Form 8938 Penalties

Form 8938 Penalties - 2 what is a specified foreign financial asset? Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web in general, form 8938 penalties will be $10,000 per year. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. 4 what exchange rate is used to convert maximum. Unlike the fbar penalties, there has been no indication that the internal revenue service plans on. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. How to avoid late fines form 8938 penalties under 6038d (fatca). Use form 8938 to report your. Web form 8938 is used by some u.s.

In general, form 893 8 reporting is required if. 3 what is the form 8938 reporting threshold? How to avoid late fines form 8938 penalties under 6038d (fatca). Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Aggregate foreign assets of usd 200,000 on the last day of the year or usd 300,000 at any time during the year. Form 8938 is one of the newest additions to the internal revenue service’s. Use form 8938 to report your. Web 1 who is a specified individual? Unlike the fbar penalties, there has been no indication that the internal revenue service plans on.

Web form 8938 is used by some u.s. Web form 8938 penalties (new) 2022 form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal. 3 what is the form 8938 reporting threshold? Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for. Use form 8938 to report your. Web 1 who is a specified individual? Or, if you have an understatement of tax relating to an undisclosed specified. Learn whether you have to file, as well as how and when. You may be subject to penalties if you fail to timely file a correct form 8938. Aggregate foreign assets of usd 200,000 on the last day of the year or usd 300,000 at any time during the year.

Form 8938 Penalties & Statute of Limitations FATCA Tax Law Firm New

Form 8938 is one of the newest additions to the internal revenue service’s. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. 3 what is the form 8938 reporting threshold? Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. Web 1 who.

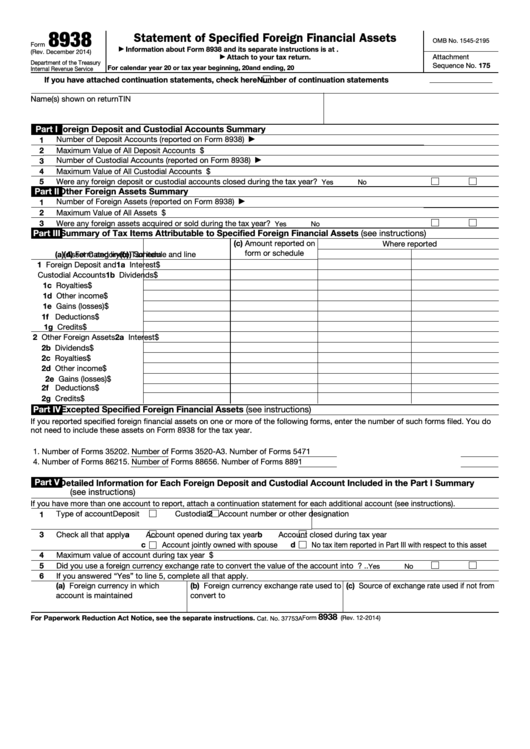

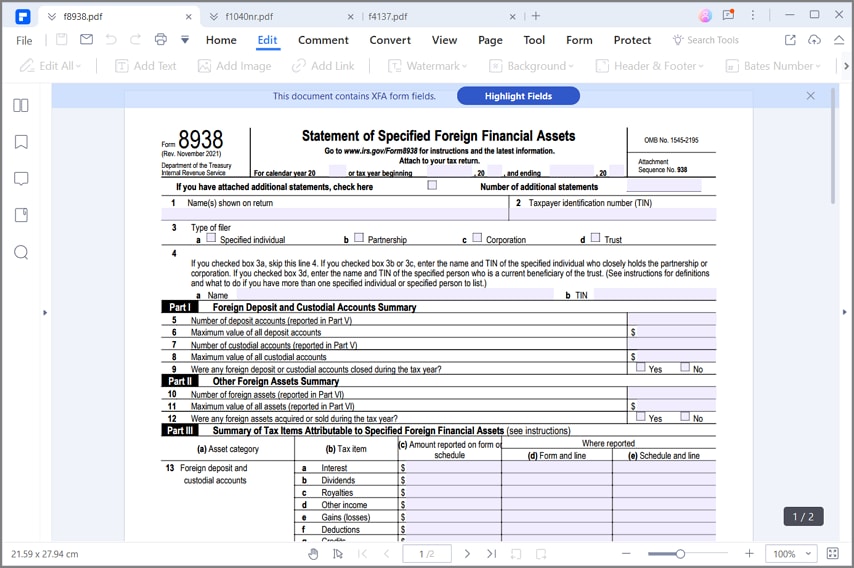

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Or, if you have an understatement of tax relating to an undisclosed specified. Web in general, form 8938 penalties will be $10,000 per year. In general, form 893 8 reporting is required if. You may be subject to penalties if you fail to timely file a correct form 8938. Person” must file annually a form 893 8 reporting their ownership.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Learn whether you have to file, as well as.

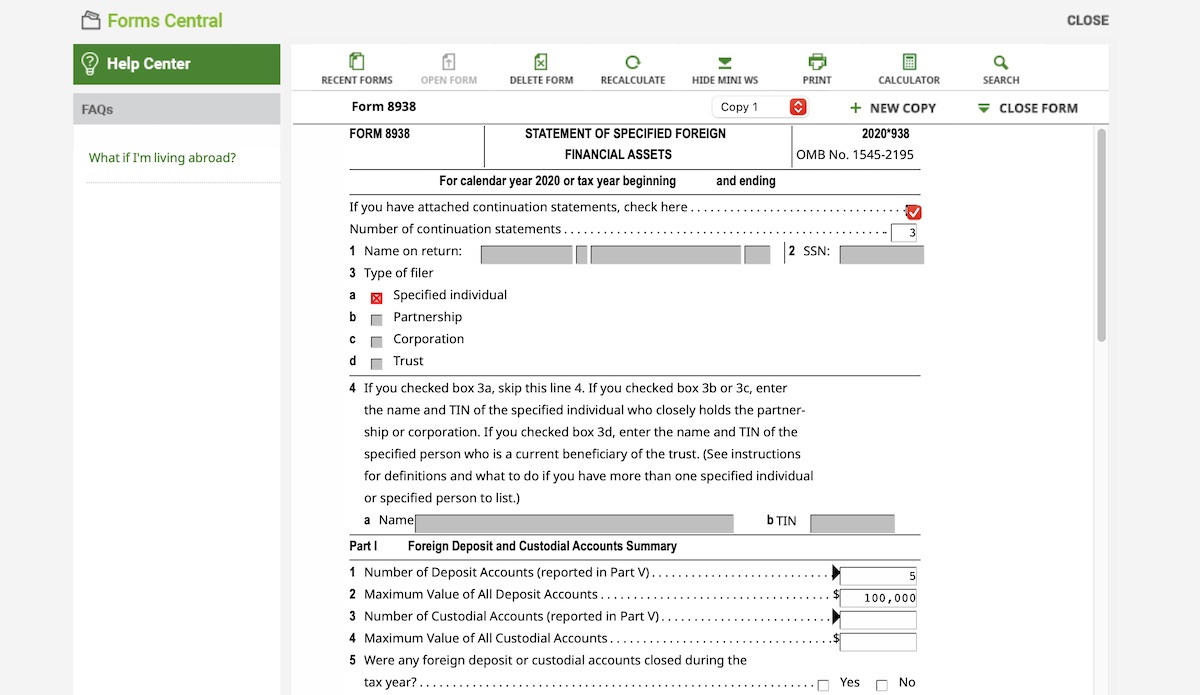

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Unlike the fbar penalties, there has been no indication that the internal revenue service plans on. In general, form 893 8 reporting is required if. Or, if you have an understatement of tax relating to an undisclosed specified. Web in general, form 8938 penalties will be $10,000 per year. Web failure to report foreign financial assets on form 8938 may.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

In general, form 893 8 reporting is required if. Web there are several ways to submit form 4868. Or, if you have an understatement of tax relating to an undisclosed specified. Form 8938 is one of the newest additions to the internal revenue service’s. Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial.

Form 8938 Vs. FBAR Filing, Reporting & Penalties Explained AKIF CPA

Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you.

Form 8938 Penalty How to Avoid Late Filed IRS Penalties

Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. Web form 8938 penalties (new) 2022 form 8938 is an irs international reporting form used to disclose overseas accounts, assets, investments, and income to the irs (internal. Web in general, form 8938 penalties will be $10,000 per year. Web if you do not.

The Counting Thread v2 (Page 298) EVGA Forums

4 what exchange rate is used to convert maximum. Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. Or, if you have an understatement of tax relating to an undisclosed specified..

Form 8938 Blank Sample to Fill out Online in PDF

2 what is a specified foreign financial asset? Web failure to report foreign financial assets on form 8938 may result in a penalty of $10,000 (and a penalty up to $50,000 for continued failure after irs notification). Person” must file annually a form 893 8 reporting their ownership of most “specified foreign financial assets.”. 3 what is the form 8938.

Spain’s Version of IRS Form 8938 Sanctions Struck Down—Part I

In general, form 893 8 reporting is required if. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to.

Unlike The Fbar Penalties, There Has Been No Indication That The Internal Revenue Service Plans On.

You may be subject to penalties if you fail to timely file a correct form 8938. Web form 8938 is used by some u.s. Web there are several ways to submit form 4868. 4 what exchange rate is used to convert maximum.

How To Avoid Late Fines Form 8938 Penalties Under 6038D (Fatca).

Web information about form 8938, statement of foreign financial assets, including recent updates, related forms and instructions on how to file. 2 what is a specified foreign financial asset? 3 what is the form 8938 reporting threshold? Web the penalty for failing to file form 8938 is $10,000, and an additional penalty of up to $50,000 or 5 percent of the total balance may be imposed.

Web 1 Who Is A Specified Individual?

Or, if you have an understatement of tax relating to an undisclosed specified. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web in general, form 8938 penalties will be $10,000 per year. Web if you do not file a correct and complete form 8938 within 90 days after the irs mails you a notice of the failure to file, you may be subject to an additional penalty of $10,000 for.

In General, Form 893 8 Reporting Is Required If.

Learn whether you have to file, as well as how and when. Taxpayers who hold foreign assets beyond a certain threshold. Web if you are married and file a separate income tax return from your spouse, you satisfy the reporting threshold only if the total value of your specified foreign financial assets is. Aggregate foreign assets of usd 200,000 on the last day of the year or usd 300,000 at any time during the year.