Form 8846 Credit

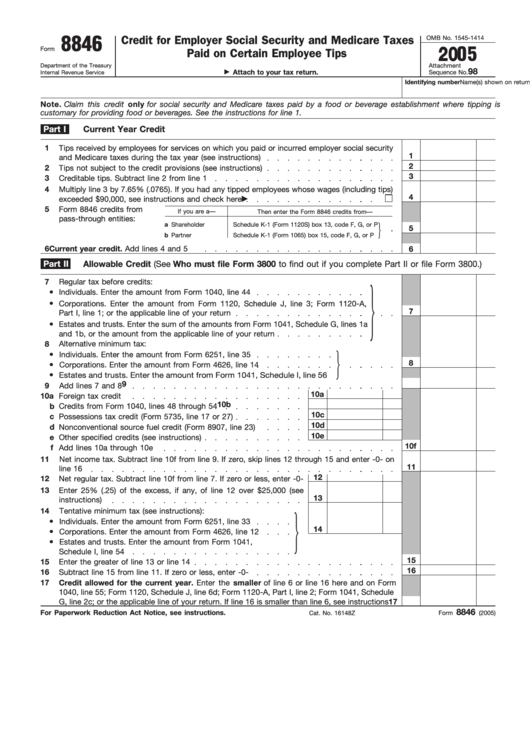

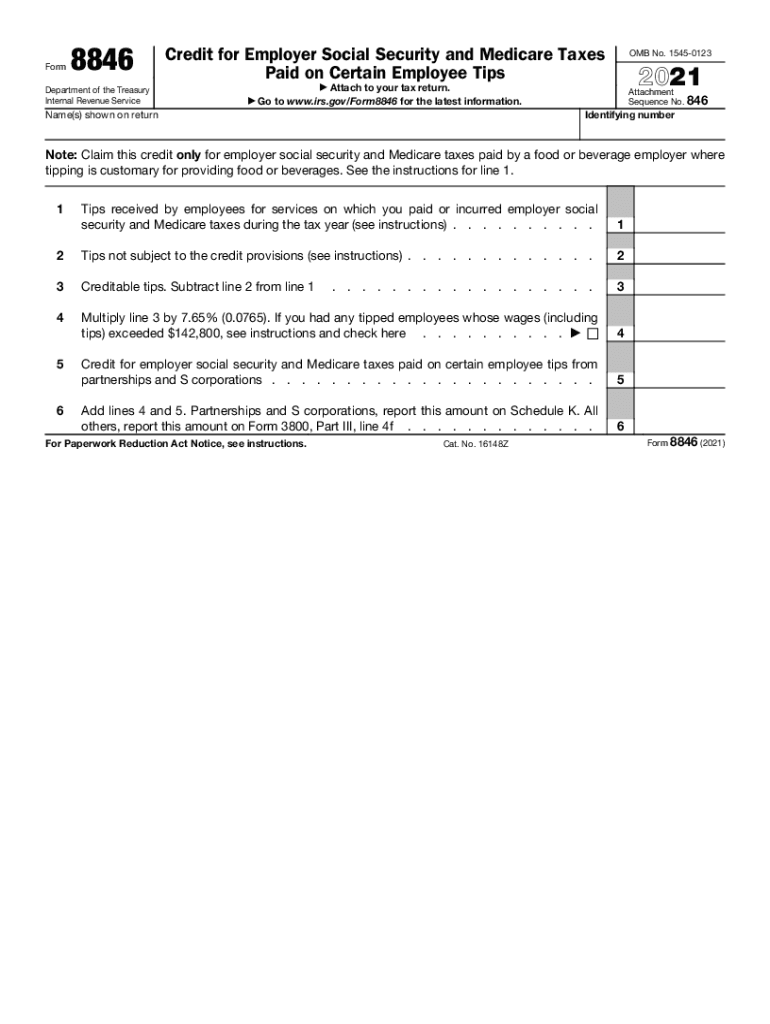

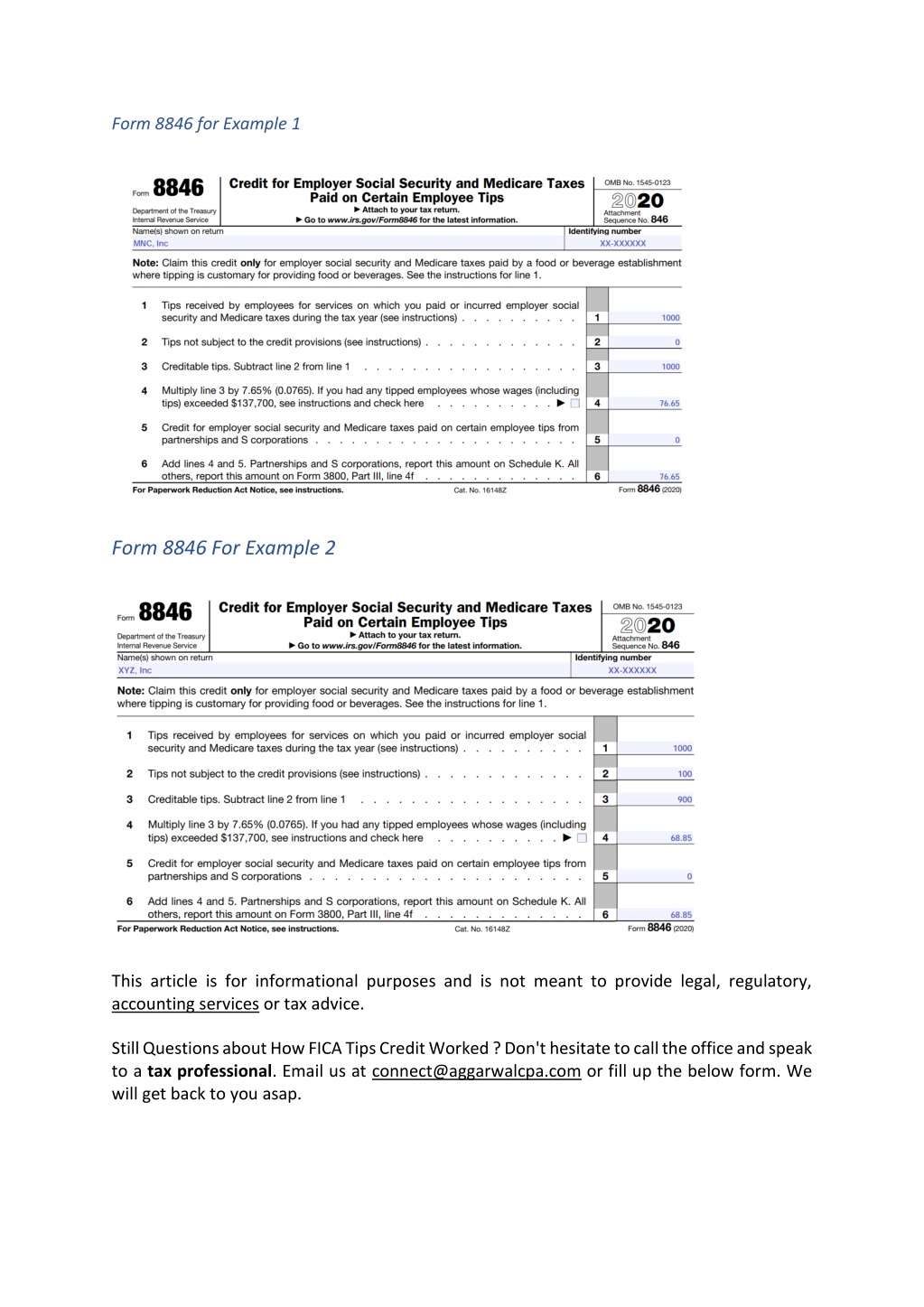

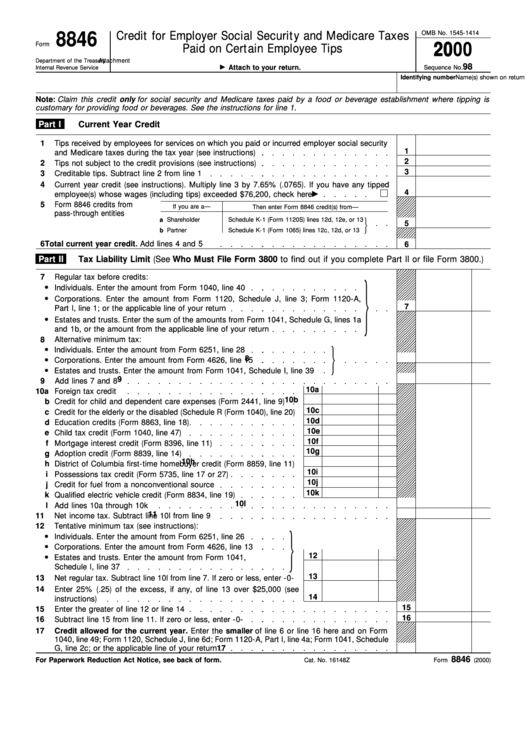

Form 8846 Credit - Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web form 8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see. The credit for employer social security and medicare taxes paid on certain. Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. Certain food and beverage establishments use this form to claim a credit for. Web the 941 can be used to fund the retention (cares act) credit. Easily fill out pdf blank, edit, and sign them.

Web form 8845 indian employment credit; Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form. Web the 941 can be used to fund the retention (cares act) credit. Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web form 8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Save or instantly send your ready documents. Web to physically take advantage of the fica tip credit in 2023, you’ll need to fill out form 8846: Easily fill out pdf blank, edit, and sign them.

Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Easily fill out pdf blank, edit, and sign them. Web form 8845 indian employment credit; Certain food and beverage establishments use this form to claim a credit for. This credit is part of the general. Web form 8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see. Form 8847 credit for contributions to. Who is eligible to use form 8846? Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred.

Fillable Form 8846 Credit For Employer Social Security And Medicare

Certain food and beverage establishments use this form to claim a credit for. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on..

Business taxes Entity selection, Form 8846 and the Work Opportunity

Form 8847 credit for contributions to. Save or instantly send your ready documents. Web form 8846 is a tax form used to claim the employer credit for social security and medicare taxes paid on certain employee tips. Form 8846 credit for employer social security and medicare taxes paid on certain employee tips; Web certain food and beverage establishments can use.

8846 Fill Out and Sign Printable PDF Template signNow

This credit is part of the general. Web it is reported on irs form 8846, which is sometimes called credit for employer social security and medicare taxes paid on certain employee tips. The credit for employer social security and medicare taxes paid on certain. Web certain food and beverage establishments (see who should file below) use form 8846 to claim.

PPT Understanding How FICA Tips Credit Worked PowerPoint Presentation

This credit is part of the general. Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social..

Form 8846 Credit for Employer Social Security and Medicare Taxes

Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form. The credit for employer social security and.

Form 8846 Credit for Employer Social Security and Medicare Taxes

Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form. Save or instantly send your ready documents. This credit is part of the general. Easily fill out pdf blank, edit, and sign them. Web certain food and beverage establishments (see who.

Form 8846 Credit for Employer Social Security and Medicare Taxes Paid

Web to physically take advantage of the fica tip credit in 2023, you’ll need to fill out form 8846: Web applying for the fica tip tax credit on irs form 8846 if desired ensuring that tip reporting for all employees meets the federal minimum threshold of 8% of gross. Web purpose of form certain food and beverage establishments (see who.

Credit For Employer Social Security And Medicare Taxes Paid On Certain

This credit is part of the general. Web we last updated the credit for employer social security and medicare taxes paid on certain employee tips in december 2022, so this is the latest version of form. Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security.

IRS Form 8846 Instructions Credit for Employer Taxes Paid on Tips

Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred. Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. The credit for employer social security.

Form 8846Credit for Social Security and Medicare Taxes Paid on Tips

Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Easily fill out pdf blank, edit, and sign them. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and.

Web Certain Food And Beverage Establishments Can Use Form 8846 Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips To Claim A Credit For Social.

Web form 8845 indian employment credit; Web certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Form 8847 credit for contributions to. Who is eligible to use form 8846?

Web We Last Updated The Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips In December 2022, So This Is The Latest Version Of Form.

Web to physically take advantage of the fica tip credit in 2023, you’ll need to fill out form 8846: Web form 8846 is a tax form used to claim the employer credit for social security and medicare taxes paid on certain employee tips. Web certain food and beverage establishments can use form 8846 to claim a credit for social security and medicare taxes paid on employee's tips. Web the 941 can be used to fund the retention (cares act) credit.

Form 8846 Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips;

Save or instantly send your ready documents. This credit is part of the general. Certain food and beverage establishments use this form to claim a credit for. Web form 8846(1995) part i part ii tips reported by employees for services on which you paid or incurred employer social security and medicare taxes during the tax year (see.

Web It Is Reported On Irs Form 8846, Which Is Sometimes Called Credit For Employer Social Security And Medicare Taxes Paid On Certain Employee Tips.

The credit for employer social security and medicare taxes paid on certain. Web certain food and beverage establishments can use form 8846 credit for employer social security and medicare taxes paid on certain employee tips to claim a credit for social. Web certain food and beverage employers (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred by the employer on. Web purpose of form certain food and beverage establishments (see who should file below) use form 8846 to claim a credit for social security and medicare taxes paid or incurred.