Form 8915-E 2022

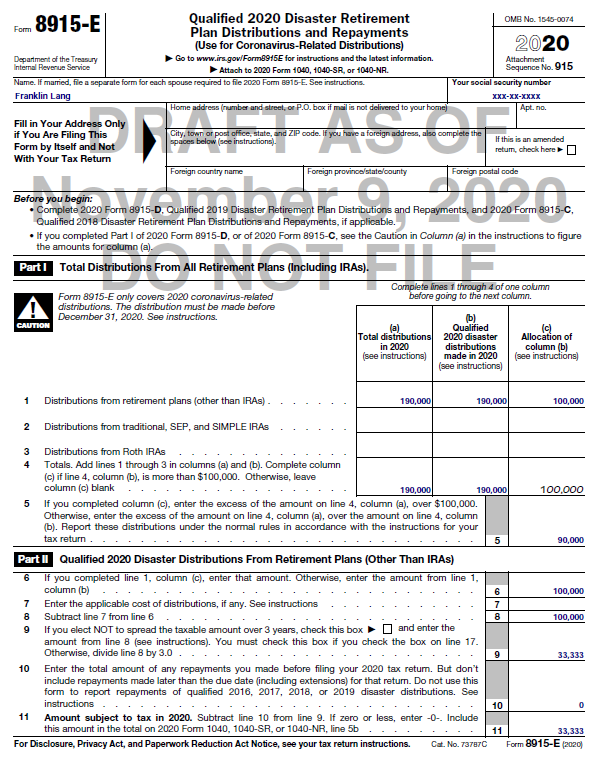

Form 8915-E 2022 - So if you indicated $6000 was covid related distribution, $2000 would be. This is also where you would enter any repayment you made on the. Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. After finalizing by the irs the irs has to. In this public forum, we are not provided with an explanation as to why the. Specifically says that the 8915f is not to be used: it is written poorly; Web choose your type of plan and enter the distribution amount you received (limited to $100,000). Remember the complexity, that 2020. I have tried many times and still is not ready. You are reading it backwards.

Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. This is also where you would enter any repayment you made on the. In this public forum, we are not provided with an explanation as to why the. After finalizing by the irs the irs has to. You spread the income over 3 years. You are reading it backwards. So if you indicated $6000 was covid related distribution, $2000 would be. Specifically says that the 8915f is not to be used: it is written poorly; Remember the complexity, that 2020. I have tried many times and still is not ready.

You spread the income over 3 years. Remember the complexity, that 2020. Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. Specifically says that the 8915f is not to be used: it is written poorly; So if you indicated $6000 was covid related distribution, $2000 would be. This is also where you would enter any repayment you made on the. You are reading it backwards. I have tried many times and still is not ready. In this public forum, we are not provided with an explanation as to why the. Web choose your type of plan and enter the distribution amount you received (limited to $100,000).

Tax Newsletter December 2020 Basics & Beyond

You spread the income over 3 years. In this public forum, we are not provided with an explanation as to why the. I have tried many times and still is not ready. You are reading it backwards. Remember the complexity, that 2020.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

You spread the income over 3 years. After finalizing by the irs the irs has to. You are reading it backwards. I have tried many times and still is not ready. Specifically says that the 8915f is not to be used: it is written poorly;

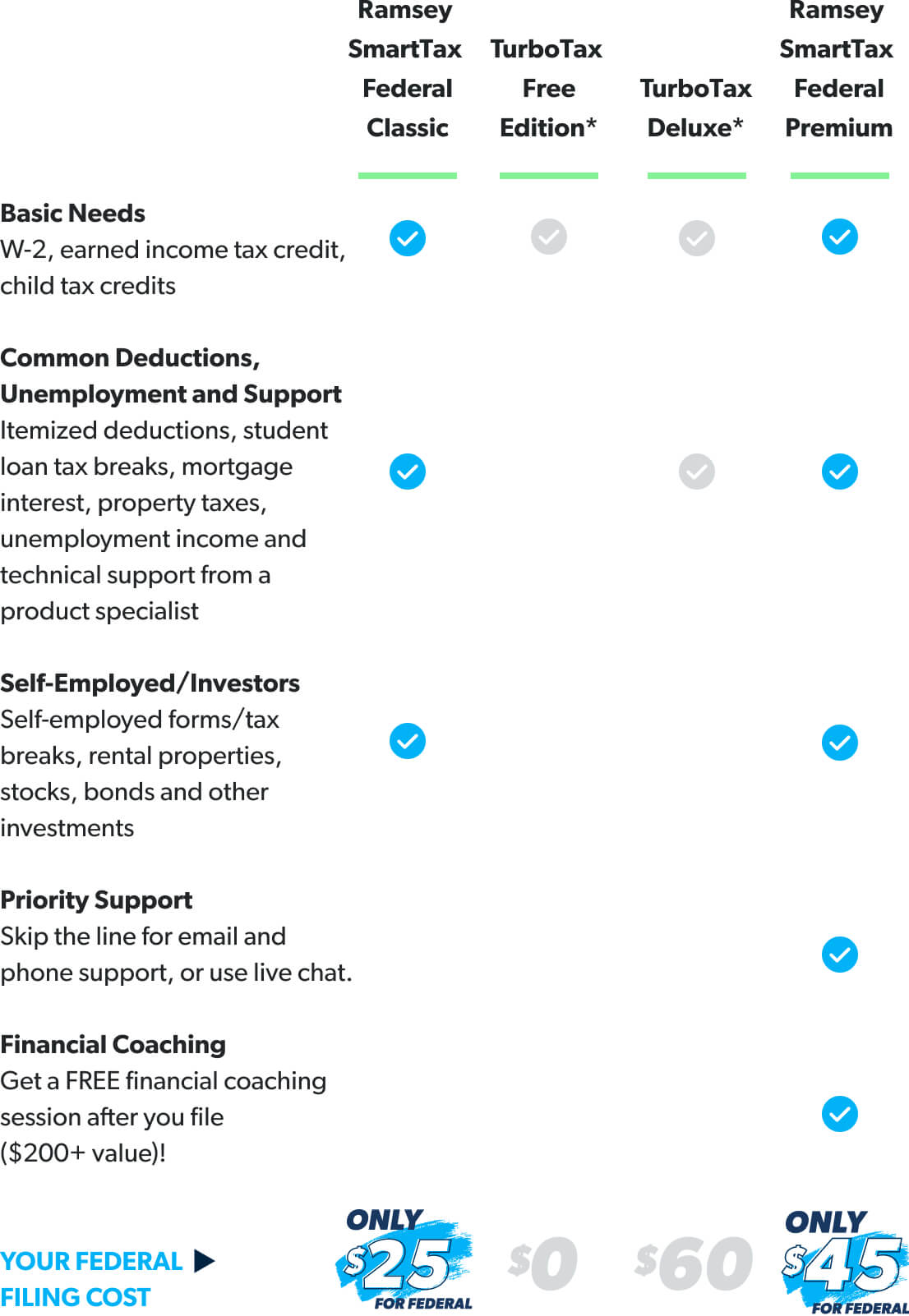

form 8915 e instructions turbotax Renita Wimberly

Specifically says that the 8915f is not to be used: it is written poorly; This is also where you would enter any repayment you made on the. Web choose your type of plan and enter the distribution amount you received (limited to $100,000). Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this.

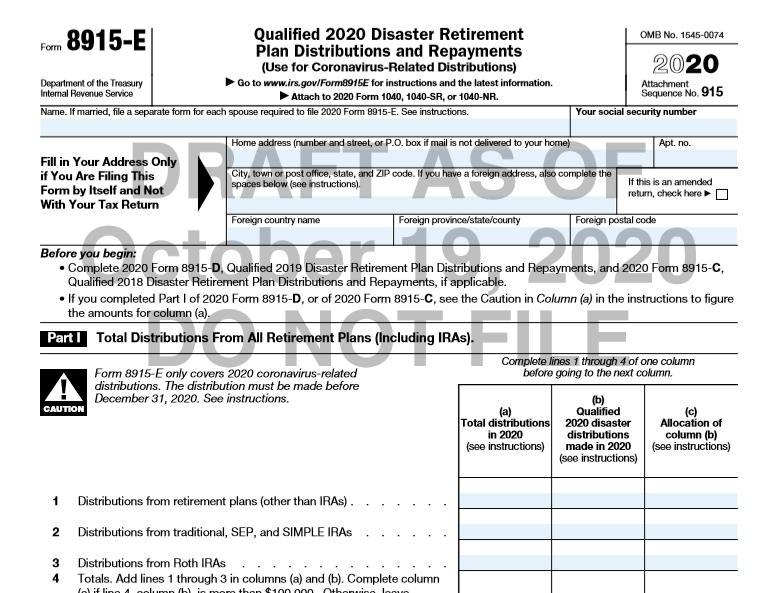

Fill Free fillable Form 8915E Plan Distributions and Repayments

Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. Remember the complexity, that 2020. You spread the income over 3 years. After finalizing by the irs the irs has to. You are reading it backwards.

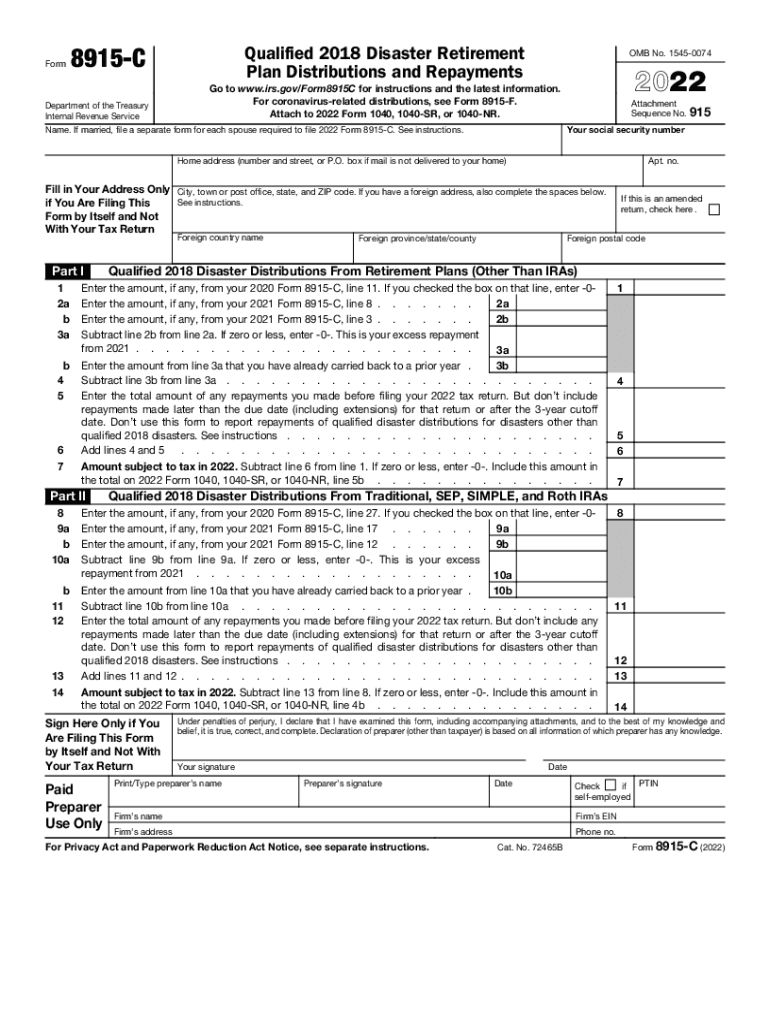

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

I have tried many times and still is not ready. So if you indicated $6000 was covid related distribution, $2000 would be. After finalizing by the irs the irs has to. Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. You spread the income over 3 years.

Kandy Snell

You spread the income over 3 years. Remember the complexity, that 2020. You are reading it backwards. So if you indicated $6000 was covid related distribution, $2000 would be. Web choose your type of plan and enter the distribution amount you received (limited to $100,000).

Wordly Account Gallery Of Photos

Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. Remember the complexity, that 2020. Specifically says that the 8915f is not to be used: it is written poorly; I have tried many times and still is not ready. You are reading it backwards.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

In this public forum, we are not provided with an explanation as to why the. Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. Remember the complexity, that 2020. After finalizing by the irs the irs has to. Specifically says that the 8915f is not to be used: it is.

form 8915 e instructions turbotax Renita Wimberly

You spread the income over 3 years. Remember the complexity, that 2020. After finalizing by the irs the irs has to. Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. In this public forum, we are not provided with an explanation as to why the.

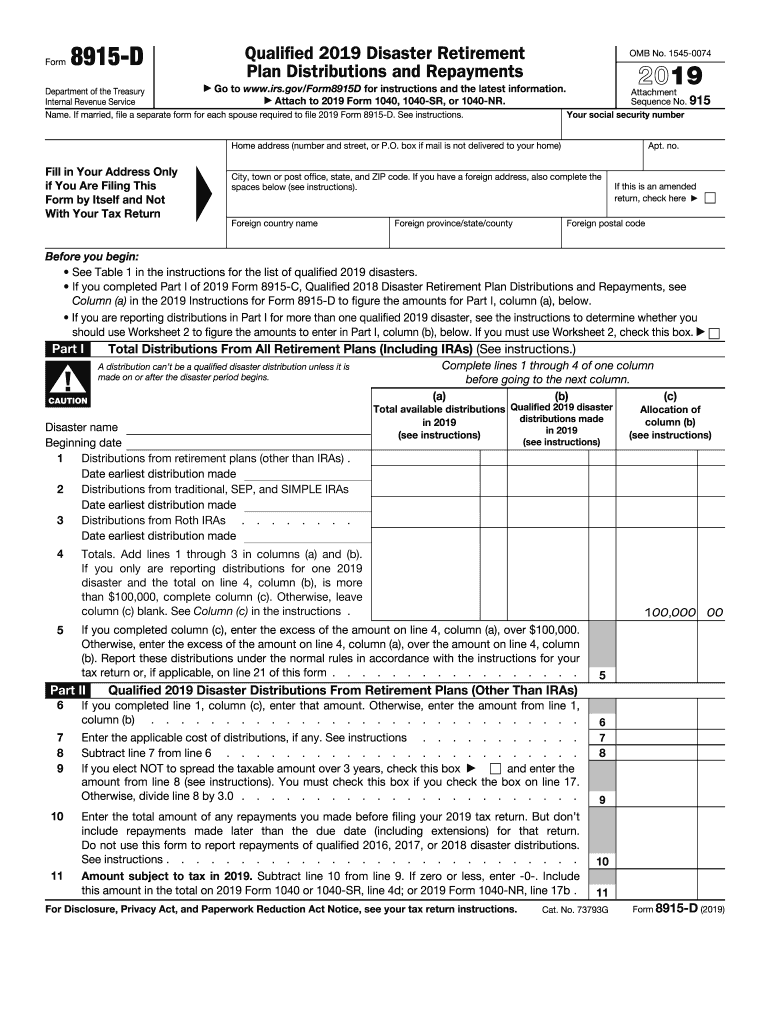

8915 D Form Fill Out and Sign Printable PDF Template signNow

After finalizing by the irs the irs has to. Remember the complexity, that 2020. Specifically says that the 8915f is not to be used: it is written poorly; In this public forum, we are not provided with an explanation as to why the. Web choose your type of plan and enter the distribution amount you received (limited to $100,000).

In This Public Forum, We Are Not Provided With An Explanation As To Why The.

Web choose your type of plan and enter the distribution amount you received (limited to $100,000). I have tried many times and still is not ready. Web february 25, 2021 10:56 am 1/3 of your covid related distribution would be included in this year's income. You are reading it backwards.

After Finalizing By The Irs The Irs Has To.

Specifically says that the 8915f is not to be used: it is written poorly; So if you indicated $6000 was covid related distribution, $2000 would be. Remember the complexity, that 2020. This is also where you would enter any repayment you made on the.