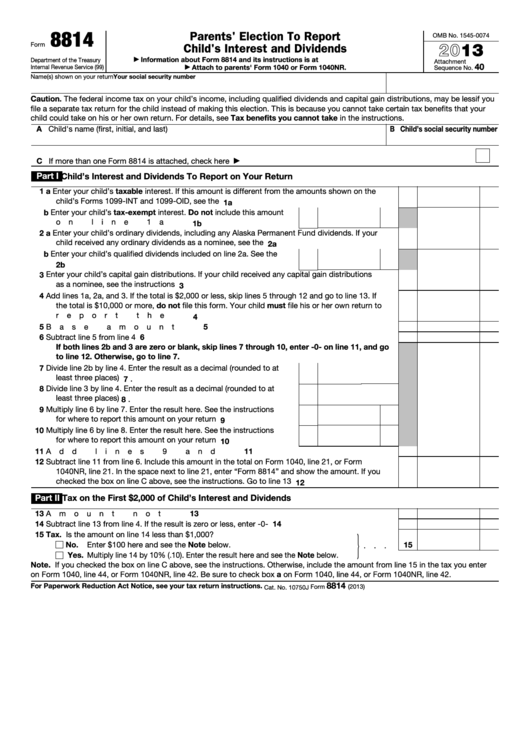

Form 8814 Instructions 2021

Form 8814 Instructions 2021 - Use this form if you. Web federal — parents' election to report child's interest and dividends download this form print this form it appears you don't have a pdf plugin for this browser. Web 2022 department of the treasuryinternal revenue service instructions for form 8814 parents’ election to report child’s interest and dividends section references are to the. Multiply results of lines 6 and 7 and enter the number in line 9. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Web common questions about form 8615 and form 8814. Web 2021 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. We have reproduced key portions of the 8814 instructions, with our own summary below. The child must be a.

Form 8814 will be used if you elect to report your child's. We have reproduced key portions of the 8814 instructions, with our own summary below. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the due date (including extensions). Web divide the number in line 3 by line 4 and enter rounded to three digits result in line 8. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Solved•by intuit•15•updated july 12, 2022. Web the irs website shows that the 2021 form 8814 has been finalized and the form appears to have been finalized in lacerte on january 19, 2022 according to. Web 2021 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. Start completing the fillable fields and carefully.

If the client elects to report their child's income on their return, the child won't have to file a return. Web how to make the election. Web subtract line 11 from line 6. Web for a parent to claim a child’s income on their tax return, certain requirements must be met to use irs form 8814. Use get form or simply click on the template preview to open it in the editor. Web federal — parents' election to report child's interest and dividends download this form print this form it appears you don't have a pdf plugin for this browser. Web 2022 department of the treasuryinternal revenue service instructions for form 8814 parents’ election to report child’s interest and dividends section references are to the. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Form 8814 will be used if you elect to report your child's. If income is reported on.

Form 8814 Parent's Election to Report Child's Interest and Dividends

Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? Solved•by intuit•15•updated july 12, 2022. Use this form if you. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Web federal — parents' election to.

PAIDI LINAS 133 6506 INSTRUCTIONS MANUAL Pdf Download ManualsLib

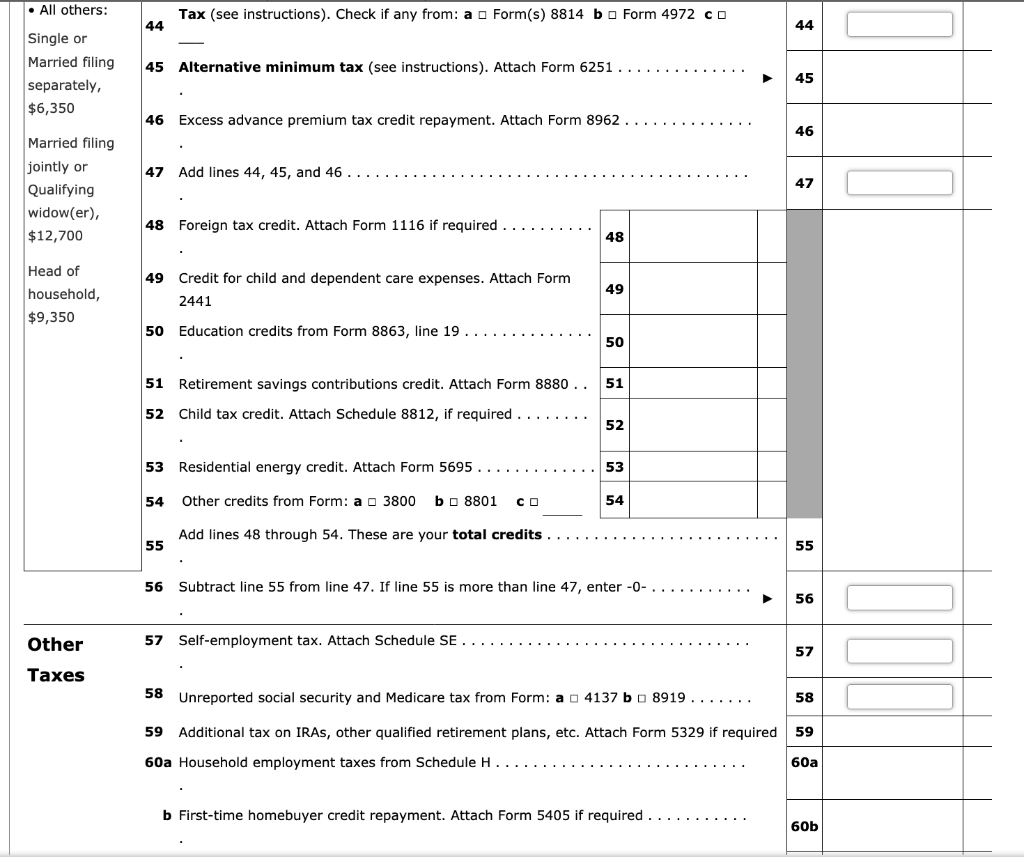

Web common questions about form 8615 and form 8814. We have reproduced key portions of the 8814 instructions, with our own summary below. The child must be a. Form 8814 will be used if you elect to report your child's. 1 8814 2 4972 3 16 17 amount from schedule 2 (form 1040), line 3.17 18 add lines 16 and.

Note This Problem Is For The 2017 Tax Year. Janic...

The child must be a. Web taxslayer support what is form 8814, parent's election to report child's interest/dividend earnings? Web federal — parents' election to report child's interest and dividends download this form print this form it appears you don't have a pdf plugin for this browser. To make the election, complete and attach form (s) 8814 to your tax.

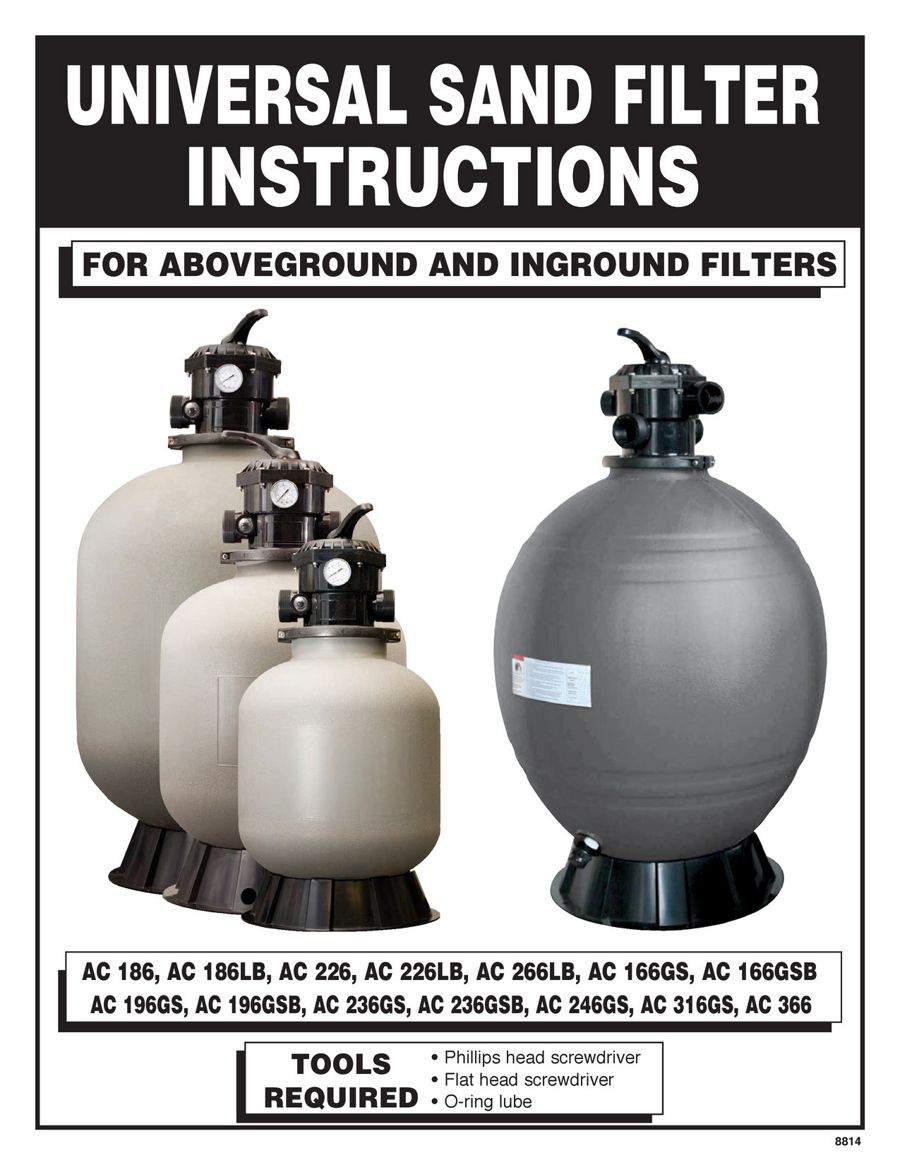

BT 8814Sand Filter Instructions by Island Recreational Flipsnack

Web how to make the election. Web taxslayer pro desktop tax computation menu desktop: In the space next to line 21, enter “form 8814” and show the amount. Web the irs website shows that the 2021 form 8814 has been finalized and the form appears to have been finalized in lacerte on january 19, 2022 according to. The client can.

Irs form 8814 instructions

Web 2021 instructions for schedule 8812 credits for qualifying children and other dependents use schedule 8812 (form 1040) to figure your child tax credits, to report advance child. The child must be a. Web let’s walk through the irs form 8814 basics. In the space next to line 21, enter “form 8814” and show the amount. Web information about form.

Fillable Form 8814 Parents' Election To Report Child'S Interest And

Multiply results of lines 6 and 7 and enter the number in line 9. Solved•by intuit•15•updated july 12, 2022. Web let’s walk through the irs form 8814 basics. Form 8814 will be used if you elect to report your child's. To make the election, complete and attach form (s) 8814 to your tax return and file your return by the.

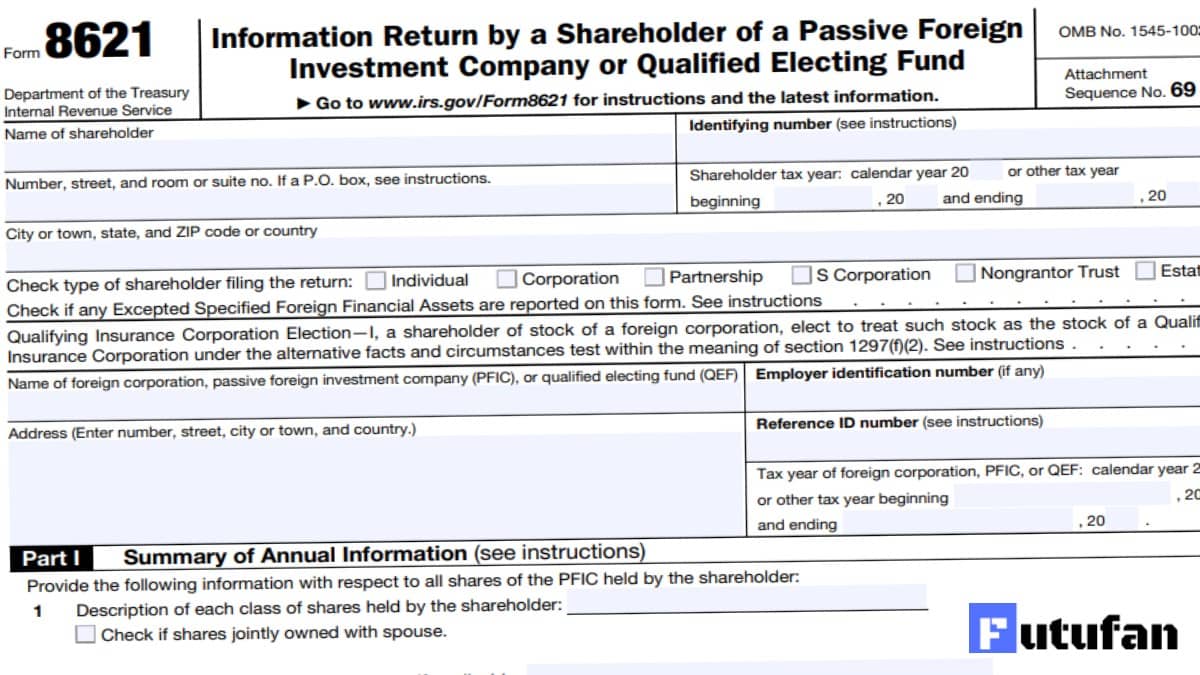

Form 8621 Instructions 2021 2022 IRS Forms

Web let’s walk through the irs form 8814 basics. Below are answers to frequently asked questions about. Include this amount in the total on form 1040, line 21, or form 1040nr, line 21. Form 8814 will be used if you elect to report your child's. Web common questions about form 8615 and form 8814.

Download 1040Ez 2020 Tax Table Table Gallery

In the space next to line 21, enter “form 8814” and show the amount. Include this amount in the total on form 1040, line 21, or form 1040nr, line 21. Form 8814 will be used if you elect to report your child's. Web taxslayer pro desktop tax computation menu desktop: Web how to make the election.

Form 8814 Parent's Election to Report Child's Interest and Dividends

1 8814 2 4972 3 16 17 amount from schedule 2 (form 1040), line 3.17 18 add lines 16 and. Use this form if you. Web information about form 8814, parent's election to report child's interest and dividends, including recent updates, related forms, and instructions on how to file. Web for a parent to claim a child’s income on their.

8814 form Fill out & sign online DocHub

Web who should file form 8814? Solved•by intuit•15•updated july 12, 2022. Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears.

Web Subtract Line 11 From Line 6.

Web how to make the election. Web 2022 department of the treasuryinternal revenue service instructions for form 8814 parents’ election to report child’s interest and dividends section references are to the. Check if any from form(s): Web common questions about form 8615 and form 8814.

Use This Form If You.

Start completing the fillable fields and carefully. Web let’s walk through the irs form 8814 basics. If income is reported on. Web taxslayer pro desktop tax computation menu desktop:

In The Space Next To Line 21, Enter “Form 8814” And Show The Amount.

Web the choice to file form 8814 parents’ election to report child’s interest and dividends with the parents' return or form 8615 tax for certain children who have unearned income. The child must be a. Web federal parents' election to report child's interest and dividends form 8814 pdf form content report error it appears you don't have a pdf plugin for this browser. Multiply results of lines 6 and 7 and enter the number in line 9.

To Make The Election, Complete And Attach Form (S) 8814 To Your Tax Return And File Your Return By The Due Date (Including Extensions).

Solved•by intuit•15•updated july 12, 2022. Web divide the number in line 3 by line 4 and enter rounded to three digits result in line 8. If the client elects to report their child's income on their return, the child won't have to file a return. Include this amount in the total on form 1040, line 21, or form 1040nr, line 21.