Form 568 2020

Form 568 2020 - Enter the amount of the llc fee. Form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web updated june 24, 2020: An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Fein • street address (suite, room, po box) pmb no. The llc must pay a fee if the total california income is equal to or greater than $250,000. Form 568, limited liability company ftb 3537 (llc), payment for automatic extension for llcs. California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions). Ftb 3522, llc tax voucher. Web if you have an llc, here’s how to fill in the california form 568:

Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Don’t enter your franchise tax paid here. California secretary of state (sos) file number • additional information. While a single member llc does not file california form 565, they. California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions). The llc should file the appropriate california return. Line 1—total income from schedule iw. Web updated june 24, 2020: Enter the amount of the llc fee. Fein • street address (suite, room, po box) pmb no.

For calendar year 2020 or fiscal year beginning and ending. Limited liability company name (type or print) a. Form 568, limited liability company ftb 3537 (llc), payment for automatic extension for llcs. Web if you have an llc, here’s how to fill in the california form 568: (m m / d d / y y y y) (m m / d d / y y y y) rp. Form 568 is something that business owners interested in forming an llc frequently have questions about. Don’t enter your franchise tax paid here. California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions). A secretary of state file number is required to be entered on. Web use form 568 as the return for calendar year 2020 or any fiscal year beginning in 2020.

2015 Form CA FTB 568BK Fill Online, Printable, Fillable, Blank pdfFiller

(m m / d d / y y y y) member’s identifying number address address city state zip code what type of entity is this member? Form 568, limited liability company ftb 3537 (llc), payment for automatic extension for llcs. While a single member llc does not file california form 565, they. (m m / d d / y y.

568 Instructions Fill Out and Sign Printable PDF Template signNow

Line 1—total income from schedule iw. Enter the amount of the llc fee. The llc must pay a fee if the total california income is equal to or greater than $250,000. •individual (4) •c corporation • (7) llp (10) exempt organization A secretary of state file number is required to be entered on.

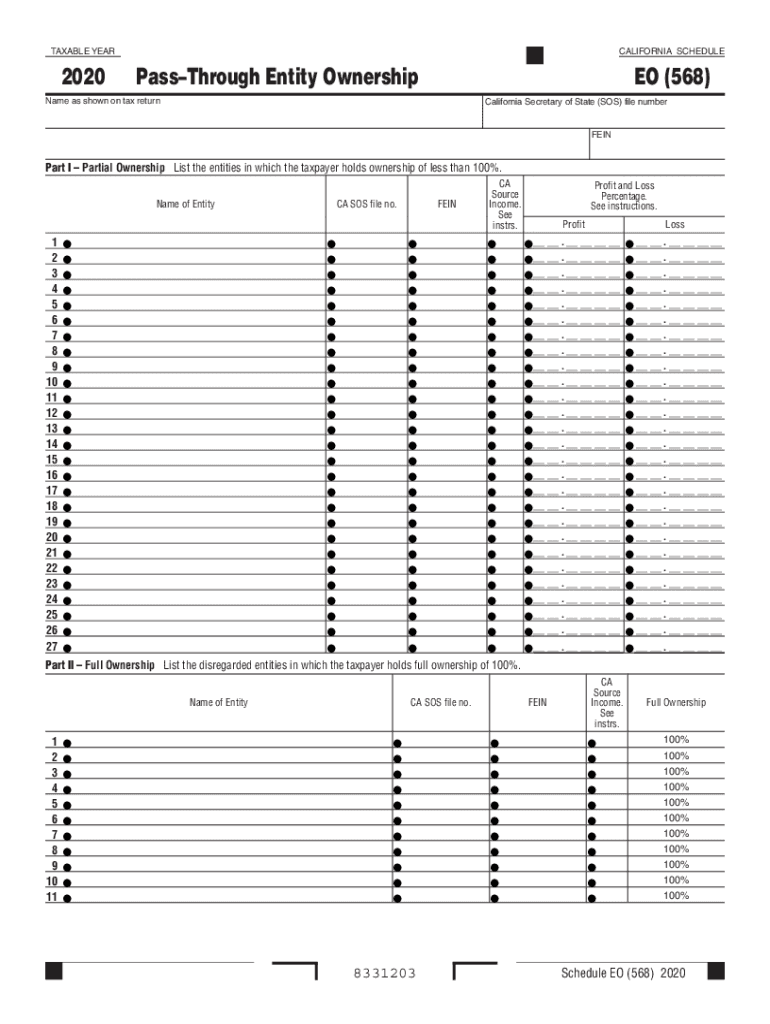

Download Instructions for Form 568 Schedule EO PassThrough Entity

California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions). Form 568 is something that business owners interested in forming an llc frequently have questions about. California secretary of state (sos) file number • additional.

20202022 Form CA EO (568) Fill Online, Printable, Fillable, Blank

California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions). (m m / d d / y y y y) (m m / d d / y y y y) rp. Web follow the simple.

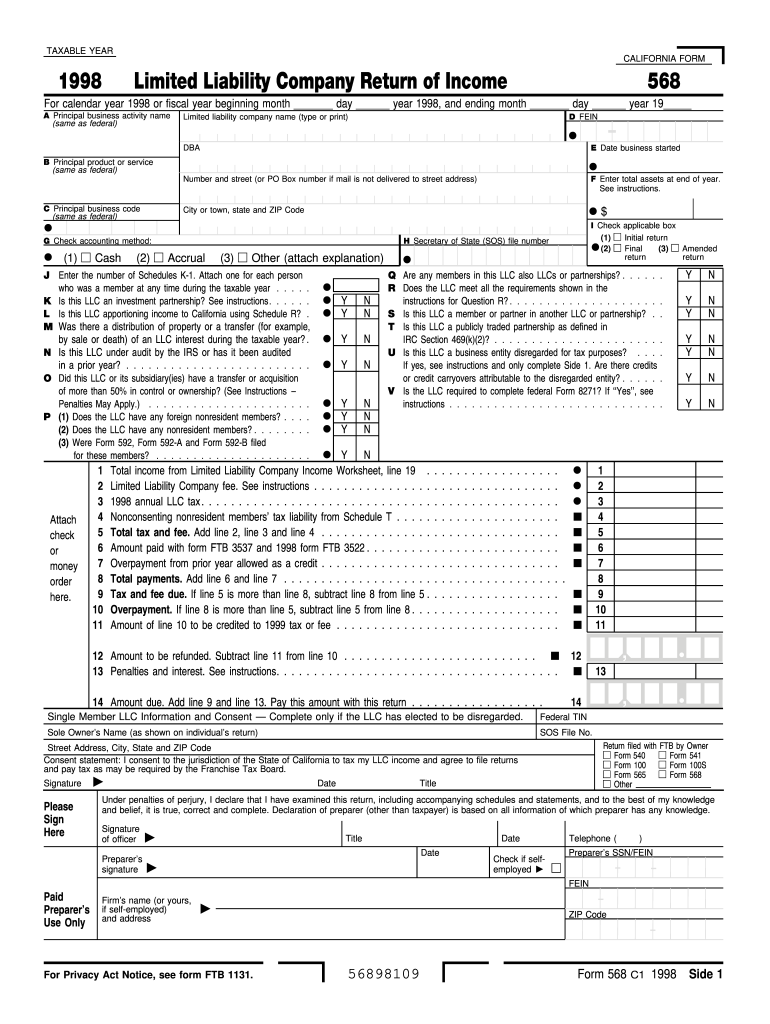

1998 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Limited liability company name (type or print) a. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t. Web if you have an llc, here’s how to fill in the california form 568: Form 568 is something that business owners interested in forming an llc frequently have questions about. Web follow the simple instructions.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web visit limited liability company tax booklet (568 booklet) for more information if you have income or loss inside and outside california, use apportionment and allocation of income (schedule r) to determine california source income. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Form 568 is something that business owners interested.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

•individual (4) •c corporation • (7) llp (10) exempt organization Fein • street address (suite, room, po box) pmb no. A secretary of state file number is required to be entered on. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Ftb 3536 (llc), estimated fee for llcs.

NEW! Ca Form 568 Instructions 2020 Coub

Enter the amount of the llc fee. The llc should file the appropriate california return. Don’t enter your franchise tax paid here. Fein • street address (suite, room, po box) pmb no. The llc must pay a fee if the total california income is equal to or greater than $250,000.

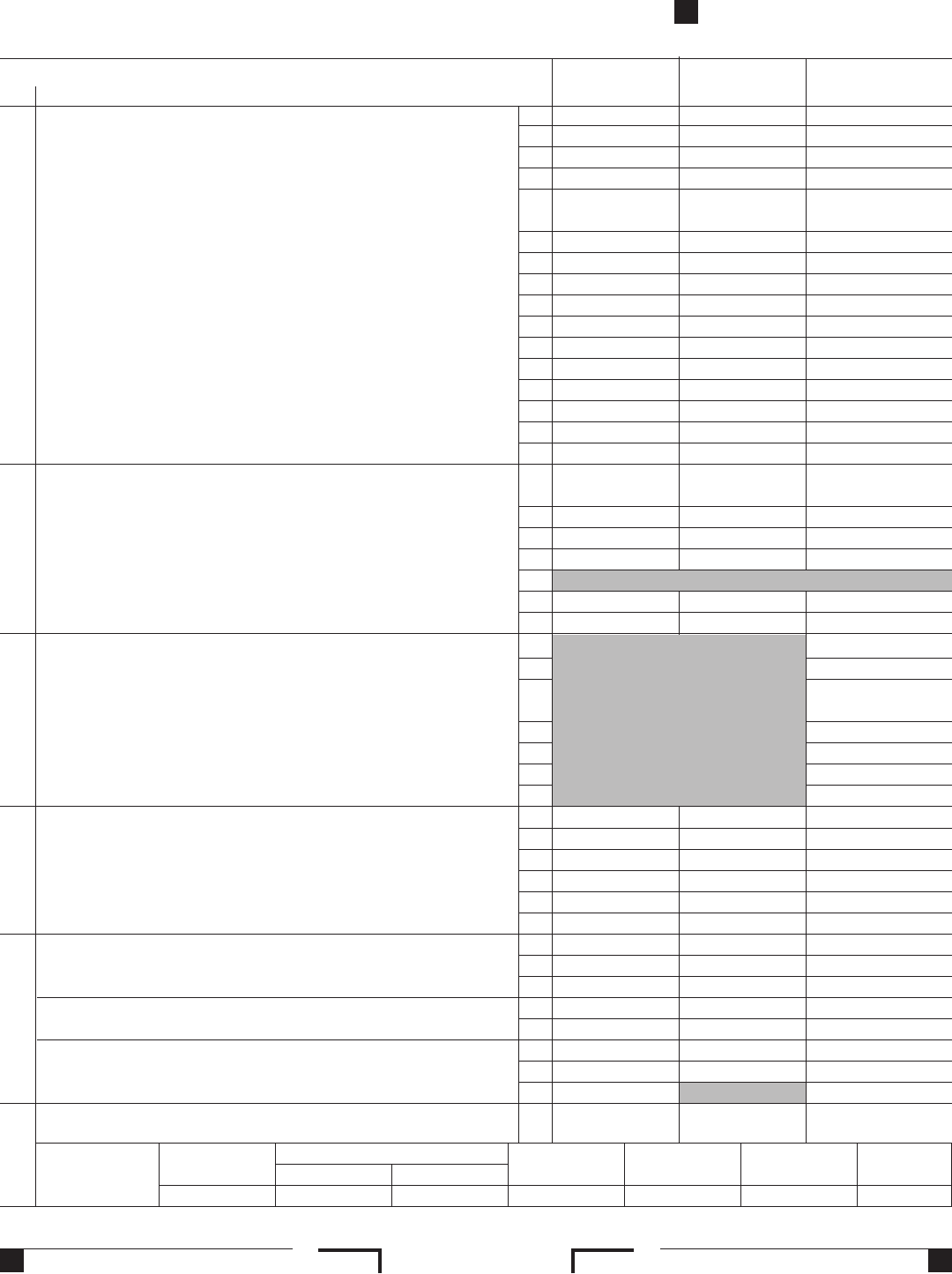

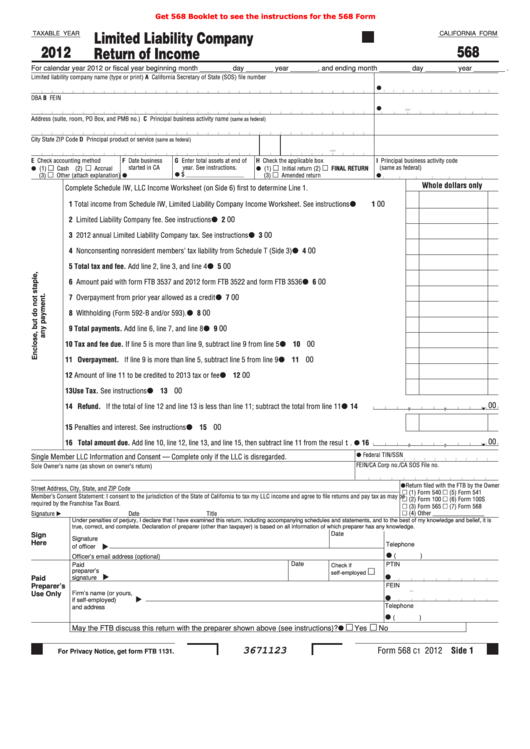

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web updated june 24, 2020: Don’t enter your franchise tax paid here. Web if you have an llc, here’s how to fill in the california form 568: Finding a authorized professional, making an appointment and coming to the office for a personal meeting makes completing a ca ftb 568 from beginning to end stressful. A secretary of state file number.

Fillable California Form 568 Limited Liability Company Return Of

California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions). Don’t enter your franchise tax paid here. Web use form 568 as the return for calendar year 2020 or any fiscal year beginning in 2020..

Line 1—Total Income From Schedule Iw.

Web updated june 24, 2020: Ftb 3522, llc tax voucher. Web follow the simple instructions below: Web use form 568 as the return for calendar year 2020 or any fiscal year beginning in 2020.

Form 568 Is Something That Business Owners Interested In Forming An Llc Frequently Have Questions About.

Form 568, limited liability company ftb 3537 (llc), payment for automatic extension for llcs. A secretary of state file number is required to be entered on. While a single member llc does not file california form 565, they. Web 568 2020 limited liability company tax booklet members of the franchise tax board betty t.

(M M / D D / Y Y Y Y) (M M / D D / Y Y Y Y) Rp.

California secretary of state (sos) file number • additional information. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. •individual (4) •c corporation • (7) llp (10) exempt organization Enter the amount of the llc fee.

Limited Liability Company Name (Type Or Print) A.

For calendar year 2020 or fiscal year beginning and ending. Fein • street address (suite, room, po box) pmb no. Web visit limited liability company tax booklet (568 booklet) for more information if you have income or loss inside and outside california, use apportionment and allocation of income (schedule r) to determine california source income. California defines a single member llc as a disregarded entity because the single owner's income is treated as a sole proprietor on the federal schedule c profit or loss from business (per the irs instructions).