Form 990 Schedule D

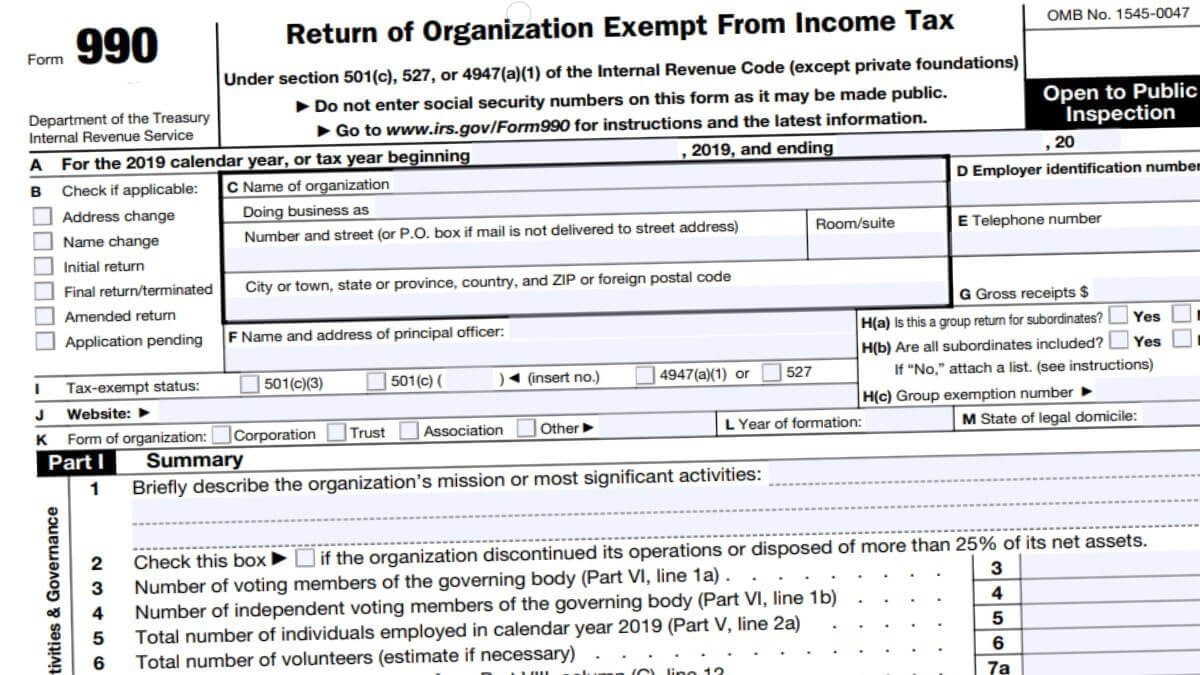

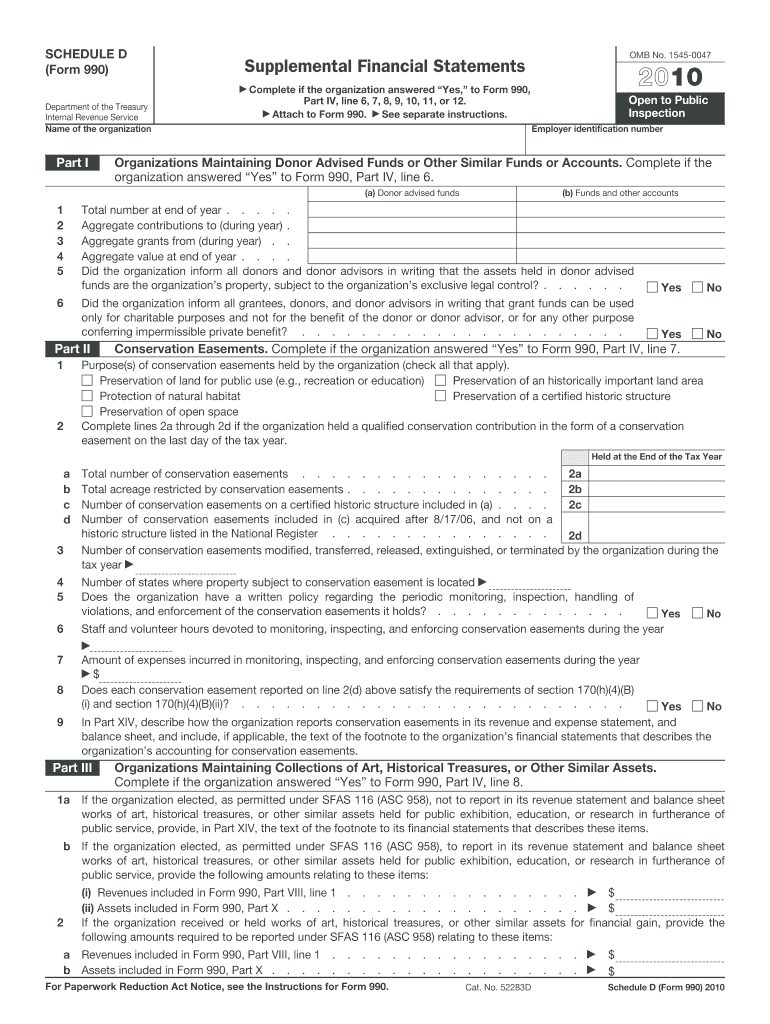

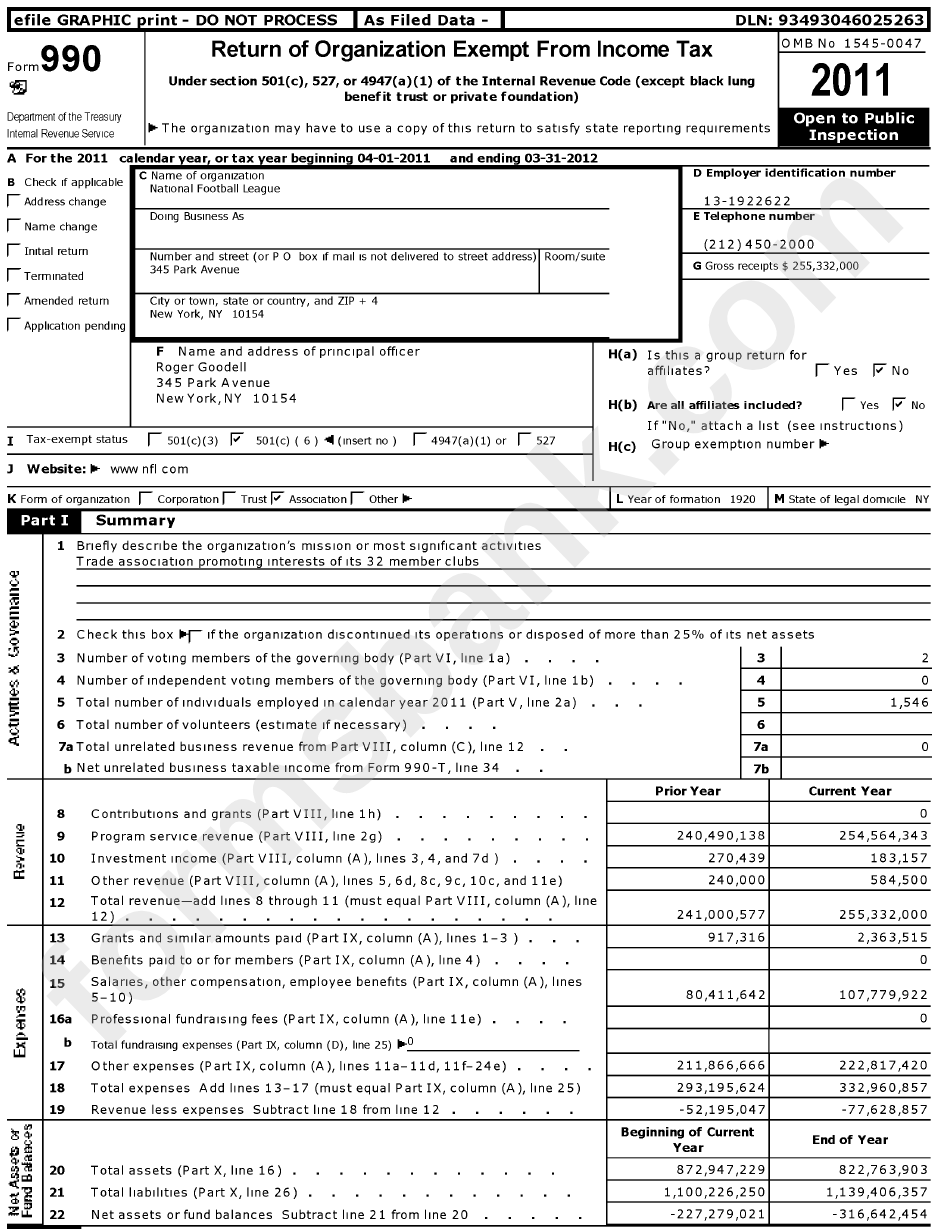

Form 990 Schedule D - Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information. You can print other federal tax forms here. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Schedule d is used by an organization to provide the required detailed reporting of donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts and. The download files are organized by month. Organizations with audited financial statements are required to provide such reconciliations on schedule d (form 990), parts xi through xii. Web an organization should keep a reconciliation of any differences between its books of account and the form 990 that is filed. In 2009, the irs and the internal revenue service office of special counsel, tax division, updated their definitions of certain terms to account for changes in the tax law and to make the requirements consistent with their. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) Web schedule d (form 990) 2022 page 2 part iii organizations maintaining collections of art, historical treasures, or other similar assets (continued) 3 using the organization's acquisition, accession, and other records, check any of the following that make significant use of its collection

The download files are organized by month. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) Web an organization should keep a reconciliation of any differences between its books of account and the form 990 that is filed. Web we last updated the supplemental financial statements in december 2022, so this is the latest version of 990 (schedule d), fully updated for tax year 2022. Web for paperwork reduction act notice, see the instructions for form 990. Web schedule d (form 990) 2022 page 2 part iii organizations maintaining collections of art, historical treasures, or other similar assets (continued) 3 using the organization's acquisition, accession, and other records, check any of the following that make significant use of its collection Web form 990, schedule d, was originally created in 1975 and was expanded in 1986 to include gifts received by a church. Some months may have more than one entry due to the size of the download. In 2009, the irs and the internal revenue service office of special counsel, tax division, updated their definitions of certain terms to account for changes in the tax law and to make the requirements consistent with their. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990).

Web schedule d (form 990) 2022 page 2 part iii organizations maintaining collections of art, historical treasures, or other similar assets (continued) 3 using the organization's acquisition, accession, and other records, check any of the following that make significant use of its collection Web we last updated the supplemental financial statements in december 2022, so this is the latest version of 990 (schedule d), fully updated for tax year 2022. Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) Web for paperwork reduction act notice, see the instructions for form 990. Web an organization should keep a reconciliation of any differences between its books of account and the form 990 that is filed. You can print other federal tax forms here. Organizations with audited financial statements are required to provide such reconciliations on schedule d (form 990), parts xi through xii. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b. Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information. In 2009, the irs and the internal revenue service office of special counsel, tax division, updated their definitions of certain terms to account for changes in the tax law and to make the requirements consistent with their.

Schedule M 2019 Tax Form Fillable and Editable PDF Template

Organizations with audited financial statements are required to provide such reconciliations on schedule d (form 990), parts xi through xii. Some months may have more than one entry due to the size of the download. In 2009, the irs and the internal revenue service office of special counsel, tax division, updated their definitions of certain terms to account for changes.

Form 990 Schedule D Edit, Fill, Sign Online Handypdf

Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Web schedule d (form 990) 2022 page 2 part iii organizations maintaining collections of art, historical treasures, or other similar assets (continued) 3 using the organization's acquisition, accession, and other records, check any of the following that make significant use of its collection.

Form 990 (Schedule F) and Form 990 Schedule D Main Differences

The download files are organized by month. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Schedule d is used by an organization to provide the required detailed reporting of donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts and. Web we last updated the supplemental financial.

990 Form 2021

In 2009, the irs and the internal revenue service office of special counsel, tax division, updated their definitions of certain terms to account for changes in the tax law and to make the requirements consistent with their. You can print other federal tax forms here. Schedule d is used by an organization to provide the required detailed reporting of donor.

2010 Form IRS 990 Schedule D Fill Online, Printable, Fillable, Blank

Web form 990, schedule d, was originally created in 1975 and was expanded in 1986 to include gifts received by a church. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web schedule d (form 990) 2022 page 2 part iii organizations maintaining collections of art, historical treasures, or other similar.

Electronic IRS Form 990 (Schedule K) 2018 2019 Printable PDF Sample

Web for paperwork reduction act notice, see the instructions for form 990. Organizations with audited financial statements are required to provide such reconciliations on schedule d (form 990), parts xi through xii. Go to www.irs.gov/form990 for instructions and the latest information. The download files are organized by month. Web schedule d (form 990) department of the treasury internal revenue service.

Nonprofit Tax Tidbits Form 990 Schedule D Hawkins Ash CPAs

Some months may have more than one entry due to the size of the download. Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line.

Form 990 2011 Sample printable pdf download

Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web an organization should keep a reconciliation of any differences between its books of account and the form 990 that is filed. The download files are organized by month. Web schedule d (form 990) department of the treasury internal revenue service supplemental.

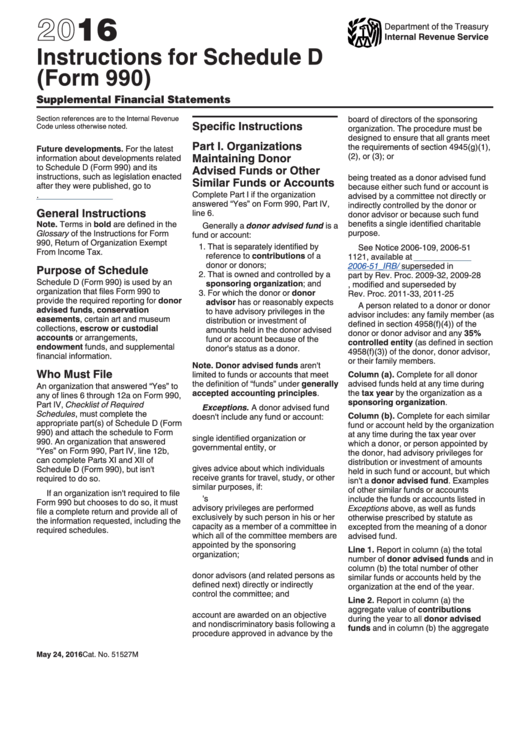

Instructions For Schedule D 990 printable pdf download

Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b. You can print other federal tax forms here. Schedule d is used by an organization to provide the required.

Form 990 (Schedule D) Supplemental Financial Statements (2015) Free

Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990). Web an organization should keep a reconciliation of any differences between its books of account and the form 990 that is filed. Web we last.

Web We Last Updated The Supplemental Financial Statements In December 2022, So This Is The Latest Version Of 990 (Schedule D), Fully Updated For Tax Year 2022.

On this page you may download the 990 series filings on record for 2021. Schedule d is used by an organization to provide the required detailed reporting of donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts and. Go to www.irs.gov/form990 for instructions and the latest information. In 2009, the irs and the internal revenue service office of special counsel, tax division, updated their definitions of certain terms to account for changes in the tax law and to make the requirements consistent with their.

You Can Print Other Federal Tax Forms Here.

Web schedule d (form 990) is used by an organization that files form 990 to provide the required reporting for donor advised funds, conservation easements, certain art and museum collections, escrow or custodial accounts or arrangements, endowment funds, and supplemental financial information. Organizations with audited financial statements are required to provide such reconciliations on schedule d (form 990), parts xi through xii. The download files are organized by month. Some months may have more than one entry due to the size of the download.

Web Form 990, Schedule D, Was Originally Created In 1975 And Was Expanded In 1986 To Include Gifts Received By A Church.

Donor advised funds funds and other accounts total number at end of year aggregate value of contributions to (during year) aggregate value of grants from (during year) Schedule d (form 990) 2022 complete if the organization answered yes on form 990, part iv, line 6. Web for paperwork reduction act notice, see the instructions for form 990. Web 2, to certify that it doesn t meet the filing requirements of schedule b (form 990).

Web Schedule D (Form 990) 2022 Page 2 Part Iii Organizations Maintaining Collections Of Art, Historical Treasures, Or Other Similar Assets (Continued) 3 Using The Organization's Acquisition, Accession, And Other Records, Check Any Of The Following That Make Significant Use Of Its Collection

Web an organization should keep a reconciliation of any differences between its books of account and the form 990 that is filed. Web schedule d (form 990) department of the treasury internal revenue service supplemental financial statements complete if the organization answered “yes” on form 990, part iv, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b.