Form 8879-S

Form 8879-S - Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return. A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. Download past year versions of this tax form as pdfs here: Submission identification number (sid) taxpayer’s name. What is the form used for? Ero must obtain and retain completed form 8879. Form 8879 does not need to be mailed to the irs, but instead is retained by the ero. January 2021) department of the treasury internal revenue service. In addition, you can make mistakes in.

A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Form 8879 does not need to be mailed to the irs, but instead is retained by the ero. January 2021) department of the treasury internal revenue service. In addition, you can make mistakes in. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return. Download past year versions of this tax form as pdfs here: Submission identification number (sid) taxpayer’s name. What is the form used for? Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. Ero must obtain and retain completed form 8879.

Download past year versions of this tax form as pdfs here: Submission identification number (sid) taxpayer’s name. January 2021) department of the treasury internal revenue service. Form 8879 does not need to be mailed to the irs, but instead is retained by the ero. In addition, you can make mistakes in. Ero must obtain and retain completed form 8879. What is the form used for? Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return. Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to:

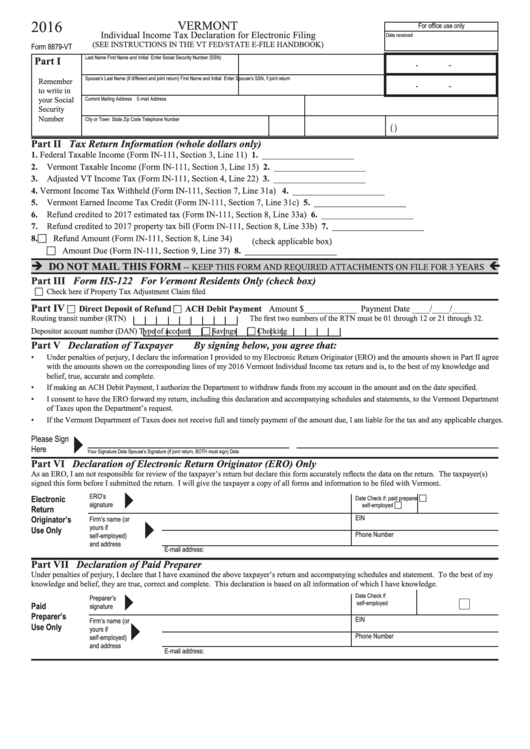

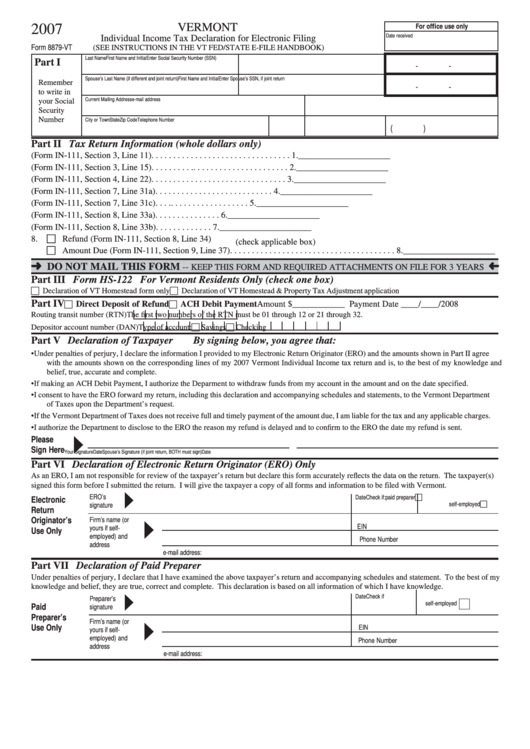

Form 8879Vt Individual Tax Declaration For Electronic Filing

Form 8879 does not need to be mailed to the irs, but instead is retained by the ero. Ero must obtain and retain completed form 8879. Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. Submission identification number (sid) taxpayer’s name. What is the form used.

Form 8879Vt Individual Tax Declaration For Electronic Filing

Download past year versions of this tax form as pdfs here: Ero must obtain and retain completed form 8879. In addition, you can make mistakes in. A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating.

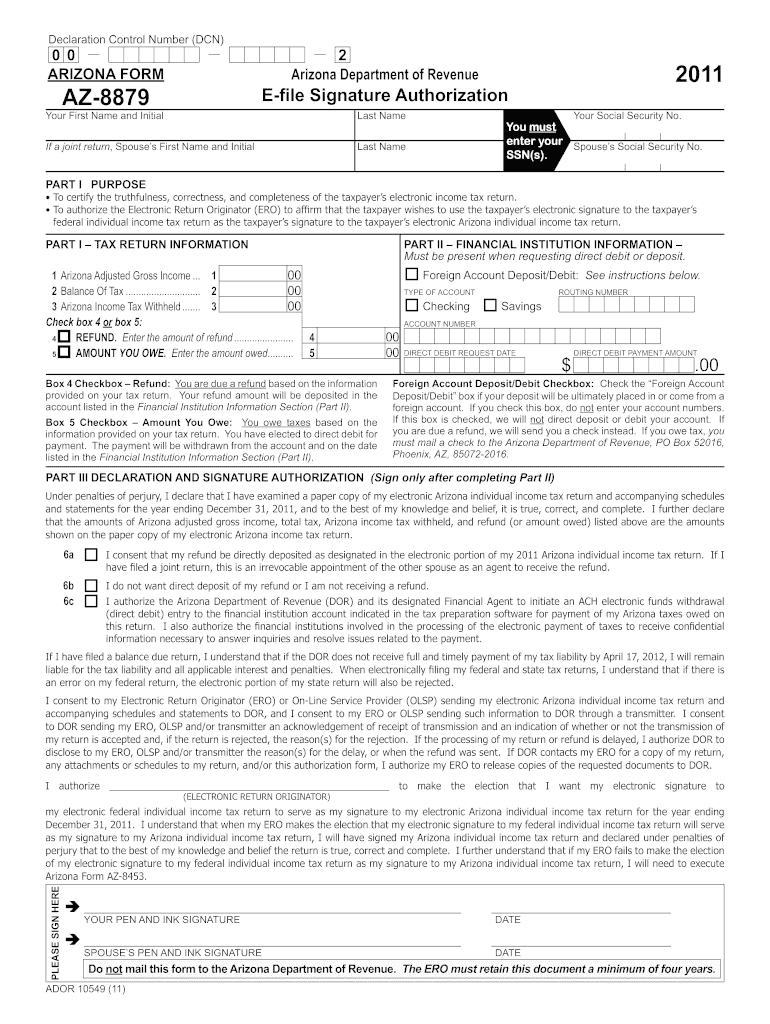

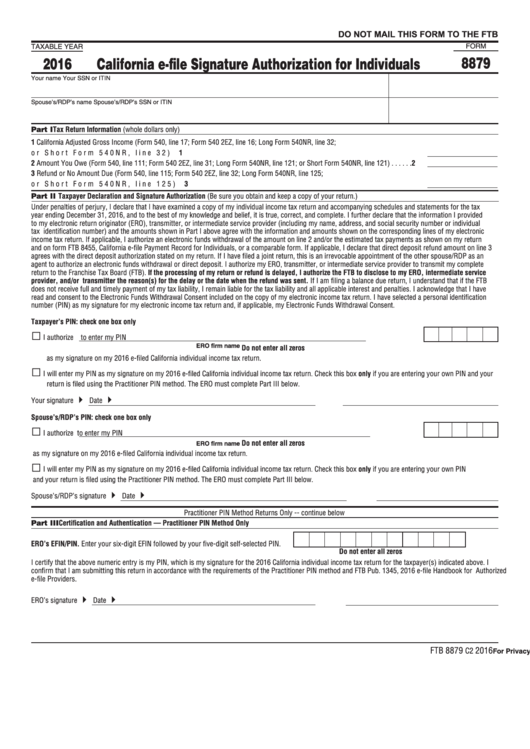

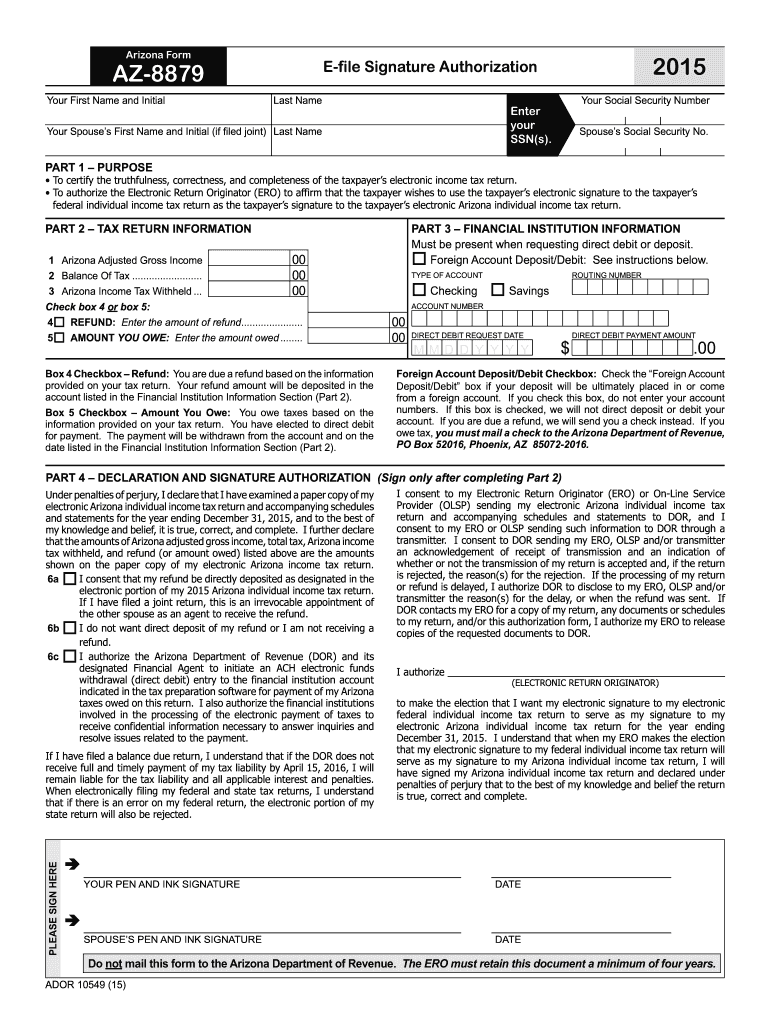

Az8879 Fill Out and Sign Printable PDF Template signNow

Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return. Form 8879 does not need to be mailed to the irs, but instead is retained by the ero..

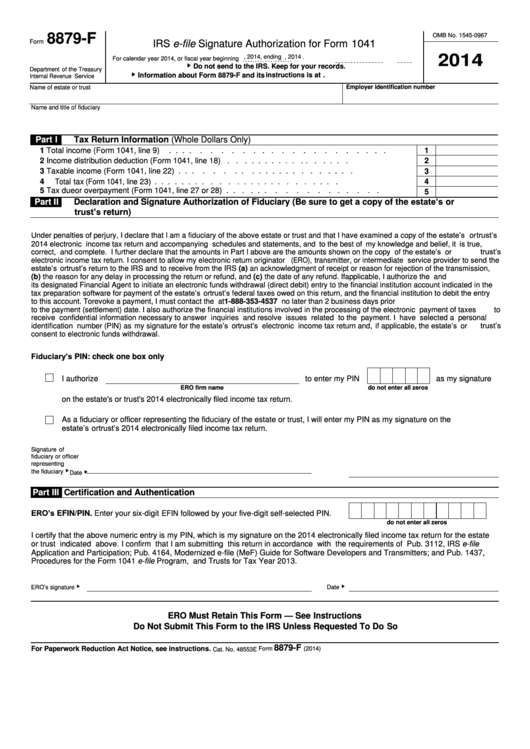

Form 8879F 2014 Irs EFile Signature Authorization For Form 1041

What is the form used for? Submission identification number (sid) taxpayer’s name. Ero must obtain and retain completed form 8879. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on.

32 Form 8879 Templates free to download in PDF, Word and Excel

A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return..

Az 8879 Fill Out and Sign Printable PDF Template signNow

A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return..

Online IRS Form 8879S 2018 2019 Fillable and Editable PDF Template

What is the form used for? Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. Download past year versions of this tax form as pdfs here: A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Web the.

Form 8879S IRS efile Signature Authorization for Form 1120S (2014

Download past year versions of this tax form as pdfs here: Ero must obtain and retain completed form 8879. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the.

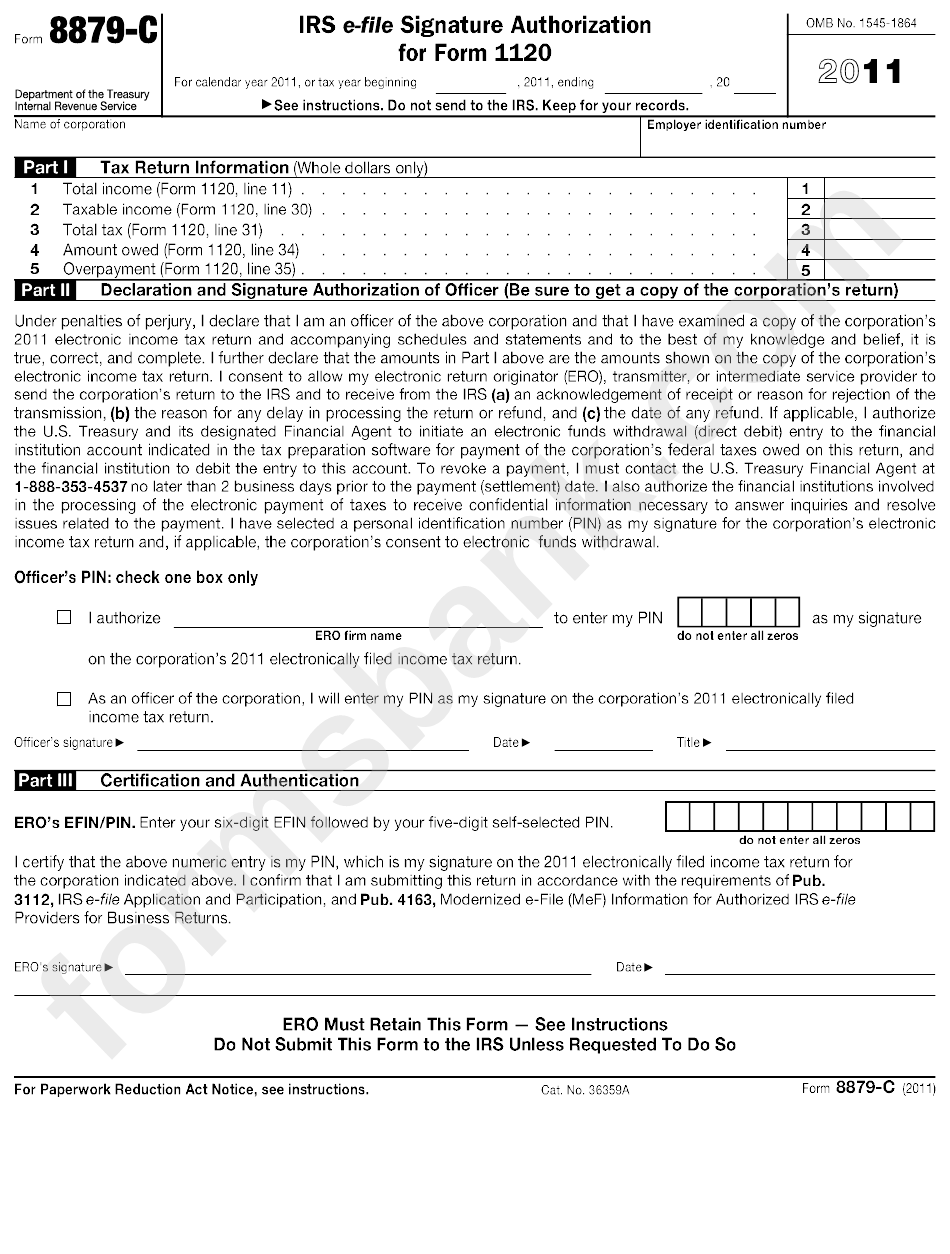

Form 8879C Irs EFile Signature Authorization For Form 1120

In addition, you can make mistakes in. A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: What is the form used for? Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. Submission identification number (sid) taxpayer’s name.

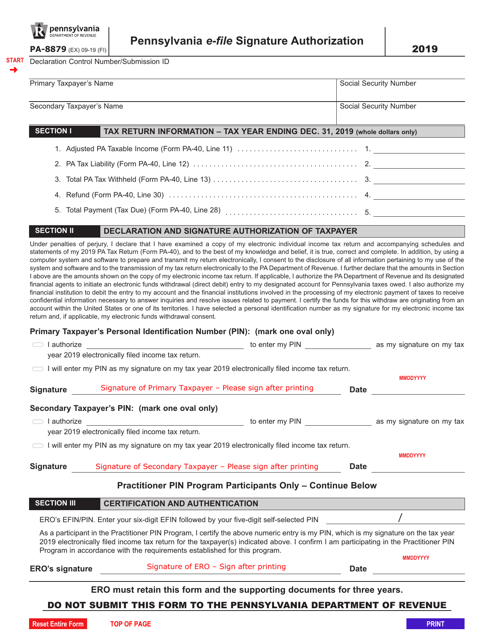

Form PA8879 Download Fillable PDF or Fill Online Pennsylvania EFile

January 2021) department of the treasury internal revenue service. What is the form used for? Submission identification number (sid) taxpayer’s name. In addition, you can make mistakes in. Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information.

Form 8879 Does Not Need To Be Mailed To The Irs, But Instead Is Retained By The Ero.

Download past year versions of this tax form as pdfs here: Use a personal identification number (pin) to electronically sign an s corporation’s electronic income tax return and, if applicable, consent to electronic funds. January 2021) department of the treasury internal revenue service. Submission identification number (sid) taxpayer’s name.

In Addition, You Can Make Mistakes In.

What is the form used for? Ero must obtain and retain completed form 8879. A corporate officer and an electronic return originator (ero) use this form when the corporate officer wants to: Web the form 8879 contains a taxpayer declaration that the taxpayer must sign and date, stating that he or she has reviewed the tax return and has ensured the tax return information of the form 8879 matches the information on the return.