Form 8886 Threshold

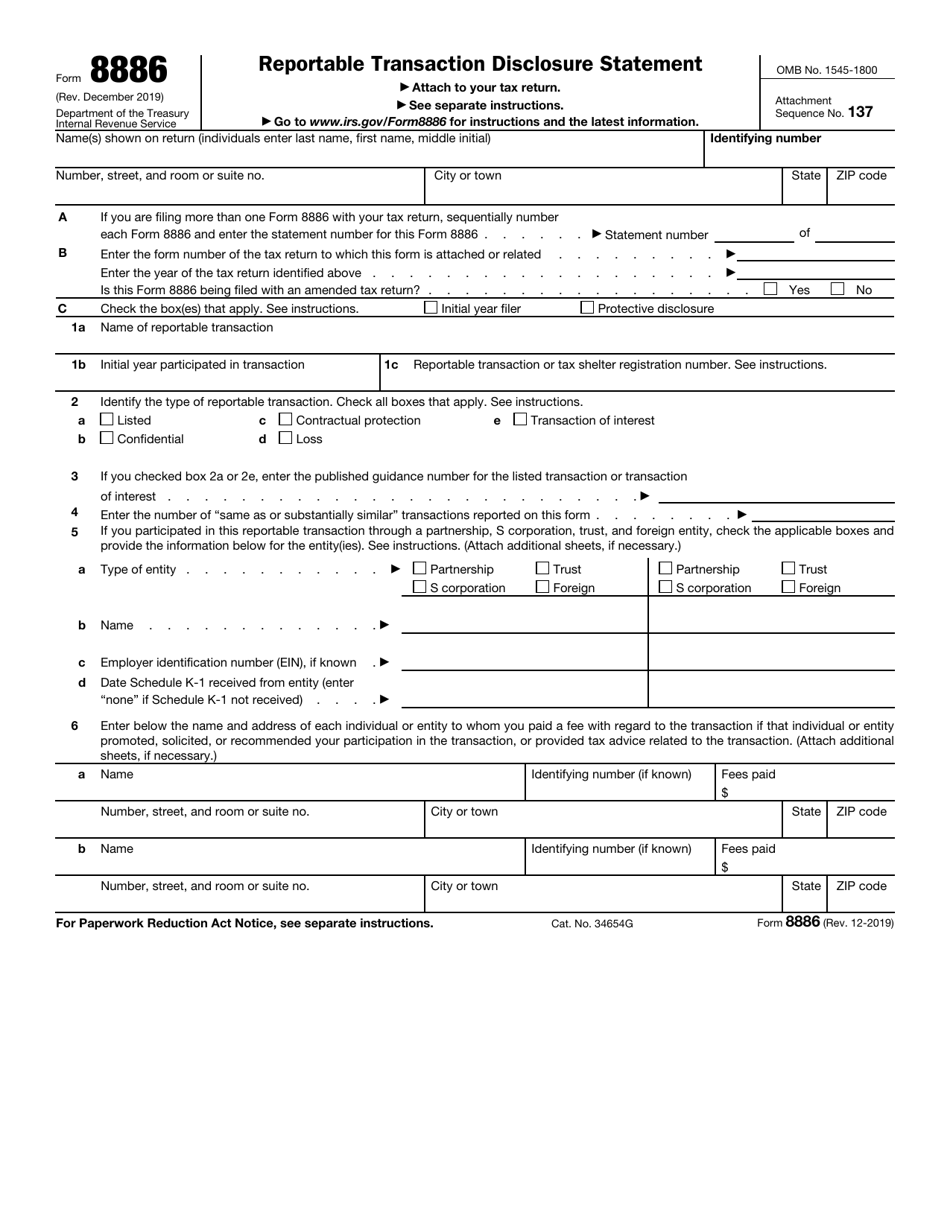

Form 8886 Threshold - Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. To be considered complete, the information provided on form 8886 must: Web losses that must be reported on forms 8886 and 8918. Check all the boxes that apply. Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of $50,000 have a. The ftb may impose penalties if the organization fails to file federal form 8886, or any other required information. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673

Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673 Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of $50,000 have a. Check all the boxes that apply. Web losses that must be reported on forms 8886 and 8918. Web form 8886 reportable transactions: The penalty is due regardless of whether any tax deficiency results from the transaction. The ftb may impose penalties if the organization fails to file federal form 8886, or any other required information. Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold.

When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Web form 8886 reportable transactions: Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673 Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on the return. If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. To be considered complete, the information provided on form 8886 must:

Section 79 Plans and Captive Insurance Form 8886

Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Stated another way — riding the line is not illegal unless a taxpayer crosses the line. To be considered complete, the information provided on form 8886 must: Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s.

Form 8886 Instructions Fill Out and Sign Printable PDF Template signNow

Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on.

IRS Form 8886 Download Fillable PDF or Fill Online Reportable

Stated another way — riding the line is not illegal unless a taxpayer crosses the line. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax.

Form 8886 Edit, Fill, Sign Online Handypdf

Web form 8886 reportable transactions: Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; The penalty is due regardless of whether any tax deficiency results from the transaction. Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673 Web the disclosures are made by filing a form 8886, reportable.

Form 8886 Reportable Transaction Disclosure Statement Editorial

Web form 8886 reportable transactions: The ftb may impose penalties if the organization fails to file federal form 8886, or any other required information. Check all the boxes that apply. To be considered complete, the information provided on form 8886 must: Describe the expected tax treatment and all potential tax benefits expected to result from the transaction;

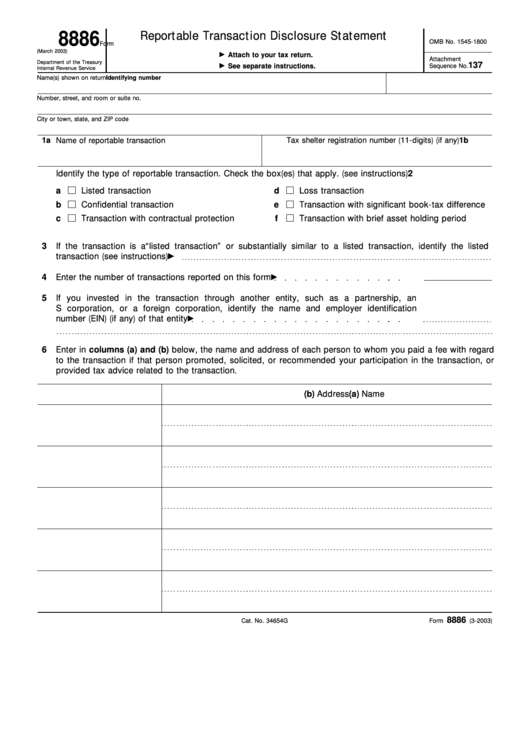

Fillable Form 8886 (Rev. March 2003) Reportable Transaction Disclosure

If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. To be considered complete, the.

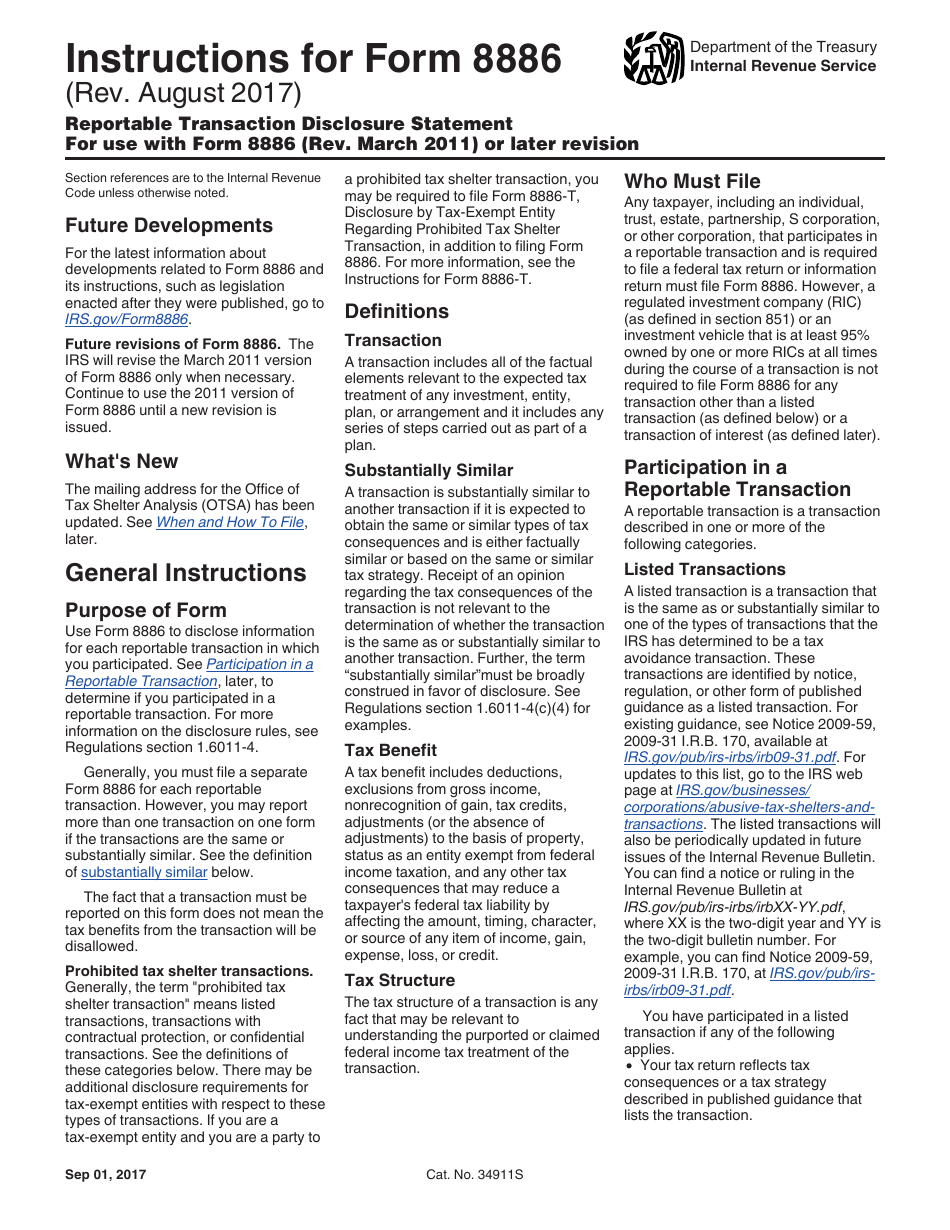

Download Instructions for IRS Form 8886 Reportable Transaction

Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in.

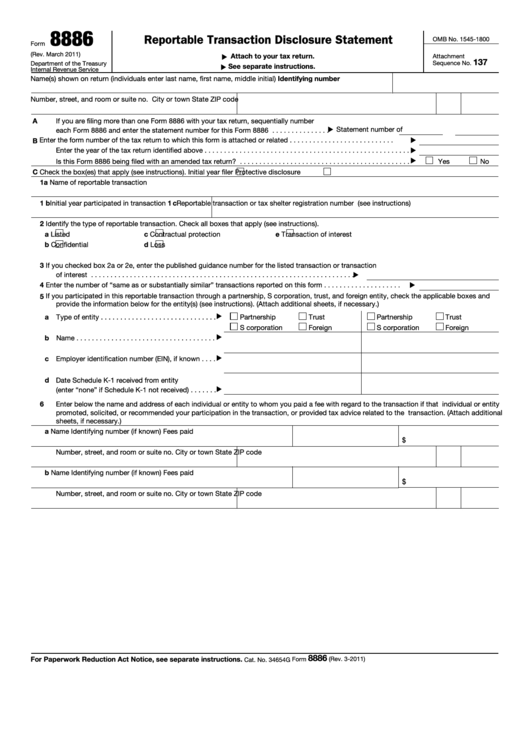

Fillable Form 8886 Reportable Transaction Disclosure Statement

Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Web form 8886 reportable transactions: Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on the return. The penalty is.

Fill Free fillable F8886 Form 8886 (Rev. December 2019) PDF form

Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673 Web the individual partner will have to disclose its $2.4 million share of the loss since it’s over the $2 million individual threshold. Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of.

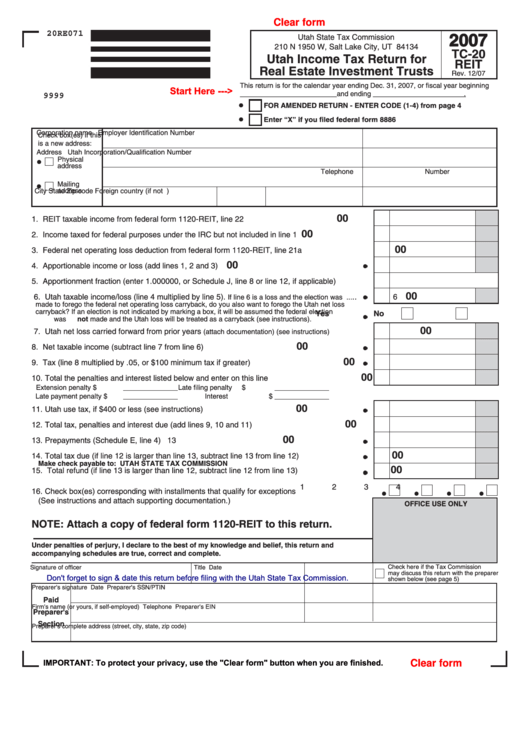

Fillable Form Tc20 Reit Utah Tax Return For Real Estate

If a taxpayer claims a loss under § 165 of at least one of the following amounts on a tax return, then the taxpayer has participated in a loss transaction and must file form 8886. When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid.

To Be Considered Complete, The Information Provided On Form 8886 Must:

Web if a transaction becomes a loss transaction because the losses equal or exceed the threshold amounts described earlier in loss transactions, form 8886 must be filed as an attachment to your income tax return or information return for the first tax year in which the threshold amount is reached and to any subsequent income tax return or. Web reportable transaction disclosure statement for paperwork reduction act notice, see separate instructions. Web information about form 8886, reportable transaction disclosure statement, including recent updates, related forms and instructions on how to file. To be considered complete, the information provided on form 8886 must:

Stated Another Way — Riding The Line Is Not Illegal Unless A Taxpayer Crosses The Line.

Web form 8886 reportable transactions: Mail tax shelter filing abs 389 ms f340 franchise tax board po box 1673 The penalty is due regardless of whether any tax deficiency results from the transaction. Web the disclosures are made by filing a form 8886, reportable transaction disclosure statement, with the taxpayer’s original or amended return or application for a refund for each year that the affected transaction has an impact on the return.

Web The Individual Partner Will Have To Disclose Its $2.4 Million Share Of The Loss Since It’s Over The $2 Million Individual Threshold.

Web if this is the first time the reportable transaction is disclosed on the return, send a duplicate copy of the federal form 8886 to the address below. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; Check all the boxes that apply. The ftb may impose penalties if the organization fails to file federal form 8886, or any other required information.

If A Taxpayer Claims A Loss Under § 165 Of At Least One Of The Following Amounts On A Tax Return, Then The Taxpayer Has Participated In A Loss Transaction And Must File Form 8886.

Does an individual with an irc § 165 loss in the current year that arose from a single irc § 988 transaction of $50,000 have a. Describe the expected tax treatment and all potential tax benefits expected to result from the transaction; When it comes to tax avoidance, as long as the us taxpayer is not intentionally seeking to illegally evade tax, then seeking to legally avoid or minimize tax is not illegal. Web losses that must be reported on forms 8886 and 8918.