Form 940 2023

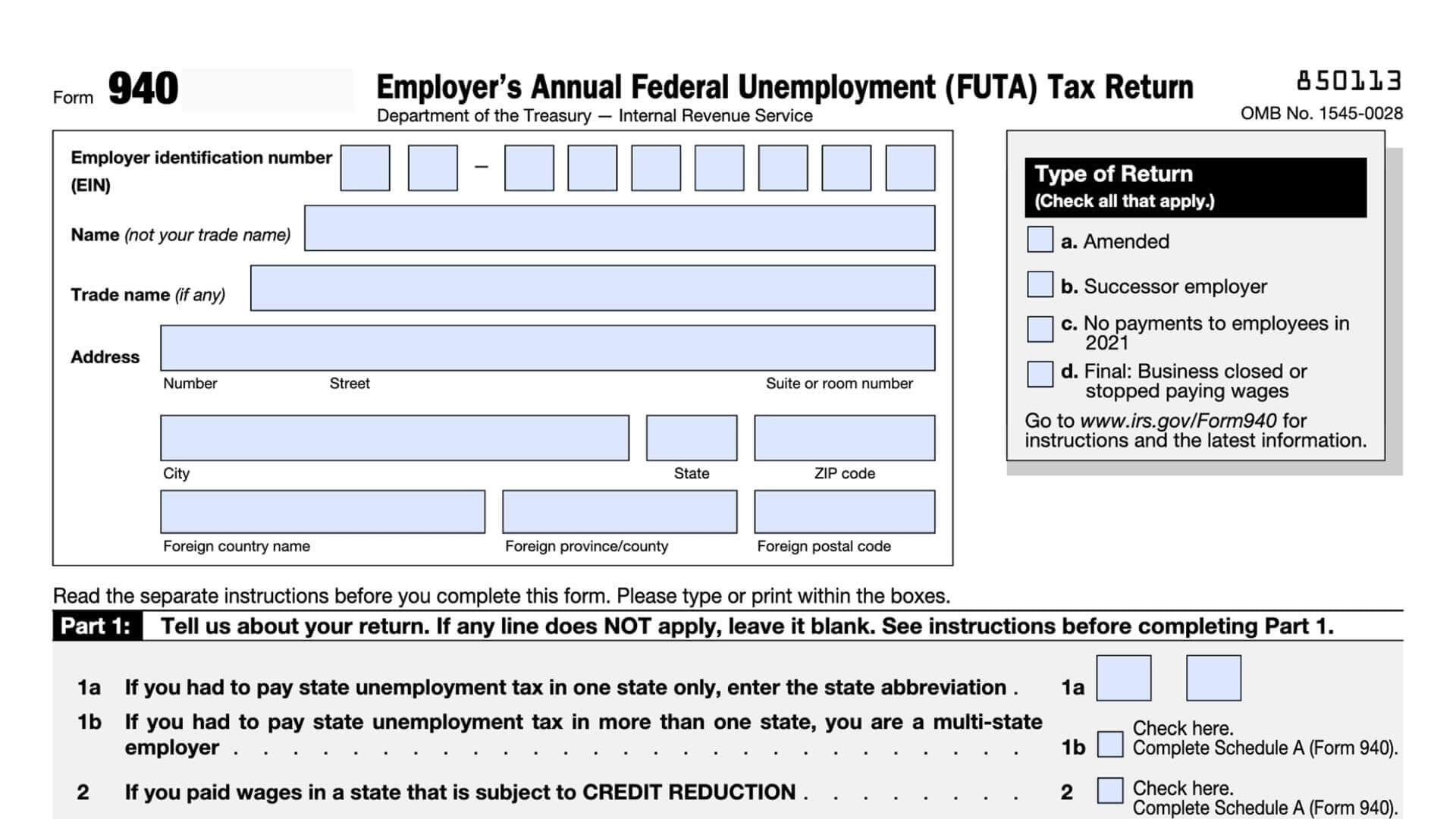

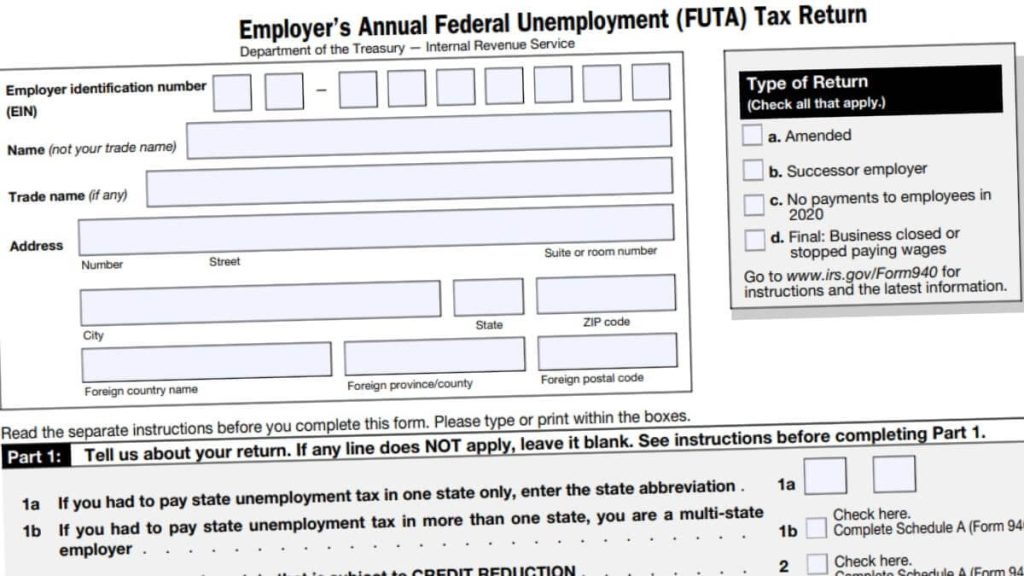

Form 940 2023 - Use form 940 to report your annual federal unemployment tax act (futa) tax. See when must you deposit your futa tax? Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. You receive acknowledgement within 24 hours. Form 941, employer's quarterly federal tax return.

You receive acknowledgement within 24 hours. In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of. In the instructions for form 940. See when must you deposit your futa tax? If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. It is secure and accurate. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes.

See when must you deposit your futa tax? Use form 940 to report your annual federal unemployment tax act (futa) tax. You receive acknowledgement within 24 hours. Form 941, employer's quarterly federal tax return. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax. In the instructions for form 940. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. I want to submit the forms myself

Payroll Tax Forms and Reports in ezPaycheck Software

I want to submit the forms myself Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. Web form 940, employer's annual federal unemployment tax return. In a major step in the new digital intake scanning.

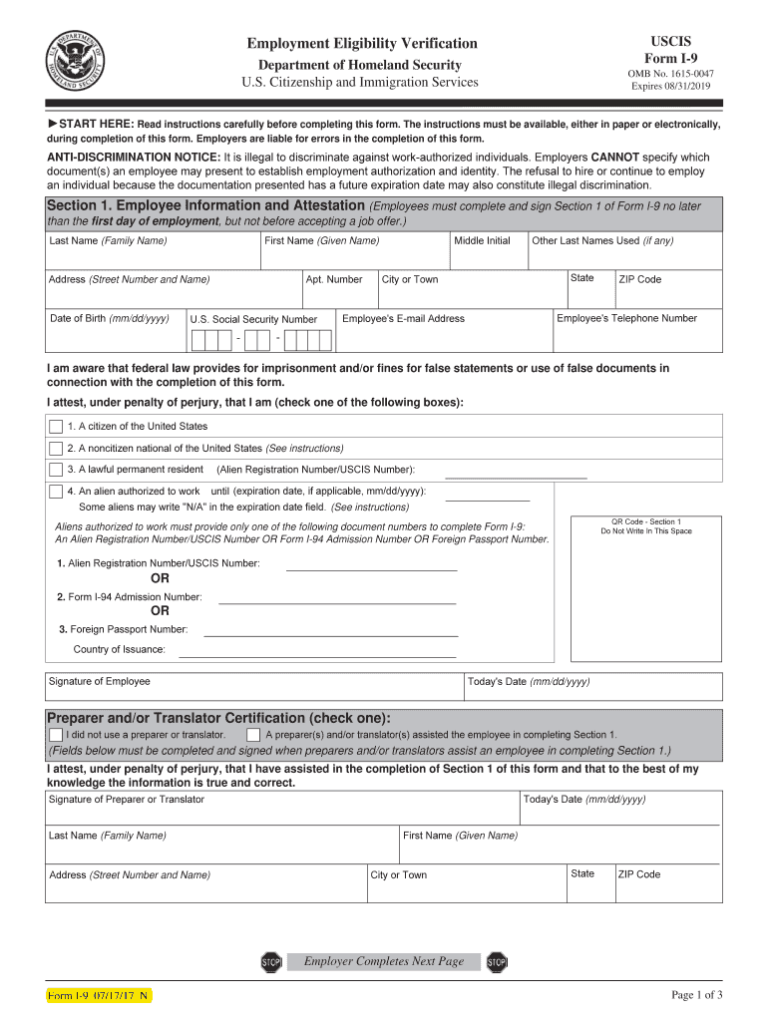

Pdf Fillable Form 940 I9 Form 2023 Printable

Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds.

940 Form 2023

Use form 940 to report your annual federal unemployment tax act (futa) tax. Futa tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. See when must you deposit your futa tax? In the instructions for form 940. Schedule r (form 940), allocation schedule for aggregate form 940.

2020 form 940 instructions Fill Online, Printable, Fillable Blank

Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. You receive acknowledgement within 24 hours. See when must you deposit your futa tax? Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and.

How to Fill out IRS Form 940 (FUTA Tax Return) YouTube

See when must you deposit your futa tax? Web the 940 form, also known as the employer's annual federal unemployment (futa) tax return, is a form used by employers to report their annual federal unemployment taxes. Form 941, employer's quarterly federal tax return. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers.

940 Form 2023

Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment.

Form 940 (Schedule A) MultiState Employer and Credit Reduction

940, 941, 943, 944 and 945. In a major step in the new digital intake scanning initiative, the irs has already scanned more than 120,000 paper forms 940 since the start of. See when must you deposit your futa tax? Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is.

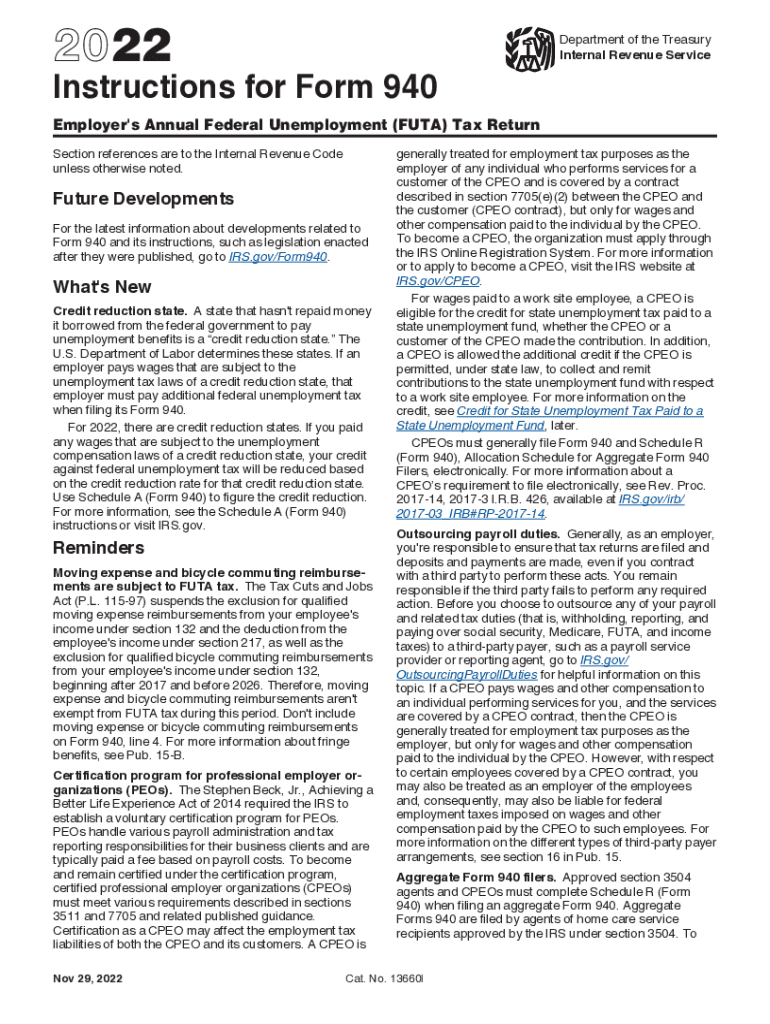

F940 Instructions 2021 Fill Out and Sign Printable PDF Template signNow

See when must you deposit your futa tax? Futa tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. In a major step in the new digital intake scanning initiative, the irs has already scanned more.

940 Form 2023 Fillable Form 2023

Web form 940, employer's annual federal unemployment tax return. 940, 941, 943, 944 and 945. You receive acknowledgement within 24 hours. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. Form 941, employer's quarterly federal tax return.

SOLUTION Form 940 And 941 Complete Studypool

Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web form 940, employer's annual federal unemployment tax return. Schedule r (form 940), allocation schedule for aggregate form 940 filers pdf. In a major step in the new digital intake scanning initiative, the irs has already scanned.

In A Major Step In The New Digital Intake Scanning Initiative, The Irs Has Already Scanned More Than 120,000 Paper Forms 940 Since The Start Of.

You receive acknowledgement within 24 hours. 940, 941, 943, 944 and 945. Web you must file your 2022 form 940 by january 31, 2023, but if you make all your required futa tax deposits by the dates they are due, this filing deadline will be extended to february 10, 2023. Use form 940 to report your annual federal unemployment tax act (futa) tax.

Schedule R (Form 940), Allocation Schedule For Aggregate Form 940 Filers Pdf.

It is secure and accurate. This form is used to report the total amount of wages paid to employees and the employer's share of the futa tax. Web form 940 only if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is $500 or less. Web form 940, employer's annual federal unemployment tax return.

Web The 940 Form, Also Known As The Employer's Annual Federal Unemployment (Futa) Tax Return, Is A Form Used By Employers To Report Their Annual Federal Unemployment Taxes.

If it is $500 or less, you can either deposit the amount or pay it with your form 940 by january 31, 2023. Form 941, employer's quarterly federal tax return. Web if your futa tax for the fourth quarter (plus any undeposited amounts from earlier quarters) is more than $500, deposit the entire amount by january 31, 2023. In the instructions for form 940.

See When Must You Deposit Your Futa Tax?

If your total futa tax after adjustments (form 940, line 12) is more than $500, you must make deposits by electronic funds transfer. Together with state unemployment tax systems, the futa tax provides funds for paying unemployment compensation to workers who have. Futa tax is a federal tax that helps fund state unemployment agencies and provides unemployment benefits to workers who have lost their jobs. Web form 940, also known as the employer’s annual federal unemployment (futa) tax return, is a form that employers use to report and pay their futa tax.