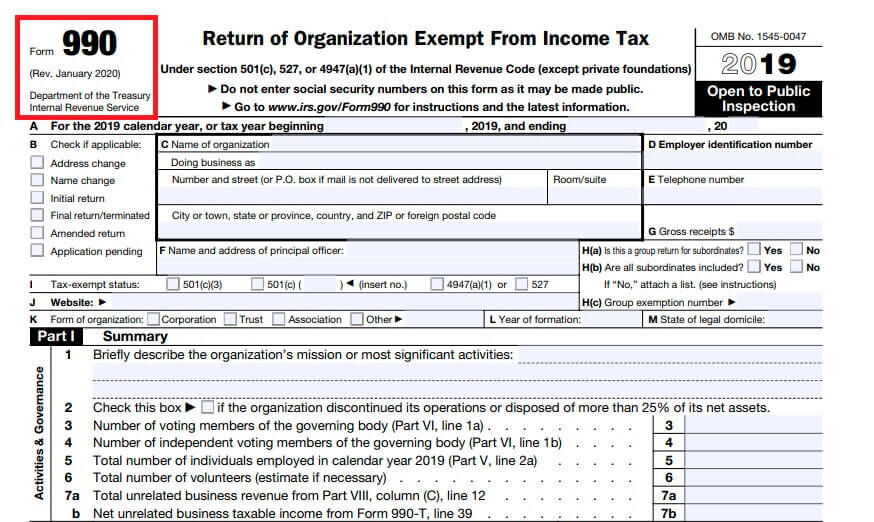

Form 990 Requirements

Form 990 Requirements - Request for taxpayer identification number (tin) and certification. Web which form an organization must file generally depends on its financial activity, as indicated in. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Web nonprofits with annual revenue of $500,000 or more must file the form 990. The act now mandates that the following forms need to be electronically. Web most need to file a 990 return, which they must do electronically. Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Employer identification number (ein), also known as a taxpayer identification number (tin) tax year (calendar or fiscal filer) legal name and mailing. Get ready for tax season deadlines by completing any required tax forms today.

Most nonprofits must file irs form 990 — a dozen pages each year requiring detailed accounting of financial. Web learn more about the irs public disclosure requirements. Get ready for tax season deadlines by completing any required tax forms today. Web nonprofits with annual revenue of $500,000 or more must file the form 990. Web do you ever have a question about your irs form 990 and can’t seem to find the answer? The act now mandates that the following forms need to be electronically. Web below are the basic requirements for each 990 form type. Request for taxpayer identification number (tin) and certification. Return of organization exempt from income tax for their annual reporting. Complete, edit or print tax forms instantly.

Most nonprofits must file irs form 990 — a dozen pages each year requiring detailed accounting of financial. Request for taxpayer identification number (tin) and certification. Ad get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Return of organization exempt from income tax for their annual reporting. Web do you ever have a question about your irs form 990 and can’t seem to find the answer? Web which form an organization must file generally depends on its financial activity, as indicated in. Complete, edit or print tax forms instantly. Web below are the basic requirements for each 990 form type.

Instructions to file your Form 990PF A Complete Guide

For additional details, always make sure to review the most current information on the irs’s website. Get ready for tax season deadlines by completing any required tax forms today. The act now mandates that the following forms need to be electronically. Web learn more about the irs public disclosure requirements. Request for transcript of tax return.

Form 990 (Schedule I) Grants and Other Assistance to Organizations

Employer identification number (ein), also known as a taxpayer identification number (tin) tax year (calendar or fiscal filer) legal name and mailing. Most nonprofits must file irs form 990 — a dozen pages each year requiring detailed accounting of financial. Request for transcript of tax return. Web form 990 must be filed by an organization exempt from income tax under.

IRS Instructions 990 2018 2019 Printable & Fillable Sample in PDF

The act now mandates that the following forms need to be electronically. For additional details, always make sure to review the most current information on the irs’s website. Complete, edit or print tax forms instantly. We’ll give you some valuable information concerning your filings, written. Complete irs tax forms online or print government tax documents.

2009 Form 990 by Camfed International Issuu

Complete, edit or print tax forms instantly. The act now mandates that the following forms need to be electronically. Request for taxpayer identification number (tin) and certification. Web do you ever have a question about your irs form 990 and can’t seem to find the answer? We’ll give you some valuable information concerning your filings, written.

Blog 1 Tips on How to Read Form 990

Web learn more about the irs public disclosure requirements. Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption). Web do you ever have a question about your irs form 990 and can’t seem to find the answer? Ad get ready for tax season.

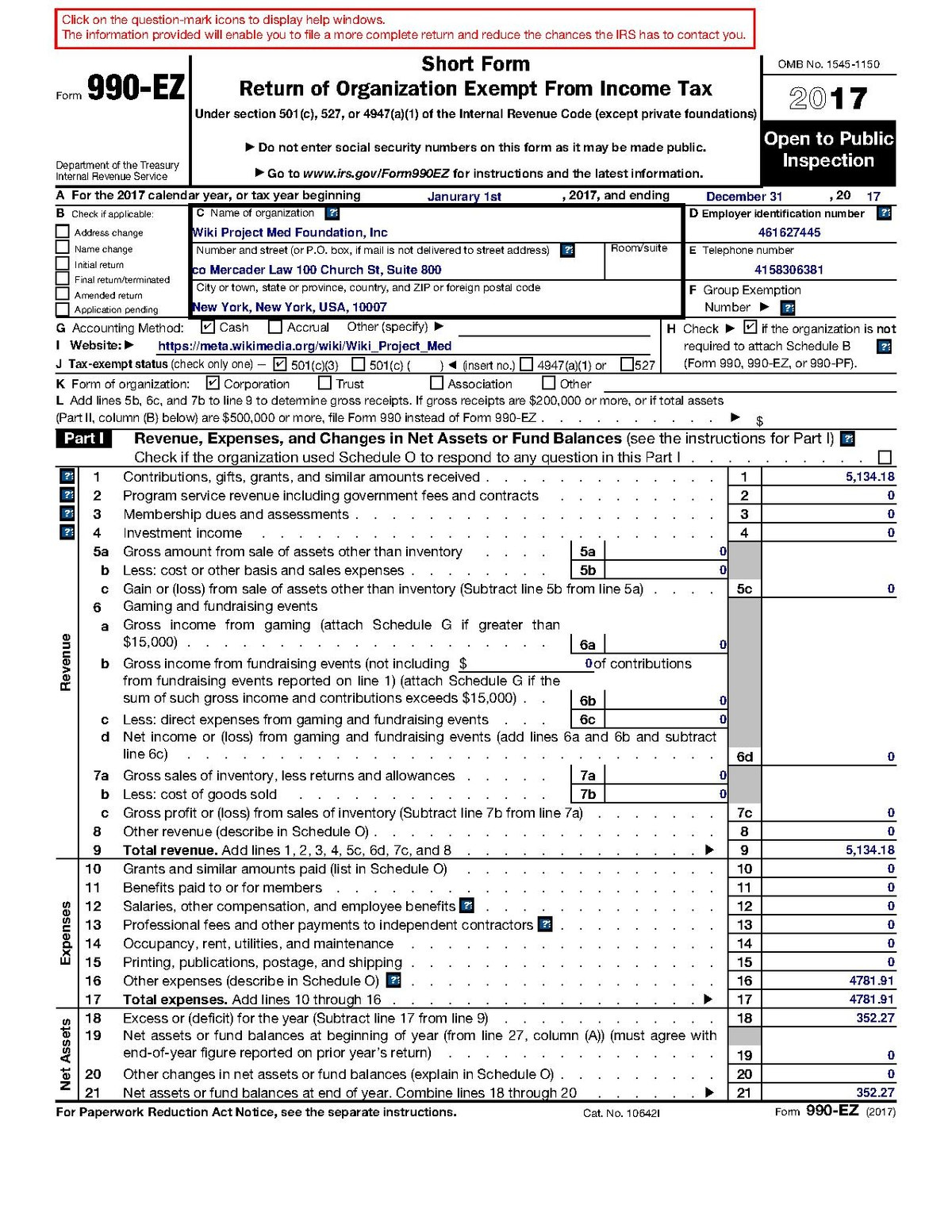

File 2017 Form 990 EZ Pdf Wikimedia Commons 2021 Tax Forms 1040 Printable

Return of organization exempt from income tax for their annual reporting. Web click through to find out the filing requirements. Web learn more about the irs public disclosure requirements. Complete, edit or print tax forms instantly. Web do you ever have a question about your irs form 990 and can’t seem to find the answer?

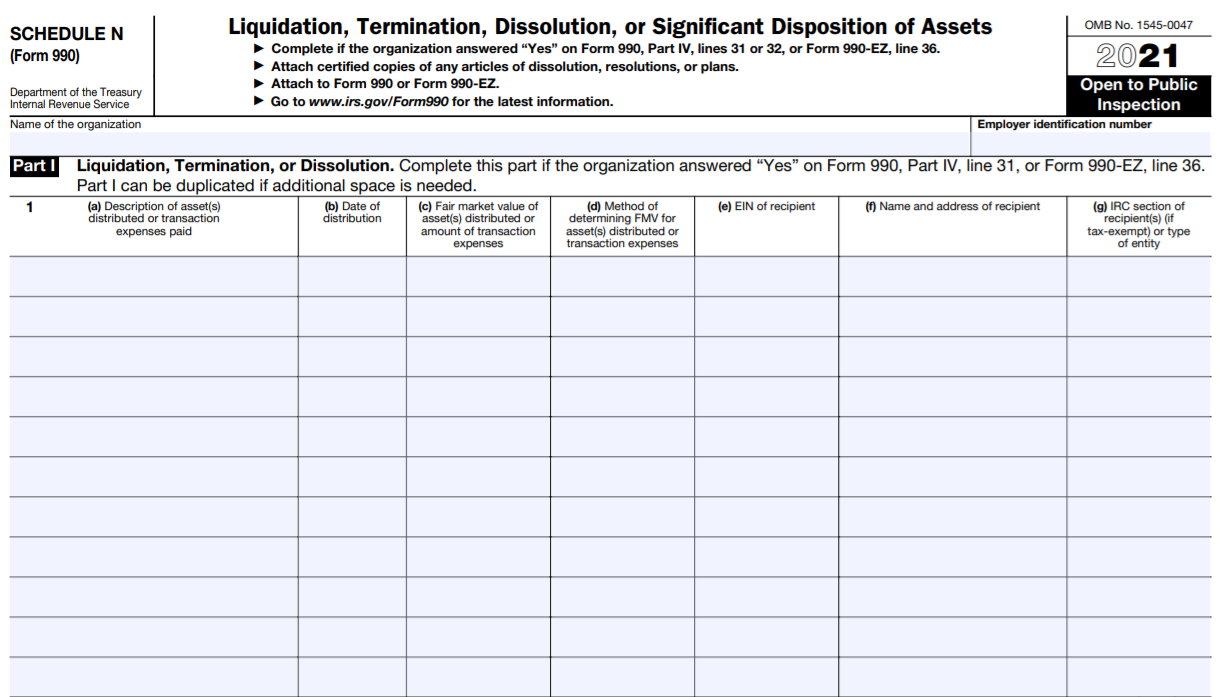

IRS Form 990/990EZ Schedule N Instructions Liquidation, Termination

Complete, edit or print tax forms instantly. Web do you ever have a question about your irs form 990 and can’t seem to find the answer? Web learn more about the irs public disclosure requirements. Return of organization exempt from income tax for their annual reporting. Web form 990 department of the treasury internal revenue service return of organization exempt.

What is form 990 • Requirements and types of forms Unemployment Gov

Web do you ever have a question about your irs form 990 and can’t seem to find the answer? Web form 990 must be filed by an organization exempt from income tax under section 501(a) (including an organization that hasn't applied for recognition of exemption). For additional details, always make sure to review the most current information on the irs’s.

Form 990EZ for nonprofits updated Accounting Today

Nonprofits with incomes below $200,000 and assets of less than $500,000 may file a shorter. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Complete irs tax forms online or print government tax documents. Web most need to file a 990 return, which.

Form 990/990EZ Schedule A IRS Form 990 Schedule A Instructions

Web click through to find out the filing requirements. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Nonprofits with incomes below $200,000 and assets of less than $500,000 may file a shorter. Web learn more about the irs public disclosure requirements. Get.

Web Click Through To Find Out The Filing Requirements.

Return of organization exempt from income tax for their annual reporting. The act now mandates that the following forms need to be electronically. Ad get ready for tax season deadlines by completing any required tax forms today. For additional details, always make sure to review the most current information on the irs’s website.

Employer Identification Number (Ein), Also Known As A Taxpayer Identification Number (Tin) Tax Year (Calendar Or Fiscal Filer) Legal Name And Mailing.

Complete, edit or print tax forms instantly. Web most need to file a 990 return, which they must do electronically. Web learn more about the irs public disclosure requirements. Nonprofits with incomes below $200,000 and assets of less than $500,000 may file a shorter.

Web Form 990 Must Be Filed By An Organization Exempt From Income Tax Under Section 501(A) (Including An Organization That Hasn't Applied For Recognition Of Exemption).

Complete, edit or print tax forms instantly. Ad get ready for tax season deadlines by completing any required tax forms today. Web nonprofits with annual revenue of $500,000 or more must file the form 990. Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

Web Which Form An Organization Must File Generally Depends On Its Financial Activity, As Indicated In.

We’ll give you some valuable information concerning your filings, written. Request for transcript of tax return. Web below are the basic requirements for each 990 form type. Web an organization that normally has $50,000 or more in gross receipts and that is required to file an exempt organization information return must file either form 990, return of.