Form 941 Schedule B Instructions

Form 941 Schedule B Instructions - Web file schedule b (form 941) if you are a semiweekly schedule depositor. Web here’s a simple tax guide to help you understand form 941 schedule b. Step by step instructions for the irs form 941 schedule b. Qualified small business payroll tax credit for increasing research. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Web popular forms & instructions; 3 by the internal revenue service. Web deadlines to file form 941 and schedule b. Reported more than $50,000 of employment taxes in.

Explore instructions, filing requirements, and tips. Individual tax return form 1040 instructions; Web form 941 schedule b filing requirements. Step by step instructions for the irs form 941 schedule b. Reported more than $50,000 of employment taxes in. Web report your tax liabilities on form 941, line 16, or on schedule b (form 941), report of tax liability for semiweekly schedule depositors, if you defer social security tax and. Employers are required to withhold a. Employee's withholding certificate form 941; Plus, our expert support team is happy to help with any questions or. We need it to figure and collect the right amount of tax.

3 by the internal revenue service. Web a schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal revenue service. Web popular forms & instructions; File schedule b (form 941) with your form these. Web here’s a simple tax guide to help you understand form 941 schedule b. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Individual tax return form 1040 instructions; Plus, our expert support team is happy to help with any questions or. Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Explore instructions, filing requirements, and tips.

What is Form 941 Schedule B, Who Should Complete It? Blog TaxBandits

It is used by those who. Web deadlines to file form 941 and schedule b. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web a schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal.

IRS Form 941 Schedule B 2023

Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. We need it to figure and collect the right amount of tax. It is used by.

IRS Instructions 941 Schedule B 2020 Fill and Sign Printable

Web a schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal revenue service. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Plus, our expert support team is happy to help.

Instructions for Schedule R Form 941 Rev June Instructions for Schedule

You are a semiweekly depositor if you: Employee's withholding certificate form 941; Web deadlines to file form 941 and schedule b. Form 941 schedule b must be filed by employers, if they are reporting more than $50,000 in employment taxes for the previous. Employers are required to withhold a.

Download Instructions for IRS Form 941 Schedule B Report of Tax

File schedule b (form 941) with your form these. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Employee's withholding certificate form 941; Employers are required to withhold a. Web here’s a simple tax guide to help you understand form 941 schedule b.

Schedule B (Form 941) Report of Tax Liability for Semiweekly Schedule

Individual tax return form 1040 instructions; It is used by those who. Step by step instructions for the irs form 941 schedule b. Web a schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal revenue service. You are required to file schedule b and form 941.

What Is A Schedule B On Form 941?

Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Qualified small business payroll tax credit for increasing research. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. 3 by the internal revenue service. Web a schedule b form.

Form 941 Instructions & How to File it Bench Accounting

You are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Web deadlines to file form 941 and schedule b. It is used by those who. Employers are required to withhold a. 3 by the internal revenue service.

Form 941 Schedule B YouTube

Web a schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal revenue service. Web file schedule b (form 941) if you are a semiweekly schedule depositor. Employers are required to withhold a. Web you are required to file schedule b and form 941 by the last.

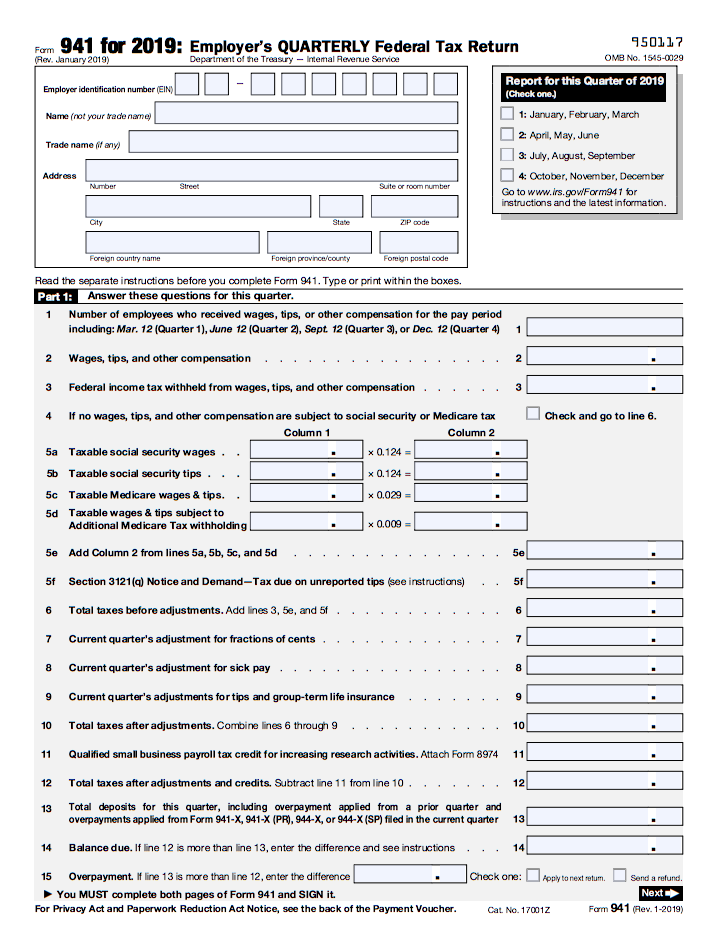

Form 941 Employer's Quarterly Federal Tax Return Form 941 Employer…

Web form 941 schedule b filing requirements. Web you are required to file schedule b and form 941 by the last day of the month following the end of the quarter. Employee's withholding certificate form 941; Reported more than $50,000 of employment taxes in. File schedule b (form 941) with your form these.

Step By Step Instructions For The Irs Form 941 Schedule B.

Reported more than $50,000 of employment taxes in. Web complete schedule b (form 941), report of tax liability for semiweekly schedule depositors, and attach it to form 941. Employers are required to withhold a. You are a semiweekly depositor if you:

Web Report Your Tax Liabilities On Form 941, Line 16, Or On Schedule B (Form 941), Report Of Tax Liability For Semiweekly Schedule Depositors, If You Defer Social Security Tax And.

Web draft instructions for schedule b of the 2022 form 941, employer’s quarterly federal tax return, were released feb. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Web form 941 schedule b filing requirements. Web here’s a simple tax guide to help you understand form 941 schedule b.

Individual Tax Return Form 1040 Instructions;

Explore instructions, filing requirements, and tips. Web file schedule b (form 941) if you are a semiweekly schedule depositor. 3 by the internal revenue service. Plus, our expert support team is happy to help with any questions or.

It Is Used By Those Who.

We need it to figure and collect the right amount of tax. File schedule b (form 941) with your form these. Web deadlines to file form 941 and schedule b. Web a schedule b form 941, also known as a report of tax liability for semiweekly schedule depositors, is a form required by the internal revenue service.