Form 8910 Instructions

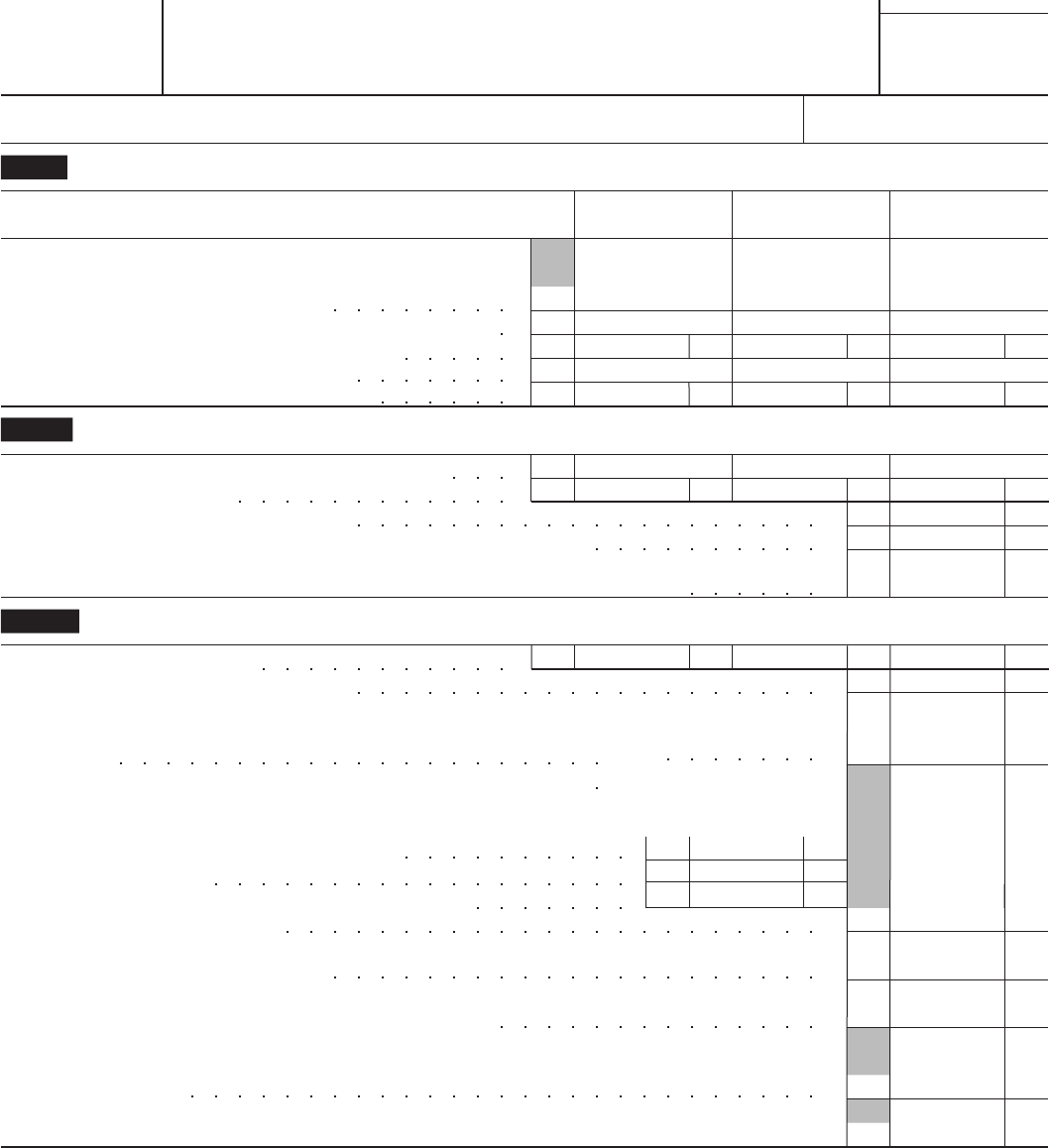

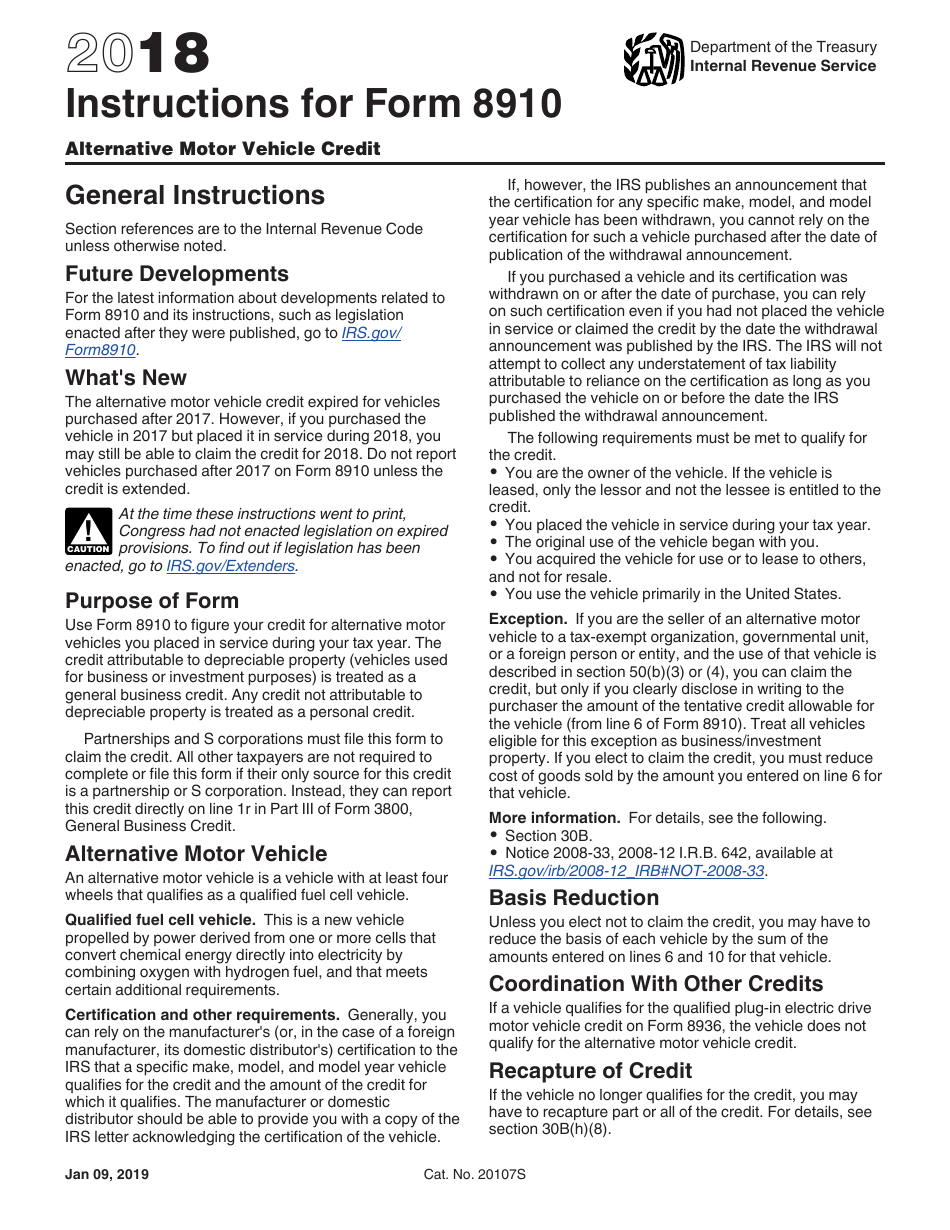

Form 8910 Instructions - Attach to your tax return. If the corporation has an overall loss from the entire disposition of a passive activity, the amount to enter on line c is the net. Web new qualified fuel cell motor vehicles. For tax year 2022, this credit is only available for a vehicle purchased in. Web instructions for form 8910(rev. The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle. The credit for these vehicles is now available under the credit for new clean vehicles for vehicles placed in service after 2022. Web information about form 8910 and its separate instructions is at www.irs.gov/form8910. In addition to meeting the professional qualifications, you must: January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the.

The alternative motor vehicle credit expired for vehicles. The credit for these vehicles is now available under the credit for new clean vehicles for vehicles placed in service after 2022. Web scroll down to the section vehicle credits (8910, 8936). Web per irs instructions for form 8910 alternative motor vehicle credit, page 1: Web popular forms & instructions; Attach to your tax return. If an electronic form is not printed on a duplex printer, the applicant’s name, date of birth, and certificate. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web form 8910 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form8910. Web • use this form to claim the credit for certain alternative motor vehicles.

The credit for these vehicles is now available under the credit for new clean vehicles for vehicles placed in service after 2022. January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the. If the corporation has an overall loss from the entire disposition of a passive activity, the amount to enter on line c is the net. Web instructions for form 8910(rev. For tax year 2022, this credit is only available for a vehicle purchased in. Individual tax return form 1040 instructions; If an electronic form is not printed on a duplex printer, the applicant’s name, date of birth, and certificate. Web instructions for form 8910(rev. Under subsection form 8936, enter the kilowatt hour capacity (x.xxx) for the vehicle. Attach to your tax return.

Instructions for Form 8910, Alternative Motor Vehicle Credit

Are there other requirements for civil surgeon designation? January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the. The alternative motor vehicle credit expired for vehicles. Web scroll down to the section vehicle credits (8910, 8936). Web for the latest information about developments related to form 8910 and its instructions, such as.

What is Form 8910 alternative motor vehicle credit? Leia aqui What is

January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the. Web new qualified fuel cell motor vehicles. If the corporation has an overall loss from the entire disposition of a passive activity, the amount to enter on line c is the net. January 2022) alternative motor vehicle credit department of the treasury.

LEGO 8910 Toa Mahri Kongu Set Parts Inventory and Instructions LEGO

The alternative motor vehicle credit expired for vehicles. Web per irs instructions for form 8910 alternative motor vehicle credit, page 1: The alternative motor vehicle credit expired in 2021. Individual tax return form 1040 instructions; January 2022) department of the treasury internal revenue service.

1040 (2020) Internal Revenue Service

The credit for these vehicles is now available under the credit for new clean vehicles for vehicles placed in service after 2022. Individual tax return form 1040 instructions; January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the. The alternative motor vehicle credit expired for vehicles purchased after 2021. January 2022) department.

Form 8910 Edit, Fill, Sign Online Handypdf

Web information about form 8910 and its separate instructions is at www.irs.gov/form8910. What's new the alternative motor vehicle credit has been extended. Web popular forms & instructions; If an electronic form is not printed on a duplex printer, the applicant’s name, date of birth, and certificate. In addition to meeting the professional qualifications, you must:

Alternative Fuel Wv Alternative Fuel Tax Credit 2012

Under subsection form 8936, enter the kilowatt hour capacity (x.xxx) for the vehicle. January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the. Web information about form 8910 and its separate instructions is at www.irs.gov/form8910. January 2022) department of the treasury internal revenue service. Web what vehicles qualify for the alternative motor.

Download Instructions for IRS Form 8910 Alternative Motor Vehicle

The alternative motor vehicle credit expired for vehicles purchased after 2021. January 2022) department of the treasury internal revenue service. The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle. Web new qualified fuel cell motor vehicles. Web for the latest information about developments related to form 8910 and its instructions, such as legislation enacted.

Form 8910 Alternative Motor Vehicle Credit (2014) Free Download

If the corporation has an overall loss from the entire disposition of a passive activity, the amount to enter on line c is the net. Under subsection form 8936, enter the kilowatt hour capacity (x.xxx) for the vehicle. For tax year 2022, this credit is only available for a vehicle purchased in. Web scroll down to the section vehicle credits.

3.11.3 Individual Tax Returns Internal Revenue Service

The credit for these vehicles is now available under the credit for new clean vehicles for vehicles placed in service after 2022. Under subsection form 8936, enter the kilowatt hour capacity (x.xxx) for the vehicle. January 2022) department of the treasury internal revenue service. Web scroll down to the section vehicle credits (8910, 8936). Web enter the net income, if.

Instructions for Form 8910, Alternative Motor Vehicle Credit

Web what vehicles qualify for the alternative motor vehicle credit (form 8910)? The alternative motor vehicle credit expired in 2021. If an electronic form is not printed on a duplex printer, the applicant’s name, date of birth, and certificate. The taxpayer certainty and disaster tax relief act of 2020 extended the alternative motor vehicle. Web instructions for form 8910(rev.

Are There Other Requirements For Civil Surgeon Designation?

What's new the alternative motor vehicle credit has been extended. Web instructions for form 8910(rev. In addition to meeting the professional qualifications, you must: Web what vehicles qualify for the alternative motor vehicle credit (form 8910)?

If An Electronic Form Is Not Printed On A Duplex Printer, The Applicant’s Name, Date Of Birth, And Certificate.

Web • use this form to claim the credit for certain alternative motor vehicles. January 2022) alternative motor vehicle credit department of the treasury internal revenue service section references are to the. Under subsection form 8936, enter the kilowatt hour capacity (x.xxx) for the vehicle. For tax year 2022, this credit is only available for a vehicle purchased in.

The Taxpayer Certainty And Disaster Tax Relief Act Of 2020 Extended The Alternative Motor Vehicle.

Web per irs instructions for form 8910 alternative motor vehicle credit, page 1: Web enter the net income, if any, from form 8810, line 1d. The alternative motor vehicle credit expired for vehicles purchased after 2021. Web scroll down to the section vehicle credits (8910, 8936).

January 2022) Alternative Motor Vehicle Credit Department Of The Treasury Internal Revenue Service Section References Are To The.

Individual tax return form 1040 instructions; The credit for these vehicles is now available under the credit for new clean vehicles for vehicles placed in service after 2022. January 2022) department of the treasury internal revenue service. The alternative motor vehicle credit expired in 2021.