Form 5500 Due Dates

Form 5500 Due Dates - Web form 5500 filing due dates. Web by the 30th day after the due date. On december 8, 2022 dol, irs, and pbgc. Complete, edit or print tax forms instantly. The irs’s aforementioned form 5500 due date for plans that end on december 31. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Complete, edit or print tax forms instantly. The form 5500 due date for filing depends on the plan year. Get ready for tax season deadlines by completing any required tax forms today. The plan year beginning and ending date on all.

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Get ready for tax season deadlines by completing any required tax forms today. On december 8, 2022 dol, irs, and pbgc. Web form 5500 filing due dates. The general rule is that form 5500s must be filed by the last day of the seventh. This is also the deadline to file form 5558 for those requesting an. Web by the 30th day after the due date. Complete, edit or print tax forms instantly.

Complete, edit or print tax forms instantly. Web by the 30th day after the due date. Web form 5500 due date. This is also the deadline to file form 5558 for those requesting an. The form 5500 due date for filing depends on the plan year. The general rule is that form 5500s must be filed by the last day of the seventh. On december 8, 2022 dol, irs, and pbgc. Get ready for tax season deadlines by completing any required tax forms today. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

Web by the 30th day after the due date. On december 8, 2022 dol, irs, and pbgc. The irs’s aforementioned form 5500 due date for plans that end on december 31. The plan year beginning and ending date on all. Get ready for tax season deadlines by completing any required tax forms today.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Web form 5500 due date. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Complete, edit.

Form 5500 Is Due by July 31 for Calendar Year Plans

Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Web form 5500 filing due dates. Web by the 30th day after the due date. Complete, edit or print tax forms instantly. The form 5500 due date for filing depends on the plan year.

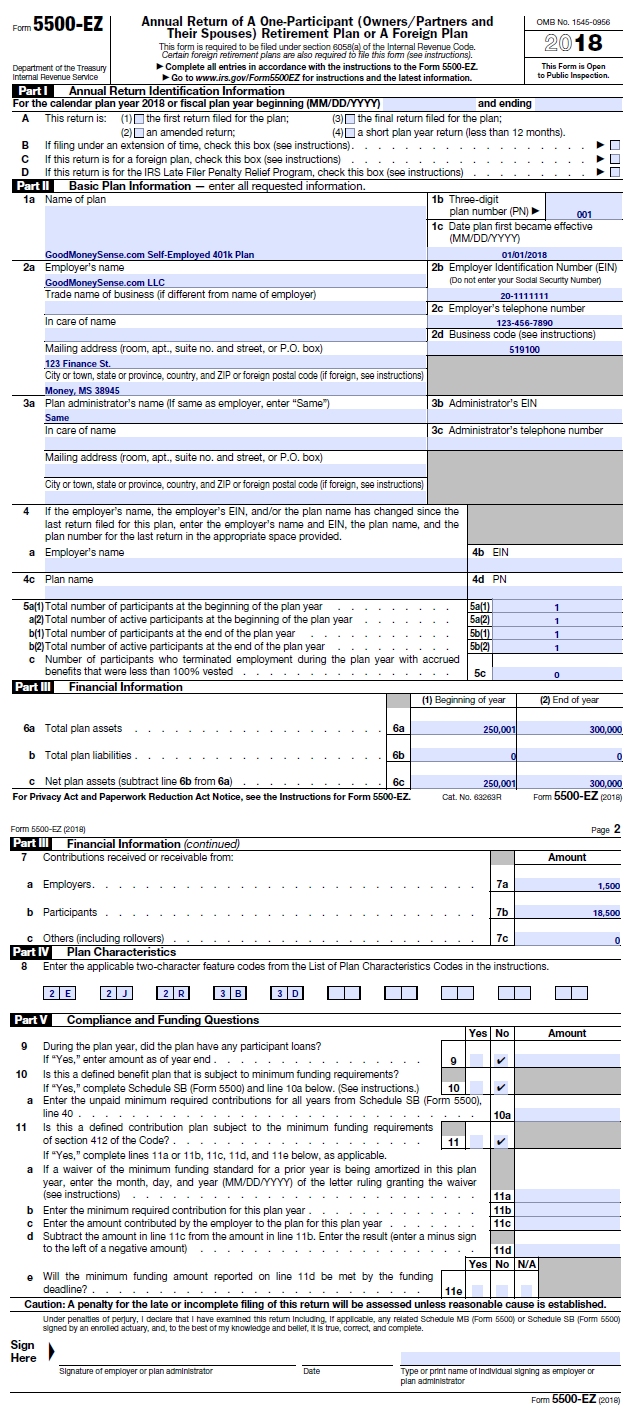

How To File The Form 5500EZ For Your Solo 401k for 2018 Good Money Sense

Complete, edit or print tax forms instantly. The general rule is that form 5500s must be filed by the last day of the seventh. The irs’s aforementioned form 5500 due date for plans that end on december 31. Complete, edit or print tax forms instantly. Department of labor, the irs and the pension benefit guaranty corporation today released federal register.

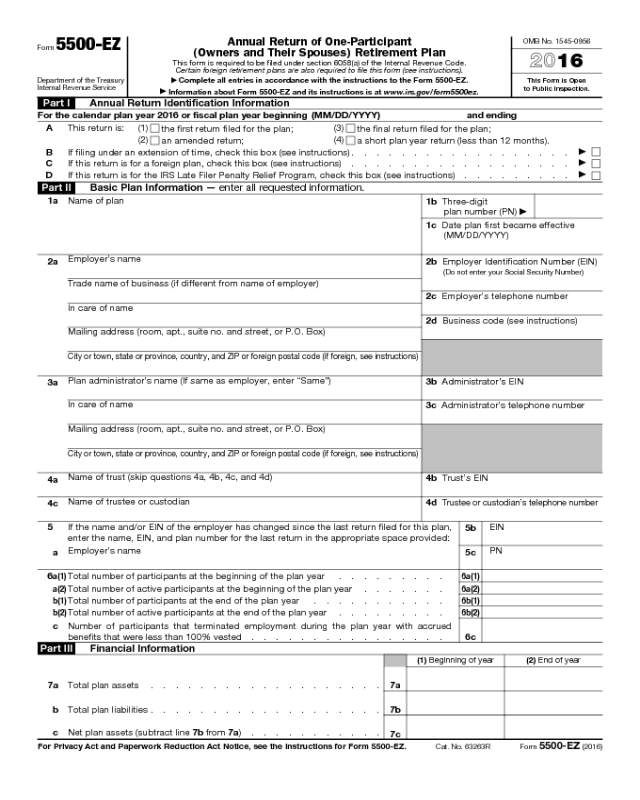

Form 5500EZ Edit, Fill, Sign Online Handypdf

The form 5500 due date for filing depends on the plan year. Get ready for tax season deadlines by completing any required tax forms today. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. Complete, edit or print tax forms instantly. The plan year beginning and ending date on all.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

Web by the 30th day after the due date. Complete, edit or print tax forms instantly. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. On december 8, 2022 dol, irs, and pbgc. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp.

How to File Form 5500EZ Solo 401k

Web form 5500 due date. Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. This is also the deadline to file form 5558 for those requesting an. Web form 5500 filing due dates. The plan year beginning and ending date on all.

What is the Form 5500? Guideline

Department of labor, the irs and the pension benefit guaranty corporation today released federal register notices that announce. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. Complete, edit or print tax forms instantly. The plan year.

Retirement plan 5500 due date Early Retirement

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. On december 8, 2022 dol, irs, and pbgc. Web form 5500 filing due dates. The form 5500 due date for filing depends on the plan year.

August 1st Form 5500 Due Matthews, Carter & Boyce

Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. The plan year beginning and ending date on all. Complete, edit or print tax forms instantly. Web by the 30th day after the due date.

Department Of Labor’s Employee Benefits Security Administration, The Irs And The Pension Benefit Guaranty Corp.

If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on. This is also the deadline to file form 5558 for those requesting an. Web by the 30th day after the due date. Get ready for tax season deadlines by completing any required tax forms today.

Department Of Labor, The Irs And The Pension Benefit Guaranty Corporation Today Released Federal Register Notices That Announce.

Web form 5500 filing due dates. Web form 5500 due date. Get ready for tax season deadlines by completing any required tax forms today. Web typically, the form 5500 is due by july 31st for calendar year plans, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next.

Complete, Edit Or Print Tax Forms Instantly.

The general rule is that form 5500s must be filed by the last day of the seventh. The form 5500 due date for filing depends on the plan year. Web 13 rows tip: The irs’s aforementioned form 5500 due date for plans that end on december 31.

Complete, Edit Or Print Tax Forms Instantly.

On december 8, 2022 dol, irs, and pbgc. The plan year beginning and ending date on all.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-1.png)