Form 8938 Example

Form 8938 Example - For example, if a married couple filing jointly lives. Web some common examples, include: Fill out the statement of specified foreign financial assets online and print it out for free. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web for example, if you do not have to file a u.s. Web form 8938 threshold 2021. Many taxpayers report information regarding sffas on other forms. Income tax return for the year, then you do not have to file form 8938, regardless of the value of your specified foreign financial assets. Complete, edit or print tax forms instantly. Web form 8938 exceptions to filing with irs (4 examples) golding & golding, international tax lawyers usa february 21 2022 can you avoid form 8938 filing.

Stock securities investments life insurance partnerships and corporations pension/retirement who is a specified individual? Fill out the statement of specified foreign financial assets online and print it out for free. To get to the 8938 section in turbotax, refer to the following instructions: For example, if a married couple filing jointly lives. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; Many taxpayers report information regarding sffas on other forms. Web filing form 8938 is only available to those using turbotax deluxe or higher. Web if you are required to file fincen form 114, it does not necessarily mean you need to file form 8938 with the irs on your taxes.i will go though a sample form 8938 and explain. Web go to screen 60, foreign reporting (114, 8938).; Get ready for tax season deadlines by completing any required tax forms today.

Web in actuality, what the publication seemed to be saying was that accounts held within an investment account such as accounts held within a foreign pension do not need to be. Many taxpayers report information regarding sffas on other forms. Complete, edit or print tax forms instantly. Use form 8938 to report your specified foreign financial assets if the total value of all the specified. Get ready for tax season deadlines by completing any required tax forms today. Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; Unlike other forms, such as a form 3520, which you file (if you meet the reporting threshold) whether or not you have to. Web if you are required to file fincen form 114, it does not necessarily mean you need to file form 8938 with the irs on your taxes.i will go though a sample form 8938 and explain. Ad get ready for tax season deadlines by completing any required tax forms today.

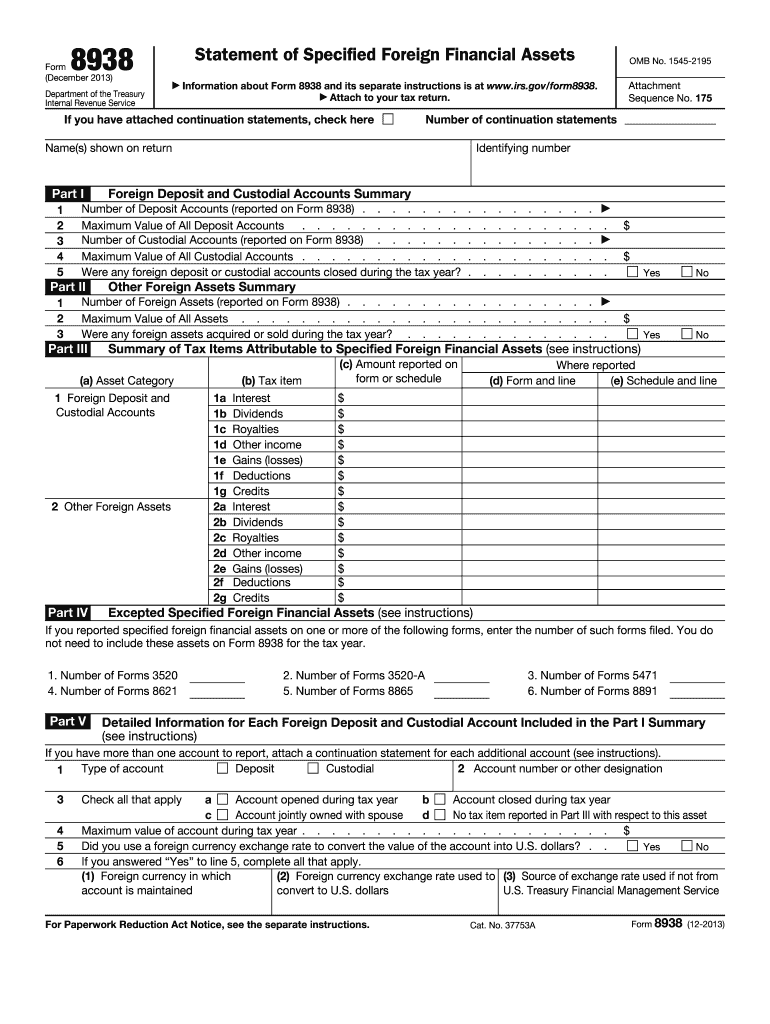

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca. Web in actuality, what the publication seemed to be saying was that accounts held within an investment account such as accounts held within a foreign pension do not need to be. Web the filing thresholds for form 8938 depend on.

Social Security NonTax Considerations « TaxExpatriation

Web about form 8938, statement of specified foreign financial assets. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Web for example, if you do not have to file a u.s. Web form 8938 threshold 2021. Get.

The Expat’s Guide to IRS Form 8938 and FATCA Reporting

Ad get ready for tax season deadlines by completing any required tax forms today. Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca. Web filing form 8938 is only available to those using turbotax deluxe or higher. Fill out the statement of specified foreign financial assets online and print.

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Web under prior law, the reporting of sffas on form 8938 solely applied to individuals,. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web go to screen 60, foreign reporting (114, 8938).; Person must complete form 8938 and attach it to their form.

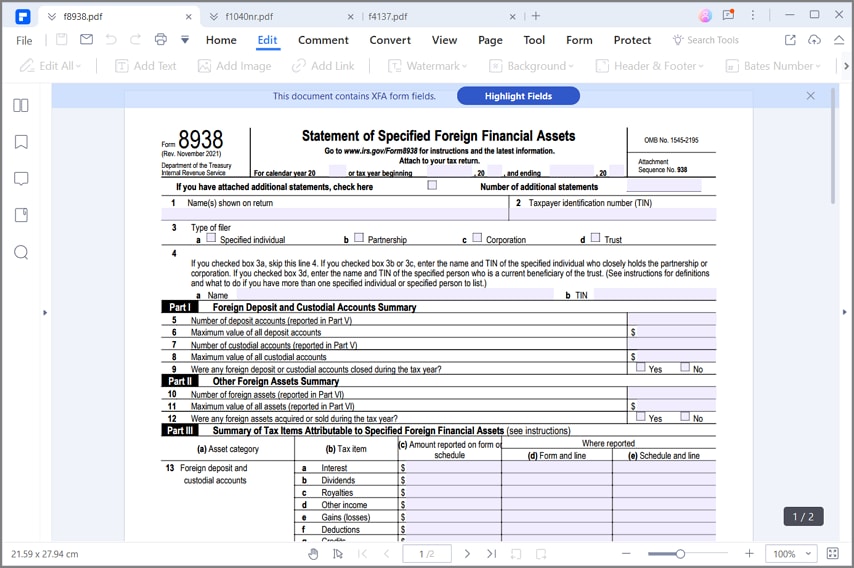

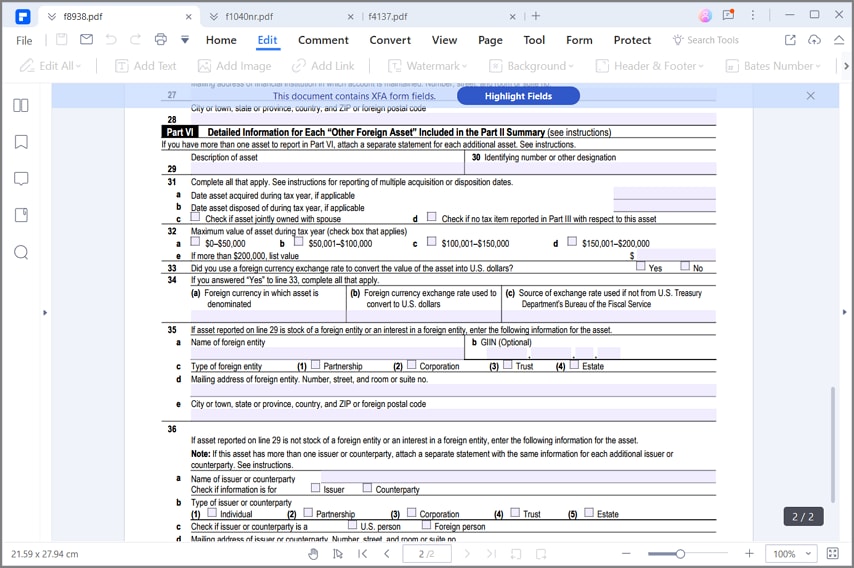

IRS Form 8938 How to Fill it with the Best Form Filler

Web under prior law, the reporting of sffas on form 8938 solely applied to individuals,. For example, if a married couple filing jointly lives. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.; Income tax return for the year, then you do not have to file form 8938, regardless of the value of your.

IRS Form 8938 How to Fill it with the Best Form Filler

Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. For example, if a married couple filing jointly lives. Web form 8938 threshold 2021. Web filing form 8938 is only available to those using turbotax deluxe or higher..

해외금융계좌 신고 3 Form 8938 (Statement of Specified Foreign Financial Assets)

For example, if a married couple filing jointly lives. Web you must file irs form 8938 statement of specified foreign financial assets if you have an interest in specified foreign assets and the value of those assets is more than the. Get ready for tax season deadlines by completing any required tax forms today. Unlike other forms, such as a.

Form 8938 Blank Sample to Fill out Online in PDF

Get ready for tax season deadlines by completing any required tax forms today. Web form 8938 instructions (how to report): Web some common examples, include: To get to the 8938 section in turbotax, refer to the following instructions: Income tax return for the year, then you do not have to file form 8938, regardless of the value of your specified.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Web go to screen 60, foreign reporting (114, 8938).; Web for example, if you do not have to file a u.s. Many taxpayers report information regarding sffas on other forms. For example, if a married couple filing jointly lives. Web form 8938 threshold 2021.

What is FATCA? (Foreign Account Tax Compliance Act)

To get to the 8938 section in turbotax, refer to the following instructions: Fill out the statement of specified foreign financial assets online and print it out for free. Web some common examples, include: Complete, edit or print tax forms instantly. Web for example, if you do not have to file a u.s.

Web Go To Screen 60, Foreign Reporting (114, 8938).;

Web about form 8938, statement of specified foreign financial assets. Web use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the. Unlike other forms, such as a form 3520, which you file (if you meet the reporting threshold) whether or not you have to. Select statement of foreign assets (8938) under foreign bank account (114) from the left panel.;

Irs Tax Form 8938 Instructions Involve The Reporting Of Specified Foreign Financial Assets To The Irs In Accordance With Fatca.

Web form 8938 exceptions to filing with irs (4 examples) golding & golding, international tax lawyers usa february 21 2022 can you avoid form 8938 filing. Web the filing thresholds for form 8938 depend on the taxpayer's filing status and whether they live in the u.s. Web some common examples, include: Use form 8938 to report your specified foreign financial assets if the total value of all the specified.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Stock securities investments life insurance partnerships and corporations pension/retirement who is a specified individual? Web filing form 8938 is only available to those using turbotax deluxe or higher. Person must complete form 8938 and attach it to their form 1040 if. Web form 8938 instructions (how to report):

Income Tax Return For The Year, Then You Do Not Have To File Form 8938, Regardless Of The Value Of Your Specified Foreign Financial Assets.

Fill out the statement of specified foreign financial assets online and print it out for free. Ad get ready for tax season deadlines by completing any required tax forms today. Web under prior law, the reporting of sffas on form 8938 solely applied to individuals,. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010.