Form 8821 Example

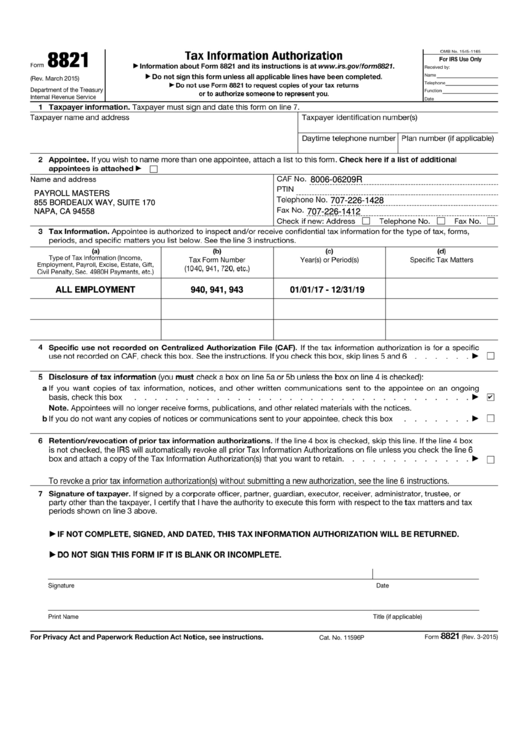

Form 8821 Example - Sample 1 sample 2 sample 3 see all ( 17) irs form 8821. Personal information about a taxpayer such as social security number history of payments made to an account It can be written as 4.190476 in decimal form (rounded to 6 decimal places). On this line and attach a list of appointees to form 8821. The form is similar to a power of attorney, albeit with lesser authority. Sign online button or tick the preview image of the document. Divide both the numerator and denominator by the gcd 88 ÷ 1 / 21 ÷ 1; Web irs form 8821, tax information authorization grants access to an individual, organization, or firm to receive and inspect your confidential tax information. This form includes 7 different sections. For example, you may list “income tax, form 1040” for calendar year “2003” and “excise tax, form 720” for the “1st, 2nd, 3rd, and 4th quarters of 2003.” for multiple years, you may list “2001 through (thru or a dash (—)) 2003” for.

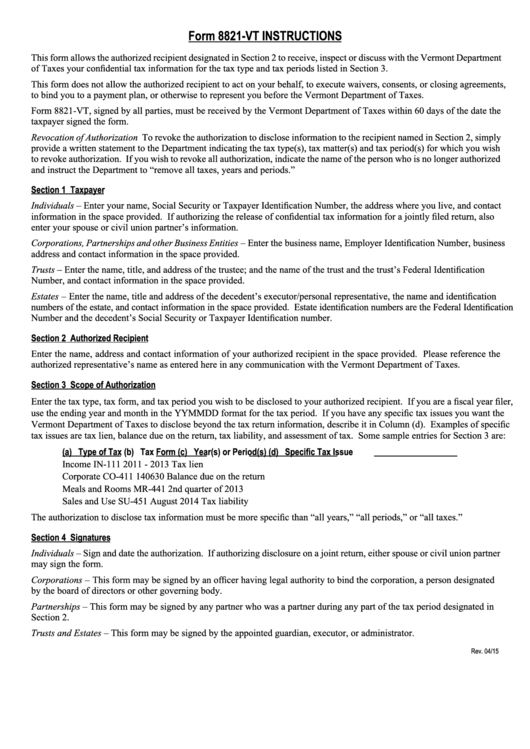

Web whereas a power of attorney form could allow the appointed third party to act on your behalf by setting up an irs online payment agreement or seeking tax abatement services, for example, form 8821 prohibits any action other than the right to. This notice also revises the document retention guidance throughout sop 50 10 6 to include the irs form 8821, if used by the sba lender to verify small business borrower financial information. This form enables the filer to give permission to view their confidential tax information to an individual, corporation, organization, firm, or partnership. Find the gcd (or hcf) of numerator and denominator gcd of 88 and 21 is 1; Web irs form 8821, tax information authorization grants access to an individual, organization, or firm to receive and inspect your confidential tax information. Form 8821 is also used to delete or revoke prior tax information authorizations. October 2012) information about form 8821 and its instructions is at www.irs.gov/form8821. Web 2.11k subscribers subscribe 13k views 4 years ago need help filling out irs form 8821? 88 / 21 therefore, 88/21. For example, say that you have a complex tax situation that spans several years and the irs is running an audit.

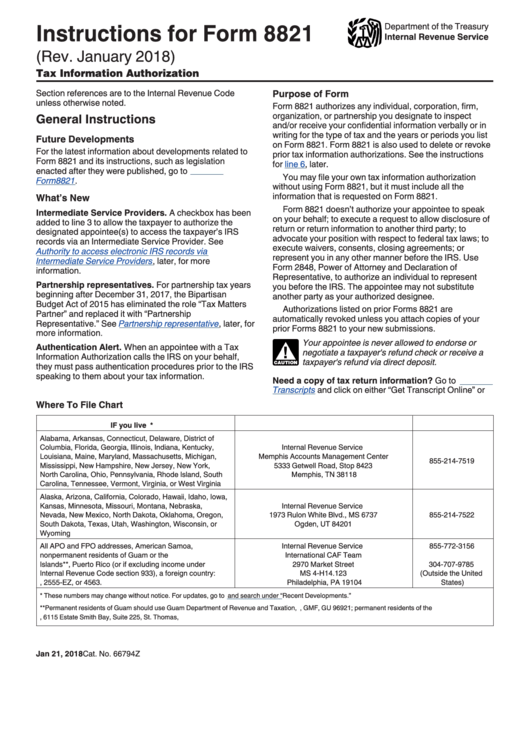

Form 8821 is also used to delete or revoke prior tax information authorizations. See the instructions for line 5, later. It can be written as 4.190476 in decimal form (rounded to 6 decimal places). Web tax information authorization 8821 form tax information authorization omb no. Web form 8821 (rev. For example, say that you have a complex tax situation that spans several years and the irs is running an audit. Web where to file chart and/or receive your confidential information verbally or in writing for the type of tax and the years or periods you list on form 8821. October 2012) information about form 8821 and its instructions is at www.irs.gov/form8821. Web 2.11k subscribers subscribe 13k views 4 years ago need help filling out irs form 8821? Form 8821 can also revoke prior authorizations.

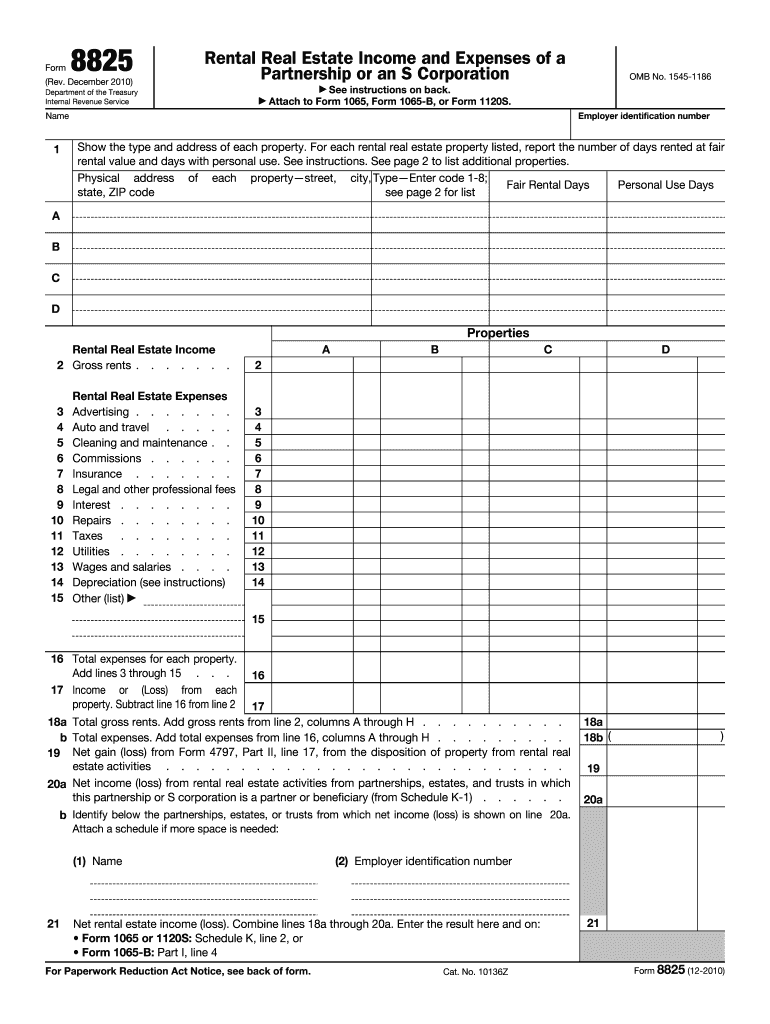

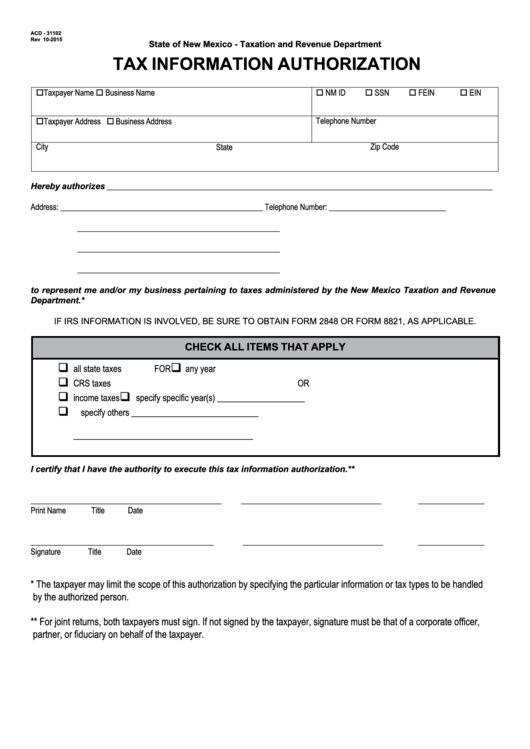

IRS Form 8821 Tax Information Authorization

Web these are a few examples of the type of information that can be accessed whenever a form 8821 is filed: Find the gcd (or hcf) of numerator and denominator gcd of 88 and 21 is 1; Personal information about a taxpayer such as social security number history of payments made to an account This form includes 7 different sections..

What Is IRS Form 8821? IRS Tax Attorney

Name telephone department of the treasury donot sign this form unless all applicable lines have been completed. The 8821 can be tricky, but we've got the tips and tricks you need to make sure your tax information. Web whereas a power of attorney form could allow the appointed third party to act on your behalf by setting up an irs.

Irs Form W4V Printable / IRS W4T PDFfiller / The internal revenue

This form includes 7 different sections. On this line and attach a list of appointees to form 8821. Find the gcd (or hcf) of numerator and denominator gcd of 88 and 21 is 1; It can be written as 4.190476 in decimal form (rounded to 6 decimal places). The 8821 can be tricky, but we've got the tips and tricks.

Top 14 Form 8821 Templates free to download in PDF format

Web form 8821 omb no. Web if signed by a corporate officer, partner, guardian, partnership representative (or designated individual, if applicable), executor, receiver, administrator, trustee, or individual other than the taxpayer, i certify that i have the legal authority to execute this form with respect to the tax matters and tax periods shown on line 3 above. It can be.

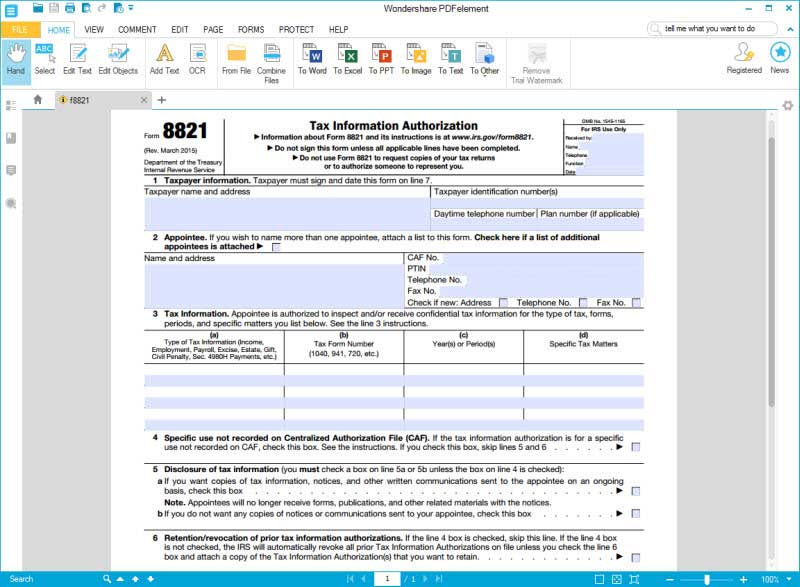

Fillable Form 8821 (Rev. March 2015) printable pdf download

For example, say that you have a complex tax situation that spans several years and the irs is running an audit. See the instructions for line 5, later. On this line and attach a list of appointees to form 8821. The 8821 can be tricky, but we've got the tips and tricks you need to make sure your tax information..

Form 8821 Tax Information Authorization printable pdf download

Sample 1 sample 2 sample 3 see all ( 17) irs form 8821. On this line and attach a list of appointees to form 8821. Personal information about a taxpayer such as social security number history of payments made to an account The same as it can allow someone else to view the tax information, form 8821 can also be.

IRS Form 8821 Fill it out electronically with the Best Program

Form 8821 can also revoke prior authorizations. For example, you may list “income tax, form 1040” for calendar year “2003” and “excise tax, form 720” for the “1st, 2nd, 3rd, and 4th quarters of 2003.” for multiple years, you may list “2001 through (thru or a dash (—)) 2003” for. October 2012) information about form 8821 and its instructions is.

Instructions For Form 8821 Tax Information Authorization printable

Designating an authorized tax representative using irs form 8821 allows the appointee to. To begin the document, utilize the fill camp; Department of the treasury internal revenue service. It can be written as 4.190476 in decimal form (rounded to 6 decimal places). Web 2.11k subscribers subscribe 13k views 4 years ago need help filling out irs form 8821?

Form 2848 YouTube

It can be written as 4.190476 in decimal form (rounded to 6 decimal places). Web whereas a power of attorney form could allow the appointed third party to act on your behalf by setting up an irs online payment agreement or seeking tax abatement services, for example, form 8821 prohibits any action other than the right to. Web example irs.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Sample 1 sample 2 sample 3 see all ( 17) irs form 8821. Web 88 / 21 is already in the simplest form. For example, you may list “income, 1040” for calendar year “2006” and “excise, 720” for “2006” (this covers. Web 2.11k subscribers subscribe 13k views 4 years ago need help filling out irs form 8821? Divide both the.

The Way To Complete The F8821 Form 8821 Example On The Web:

Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Divide both the numerator and denominator by the gcd 88 ÷ 1 / 21 ÷ 1; The same as it can allow someone else to view the tax information, form 8821 can also be used for lifting the prior tax. Web these are a few examples of the type of information that can be accessed whenever a form 8821 is filed:

The 8821 Can Be Tricky, But We've Got The Tips And Tricks You Need To Make Sure Your Tax Information.

April 2004)department of the treasuryinternal revenue servicetax information authorizationdo not use this form to request a copy or transcript of your tax return.instead, use form 4506. This notice also revises the document retention guidance throughout sop 50 10 6 to include the irs form 8821, if used by the sba lender to verify small business borrower financial information. Web whereas a power of attorney form could allow the appointed third party to act on your behalf by setting up an irs online payment agreement or seeking tax abatement services, for example, form 8821 prohibits any action other than the right to. The form is similar to a power of attorney, albeit with lesser authority.

88 / 21 Therefore, 88/21.

Sign online button or tick the preview image of the document. Web sample irs form 8821. Web if you are submitting form 8821 to authorize disclosure of your confidential tax information for a purpose other than addressing or resolving a tax matter with the irs (for example, for income verification required by a lender), the irs must receive the form 8821 within 120 days of the taxpayer’s signature date on the form. Web example scenario for form 8821.

Sba Lenders Must Retain In Their Loan File Whichever Irs Form Was Used For Purposes Of.

Web where to file chart and/or receive your confidential information verbally or in writing for the type of tax and the years or periods you list on form 8821. Web example irs form 8821 used for participant employer to designate fiscal/employer agent as appointees for employment tax purposes box 1 is completed with the participant/representative employer information. There are a number of situations where a taxpayer would need help from a professional and want that professional to be able to access information. For example, you may list “income tax, form 1040” for calendar year “2003” and “excise tax, form 720” for the “1st, 2nd, 3rd, and 4th quarters of 2003.” for multiple years, you may list “2001 through (thru or a dash (—)) 2003” for.