Form 5558 Extension Due Date 2022

Form 5558 Extension Due Date 2022 - Web file one form 5558 to request an extension of time to file form 5330 for excise taxes with the same filing due date. 17 2022 ) by filing irs form 5558 by aug. 17 2022) by filing irs form 5558 by aug. (1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of. Web the application is automatically approved to the date shown on line 1 (above) if: Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Web plan name plan number plan year end date the irs chooses specific delivery services that employers can use to file form 5558 that meet the agency's timely mailing treated as. Web (due january 15, which falls on a weekend in 2022. Alternatively, plans can rely on the extension for the business tax return. Web for a calendar year plan, form 5558 is the lifeline that extends the due date to october 15th.

Web individuals and families. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. 17 2022) by filing irs form 5558 by aug. For specific information on excise tax due dates, see the. Web filings for the 2022 plan year generally are not due until seven months after the end of the 2022 plan year, e.g., july 31, 2023, for calendar year plans, and a 2½. Edit, sign and print tax forms on any device with uslegalforms. Since april 15 falls on a saturday, and emancipation day. Whether a plan maintains a calendar year plan year (12/31) or an off. Web the application is automatically approved to the date shown on line 1 (above) if: Typically, the form 5500 is due by july 31st for calendar year plans, with an extension.

(1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Alternatively, plans can rely on the extension for the business tax return. Edit, sign and print tax forms on any device with uslegalforms. 15) are imposed by the department of labor (dol) and. Web form 5558, application for extension of time to file certain employee plan returns Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra time. Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Web plan name plan number plan year end date the irs chooses specific delivery services that employers can use to file form 5558 that meet the agency's timely mailing treated as. Since april 15 falls on a saturday, and emancipation day.

Avoid Using the 5500 Extension Wrangle 5500 ERISA Reporting and

Web for a calendar year plan, form 5558 is the lifeline that extends the due date to october 15th. For specific information on excise tax due dates, see the. Web what is the deadline to file? (1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of. Web share along.

Form 12 Where To File The Five Secrets About Form 12 Where To File Only

Web the application is automatically approved to the date shown on line 1 (above) if: Web for a calendar year plan, form 5558 is the lifeline that extends the due date to october 15th. Since april 15 falls on a saturday, and emancipation day. Web plan name plan number plan year end date the irs chooses specific delivery services that.

Extension Due Date on Tax Return Form Filling (Latest Updated

Web share along with other employers that offer benefit plans covered by the employee retirement income security act of 1974 (erisa), companies that sponsor. For specific information on excise tax due dates, see the. 17 2022) by filing irs form 5558 by aug. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension. Web.

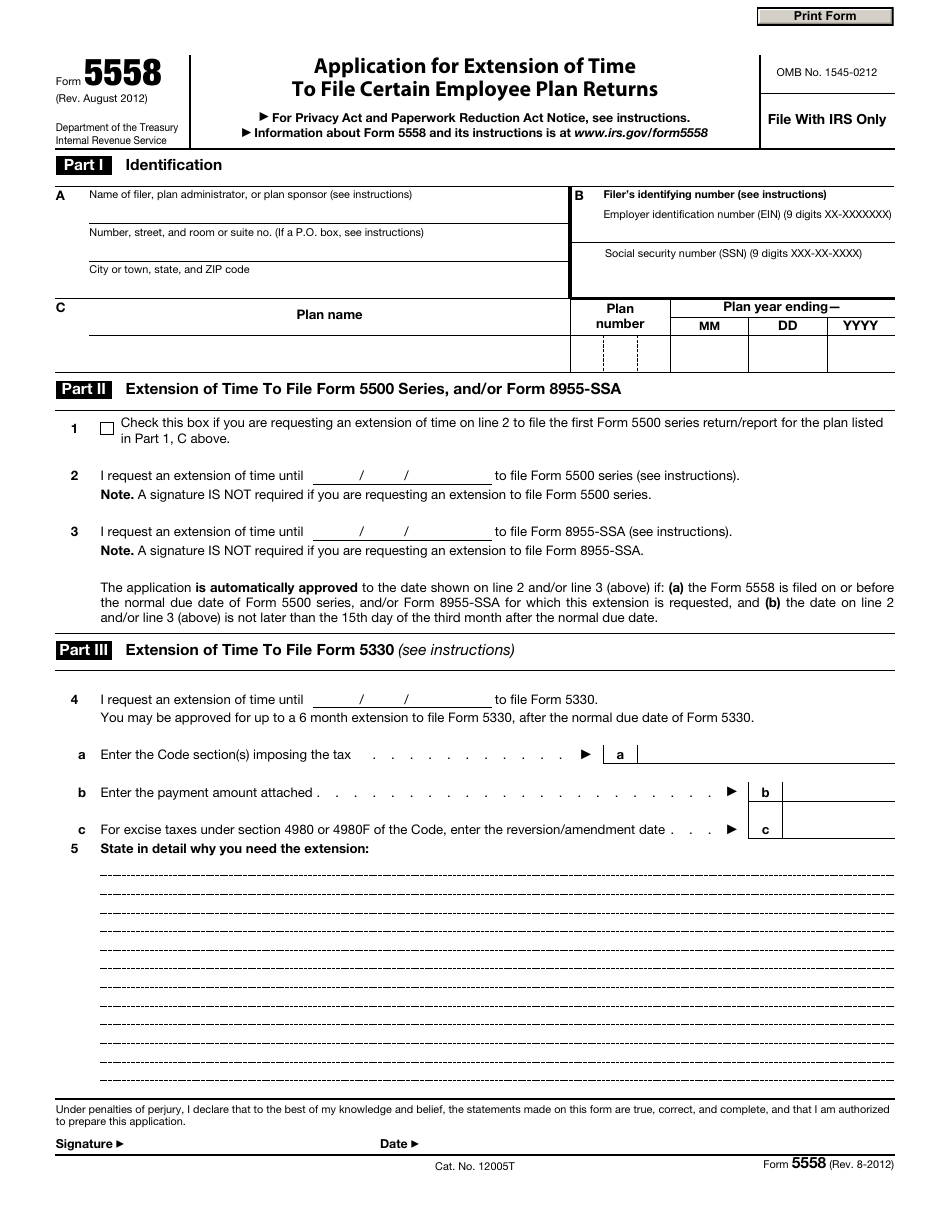

Fillable Form 5558 Application For Extension Of Time To File Certain

The deadline to file is linked to the last day of the plan year. (1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of. 17 2022 ) by filing irs form 5558 by aug. Web share along with other employers that offer benefit plans covered by the employee retirement.

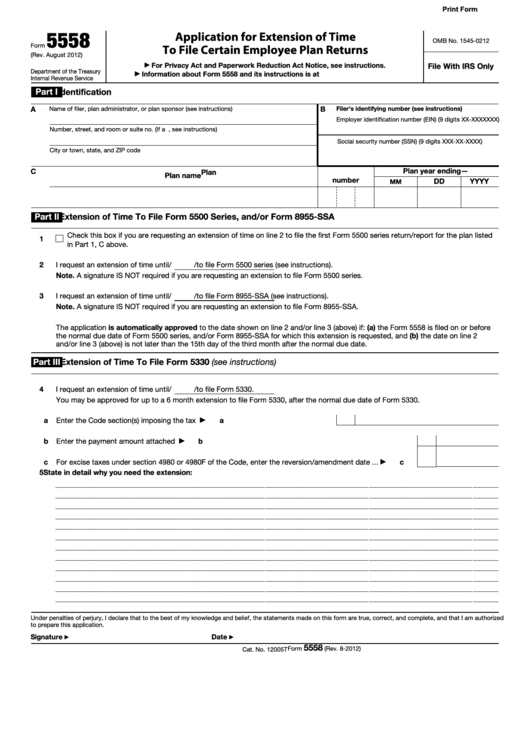

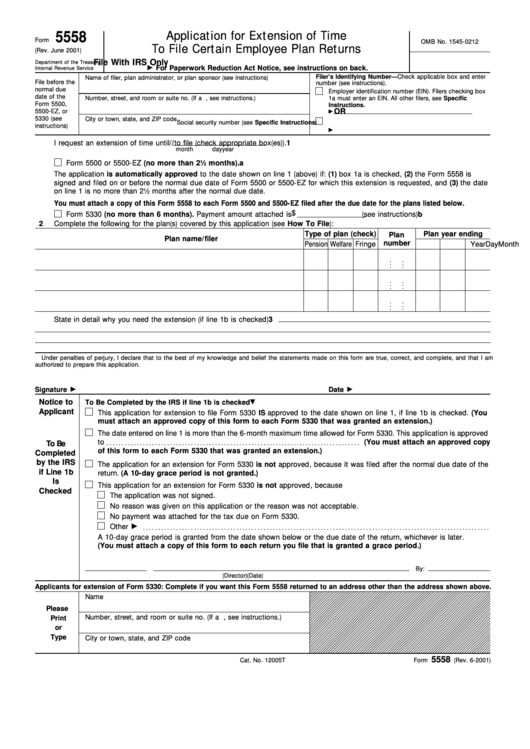

Form 5558 Application For Extension Of Time To File Certain Employee

Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. For specific information on excise tax due dates, see the. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension. Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which.

Form 5558 Application for Extension of Time to File Certain Employee

For specific information on excise tax due dates, see the. Web what is the deadline to file? Edit, sign and print tax forms on any device with uslegalforms. Web file one form 5558 to request an extension of time to file form 5330 for excise taxes with the same filing due date. Web the application is automatically approved to the.

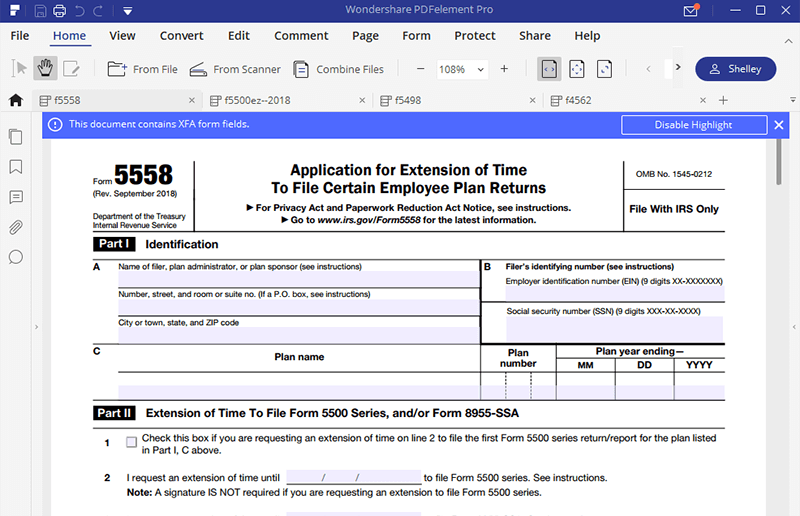

How to Fill Out 2021 Form 5558 Application for Extension of Time to

Web form 5558, application for extension of time to file certain employee plan returns form 8809, application for extension of time to file information returns form. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension. Since april 15 falls on a saturday, and emancipation day. Web form 5558, application for extension of time.

How to File a Tax Extension? ZenLedger

(1) box 1a is checked, (2) the form 5558 is signed and filed on or before the normal due date of. Whether a plan maintains a calendar year plan year (12/31) or an off. Web the deadlines for filing tax returns in conjunction with the 5558 extension form vary depending on the specific return for which you request the extra.

Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500

For specific information on excise tax due dates, see the. Web file one form 5558 to request an extension of time to file form 5330 for excise taxes with the same filing due date. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web overlapping penalties for failing to timely file form 5500 by july 31 (or,.

IRS Form 5558 Download Fillable PDF or Fill Online Application for

Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web (due january 15, which falls on a weekend in 2022. Edit, sign and print tax forms on any device with uslegalforms. The irs provides that dates that fall on a saturday, sunday or holiday are delayed until the.

Web Individuals And Families.

Web overlapping penalties for failing to timely file form 5500 by july 31 (or, with a form 5558 extension, by oct. Web form 5558, application for extension of time to file certain employee plan returns Web file one form 5558 to request an extension of time to file form 5330 for excise taxes with the same filing due date. Since april 15 falls on a saturday, and emancipation day.

For Specific Information On Excise Tax Due Dates, See The.

17 2022) by filing irs form 5558 by aug. Whether a plan maintains a calendar year plan year (12/31) or an off. Web what is the deadline to file? Alternatively, plans can rely on the extension for the business tax return.

Web The Deadlines For Filing Tax Returns In Conjunction With The 5558 Extension Form Vary Depending On The Specific Return For Which You Request The Extra Time.

Web filings for the 2022 plan year generally are not due until seven months after the end of the 2022 plan year, e.g., july 31, 2023, for calendar year plans, and a 2½. Web plan name plan number plan year end date the irs chooses specific delivery services that employers can use to file form 5558 that meet the agency's timely mailing treated as. Web share along with other employers that offer benefit plans covered by the employee retirement income security act of 1974 (erisa), companies that sponsor. 15) are imposed by the department of labor (dol) and.

17 2022 ) By Filing Irs Form 5558 By Aug.

Web on october 5, 2022 irs published notice and request for comments for proposed changes to form 5558, application for extension of time to file certain. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Edit, sign and print tax forms on any device with uslegalforms. Typically, the form 5500 is due by july 31st for calendar year plans, with an extension.

![Form 5558 Extension The Complete Guide [Form & IRS Hazards] » Online 5500](https://online5500.com/wp-content/uploads/2022/04/p1-768x512.jpg)