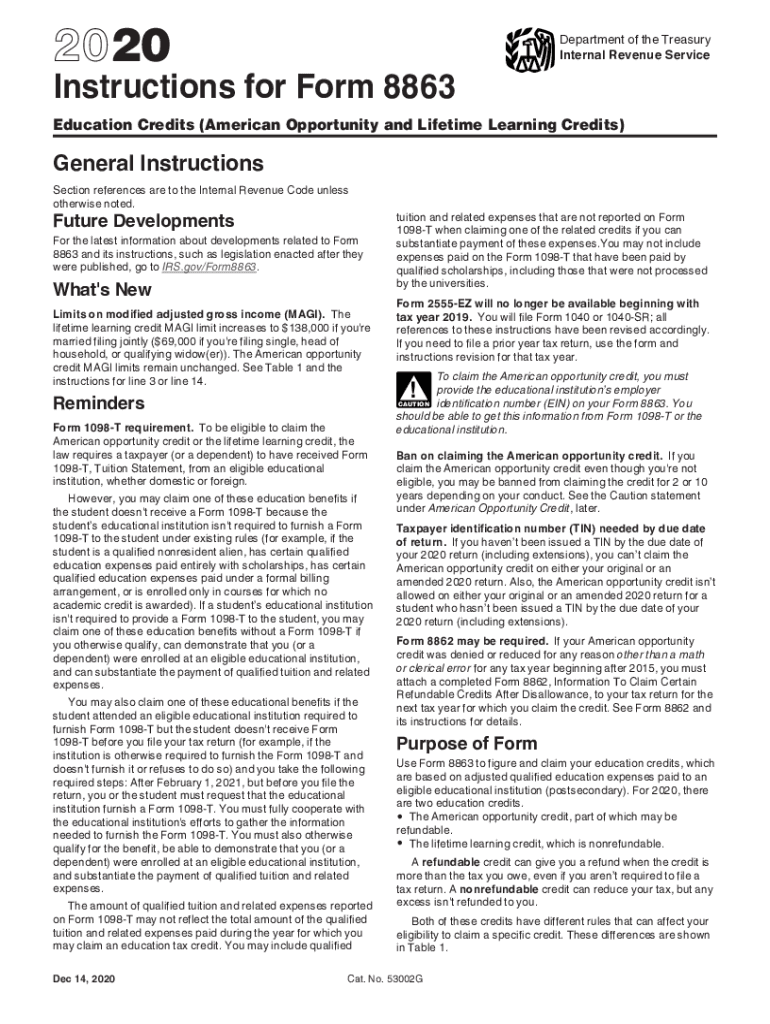

Form 8863 2020

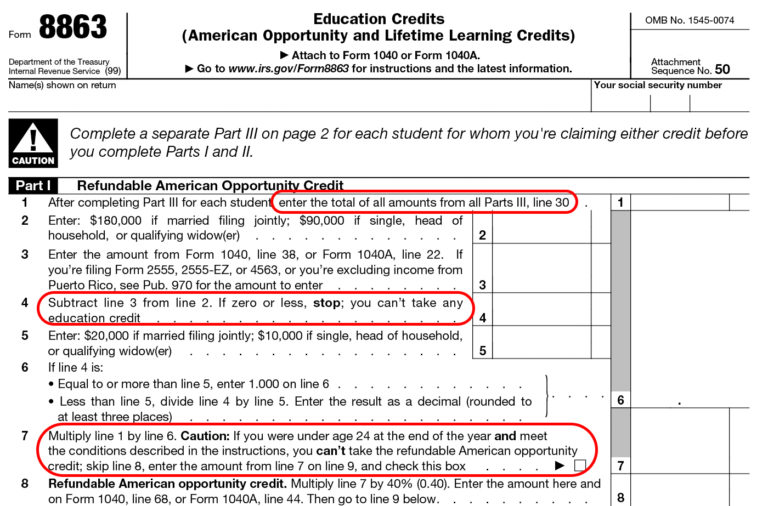

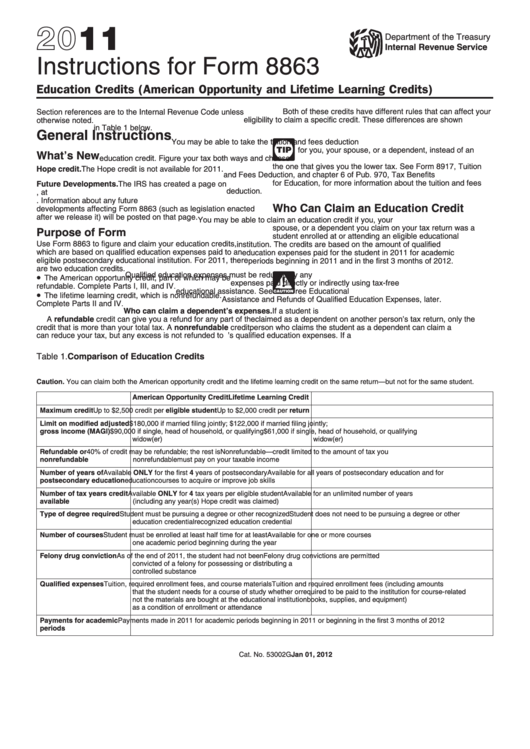

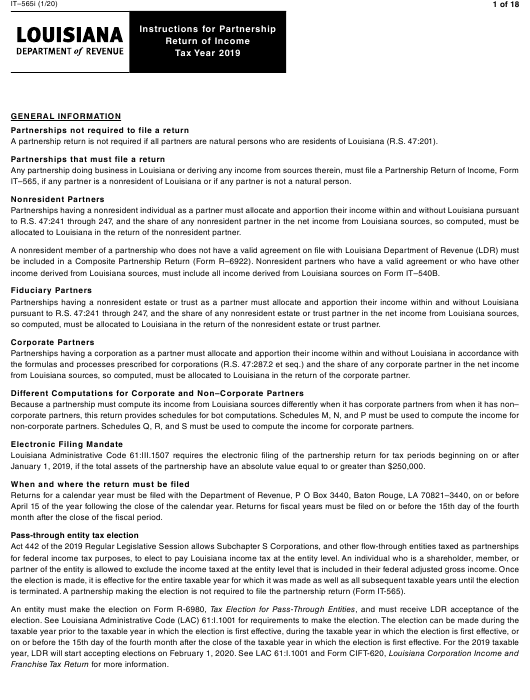

Form 8863 2020 - Age 18 at the end of. Web you don't qualify for a refundable american opportunity credit if 1 (a, b, or c), 2, and 3 below apply to you. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Use the information on the form. Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web up to $40 cash back easily complete a printable irs 8863 form 2020 online. Web editable irs instruction 8863 2020. Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general.

The tax credit is calculated. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Complete, sign, print and send your tax documents easily with us legal forms. Form 8863 typically accompanies your 1040 form,. Upload, modify or create forms. Download blank or fill out online in pdf format. Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for. Web up to $40 cash back easily complete a printable irs 8863 form 2020 online. Use form 8863 to figure and claim your education.

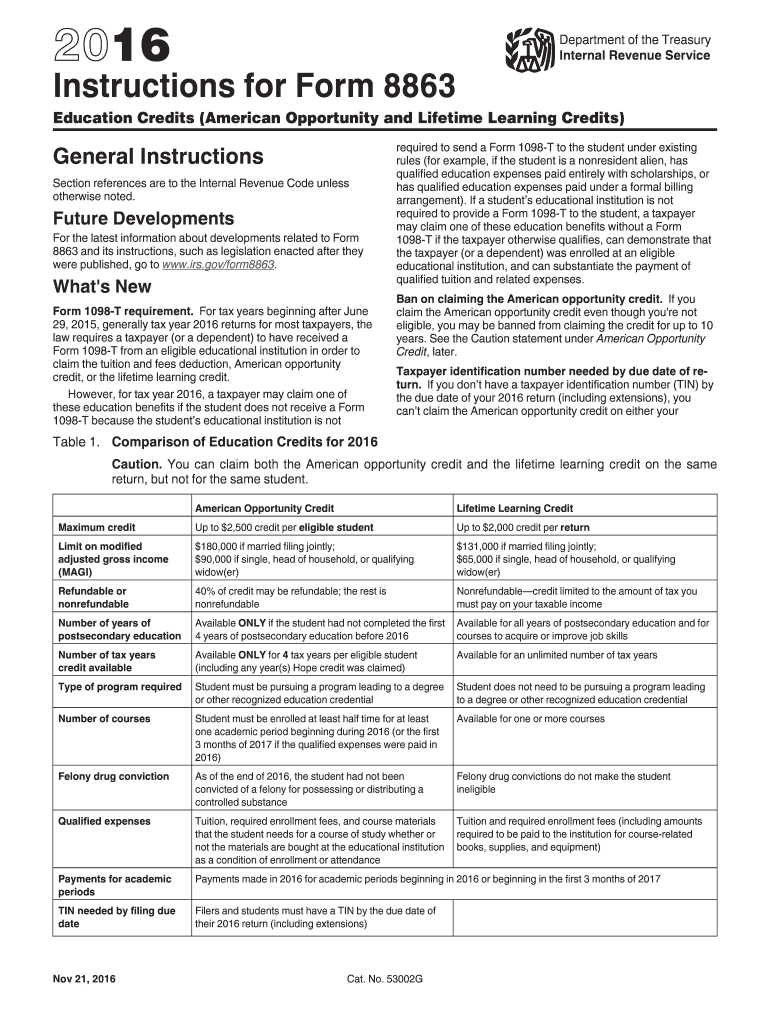

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general. Upload, modify or create forms. Try it for free now! Web up to $40 cash back easily complete a printable irs 8863 form 2020 online. Irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. The tax credit is calculated. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Web editable irs instruction 8863 2020. Form 8863 typically accompanies your 1040 form,.

8863 Instructions Form Fill Out and Sign Printable PDF Template signNow

Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web editable irs instruction 8863 2020. Under age 18 at the end of 2020, or. Web you must attach the federal form 8863. Download blank or fill out online in pdf format.

Instructions For Form 8863 Instructions For Form 8863, Education

Use the information on the form. Web editable irs instruction 8863 2020. The tax credit is calculated. Irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit. Web the irs announced today that they are now able to process tax returns that contain form 8863 with education credits beginning february 14th.

Form 8863 Instructions Information On The Education 1040 Form Printable

Web the irs announced today that they are now able to process tax returns that contain form 8863 with education credits beginning february 14th. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Complete, sign, print and send your tax documents easily with us legal forms. Create a blank &.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Create a blank & editable 8863 form,. Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. Download blank or fill out online in pdf format. Irs form 8863 is a two page form that entitles eligible tax payers for the american opportunity tax credit.

Understanding IRS Form 8863 Do I Qualify for American Opportunity

Use the information on the form. Get ready for tax season deadlines by completing any required tax forms today. Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general. Web you don't qualify for a refundable american opportunity credit if 1 (a, b, or c), 2, and 3 below.

2020 IRS Gov Forms Fillable, Printable PDF & Forms Handypdf

Complete, sign, print and send your tax documents easily with us legal forms. Try it for free now! Under age 18 at the end of 2020, or. Web you don't qualify for a refundable american opportunity credit if 1 (a, b, or c), 2, and 3 below apply to you. Web editable irs instruction 8863 2020.

Instructions For Form 8863 Education Credits (American Opportunity

Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for. Use form 8863 to figure and claim your education. Web editable irs instruction 8863 2020. Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning.

Maximizing The Higher Education Tax Credits Turbo Tax

Complete, sign, print and send your tax documents easily with us legal forms. Web to claim aotc, you must file a federal tax return, complete the form 8863 and attach the completed form to your form 1040 or form 1040a. Web you don't qualify for a refundable american opportunity credit if 1 (a, b, or c), 2, and 3 below.

MW My 2004 Federal and State Tax Returns

Web form 8863 is used by individuals to figure and claim education credits (hope credit, lifetime learning credit, etc.). Use form 8863 to figure and claim your education. The tax credit is calculated. Web what is irs form 8863? Under age 18 at the end of 2020, or.

Form 8863 Edit, Fill, Sign Online Handypdf

Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for. Web you must attach the federal form 8863. Enter the amount from form 8863, line 18. Get ready for tax season deadlines by completing any required tax forms today. Web 2020 department.

Web Use Form 8863 To Figure And Claim Your Education Credits, Which Are Based On Adjusted Qualified Education Expenses Paid To An Eligible Educational Institution (Postsecondary).

Create a blank & editable 8863 form,. Use form 8863 to figure and claim your education. Enter the amount from form 8863, line 18. Age 18 at the end of.

Web Editable Irs Instruction 8863 2020.

Web what is irs form 8863? Complete, sign, print and send your tax documents easily with us legal forms. Web we last updated the education credits (american opportunity and lifetime learning credits) in december 2022, so this is the latest version of form 8863, fully updated for. The tax credit is calculated.

Form 8863 Typically Accompanies Your 1040 Form,.

Web you don't qualify for a refundable american opportunity credit if 1 (a, b, or c), 2, and 3 below apply to you. Download blank or fill out online in pdf format. Try it for free now! Department of the treasury internal revenue service.

Web To Claim Aotc, You Must File A Federal Tax Return, Complete The Form 8863 And Attach The Completed Form To Your Form 1040 Or Form 1040A.

Get ready for this year's tax season quickly and safely with pdffiller! Web 2020 department of the treasuryinternal revenue service instructions for form 8863 education credits (american opportunity and lifetime learning credits) general. Use the information on the form. Web up to $40 cash back easily complete a printable irs 8863 form 2020 online.