Form 5471 Late Filing Penalty

Form 5471 Late Filing Penalty - Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Web late filing the irs form 5471. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471. The form 5471 penalties are one the rise. Persons with respect to certain foreign corporations, and/or form 5472,. Web penalties systematically assessed when a form 5471, information return of u.s. Learn how this could impact your business. Web for example, the notice states that penalty relief is available for forms 5471 and 5472 attached to a late filed form 1120 or 1065, but the notice does not make clear. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Penalties for the failure to file a form.

When is irs form 5471. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. The form 5471 penalties are one the rise. Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Web penalties systematically assessed when a form 5471, information return of u.s. The 5471 form is due when the filer is required to file a tax return. Learn how this could impact your business. Web for example, the notice states that penalty relief is available for forms 5471 and 5472 attached to a late filed form 1120 or 1065, but the notice does not make clear. Web the maximum continuation penalty per form 5471 is $50,000. For any of these three.

Web when a taxpayer misses filing form 5471, they may become subject to fines and penalties. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. When is irs form 5471. Tax court today held that the irs did not have statutory authority to assess penalties under section 6038 (b) against a taxpayer who willfully failed to file. Common issues and questions we receive regarding irs form 5471 penalties: 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471. Web we summarize the irs form 5471 late & delinquent filing penalty. These penalties may apply to each required form 5471 on an annual basis.

What is a CFC for Purposes of Filing a Form 5471? SF Tax Counsel

Persons with respect to certain foreign corporations, and/or form 5472,. Criminal penalties may also apply for. For any of these three. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Web we summarize the irs form 5471 late & delinquent filing.

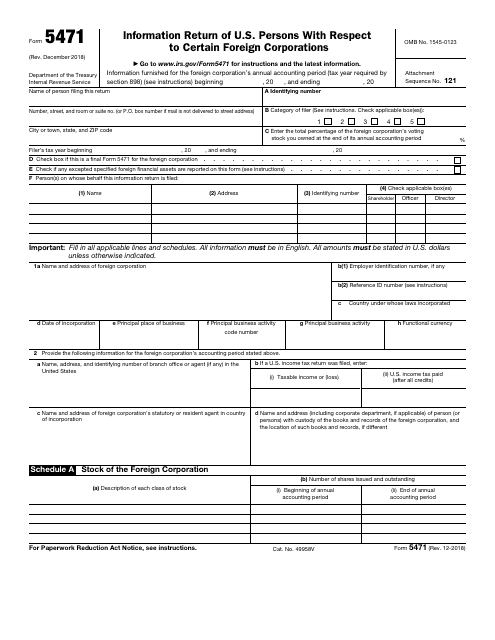

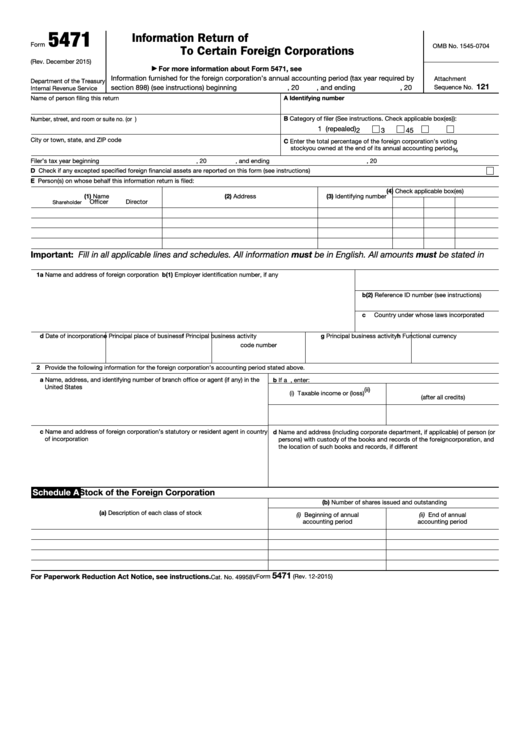

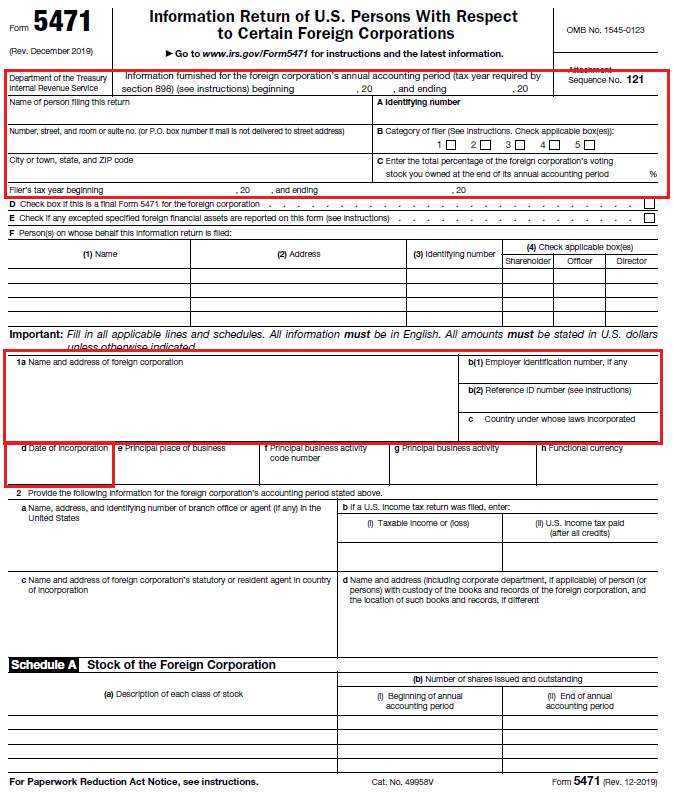

IRS Form 5471 Download Fillable PDF or Fill Online Information Return

Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. Persons with respect to certain foreign corporations, and/or form 5472,. Web penalties systematically assessed when a form 5471, information return of u.s. Web this article explains circumstances in which taxpayers must file.

Fillable Form 5471 Information Return Of U.s. Persons With Respect To

Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date (including extensions) for that return. When is irs form 5471. These penalties may apply to each required form 5471 on an annual basis. The 5471 form is due when the filer is required to file a tax.

IRS Letter and 10,000 Penalty for Late 5471 Hutcheson & Co.

Learn how this could impact your business. Web the maximum continuation penalty per form 5471 is $50,000. The form 5471 penalties are one the rise. Common issues and questions we receive regarding irs form 5471 penalties: For any of these three.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web the maximum continuation penalty per form 5471 is $50,000. Web we summarize the irs form 5471 late & delinquent filing penalty. 6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Web (8) irm 20.1.9.3.5 (3) — clarified abatement policy for penalties systemically assessed when a form 5471 is attached.

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

6038 may apply when a form 5471 is filed late, is substantially incomplete, or is not filed at all. Criminal penalties may also apply for. Web the maximum annual penalty for failure to include information with respect to a listed transaction is $100,000 in the case of an individual and $200,000 in any other case. Web late filing the irs.

Substantial Compliance Form 5471 Advanced American Tax

Web we summarize the irs form 5471 late & delinquent filing penalty. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. Persons with respect to certain foreign corporations, and/or form 5472,. For any of these three. Web late filing the irs form 5471.

The Tax Times IRS Issues Updated New Form 5471 What's New?

Web the maximum continuation penalty per form 5471 is $50,000. Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. Tax court.

What is a Dormant Foreign Corporation?

Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. Web the ipu provides that penalties under sec. The 5471 form is due when the filer is required to file a tax return. Form 5471, information return of.

Penalty for Late Filing Form 2290 Computer Tech Reviews

Web this article explains circumstances in which taxpayers must file forms 5471, stringent standards that the irs and courts apply when considering potential abatement of. Web penalties systematically assessed when a form 5471, information return of u.s. Web the form 547 1 filing is attached to your individual income tax return and is to be filed by the due date.

Form 5471, Information Return Of U.s.

Web this article explains circumstances in which taxpayers must file forms 5471, stringent standards that the irs and courts apply when considering potential abatement of. Persons with respect to certain foreign corporations, and/or form 5472,. Tax court has ruled that the irs doesn't have authority to assess penalties for failure to file form 5471. Learn how this could impact your business.

Criminal Penalties May Also Apply For.

Web when a taxpayer misses filing form 5471, they may become subject to fines and penalties. When is irs form 5471. Web the ipu provides that penalties under sec. Web we summarize the irs form 5471 late & delinquent filing penalty.

Web For Example, The Notice States That Penalty Relief Is Available For Forms 5471 And 5472 Attached To A Late Filed Form 1120 Or 1065, But The Notice Does Not Make Clear.

For any of these three. Web some of these returns carry an automatic penalty of $25,000 for each late filed return. Penalties for the failure to file a form. These penalties may apply to each required form 5471 on an annual basis.

The Form 5471 Penalties Are One The Rise.

The 5471 form is due when the filer is required to file a tax return. Web the maximum continuation penalty per form 5471 is $50,000. Web the penalty for failing to timely file a form 5471 or correctly file a form 5471 is $10,000 per year, with an additional $10,000 penalties accruing (ninety days after notification of. Web late filing the irs form 5471.