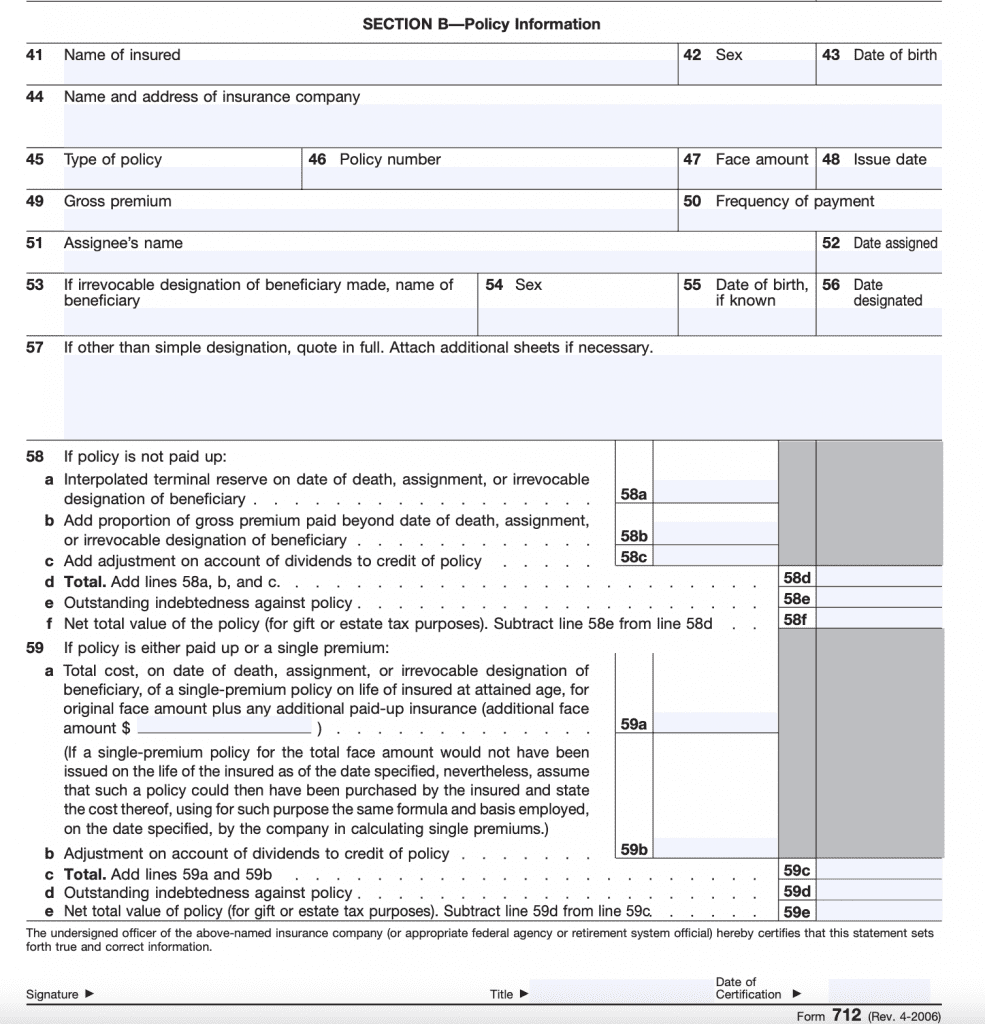

Form 712 For Life Insurance

Form 712 For Life Insurance - The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web i received form 712 for a $5000 life insurance payout following my husband's death. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Do i need to report that as income? Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. If there were multiple policies in effect, the. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web form 712 reports the value of a policy in order to prepare the estate tax forms. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file.

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web i received form 712 for a $5000 life insurance payout following my husband's death. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: If a policy doesn’t meet the. Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. Do i need to report that as income? The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not.

Do i need to report that as income? Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. If there were multiple policies in effect, the. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web i received form 712 for a $5000 life insurance payout following my husband's death. If a policy doesn’t meet the. Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file.

Insurance Policy Form 712

Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your.

United Insurance Claim Form Pdf

Web i received form 712 for a $5000 life insurance payout following my husband's death. Do i need to report that as income? The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web information about gestalt 712, life.

Form 712 Life Insurance Statement (2006) Free Download

If there were multiple policies in effect, the. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. Web form 712 reports the value of a policy in order to prepare the estate tax.

Form 712 Life Insurance Statement (2006) Free Download

If a policy doesn’t meet the. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: If there were multiple policies in effect, the. Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web information about gestalt 712, life insurance statement, including recent actualizations, related forms, and instructions on how to file. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: If there were multiple policies in effect, the. Web internal revenue service (irs) tax code 7702 sets the guidelines for.

IRS Form 945 Instructions

Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return. Do i need to report that as income? Web i received form 712 for a $5000 life insurance payout following my husband's death. This.

Form 712 Life Insurance Statement (2006) Free Download

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your.

IRS Form 712 A Guide to the Life Insurance Statement

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web irs form 712 is an informational tax form that is used to report the value.

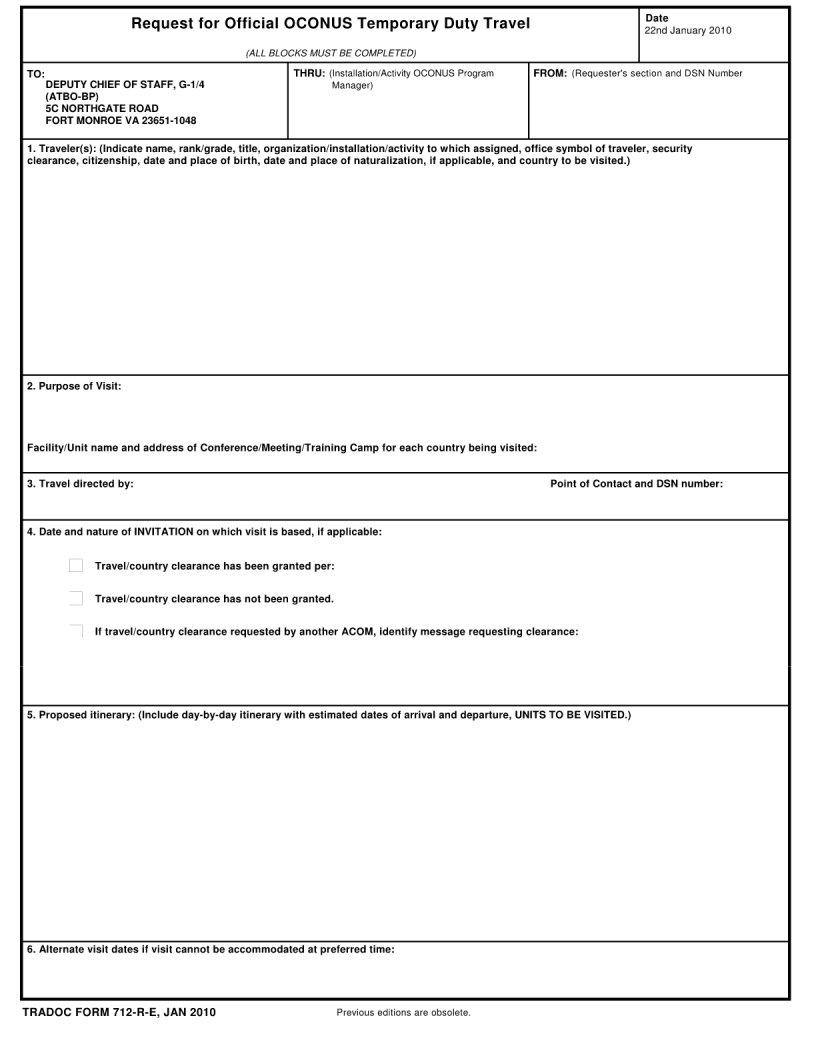

Tradoc Form 712 R E ≡ Fill Out Printable PDF Forms Online

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web form 712 reports the value of a policy in order to prepare the estate tax forms. If a policy doesn’t meet the. The value of all policies on the decedent’s life must be reported on the.

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

Web form 712 reports the value of a policy in order to prepare the estate tax forms. This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other.

If There Were Multiple Policies In Effect, The.

Web irs form 712 is an informational tax form that is used to report the value of life insurance policies as part of an estate tax return. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web internal revenue service (irs) tax code 7702 sets the guidelines for determining the tax status of whole, universal life and other types of permanent life insurance. Turbotax home & biz windows posted june 4, 2019 7:13 pm last updated june 04, 2019 7:13 pm 0 2 6,799 reply bookmark icon 1 best answer sweetiejean level 15 not on your personal tax return.

Web Information About Gestalt 712, Life Insurance Statement, Including Recent Actualizations, Related Forms, And Instructions On How To File.

The value of all policies on the decedent’s life must be reported on the estate tax return on schedule d, regardless of whether they were owned inside the estate or not. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. If a policy doesn’t meet the. Do i need to report that as income?

Web I Received Form 712 For A $5000 Life Insurance Payout Following My Husband's Death.

This form is not filed by itself, but as an accompaniment to other estate tax forms, most notably irs form 706: Web form 712 reports the value of a policy in order to prepare the estate tax forms.