Form 5564 Notice Of Deficiency Waiver

Form 5564 Notice Of Deficiency Waiver - Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10 off orator sites upcoming southwest airlines flight promo codes. If you are making a payment, include it with the form. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Along with notice cp3219a, you should receive form 5564. If you disagree you have the right to challenge this determination in u.s. Web in this case, you can simply sign the notice of deficiency waiver (irs form 5564) and send it directly to the irs. Contact the third party that furnished the. Web actions listed in paragraph 1 of the petition form (form 2) and meets certain dollar limits, which vary slightly depending on the type of action you seek to have the tax court. How to complete the ir's form 5564 notice.

Along with notice cp3219a, you should receive form 5564. Contact the third party that furnished the. How to complete the ir's form 5564 notice. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10 off orator sites upcoming southwest airlines flight promo codes. If you agree with the information on your notice,. Web a letter explaining the purpose of the notice, the tax period (s) involved, the amount of the deficiency and the taxpayer’s options, an agreement form (waiver) to allow the. Web if you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. If you disagree you have the right to challenge this determination in u.s. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs.

Tax court by august 19, 2013, you’ll receive a bill from us for the additional. Web if you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. This form notifies the irs that you agree with the proposed additional tax due. Web if we don’t receive your form 5564 notice of deficiency waiver, or you don’t file a petition with the u.s. Web this letter is your notice of deficiency, as required by law. How to complete the ir's form 5564 notice. Contact the third party that furnished the. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10 off orator sites upcoming southwest airlines flight promo codes.

4.8.9 Statutory Notices of Deficiency Internal Revenue Service

Web a letter explaining the purpose of the notice, the tax period (s) involved, the amount of the deficiency and the taxpayer’s options, an agreement form (waiver) to allow the. If you agree with the information on your notice,. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on.

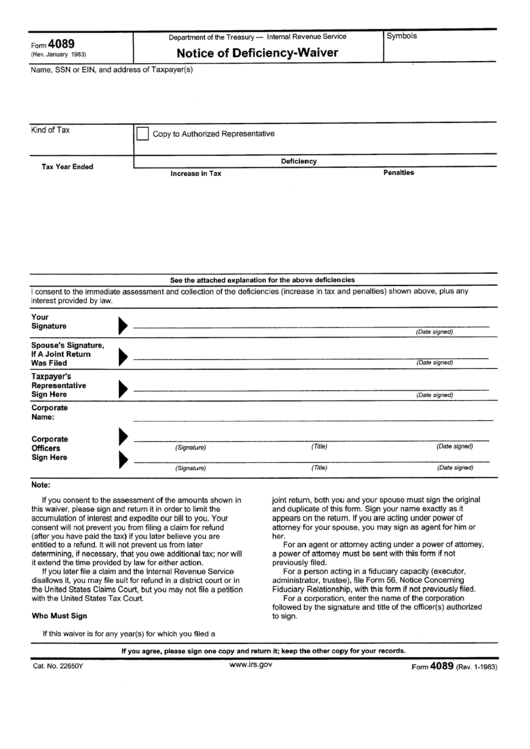

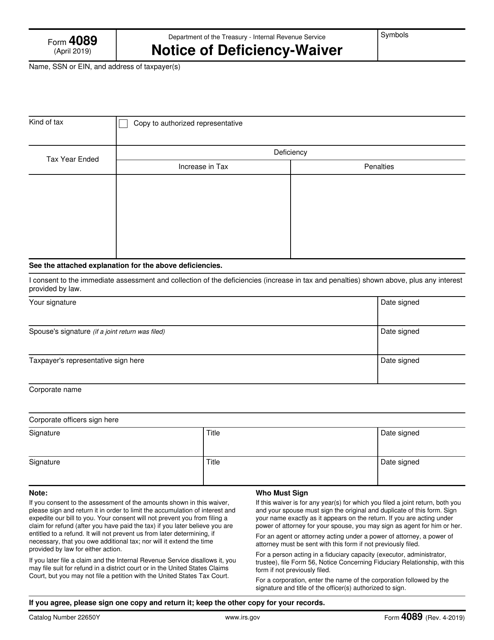

Form 4089 Notice Of DeficiencyWaiver printable pdf download

Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Contact the third party that furnished the. Web (1) if you seek review of a notice of deficiency, the amount of the deficiency (including any additions to tax or.

Construction Deficiency Report Template

Web this letter is your notice of deficiency, as required by law. Web in this case, you can simply sign the notice of deficiency waiver (irs form 5564) and send it directly to the irs. If you disagree you have the right to challenge this determination in u.s. Web (1) if you seek review of a notice of deficiency, the.

IRS Form 4089 Download Fillable PDF or Fill Online Notice of Deficiency

Web this letter is your notice of deficiency, as required by law. If you disagree you have the right to challenge this determination in u.s. Web if the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency informing you of the proposed change resulting. Tax court by august.

IRS Audit Letter CP3219A Sample 1

Contact the third party that furnished the. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web this letter is your notice of deficiency, as required by law. Web in this case, you can simply sign the notice of deficiency waiver (irs form 5564) and send it directly to the irs. If you.

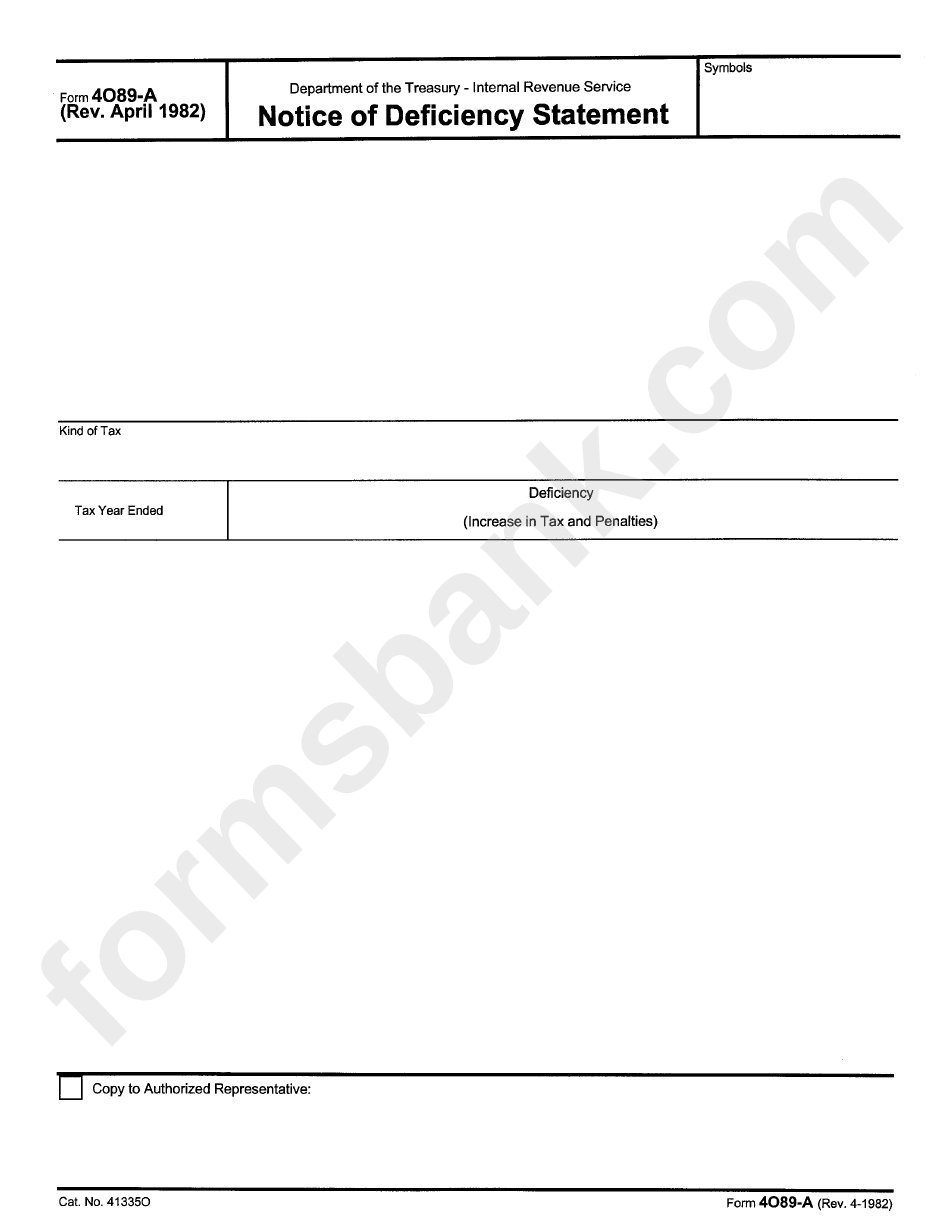

Form 4089A Notice Of Deficiency Statement printable pdf download

Tax court by august 19, 2013, you’ll receive a bill from us for the additional. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web this letter is your notice of deficiency, as required by law. Web if we don’t receive your form.

Where do you mail IRS Form 5564 and a payment?

Along with notice cp3219a, you should receive form 5564. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs. If you’re wondering where to mail form 5564, look. Web in this case, you can simply sign the notice of deficiency waiver.

IRS Audit Letter CP3219A Sample 1

Web actions listed in paragraph 1 of the petition form (form 2) and meets certain dollar limits, which vary slightly depending on the type of action you seek to have the tax court. Web up to $40 cash back 5564 notice of deficiency waiver free ebay auction templatesvictoria secret coupons 2012 ×10 off orator sites upcoming southwest airlines flight promo.

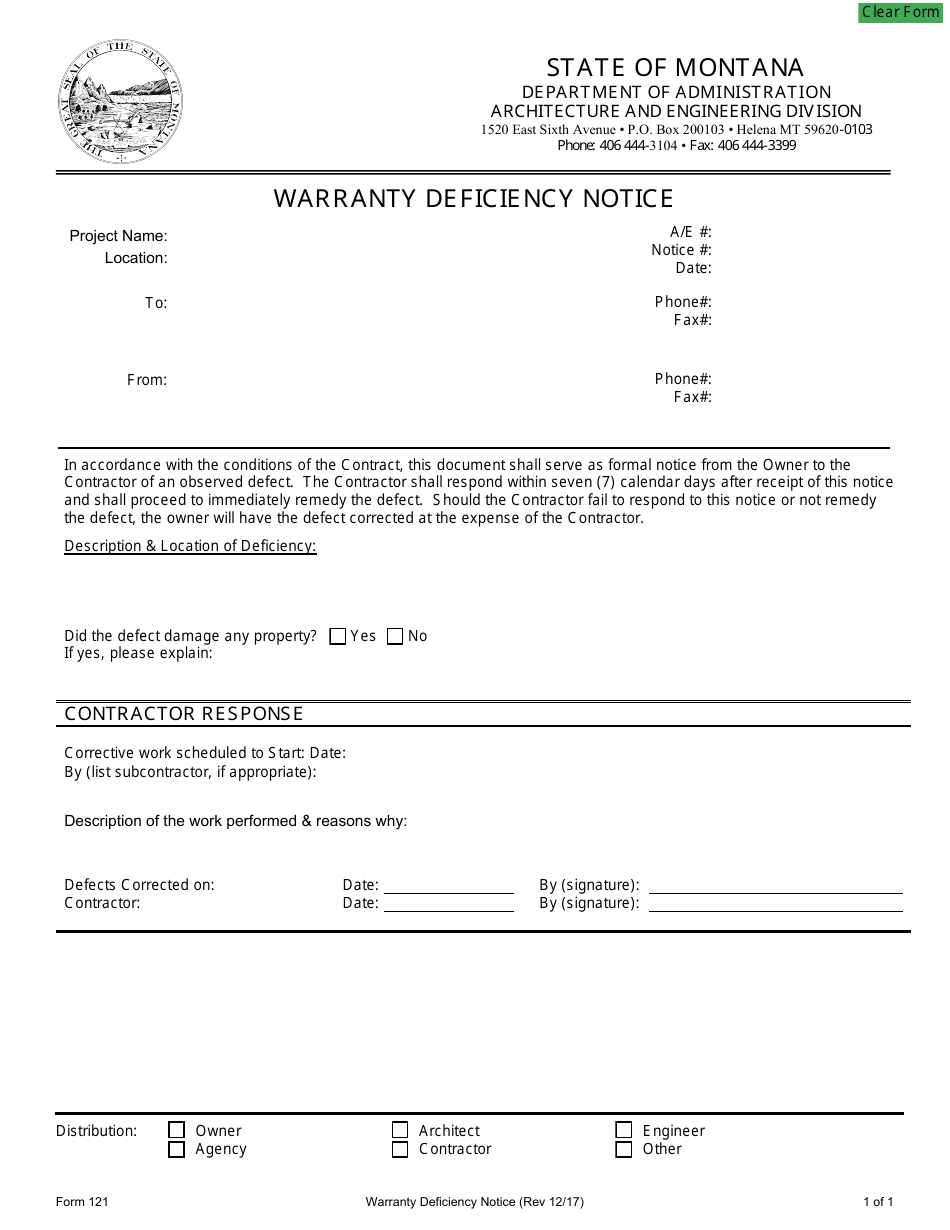

Form 121 Download Fillable PDF or Fill Online Warranty Deficiency

If you’re wondering where to mail form 5564, look. If you agree with the information on your notice,. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Contact the third party that furnished the. Web form 5564 notice of deficiency waiver if the.

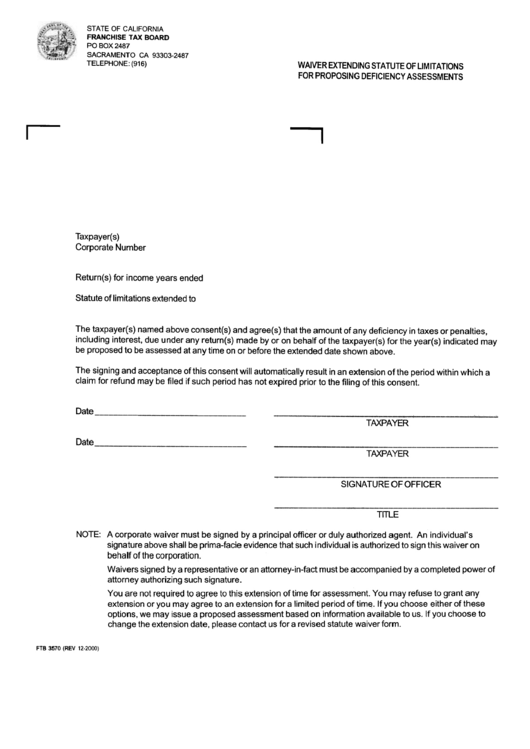

Form Ftb 3570 Waiver Extending Statute Of Limitations For Proposing

Tax court by august 19, 2013, you’ll receive a bill from us for the additional. Web mail or fax form 5564 back to the address on the notice by the deadline along with the new information you feel disputes the notice. Web (1) if you seek review of a notice of deficiency, the amount of the deficiency (including any additions.

Web What Is Irs Form 5564?

This form notifies the irs that you agree with the proposed additional tax due. Web a letter explaining the purpose of the notice, the tax period (s) involved, the amount of the deficiency and the taxpayer’s options, an agreement form (waiver) to allow the. Web if the irs is proposing to adjust the amount of tax you owe, you will typically be sent a statutory notice of deficiency informing you of the proposed change resulting. If you’re wondering where to mail form 5564, look.

Web This Letter Is Your Notice Of Deficiency, As Required By Law.

If you disagree you have the right to challenge this determination in u.s. Along with notice cp3219a, you should receive form 5564. Web (1) if you seek review of a notice of deficiency, the amount of the deficiency (including any additions to tax or penalties) that you dispute cannot exceed $50,000 for any year. Contact the third party that furnished the.

Tax Court By August 19, 2013, You’ll Receive A Bill From Us For The Additional.

If you are making a payment, include it with the form. If you agree with the information on your notice,. Web irs form 5564 is included when the federal tax agency sends the irs notice cp3219a. Web actions listed in paragraph 1 of the petition form (form 2) and meets certain dollar limits, which vary slightly depending on the type of action you seek to have the tax court.

How To Complete The Ir's Form 5564 Notice.

Web in this case, you can simply sign the notice of deficiency waiver (irs form 5564) and send it directly to the irs. Web if you agree, sign the enclosed form 5564 and mail or fax it to the address or fax number listed on the letter. Web form 5564 notice of deficiency waiver if the irs believes that you owe more tax than what was reported on your tax return, the irs will send a notice of. Web you should determine if you agree with the proposed changes or wish to file a petition with the tax court to dispute the adjustments made by the irs.