Form 990 Due Date Extension

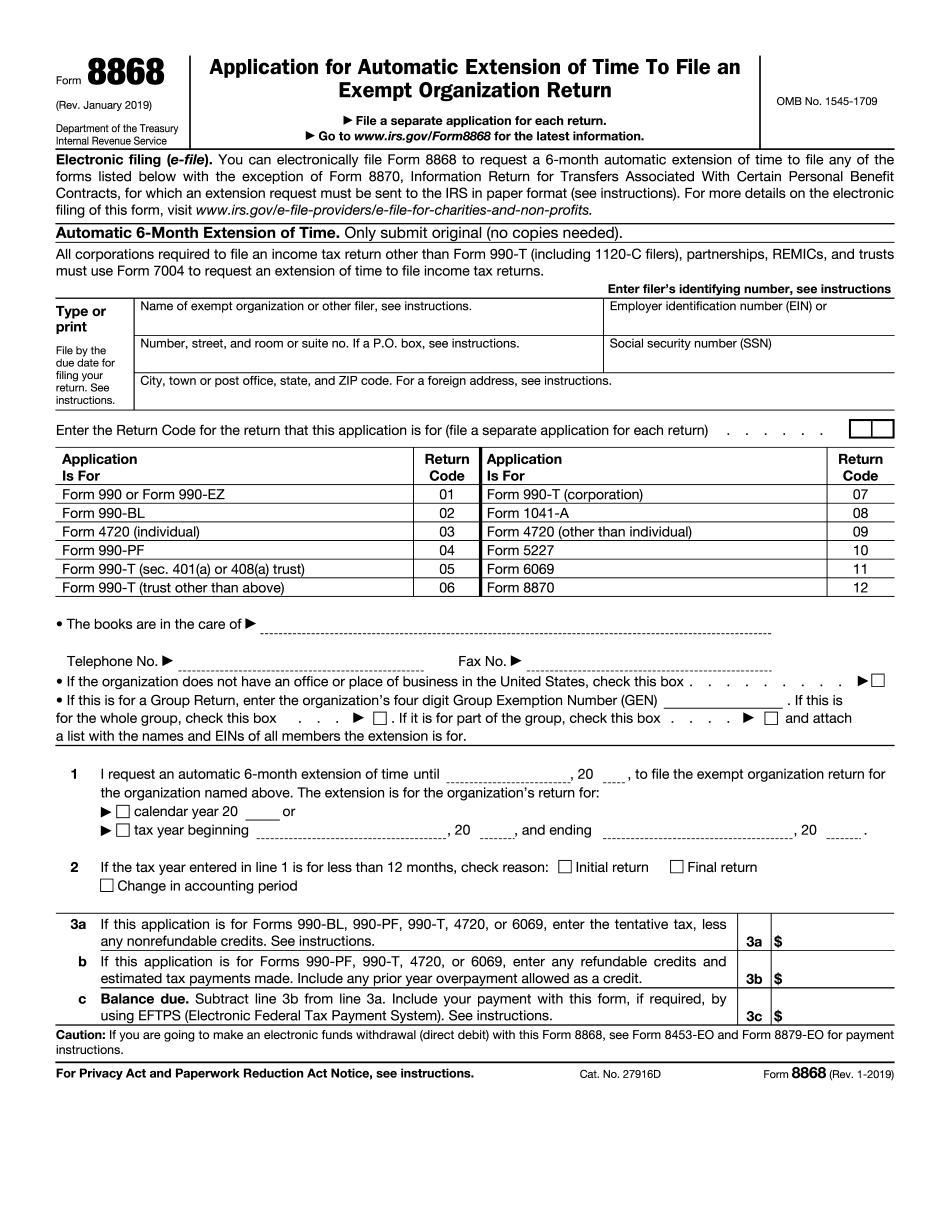

Form 990 Due Date Extension - Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. Nonprofit filing deadline for form 990 is may 17. Corporations, for example, still had to file by april 15, 2021. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. Web state deadlines are different! If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Ending date of tax year. And will that extension request automatically extend to my state filing deadline?

And will that extension request automatically extend to my state filing deadline? Corporations, for example, still had to file by april 15, 2021. When is form 990 due with extension form 8868? Web upcoming form 990 deadline: To use the table, you must know when your organization’s tax year ends. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. Ending date of tax year.

Nonprofit filing deadline for form 990 is may 17. Web state deadlines are different! And will that extension request automatically extend to my state filing deadline? Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Ending date of tax year. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023.

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

Web upcoming form 990 deadline: Ending date of tax year. If the organization follows a fiscal tax period (with an ending date other december 31), the due date is the 15th day of the 5th month following the end of your accounting period. And will that extension request automatically extend to my state filing deadline? Nonprofit filing deadline for form.

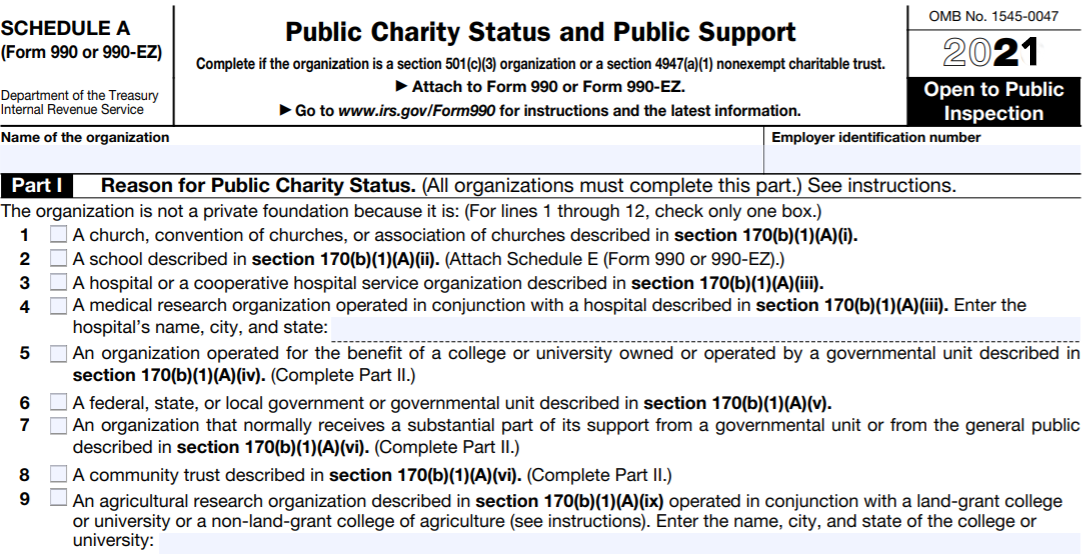

IRS Form 990 Schedules

Nonprofit filing deadline for form 990 is may 17. If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. Ending date of tax year. To use the table, you must know when your organization’s tax year ends. And will that extension request automatically extend to my.

form 990 due date 2018 extension Fill Online, Printable, Fillable

If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. To use the table, you must know when your organization’s tax year ends. Ending date of tax year. And will that extension request automatically extend to my state filing deadline? Also, if you filed an.

Form 990 Filing Date Universal Network

And will that extension request automatically extend to my state filing deadline? If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Nonprofit filing deadline for form 990 is may 17. Web state deadlines are different! Corporations, for example, still had to file by april.

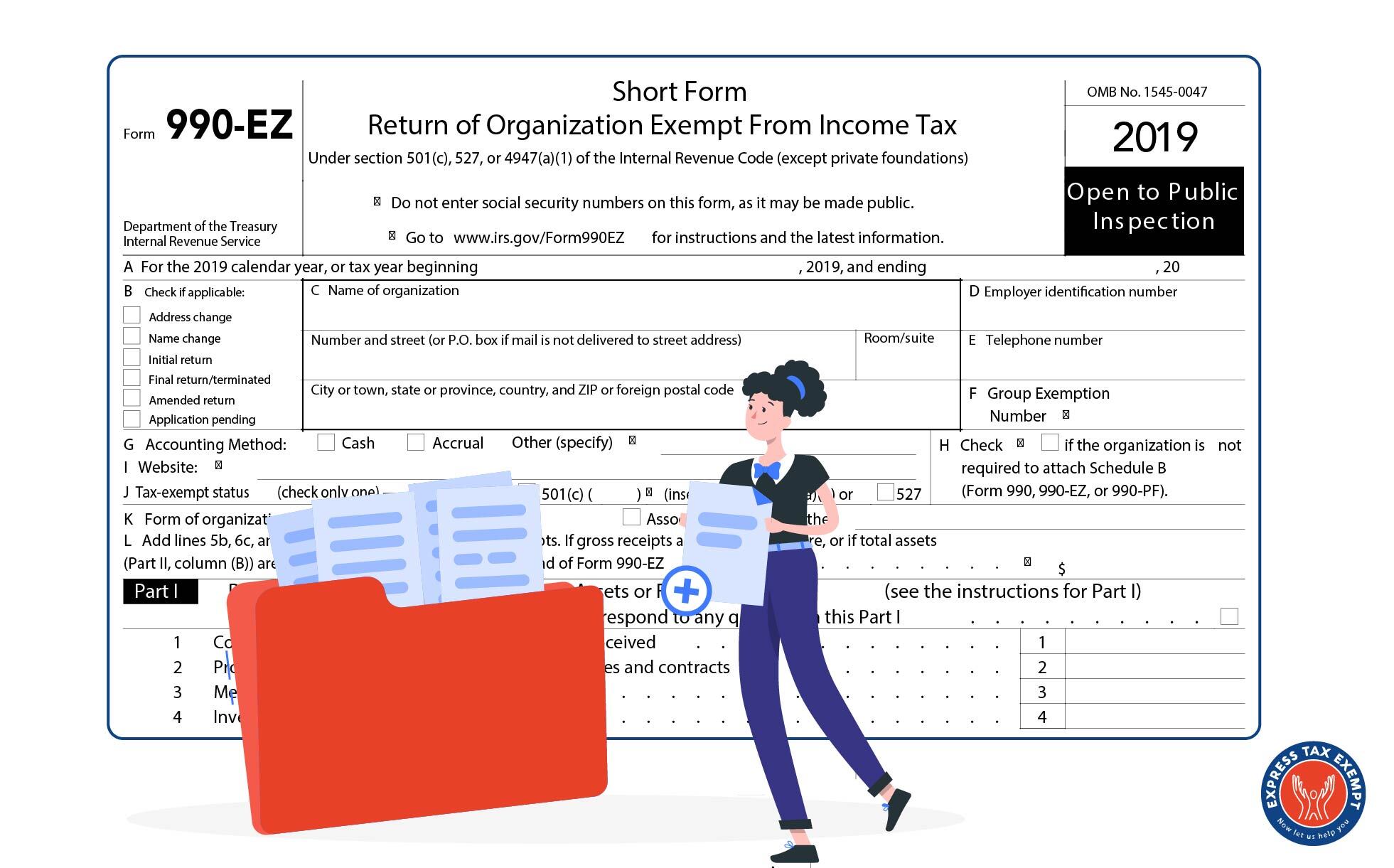

What Is The Form 990EZ and Who Must File It?

If your organization’s accounting tax period starts on march 01, 2022, and ends in february 2023, your form 990 is due by july 17, 2023. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022..

What To Do When You Miss The IRS Form 990 Deadline ExpressTaxExempt

Web can any officer file the extension request? And will that extension request automatically extend to my state filing deadline? Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is. Ending date of tax year. When is form 990 due with extension form 8868?

form 990 extension due date 2020 Fill Online, Printable, Fillable

When is form 990 due with extension form 8868? Corporations, for example, still had to file by april 15, 2021. Ending date of tax year. Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Web can any officer file the extension request?

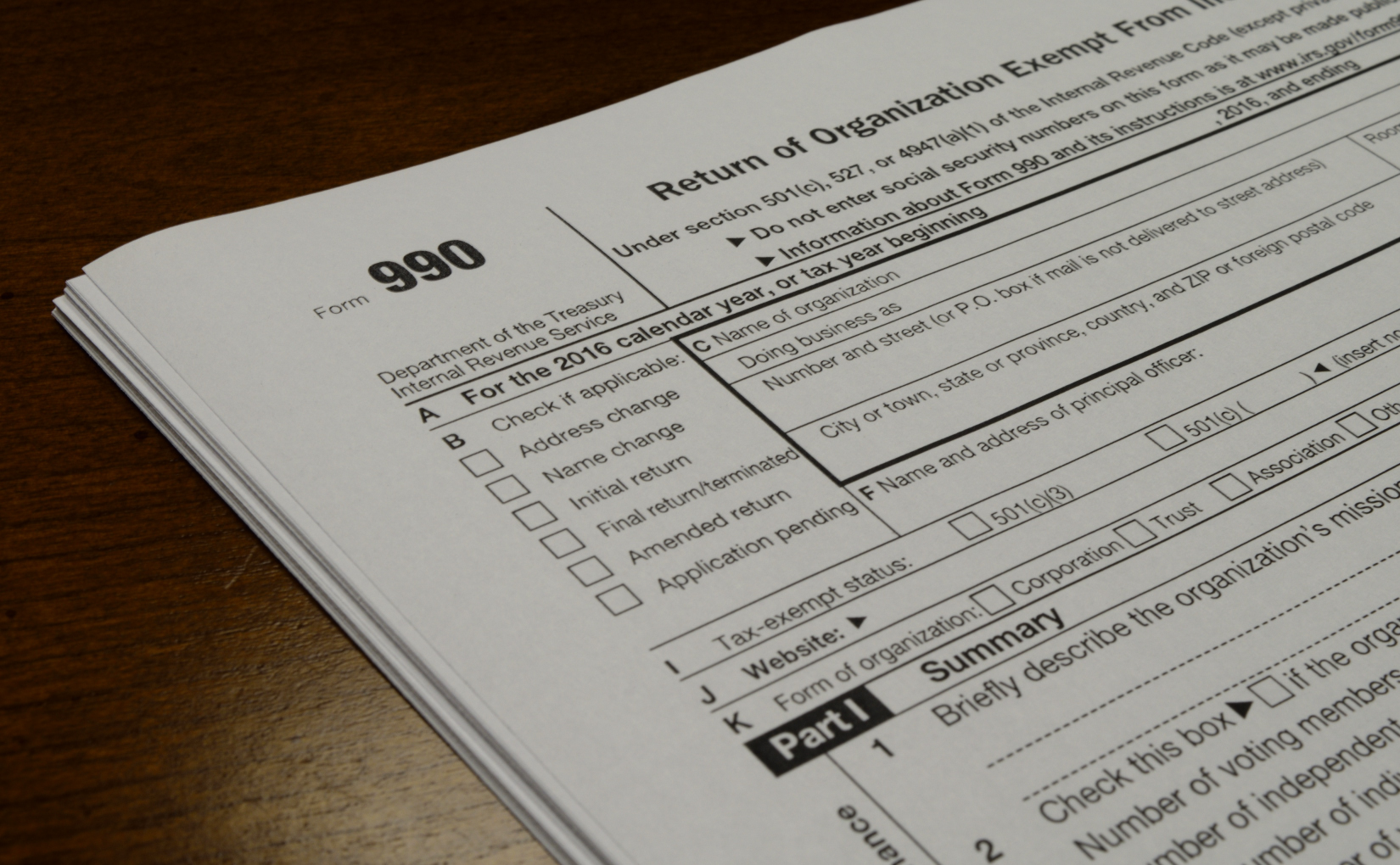

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17. Corporations, for example, still had to file by april 15, 2021. Nonprofit filing deadline for form 990 is may 17. Web can any officer file the extension request? Web if an organization is unable to complete its required forms.

How To Never Mistake IRS Form 990 and Form 990N Again

To use the table, you must know when your organization’s tax year ends. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. If you send a letter asking for an extension, along with the.

Instructions to file your Form 990PF A Complete Guide

When is form 990 due with extension form 8868? Web state deadlines are different! Usually, the deadline is determined by the 5th day of the 5th month after your organization’s tax year ends, but this year has been anything but typical. Ending date of tax year. And will that extension request automatically extend to my state filing deadline?

Usually, The Deadline Is Determined By The 5Th Day Of The 5Th Month After Your Organization’s Tax Year Ends, But This Year Has Been Anything But Typical.

To use the table, you must know when your organization’s tax year ends. Web if an organization is unable to complete its required forms by this year’s may 16 deadline, filing form 8868 can extend the filing date for the 2021 form 990 out to november 15, 2022. Nonprofit filing deadline for form 990 is may 17. Not all organizations and due dates were affected when the irs pushed the annual tax filing deadline back to may 17.

If The Organization Follows A Fiscal Tax Period (With An Ending Date Other December 31), The Due Date Is The 15Th Day Of The 5Th Month Following The End Of Your Accounting Period.

Web upcoming form 990 deadline: When is form 990 due with extension form 8868? Corporations, for example, still had to file by april 15, 2021. Also, if you filed an 8868 extension on january 15, 2023, then your form 990 extended deadline is.

If Your Organization’s Accounting Tax Period Starts On March 01, 2022, And Ends In February 2023, Your Form 990 Is Due By July 17, 2023.

If you send a letter asking for an extension, along with the form 8868 and the $15 filing fee, they will usually grant a. Web state deadlines are different! And will that extension request automatically extend to my state filing deadline? Ending date of tax year.