Form 8867 Due Diligence Checklist

Form 8867 Due Diligence Checklist - Once completed you can sign your fillable form or send for signing. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Ad access irs tax forms. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Get ready for tax season deadlines by completing any required tax forms today. Web the internal revenue service (irs) created form 8867 paid preparer's due diligence checklist for paid tax preparers to certify, to the best of their knowledge, that the. Web complete this form 8867 truthfully and accurately and complete the actions described in this checklist for any applicable credit(s) claimed and hoh filing status, if claimed;. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. Complete, edit or print tax forms instantly.

Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Get ready for tax season deadlines by completing any required tax forms today. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Web the due diligence regulations require a paid tax return preparer to complete and submit form 8867, pdf paid preparer's due diligence checklist, with. Earned income credit (eic), american opportunity tax credit. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. All forms are printable and downloadable. Web solvedby intuit•updated 20 minutes ago. Once completed you can sign your fillable form or send for signing.

Web solvedby intuit•updated 20 minutes ago. Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. November 2022) paid preparer’s due diligence checklist for the earned income. Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Below, you'll find information about entering form 8867, paid preparer's due diligence checklist: Use this section to provide information for and. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. Paid tax return preparers are required to exercise due diligence when preparing any client’s return or claim for. December 2021) department of the treasury internal revenue service.

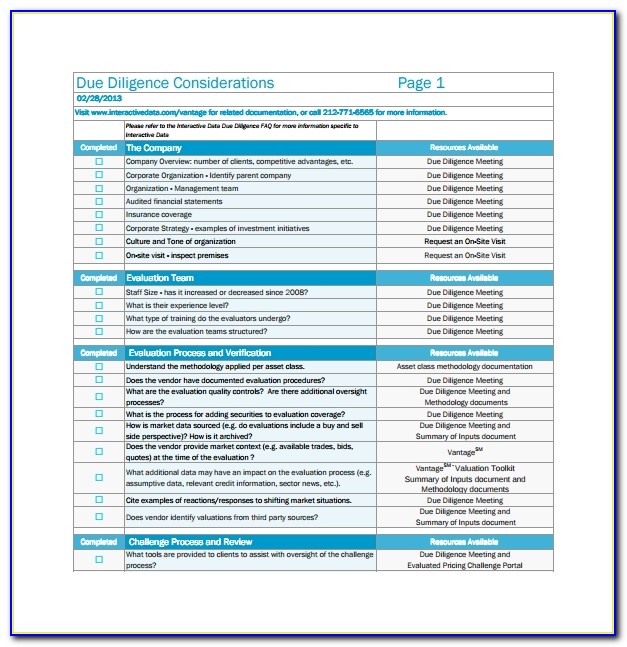

Due Diligence Checklist Template Excel Template 1 Resume Examples

Once completed you can sign your fillable form or send for signing. Earned income credit (eic), american opportunity tax credit. Keep a copy of the worksheets or computations used to compute the amount. Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. Web use fill to complete blank online irs pdf forms for free.

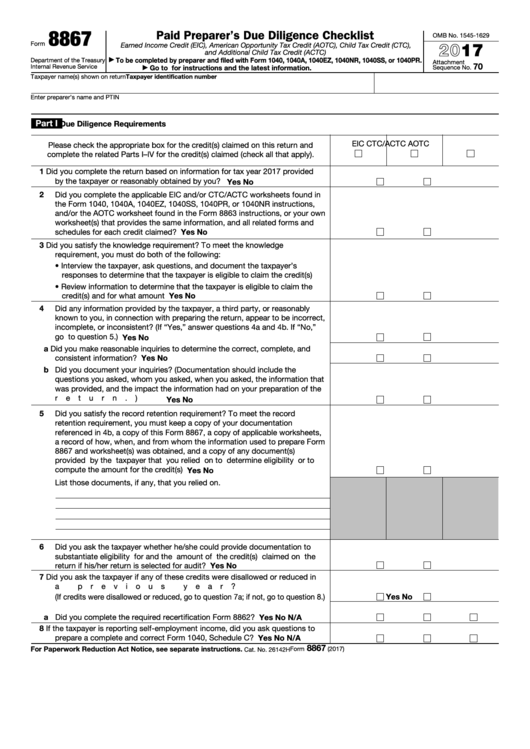

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Ad access irs tax forms. Earned income credit (eic), american opportunity tax credit. Web use fill to complete blank online irs pdf forms for free. Paid tax return preparers are required to exercise due diligence when preparing any client’s return or claim for.

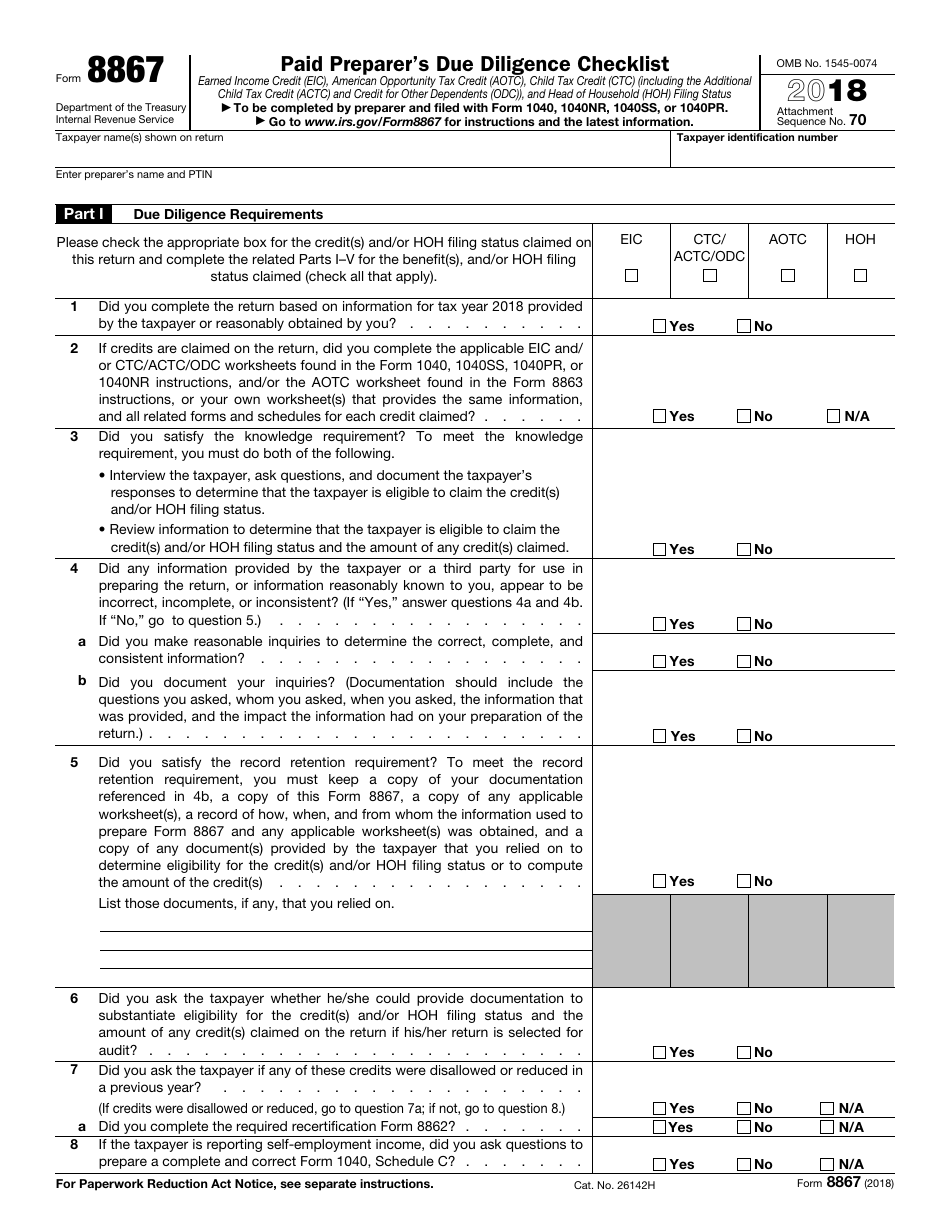

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. Use this section to provide information for and. Web solvedby intuit•updated 20 minutes ago. Web.

Due Diligence Checklist Template Uk

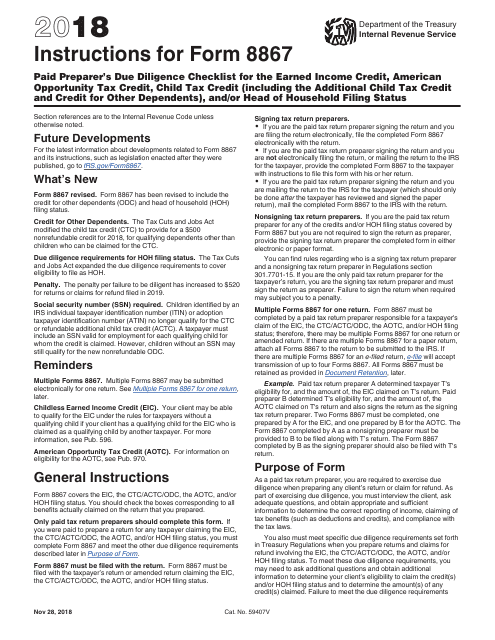

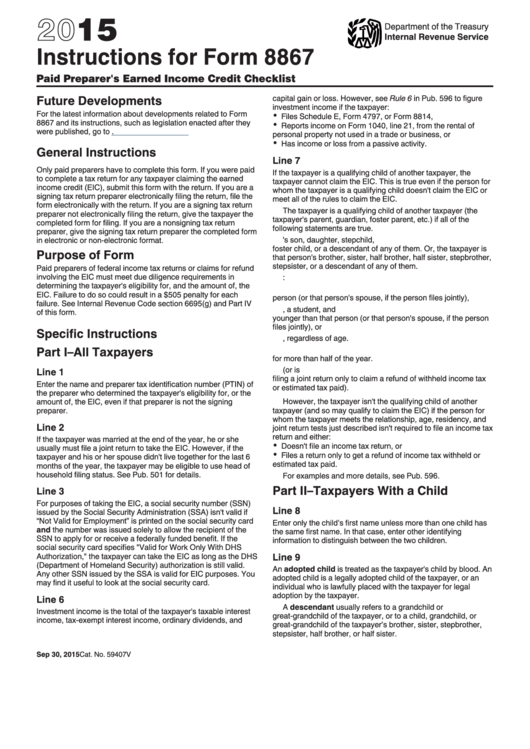

Web instructions for form 8867 department of the treasury internal revenue service (rev. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. Ad access irs tax forms. Complete, edit or print tax forms instantly. Use this section to provide information.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

November 2022) paid preparer’s due diligence checklist for the earned income. Web solvedby intuit•updated 20 minutes ago. Paid preparer’s due diligence checklist. Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. Web the purpose of the form is to ensure that.

Due Diligence Checklist Template Word Template 1 Resume Examples

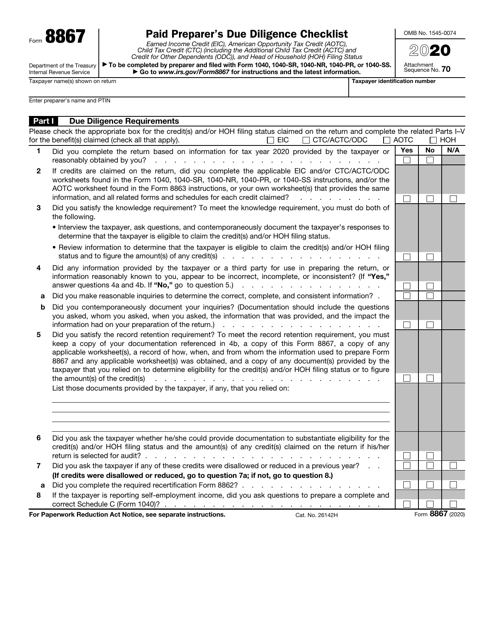

Web use fill to complete blank online irs pdf forms for free. Web instructions for form 8867 department of the treasury internal revenue service (rev. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. Paid preparer’s due diligence checklist. Paid.

Due Diligence Checklist Form 8867 Template 1 Resume Examples

Department of the treasury internal revenue service. All forms are printable and downloadable. Earned income credit (eic), american opportunity tax credit. Paid preparer’s due diligence checklist. Paid preparer’s due diligence checklist.

Download Instructions for IRS Form 8867 Paid Preparer's Due Diligence

Web use fill to complete blank online irs pdf forms for free. Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. Web knowledge.

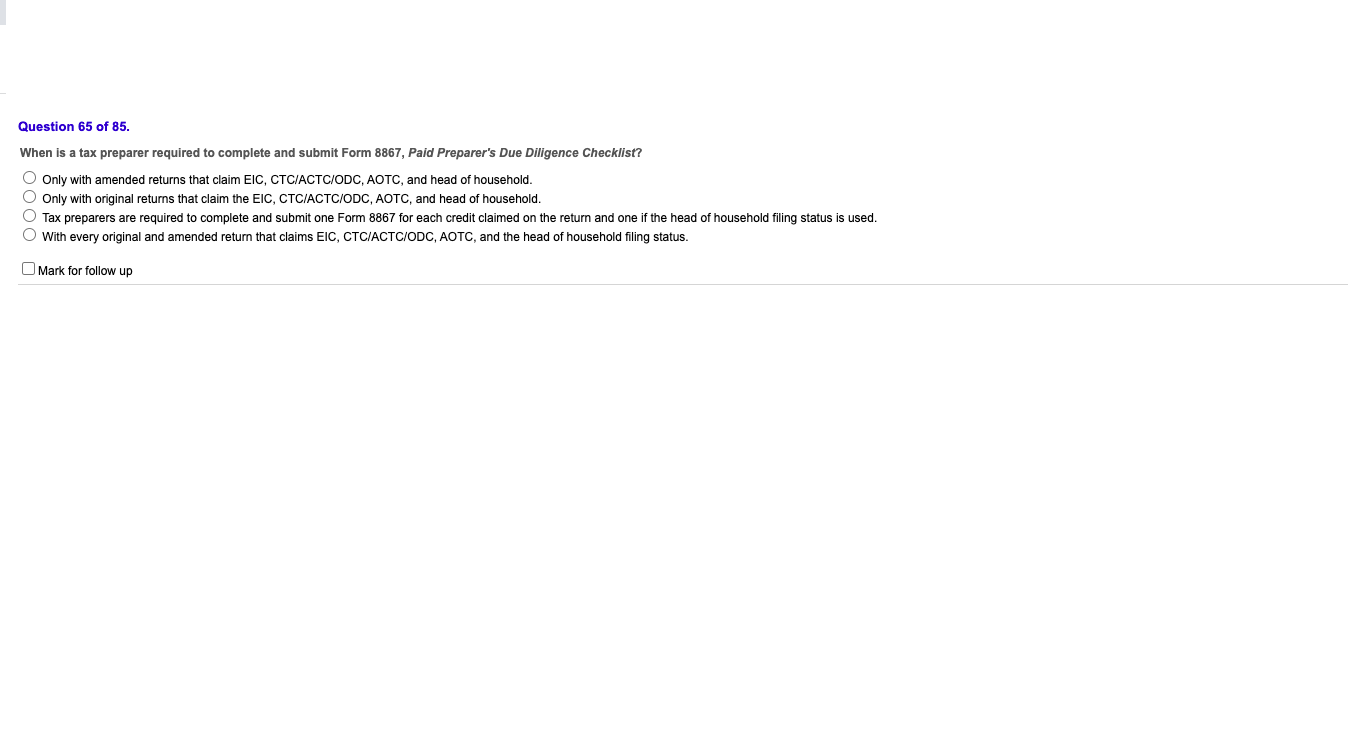

Solved Question 65 of 85. When is a tax preparer required to

Earned income credit (eic), american opportunity tax credit. Web instructions for form 8867 department of the treasury internal revenue service (rev. Once completed you can sign your fillable form or send for signing. December 2021) department of the treasury internal revenue service. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all.

Instructions For Form 8867 Paid Preparer'S Earned Credit

Complete, edit or print tax forms instantly. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the. Keep all five of the following records for 3 years from the latest of the dates specified in the form 8867 instructions under. Below,.

Use This Section To Provide Information For And.

Web knowledge retention of records preparers who fail to meet the due diligence requirements can be assessed a penalty of $530 for each failure to meet all four due diligence. Web the due diligence regulations require a paid tax return preparer to complete and submit form 8867, pdf paid preparer's due diligence checklist, with. Web keep a copy of the completed form 8867, paid preparer's due diligence checklist. Web use fill to complete blank online irs pdf forms for free.

Web Complete This Form 8867 Truthfully And Accurately And Complete The Actions Described In This Checklist For Any Applicable Credit(S) Claimed And Hoh Filing Status, If Claimed;.

December 2021) department of the treasury internal revenue service. 204) if the taxpayer is. Paid preparer’s due diligence checklist. All forms are printable and downloadable.

Ad Access Irs Tax Forms.

Paid tax return preparers are required to exercise due diligence when preparing any client’s return or claim for. Web the form 8867 2019 paid preparer’s due diligence checklist form is 2 pages long and contains: Paid preparer’s due diligence checklist. Get ready for tax season deadlines by completing any required tax forms today.

November 2022) Paid Preparer’s Due Diligence Checklist For The Earned Income.

Department of the treasury internal revenue service. Web solvedby intuit•updated 20 minutes ago. Keep a copy of the worksheets or computations used to compute the amount. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared, such as the.