Form 7202 And Unemployment

Form 7202 And Unemployment - If a person received sick pay, they should not have claimed unemployment for that time period. For questions or assistance, regional claims. Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. In the hypothetical reasoning that the 7202 credits are 'wage. If the form 7202 will be included with your. Web form 7202 is for paid sick leave for a self employed person. Essentially, if you worked for an employer this. Web flightaware couldn't find flight tracking data for ual7202 just yet. Learn how to file for benefits, avoid delays with your claim, and look for work. I need to register a.

Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web filing online is one of the fastest ways to complete the claim process. Web 7202 and unemployment is there any guidance on interaction between 7202 and unemployment benefits? Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year? For questions or assistance, regional claims. If the form 7202 will be included with your. Web form 7202 is for paid sick leave for a self employed person. I want to file an unemployment claim or view my claim information. Web flightaware couldn't find flight tracking data for ual7202 just yet. I am an employer and have a des employer account number.

Web flightaware couldn't find flight tracking data for ual7202 just yet. Web filing online is one of the fastest ways to complete the claim process. I am an employer and have a des employer account number. Web 7202 and unemployment is there any guidance on interaction between 7202 and unemployment benefits? Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. For questions or assistance, regional claims. Learn how to file for benefits, avoid delays with your claim, and look for work. Web form 7202 is for paid sick leave for a self employed person. You can complete a claim online at getkansasbenefits.gov provided you meet these criteria: In the hypothetical reasoning that the 7202 credits are 'wage.

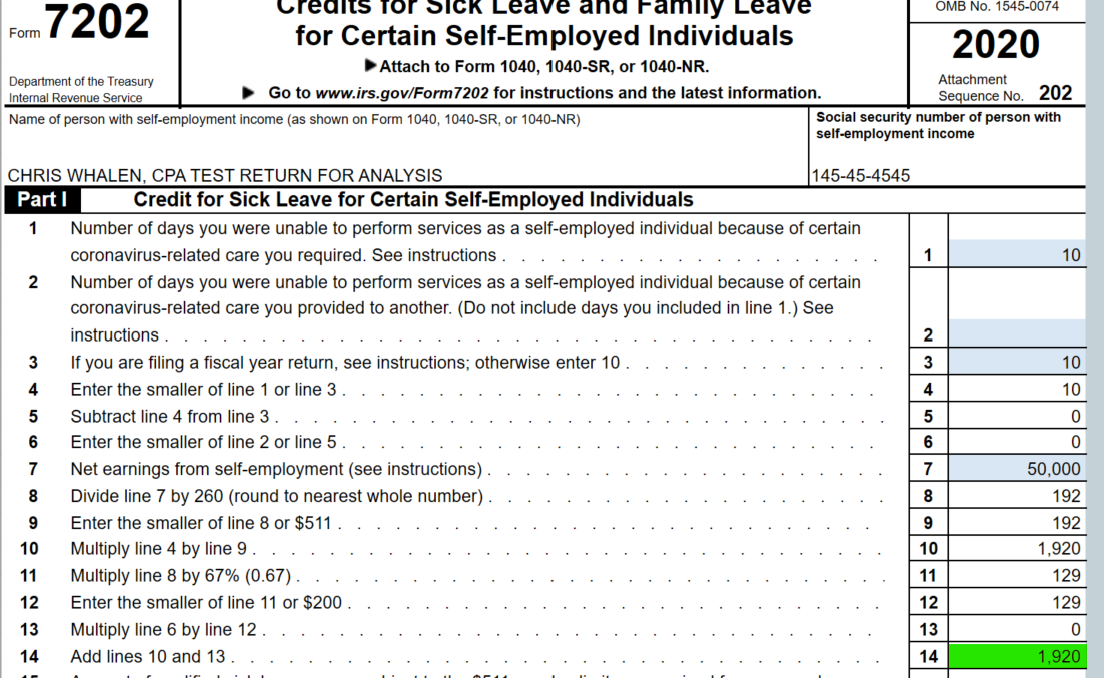

Printable Fileable IRS Form 7202 Self Employed Sick Leave and Family

In the hypothetical reasoning that the 7202 credits are 'wage. Learn how to file for benefits, avoid delays with your claim, and look for work. Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year? I need to register a. I want to file an unemployment claim or view my claim.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

You can complete a claim online at getkansasbenefits.gov provided you meet these criteria: I need to register a. Web ask about meeting with an unemployment insurance navigator. Web filing online is one of the fastest ways to complete the claim process. If a person received sick pay, they should not have claimed unemployment for that time period.

Memo SelfEmployed People, Don't Miss Your 2020 Coronavirus Tax

Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year? Web filing online is one of the fastest ways to complete the claim process. Web 7202 and unemployment is there any guidance on interaction between 7202 and unemployment benefits? Web ask about meeting with an unemployment insurance navigator. I want to.

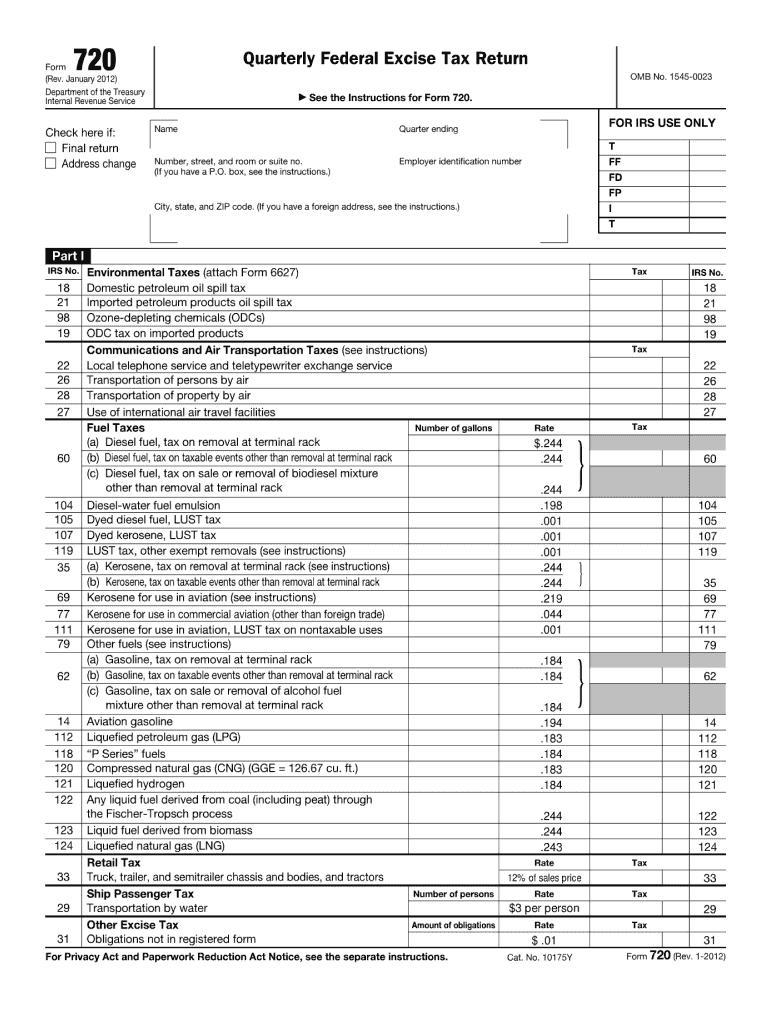

How to Complete Form 720 Quarterly Federal Excise Tax Return

I want to file an unemployment claim or view my claim information. I need to register a. Web filing online is one of the fastest ways to complete the claim process. Web ask about meeting with an unemployment insurance navigator. You can complete a claim online at getkansasbenefits.gov provided you meet these criteria:

Form 720 Fill Out and Sign Printable PDF Template signNow

If a person received sick pay, they should not have claimed unemployment for that time period. Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year? For instructions and the latest information. You can complete a claim online at getkansasbenefits.gov provided you meet these criteria: Web ask about meeting with an.

Form 7202 Pdf Fill and Sign Printable Template Online US Legal Forms

Learn how to file for benefits, avoid delays with your claim, and look for work. If a person received sick pay, they should not have claimed unemployment for that time period. If the form 7202 will be included with your. Web 7202 and unemployment is there any guidance on interaction between 7202 and unemployment benefits? You can complete a claim.

New Stimulus Package Broadens Unemployment Eligibility and Increases

For instructions and the latest information. Web filing online is one of the fastest ways to complete the claim process. You can complete a claim online at getkansasbenefits.gov provided you meet these criteria: Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year? Web 7202 and unemployment is there any guidance.

Draft of Form to be Used by SelfEmployed Individuals to Compute FFCRA

Web ask about meeting with an unemployment insurance navigator. You can complete a claim online at getkansasbenefits.gov provided you meet these criteria: I am an employer and have a des employer account number. Web form 7202 is for paid sick leave for a self employed person. I need to register a.

Desktop 2020 Form 7202 Credits for Sick Leave and Family Leave for

If you typed it in correctly and it's still not showing up, or you're. Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year? I need to register a. For questions or assistance, regional claims. Essentially, if you worked for an employer this.

IRS Form 7202 LinebyLine Instructions 2022 Sick Leave and Family

Learn how to file for benefits, avoid delays with your claim, and look for work. Web form 7202 is for paid sick leave for a self employed person. If you typed it in correctly and it's still not showing up, or you're. I need to register a. I am an employer and have a des employer account number.

Web Form 7202 Is For Paid Sick Leave For A Self Employed Person.

Maximum $511 paid sick leave credit per day, and $5,110 in the aggregate. Web ask about meeting with an unemployment insurance navigator. Learn how to file for benefits, avoid delays with your claim, and look for work. If you typed it in correctly and it's still not showing up, or you're.

Essentially, If You Worked For An Employer This.

Web flightaware couldn't find flight tracking data for ual7202 just yet. If a person received sick pay, they should not have claimed unemployment for that time period. In the hypothetical reasoning that the 7202 credits are 'wage. Web can i file form 7202 on my return and have done received unemployment for the 2020 filing year?

If The Form 7202 Will Be Included With Your.

For questions or assistance, regional claims. Web filing online is one of the fastest ways to complete the claim process. You can complete a claim online at getkansasbenefits.gov provided you meet these criteria: I need to register a.

I Am An Employer And Have A Des Employer Account Number.

I want to file an unemployment claim or view my claim information. Web 7202 and unemployment is there any guidance on interaction between 7202 and unemployment benefits? For instructions and the latest information.