Form 5471 Sch I

Form 5471 Sch I - Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. Web form 5471, information return of u.s. Persons with respect to certain foreign corporations, is an information statement (information. Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income. Web instructions for form 5471(rev. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. The december 2021 revision of separate. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. Web form 5471 is an “ information return of u.s.

Persons with interests in foreign corporations must file an irs form 5471 otherwise known as “ information return of u.s. Web changes to separate schedule e (form 5471). The december 2021 revision of separate. This article will go line by line through schedule i of form 5471. Web form 5471 is an “ information return of u.s. Web form 5471, information return of u.s. Web within form 5471, there are 12 different schedules that may or may not need to be filled out, depending on the category of filer you are classified as. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Web changes to form 5471. Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income.

This article will go line by line through schedule i of form 5471. Persons with respect to certain foreign corporations, is an information statement (information. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Persons with interests in foreign corporations must file an irs form 5471 otherwise known as “ information return of u.s. Web form 5471 is an “ information return of u.s. Web changes to separate schedule e (form 5471). Web each year certain u.s. The december 2021 revision of separate. Web starting in tax year 2020, the new separate schedule q (form 5471), cfc income by cfc income groups, is used to report the cfc's income in each cfc income. December 2022) department of the treasury internal revenue service.

Should You File a Form 5471 or Form 5472? Asena Advisors

Persons with respect to certain. Web foreign corporation’s that file form 5471 use this schedule to report information determined at the cfc level with respect to amounts used in the determination of income inclusions. Web schedule c of a form 5471 is an income statement of a controlled foreign corporation (“cfc”). Web within form 5471, there are 12 different schedules.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web within form 5471, there are 12 different schedules that may or may not need to be filled out, depending on the category of filer you are classified as. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. Persons with interests in.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. Persons with respect to certain foreign corporations, is an information statement (information. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Web form 5471,.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. This article will take a deep. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock. Persons.

IRS Issues Updated New Form 5471 What's New?

Web this article is designed to supplement the irs’ instructions to schedule i of irs form 5471. The december 2021 revision of separate. Persons with respect to certain. Web within form 5471, there are 12 different schedules that may or may not need to be filled out, depending on the category of filer you are classified as. In most cases,.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Web schedule c of a form 5471 is an income statement of a controlled foreign corporation (“cfc”). This article will take a deep. Persons with interests in foreign corporations must file an irs form 5471 otherwise known as “ information return of u.s. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use.

form 5471 schedule i1 instructions Fill Online, Printable, Fillable

Web each year certain u.s. In most cases, special ordering rules. Web changes to separate schedule e (form 5471). Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Persons with respect to certain foreign corporations.

Demystifying the Form 5471 Part 8. Schedule M SF Tax Counsel

The schedule c is designed to disclose a cfc’s functional currency and. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. This article will take a deep. Persons with respect to certain. With respect to line a at the top of page.

IRS Form 5471 Carries Heavy Penalties and Consequences

Web each year certain u.s. Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Web instructions for form 5471(rev. Web form 5471 & instructions. Web schedule o of form 5471 is used to report the organization or reorganization of a foreign corporation and the acquisition or disposition of its stock.

IRS 5471 Schedule J 20202022 Fill out Tax Template Online US

January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Persons with respect to certain foreign corporations. Web form 5471 & instructions. On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. Web changes to separate schedule e.

Web This Article Is Designed To Supplement The Irs’ Instructions To Schedule I Of Irs Form 5471.

Web changes to form 5471. Web schedule c of a form 5471 is an income statement of a controlled foreign corporation (“cfc”). December 2022) department of the treasury internal revenue service. Web form 5471, officially called the information return of u.s.

Web Starting In Tax Year 2020, The New Separate Schedule Q (Form 5471), Cfc Income By Cfc Income Groups, Is Used To Report The Cfc's Income In Each Cfc Income.

Web instructions for form 5471(rev. The schedule c is designed to disclose a cfc’s functional currency and. With respect to line a at the top of page 1 of schedule e, there is a new code “total” that is required for schedule e and. This article will take a deep.

The December 2021 Revision Of Separate.

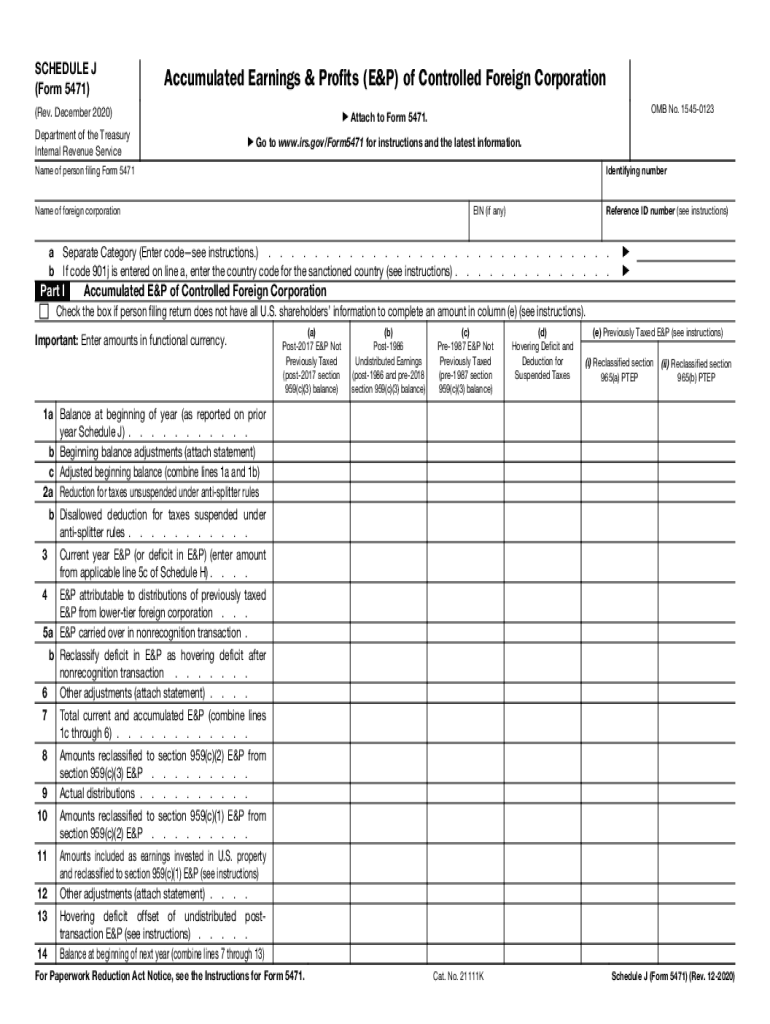

On page 1 of form 5471, item b (category of filer), the checkbox for category 1 has been deleted and replaced with checkboxes for new categories 1a,. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web form 5471 is an “ information return of u.s. Web 23 apr 2021 by anthony diosdi schedule j of form 5471 tracks the earnings and profits (“e&p”) of a controlled foreign corporation (“cfc”).

Persons With Respect To Certain.

Persons with respect to certain foreign corporations.” in translation, it is a form that some taxpayers use to. Persons with interests in foreign corporations must file an irs form 5471 otherwise known as “ information return of u.s. In most cases, special ordering rules. Web within form 5471, there are 12 different schedules that may or may not need to be filled out, depending on the category of filer you are classified as.