Form 8865 Schedule G

Form 8865 Schedule G - Statement of application of the gain deferral method under section 721(c) if the gain deferral method is applied to section 721(c) property, a u.s. Web schedule g (form 8865)—statement of application of the gain deferral method under section 721 schedule h (form 8865)—acceleration events and exceptions reporting. Persons with respect to certain foreign partnerships. Web form 8865 is used by u.s. Statement of application of the gain deferral method under section 721\⠀挀尩 schedule h. Web form 8865 refers to the irs’ return of u.s. When completing form 8865, category 1 filers must complete the initial identifying information section on page 1 as. Web schedule g (form 8865) (rev. Statement of application of the gain deferral method under. Transferor uses schedule g to comply with the reporting.

Income statement—trade or business income. Web (to form 8865) schedule g, statement of application of the gain deferral method under section 721(c), containing the information required in regulations section 1.721(c). Schedule p, acquisitions, dispositions, and changes. Whether or not a filer of a form 8865 is required to complete a specific. When completing form 8865, category 1 filers must complete the initial identifying information section on page 1 as. You must have a separate ultratax. Statement of application of the gain deferral method under section 721\⠀挀尩 schedule h. Web form 8865 refers to the irs’ return of u.s. Web 50% of the foreign partnership’s losses. Statement of application of the gain deferral method under section 721(c) a u.s.

Web schedule g (form 8865) (rev. Statement of application of the gain deferral method under section 721(c) a u.s. Income statement—trade or business income. Transferor uses schedule g to comply with the reporting. Web (to form 8865) schedule g, statement of application of the gain deferral method under section 721(c), containing the information required in regulations section 1.721(c). You must have a separate ultratax. Web form 8865 is used by u.s. Statement of application of the gain deferral method under. Acceleration events and exceptions reporting relating to. Whether or not a filer of a form 8865 is required to complete a specific.

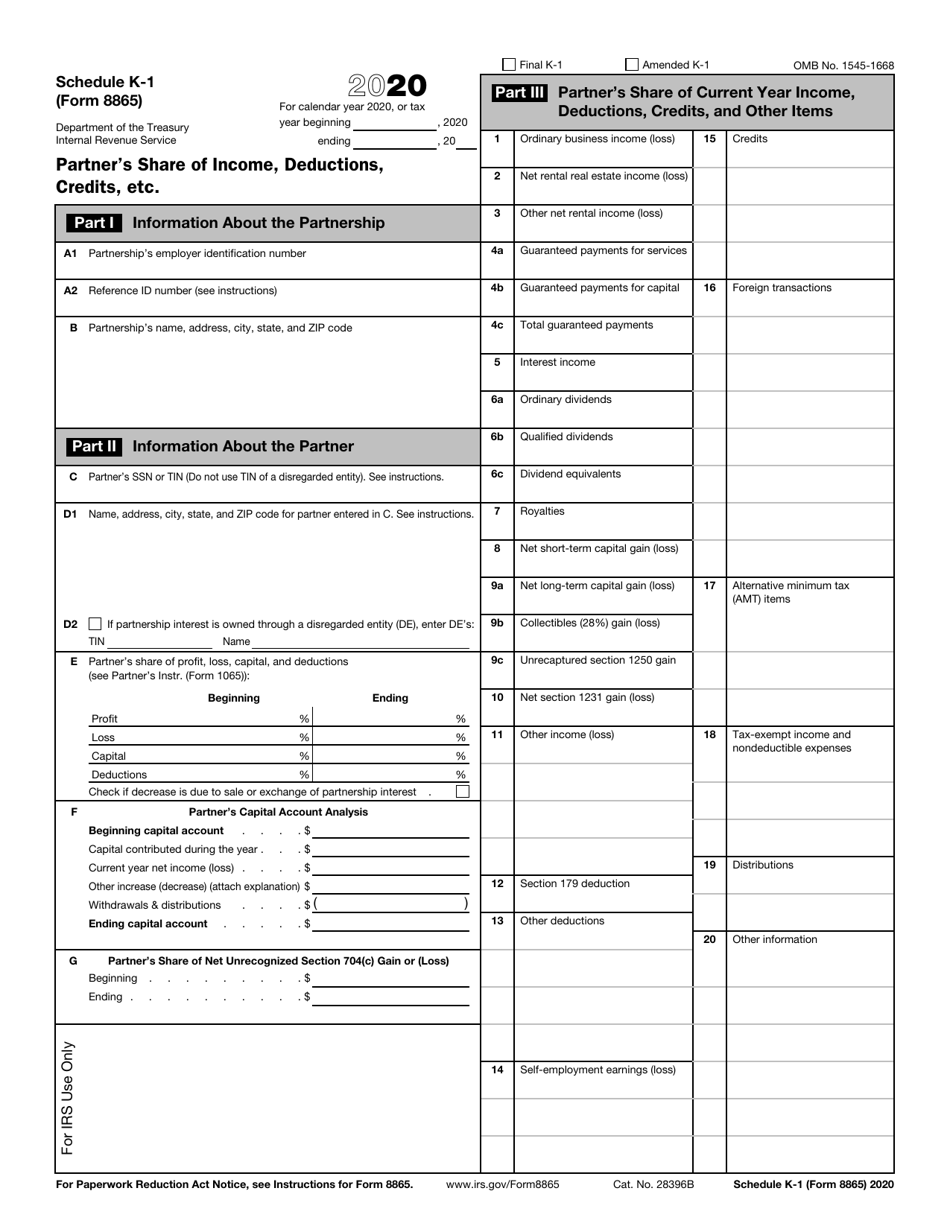

Form 8865 (Schedule K1) Partner's Share of Deductions and

Allocation percentages of partnership items with respect to section 721(c) property (see instructions) part i, line. Persons with respect to certain foreign partnerships. Web home how do i generate form 8865 using cch axcess™ tax or cch® prosystem fx® tax. Whether or not a filer of a form 8865 is required to complete a specific. Statement of application of the.

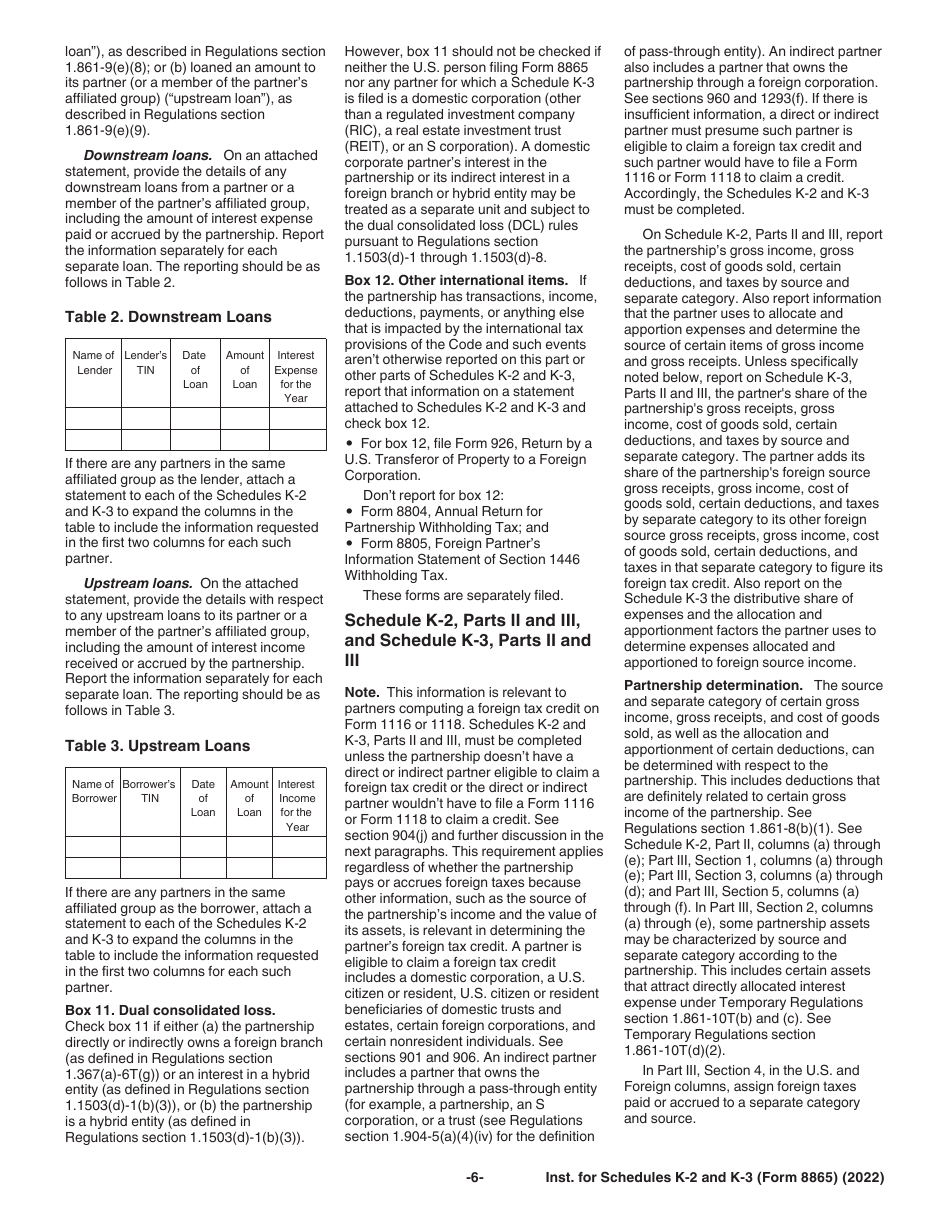

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Web home how do i generate form 8865 using cch axcess™ tax or cch® prosystem fx® tax. Web form 8865 is used by u.s. You must have a separate ultratax. Web schedule g (form 8865)—statement of application of the gain deferral method under section 721 schedule h (form 8865)—acceleration events and exceptions reporting. Persons to report information regarding controlled foreign.

Download Instructions for IRS Form 8865 Schedule K2, K3 PDF

Allocation percentages of partnership items with respect to section 721(c) property (see instructions) part i, line. When completing form 8865, category 1 filers must complete the initial identifying information section on page 1 as. Persons with respect to certain foreign partnerships. Statement of application of the gain deferral method under section 721(c) a u.s. Use the links below to find.

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Web form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Web schedule g (form 8865). Web form 8865 refers to the irs’ return of u.s. When completing form 8865, category 1 filers must complete the initial identifying information section on page 1 as. Statement of application.

Form 8865 (Schedule P) Acquisitions, Dispositions, and Changes of

Web schedule o (form 8865) department of the treasury internal revenue service transfer of property to a foreign partnership (under section 6038b) attach to form 8865. When a united states taxpayer has ownership in a foreign partnership,. Schedule p, acquisitions, dispositions, and changes. Statement of application of the gain deferral method under section 721(c) if the gain deferral method is.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

Statement of application of the gain deferral method under. When completing form 8865, category 1 filers must complete the initial identifying information section on page 1 as. Web 50% of the foreign partnership’s losses. Web form 8865 is used by u.s. The form cannot be electronically filed separately.

Irs form 8865 instructions

Web 50% of the foreign partnership’s losses. Schedule o, transfer of property to a foreign partnership (under section 6038b)form 8865: Web form 8865 refers to the irs’ return of u.s. Whether or not a filer of a form 8865 is required to complete a specific. Web form 8865 is used to report the information required under section 6038 (reporting with.

Form 8865 (Schedule O) Transfer of Property to a Foreign Partnership

Statement of application of the gain deferral method under section 721(c) a u.s. Statement of application of the gain deferral method under. Persons with respect to certain foreign partnerships. Web form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Web form 8865 is used by u.s.

IRS Form 8865 Schedule K1 Download Fillable PDF or Fill Online Partner

Web form 8865 is used to report the information required under section 6038 (reporting with respect to controlled foreign partnerships), section 6038b (reporting of. Acceleration events and exceptions reporting relating to. Schedule p, acquisitions, dispositions, and changes. Web home how do i generate form 8865 using cch axcess™ tax or cch® prosystem fx® tax. Income statement—trade or business income.

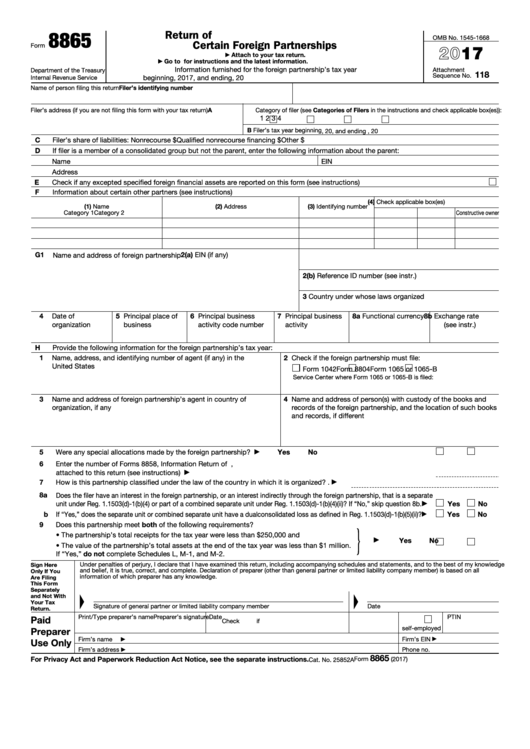

Fillable Form 8865 Return Of U.s. Persons With Respect To Certain

Persons with respect to certain foreign partnerships. Web schedule g (form 8865)—statement of application of the gain deferral method under section 721 schedule h (form 8865)—acceleration events and exceptions reporting. Statement of application of the gain deferral method under. When a united states taxpayer has ownership in a foreign partnership,. Statement of application of the gain deferral method under section.

The Form Cannot Be Electronically Filed Separately.

Web schedule g (form 8865). Statement of application of the gain deferral method under. Persons to report information regarding controlled foreign partnerships (section 6038), transfers to foreign partnerships (section 6038b), and. Transferor uses schedule g to comply with the reporting.

Statement Of Application Of The Gain Deferral Method Under Section 721\⠀挀尩 Schedule H.

Persons with respect to certain foreign partnerships. Schedule p, acquisitions, dispositions, and changes. Statement of application of the gain deferral method under section 721(c) if the gain deferral method is applied to section 721(c) property, a u.s. Web form 8865 can be electronically filed only if the form is attached to the filer’s electronic file.

Web Home How Do I Generate Form 8865 Using Cch Axcess™ Tax Or Cch® Prosystem Fx® Tax.

Web schedule g (form 8865)—statement of application of the gain deferral method under section 721 schedule h (form 8865)—acceleration events and exceptions reporting. Web (to form 8865) schedule g, statement of application of the gain deferral method under section 721(c), containing the information required in regulations section 1.721(c). Web schedule g (form 8865) (rev. Web form 8865 is used by u.s.

Whether Or Not A Filer Of A Form 8865 Is Required To Complete A Specific.

Allocation percentages of partnership items with respect to section 721(c) property (see instructions) part i, line. Acceleration events and exceptions reporting relating to. When a united states taxpayer has ownership in a foreign partnership,. Use the links below to find articles specific to various pages or schedules.