Form 8958 Irs

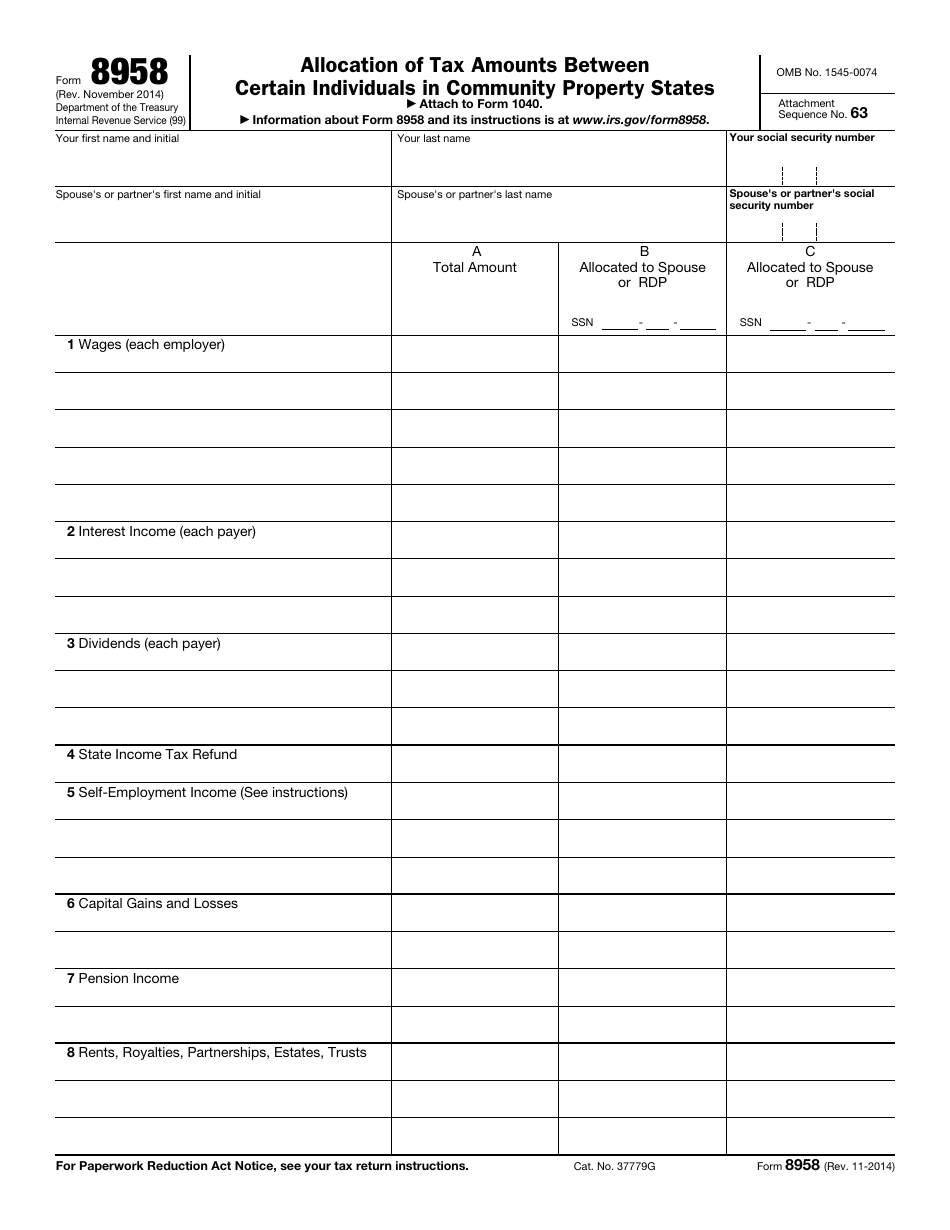

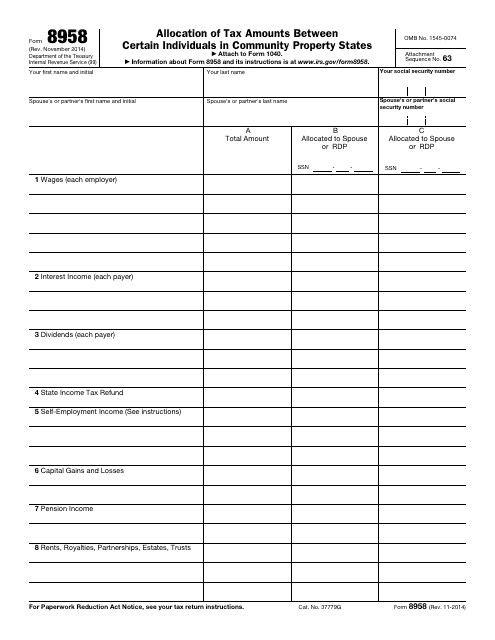

Form 8958 Irs - Web tennessee and south dakota. The allocation shown on forms 8958 in the two returns should be consistent. Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax. Per irs publication 555 community property, page 2: Income allocation information is required when electronically filing a return with a married filing separately or registered domestic. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). If filing jointly generally results in the lowest total tax, why would married taxpayers want to. Web employer's quarterly federal tax return. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half of all community income and all your separately earned income.

Web tennessee and south dakota. File with a tax pro file online If form 8958 is needed, a federal note is produced, and a state ef message may also be produced. About form 8958, allocation of tax amounts between certain individuals in community property states | internal revenue service Instructions for form 941 pdf Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property state. This publication does not address the federal tax treatment of income or property subject to the community property election. If you need more room, attach a statement listing the source of the item and the total plus the allocated amounts. I got married in nov 2021. Publication 555 discusses community property laws that affect how income is figured for your tax return if you are married, live in a community property state or country, and file separate returns.

Instructions for form 941 pdf The states of tennessee and south dakota have passed elective community property laws. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Web tennessee and south dakota. Not all income is community income needing to be divided between spouses/rdps. If you need more room, attach a statement listing the source of the item and the total plus the allocated amounts. If form 8958 is needed, a federal note is produced, and a state ef message may also be produced. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Employers who withhold income taxes, social security tax, or medicare tax from employee's paychecks or who must pay the employer's portion of social security or medicare tax.

Fillable Form 8958 Allocation Of Tax Amounts Between Certain

If form 8958 is needed, a federal note is produced, and a state ef message may also be produced. Web employer's quarterly federal tax return. Income allocation information is required when electronically filing a return with a married filing separately or registered domestic. Form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property state. Web common questions about entering form 8958 income for community property allocation in lacerte. The allocation shown on forms 8958 in the two returns should be consistent. Form 8958 allocation of tax.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

See the instructions for form 8958 for details on completing the form. Web employer's quarterly federal tax return. Web form 8958 is a federal corporate income tax form. Web refer to irs publication 555 for information regarding which income and expenses are considered community property, and which are considered separate property. Web you only need to complete form 8958 allocation.

Form 8958 Fill Out and Sign Printable PDF Template signNow

My wife and i are filing married, filing separately for 2021. This allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal return. Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Web tennessee.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). The allocation shown on forms 8958 in the two returns should be consistent. Not all income is community income needing to be divided between spouses/rdps. Web.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Per irs publication 555 community property, page 2: Web submitting the irs form 8958 fillable with signnow will give greater confidence that the output document will be legally binding and safeguarded. Technically our community earnings are only from nov 2021 to dec.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

Web form 8958 is a federal corporate income tax form. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report half of all community income and all your separately earned income. File with a tax pro file online The states.

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

My wife and i are filing married, filing separately for 2021. Quick guide on how to complete irs form 8958 fillable forget about scanning and printing out forms. Form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Instructions for form 941 pdf Web in each split return,.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web in each split return, this will force the software to produce form 8958, allocation of tax amounts between certain individuals in community property states. If you need more room, attach a statement listing the source of the item and the total plus the allocated amounts. File with a tax pro file online Some common tax credits apply to many.

Form 8958 instructions 2023 Fill online, Printable, Fillable Blank

Use our detailed instructions to fill out and esign your documents online. About form 8958, allocation of tax amounts between certain individuals in community property states | internal revenue service I'm curious as to how to fill out form 8958 when it comes to our income. My wife and i are filing married, filing separately for 2021. File with a.

Web Form 8958 Allocation Of Tax Amounts Between Certain Individuals In Community Property States Allocates Income Between Spouses/Partners When Filing A Separate Return.

Income allocation information is required when electronically filing a return with a married filing separately or registered domestic. Web common questions about entering form 8958 income for community property allocation in lacerte. Web information about publication 555, community property, including recent updates and related forms. The allocation shown on forms 8958 in the two returns should be consistent.

Web Submitting The Irs Form 8958 Fillable With Signnow Will Give Greater Confidence That The Output Document Will Be Legally Binding And Safeguarded.

File with a tax pro file online See the instructions for form 8958 for details on completing the form. Web how to properly fill out form 8958 i moved to nevada in feb 2021 from north carolina. Technically our community earnings are only from nov 2021 to dec 31, 2021?

I'm Curious As To How To Fill Out Form 8958 When It Comes To Our Income.

Web you only need to complete form 8958 allocation of tax amounts between certain individuals in community property states if you were domiciled in a community property state. About form 8958, allocation of tax amounts between certain individuals in community property states | internal revenue service Form 8958 allocation of tax amounts between certain individuals in community property states allocates income between spouses/partners when filing a separate return. Instructions for form 941 pdf

This Allocation Worksheet Does Not Need To Be Completed If You Are Only Filing The State Returns Separately And Filing A Joint Federal Return.

Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or qualifying widow (er). Community property laws only apply to those who are actually domiciled in the state. Please refer to pub 555 for more information. If you need more room, attach a statement listing the source of the item and the total plus the allocated amounts.