Form 592 B Instructions

Form 592 B Instructions - Go to the california > other information. Web when filing form 592 with the ftb, the. Withholding agent is not required to submit. This form is for income earned in tax year 2022, with tax. Individuals who are not residents of california. Corporations not qualified through the california secretary of state (ca sos) to do. Generally a taxpayer receives this. A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web nonresident includes all of the following:

Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Withholding agent is not required to submit. Corporations not qualified through the california secretary of state (ca sos) to do. Web nonresident includes all of the following: Web when filing form 592 with the ftb, the. Individuals who are not residents of california. This form is for income earned in tax year 2022, with tax. Generally a taxpayer receives this. Go to the california > other information.

Web nonresident includes all of the following: Generally a taxpayer receives this. Individuals who are not residents of california. Go to the california > other information. A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Corporations not qualified through the california secretary of state (ca sos) to do. Web when filing form 592 with the ftb, the. Withholding agent is not required to submit. This form is for income earned in tax year 2022, with tax.

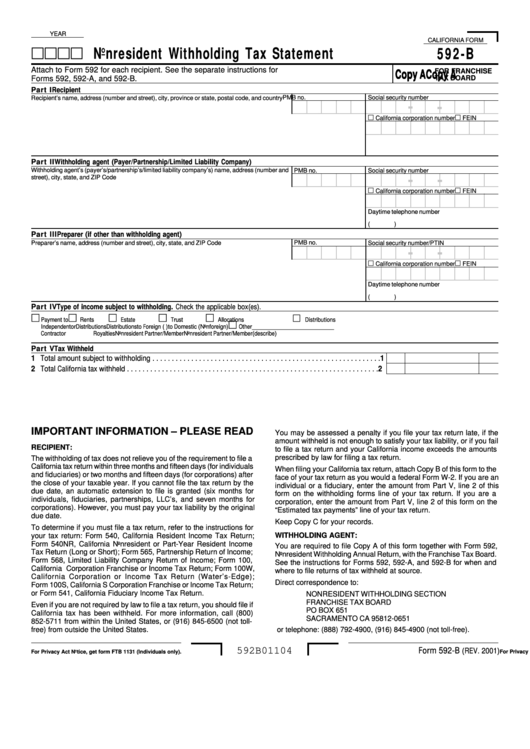

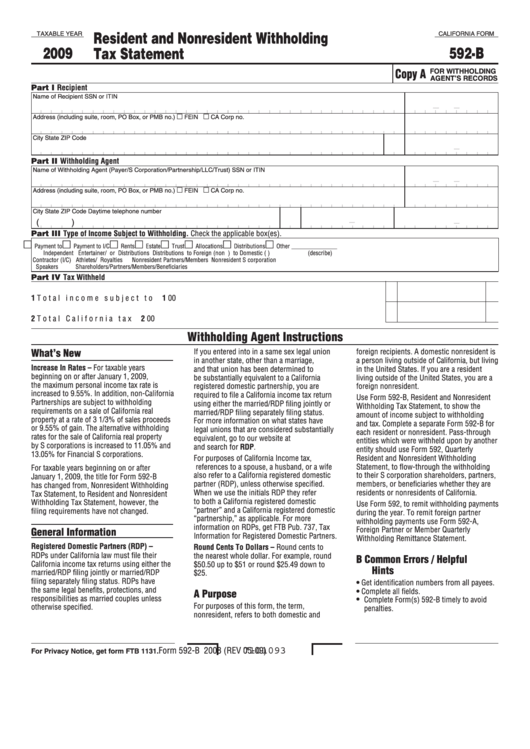

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. This form is for income earned in tax year 2022, with tax. Go to the california > other information. Corporations not qualified through the california secretary of state (ca sos) to do. A form 592‑b, resident and nonresident withholding.

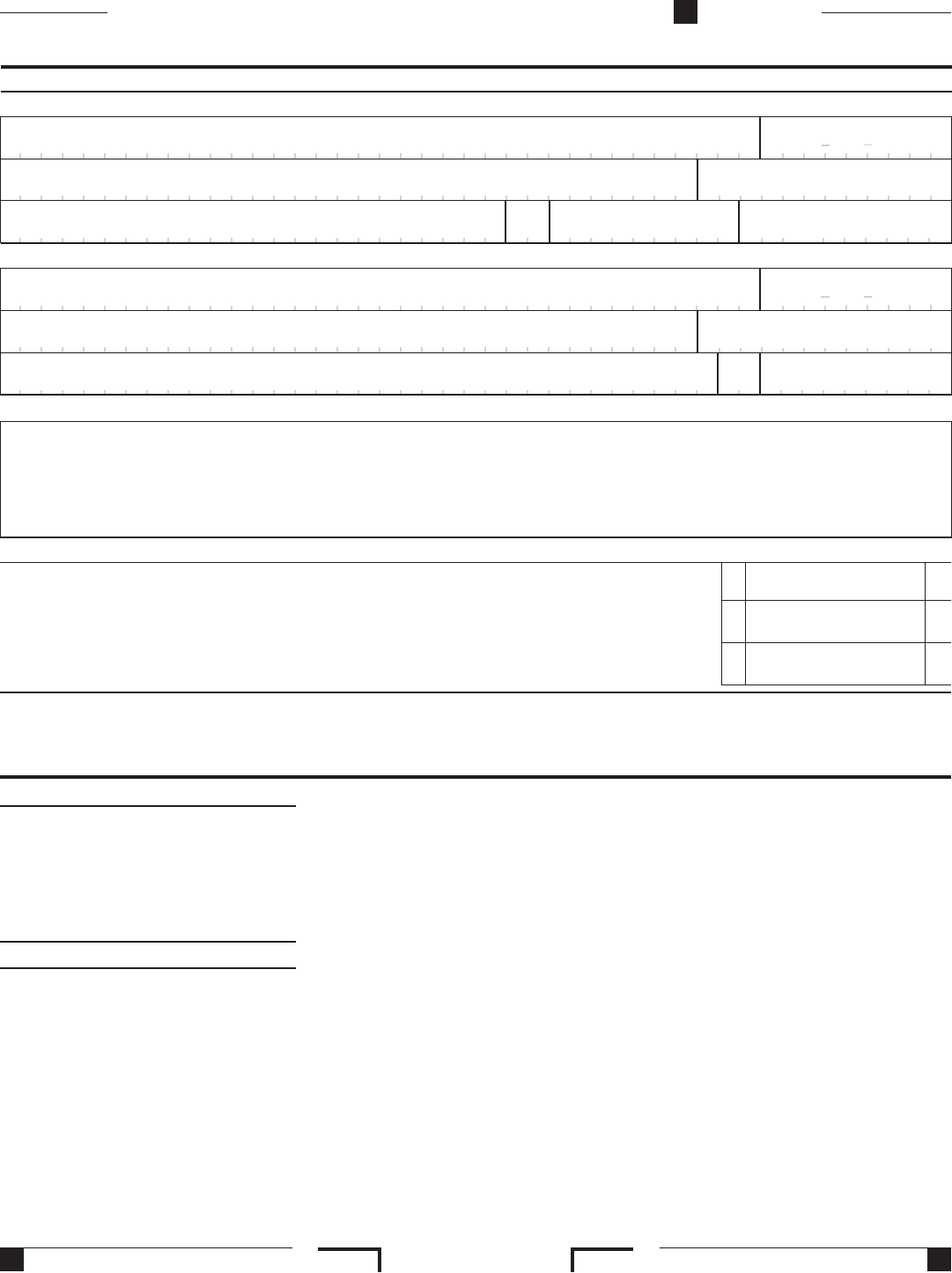

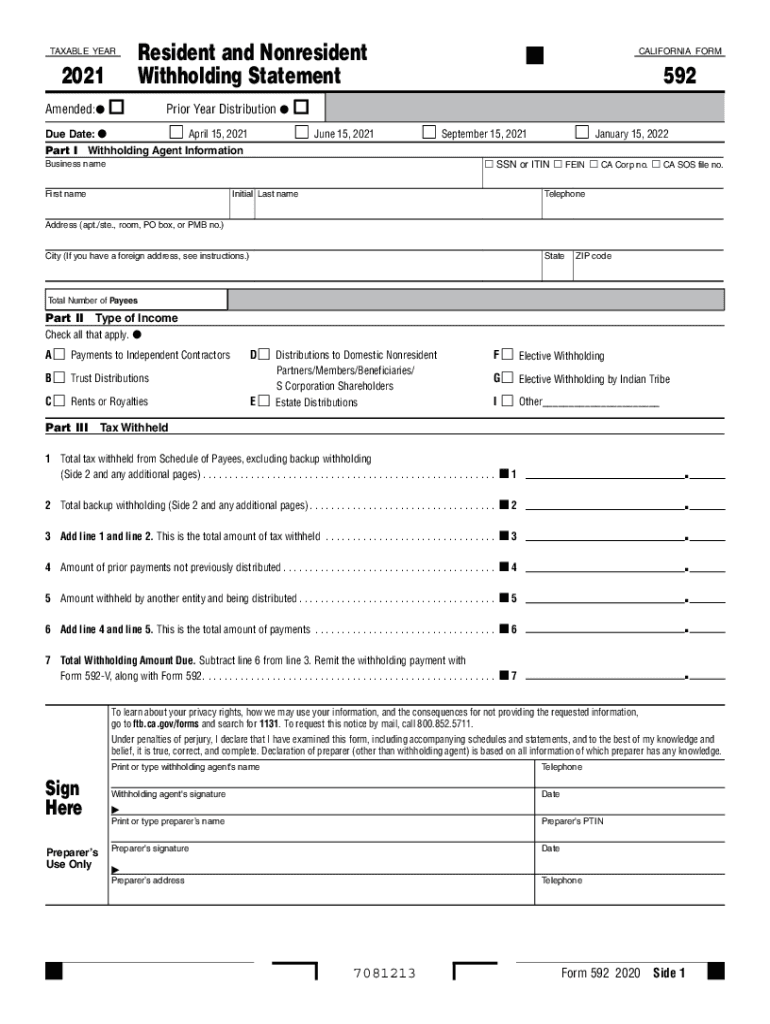

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

Individuals who are not residents of california. Generally a taxpayer receives this. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Withholding agent is not required to submit. Go to the california > other information.

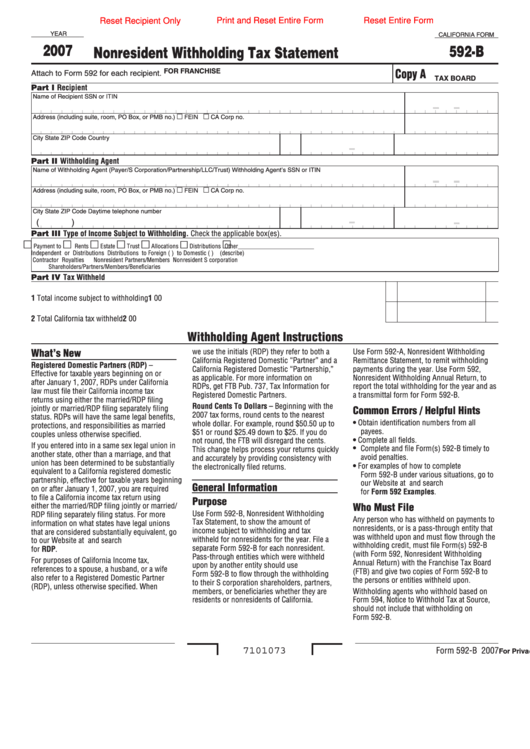

Fillable California Form 592B Nonresident Withholding Tax Statement

Web nonresident includes all of the following: A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Generally a taxpayer receives this. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Go to the california > other information.

Form 592B Franchise Tax Board Edit, Fill, Sign Online Handypdf

Withholding agent is not required to submit. Web nonresident includes all of the following: A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. This form is for income earned in tax year 2022, with.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

Individuals who are not residents of california. A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. This form is for income earned in tax year 2022, with tax. Corporations not qualified through the california secretary of state (ca sos) to do. Web when filing form 592 with the ftb, the.

ftb.ca.gov forms 09_592v

Go to the california > other information. Web nonresident includes all of the following: Web when filing form 592 with the ftb, the. Individuals who are not residents of california. This form is for income earned in tax year 2022, with tax.

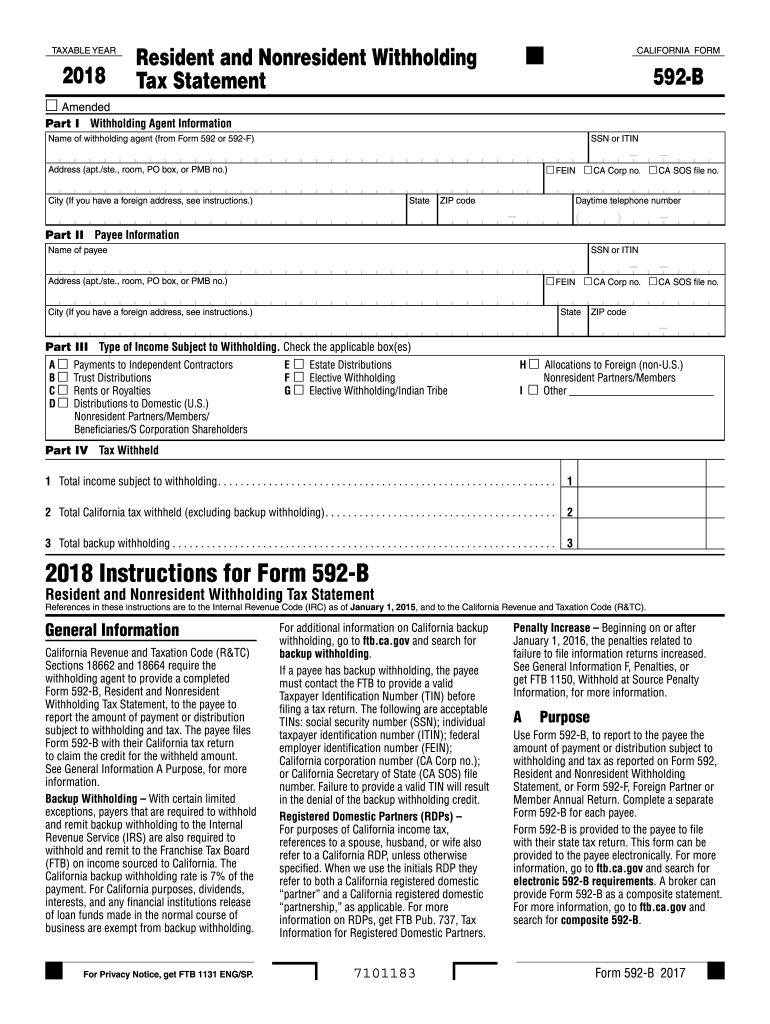

2018 form 592B Resident and Nonresident Withholding. 2018, form 592B

Withholding agent is not required to submit. Generally a taxpayer receives this. Individuals who are not residents of california. Go to the california > other information. Web when filing form 592 with the ftb, the.

Ca 592 form Fill out & sign online DocHub

Web nonresident includes all of the following: Individuals who are not residents of california. A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Web when filing form 592 with the ftb, the. Go to the california > other information.

Fillable California Form 592B Resident And Nonresident Withholding

A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Generally a taxpayer receives this. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web when filing form 592 with the ftb, the. Web nonresident includes all of the following:

2017 Form 592F Foreign Partner Or Member Annual Return Edit, Fill

Web nonresident includes all of the following: Web when filing form 592 with the ftb, the. A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Withholding agent is not required to submit. Corporations not qualified through the california secretary of state (ca sos) to do.

Web When Filing Form 592 With The Ftb, The.

A form 592‑b, resident and nonresident withholding tax statement, to the ftb, for each. Web purpose use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. This form is for income earned in tax year 2022, with tax. Withholding agent is not required to submit.

Web Nonresident Includes All Of The Following:

Corporations not qualified through the california secretary of state (ca sos) to do. Go to the california > other information. Generally a taxpayer receives this. Individuals who are not residents of california.