Form 940 Fillable

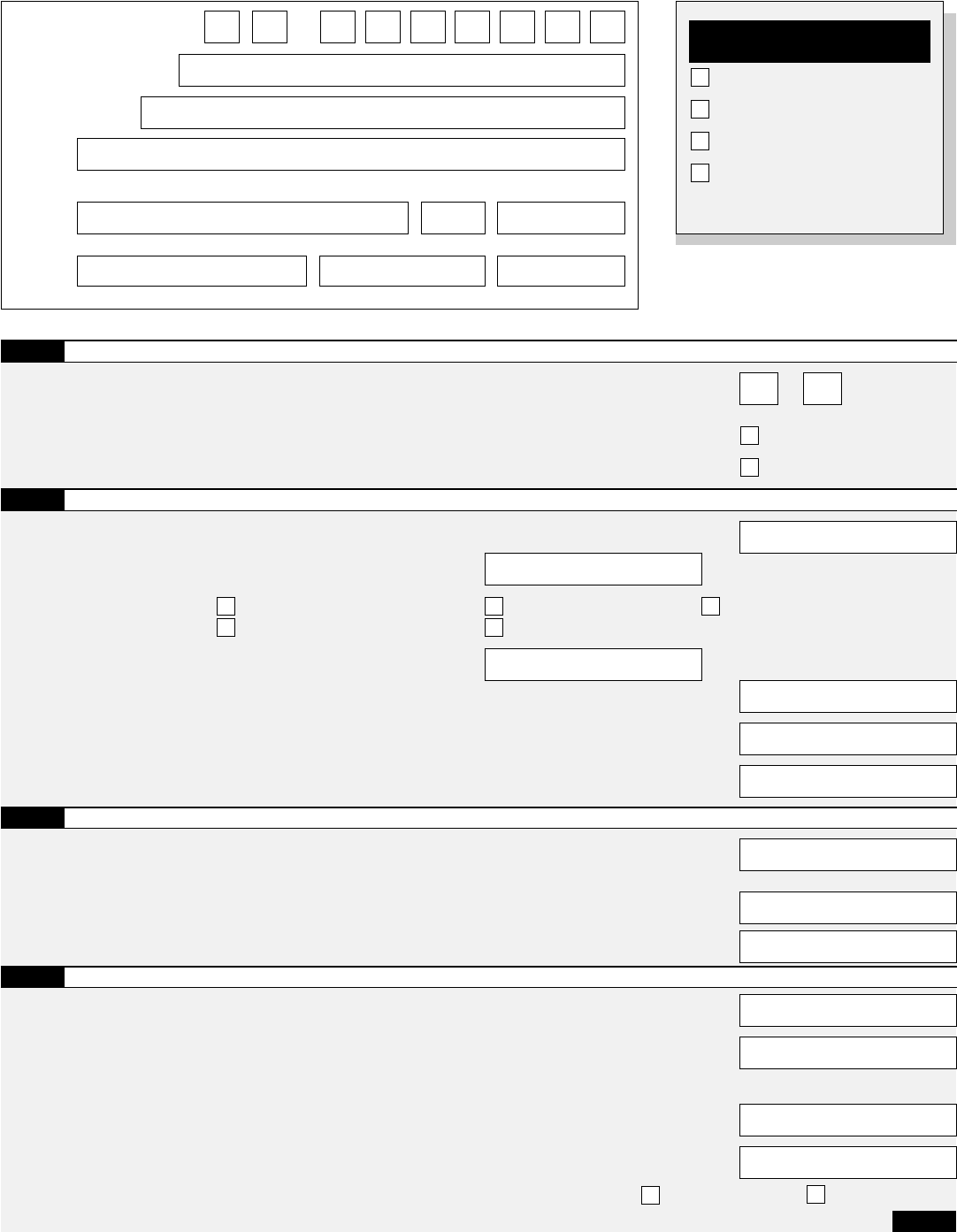

Form 940 Fillable - Web schedule a (form 940) for 2022: Schedule a is a worksheet that lists the applicable tax rates in each state. To complete irs form 940 for 2022, you can use an. Upload, modify or create forms. Web to calculate your futa tax rate, complete schedule a (form 940). Ad download or email irs 940 & more fillable forms, register and subscribe now! Additionally, the irs website offers detailed instructions on how. Complete, edit or print tax forms instantly. Web what i need the irs 940 form for? Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa).

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Web what i need the irs 940 form for? You can find your credit. 03 export or print immediately. To complete irs form 940 for 2022, you can use an. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Web here’s how to fill out each of the required sections of form 940 (note that, if any line is not applicable, you should leave the field blank): Web employment tax forms: Try it for free now!

Web you can find a printable version of the 940 form, a fillable version, or even a sample form to help you get started. Ad access irs tax forms. To complete form 940, you’ll need the following: Get ready for tax season deadlines by completing any required tax forms today. Upload, modify or create forms. Web making payments with form 940 to avoid a penalty, make your payment with your 2022 form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts. Ad download or email irs 940 & more fillable forms, register and subscribe now! The internal revenue service requires employers to file the 940 tax form annually on or before january 31st. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year.

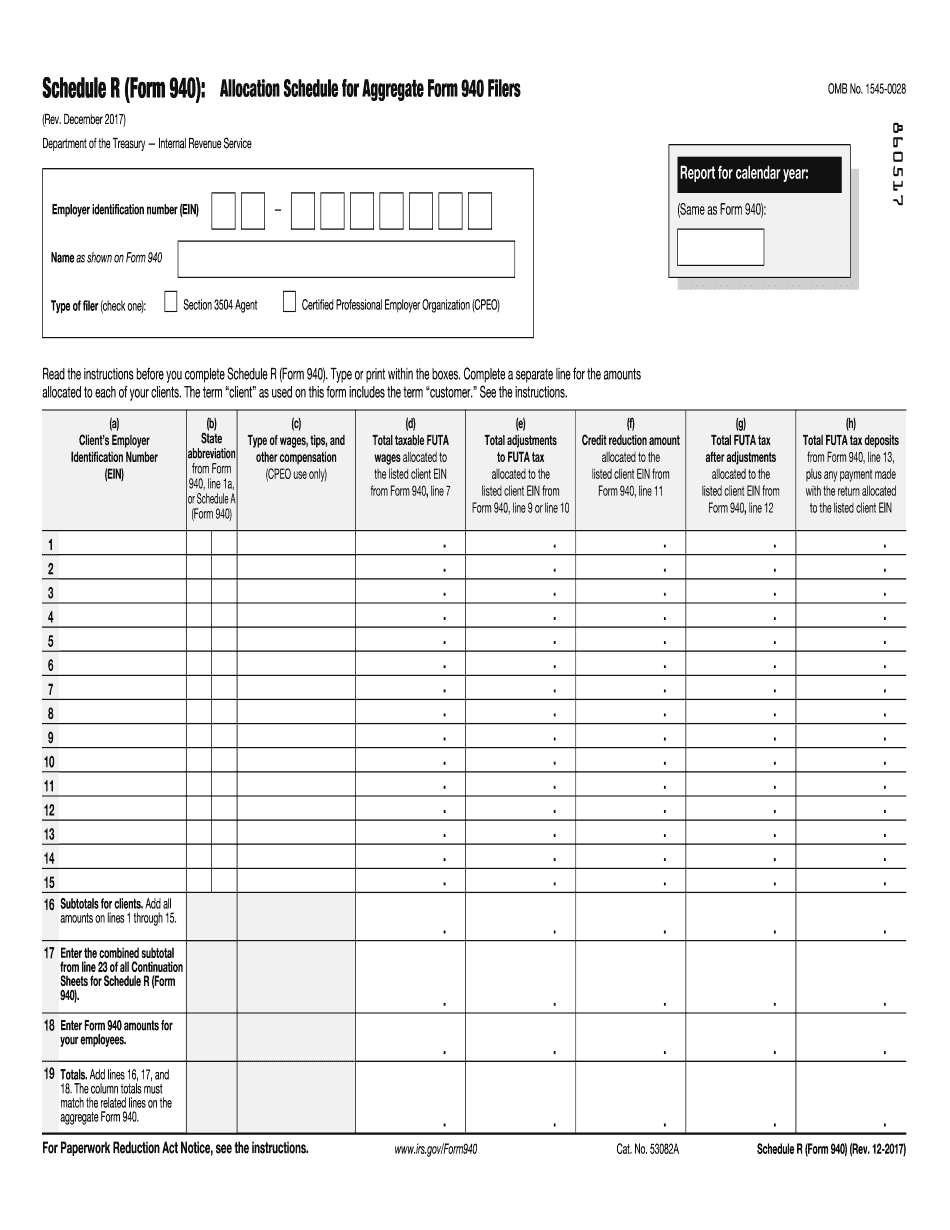

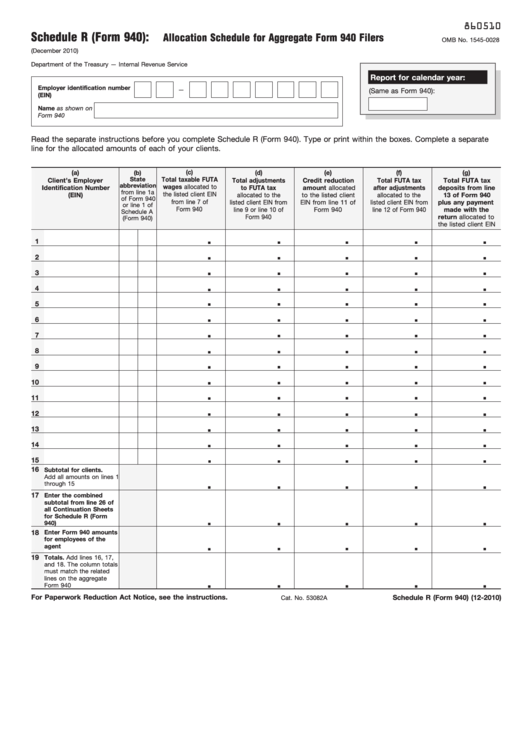

Are 940 schedule r form

01 fill and edit template. Use fill to complete blank online irs pdf forms for free. Web irs form 940 is used to report unemployment taxes that employers pay to the federal government under the federal unemployment tax act (futa). Futa is different from fica as employees don’t contribute. Web schedule a (form 940) for 2022:

940 Form 2023 Fillable Form 2023

Web schedule a (form 940) for 2022: Web get your form 940 (2020) in 3 easy steps. Ad access irs tax forms. Once completed you can sign your fillable. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due.

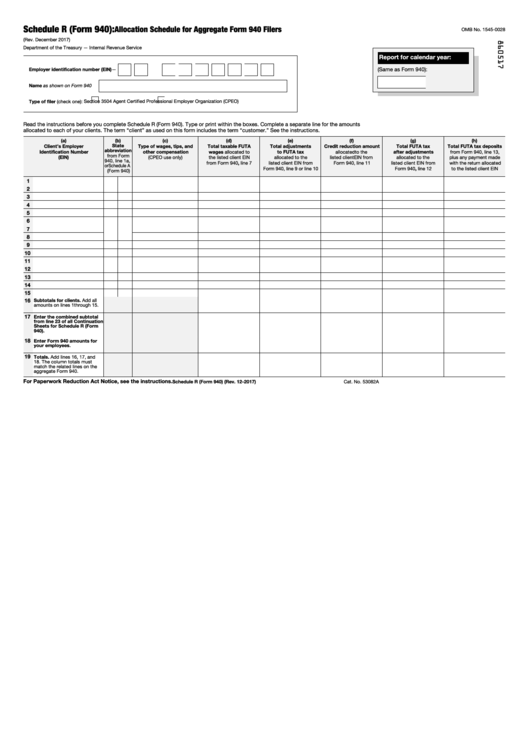

Fill Free fillable IRS form 940 schedule A 2019 PDF form

Provides a comprehensive guide into irs 940 form; Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Use fill to complete blank online irs pdf forms for free. Get ready for tax season deadlines by completing any required tax forms today. Additionally, the irs website offers detailed instructions on.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

Ad access irs tax forms. Complete, edit or print tax forms instantly. Web form 940 fillable vs printable. Once completed you can sign your fillable. Web get your form 940 (2020) in 3 easy steps.

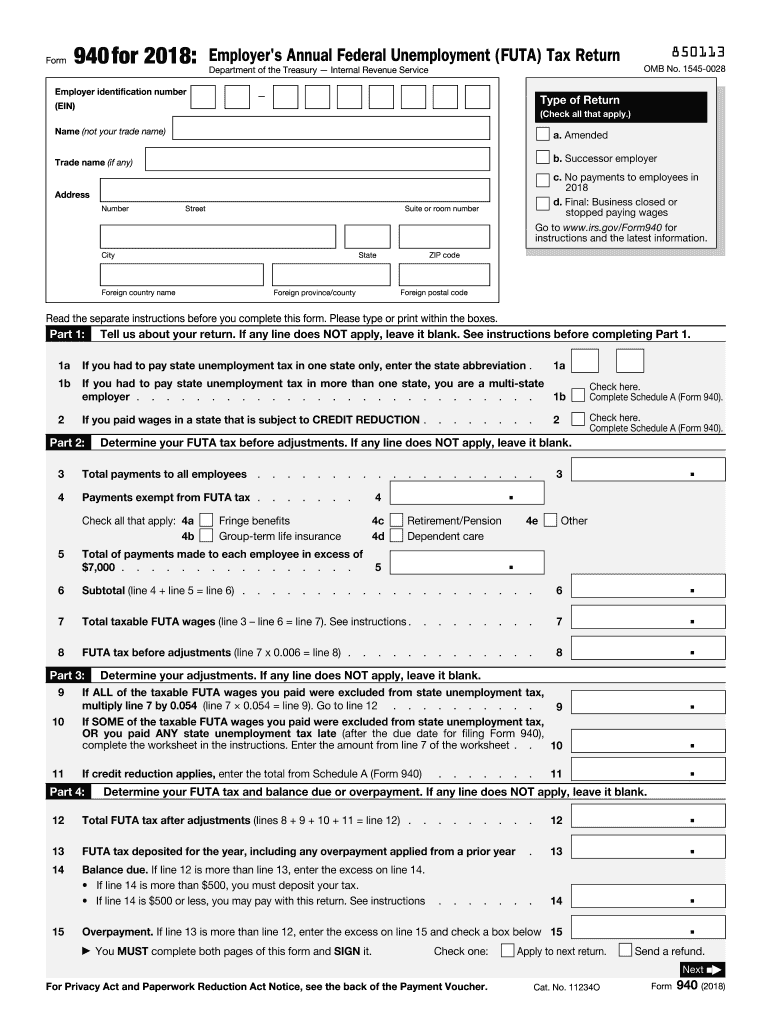

Form 940 For 2018 Fill Out and Sign Printable PDF Template signNow

Web get your form 940 (2020) in 3 easy steps. The internal revenue service requires employers to file the 940 tax form annually on or before january 31st. Web here’s how to fill out each of the required sections of form 940 (note that, if any line is not applicable, you should leave the field blank): Use fill to complete.

Fillable Schedule R (Form 940) Allocation Schedule For Aggregate Form

01 fill and edit template. Provides a comprehensive guide into irs 940 form; Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Ad download or email irs 940 & more fillable forms, register and subscribe now! Web what i need the.

Form 940 Edit, Fill, Sign Online Handypdf

You can visit online forms and publications for a complete list of edd forms available to view or order online. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Get ready for tax season deadlines by completing any required tax forms today. Web employment tax forms: Once completed.

Form 940 pr 2022 Fill online, Printable, Fillable Blank

Schedule a is a worksheet that lists the applicable tax rates in each state. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web what i need the irs 940 form for? Ad access irs tax forms. Provides a comprehensive guide.

940 pr 2021 Fill Online, Printable, Fillable Blank

Schedule a is a worksheet that lists the applicable tax rates in each state. Complete, edit or print tax forms instantly. Ad access irs tax forms. Web schedule a (form 940) for 2022: Once completed you can sign your fillable.

2020 form 940 schedule a instructions Fill Online, Printable

Web here’s how to fill out each of the required sections of form 940 (note that, if any line is not applicable, you should leave the field blank): To complete irs form 940 for 2022, you can use an. Additionally, the irs website offers detailed instructions on how. Web you can find a printable version of the 940 form, a.

Web Form 940 Fillable Vs Printable.

You can download the latest version for free;. Web form 940 is a tax return used to report a small business owner’s futa tax liability throughout the calendar year. Once completed you can sign your fillable. Web you can find a printable version of the 940 form, a fillable version, or even a sample form to help you get started.

Try It For Free Now!

You can visit online forms and publications for a complete list of edd forms available to view or order online. Form 940, employer's annual federal unemployment tax return. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Ad access irs tax forms.

Web Irs Form 940 Is Used To Report Unemployment Taxes That Employers Pay To The Federal Government Under The Federal Unemployment Tax Act (Futa).

Futa is different from fica as employees don’t contribute. 01 fill and edit template. Web here’s how to fill out each of the required sections of form 940 (note that, if any line is not applicable, you should leave the field blank): You can find your credit.

To Complete Form 940, You’ll Need The Following:

Web what i need the irs 940 form for? Provides a comprehensive guide into irs 940 form; 03 export or print immediately. Schedule a is a worksheet that lists the applicable tax rates in each state.