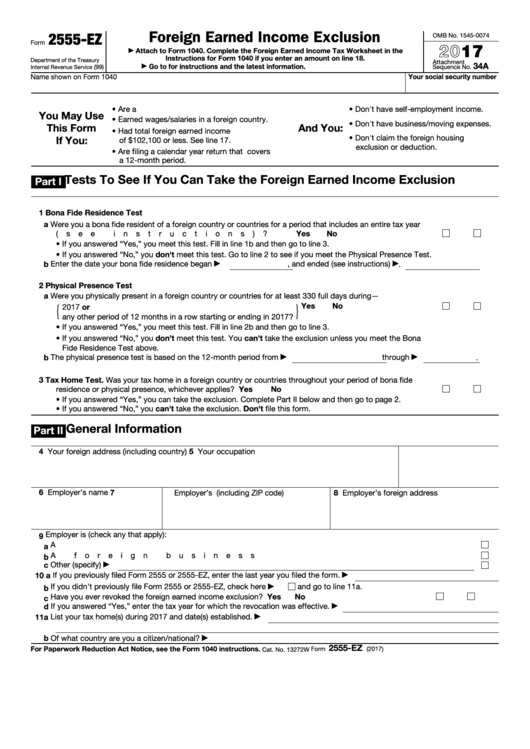

Fillable Form 2555Ez Foreign Earned Exclusion 2017 printable

Earned wages/salaries in a foreign country. In screen 31, foreign income exclusion (2555), locate the employer subsection. It is used to claim the foreign earned income exclusion and/or the. Web youmay use this form if you: Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file.

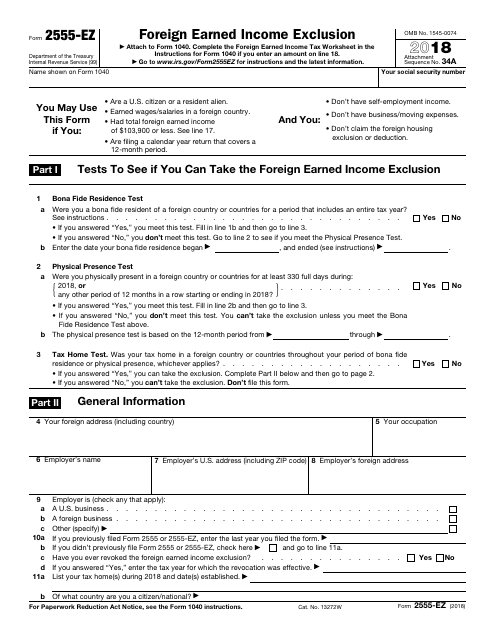

IRS Form 2555EZ Download Fillable PDF or Fill Online Foreign Earned

Ad access irs tax forms. Company c self any that apply): Web the exact limit changes each year. Web what is form 2555? In screen 31, foreign income exclusion (2555), locate the employer subsection.

Form 2555EZ U.S Expat Taxes Community Tax

Earned wages/salaries in a foreign country. Web form 2555 department of the treasury internal revenue service foreign earned income. Web 5 employer is (check a a foreign entity b a u.s. Get ready for tax season deadlines by completing any required tax forms today. Web form 2555 is a tax form that must be filed by nonresident aliens who have.

Form 2555, Foreign Earned Exclusion YouTube

Since tax year 2019, the form is no longer used to claim the feie. If you qualify, you can use form. Web what is form 2555? Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Complete, edit or print tax forms instantly.

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Ad complete irs tax forms online or print government tax documents. If you qualify, you can use form 2555 to figure your foreign. D a foreign affiliate of a u.s. If you qualify, you can use form.

Web 235 Rows Purpose Of Form.

It is used to claim the foreign earned income exclusion and/or the. Web if you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Complete, edit or print tax forms instantly. Web form 2555 department of the treasury internal revenue service foreign earned income.

D A Foreign Affiliate Of A U.s.

Web 5 employer is (check a a foreign entity b a u.s. Ad complete irs tax forms online or print government tax documents. Ad access irs tax forms. Web the exact limit changes each year.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 2555 is a tax form that must be filed by nonresident aliens who have earned income from the united states. Company c self any that apply): Web youmay use this form if you: In screen 31, foreign income exclusion (2555), locate the employer subsection.

You Cannot Exclude Or Deduct More Than The.

Since tax year 2019, the form is no longer used to claim the feie. If you qualify, you can use form 2555 to figure your foreign. In order to use the foreign earned. If you qualify, you can use form.