Form 5227 Extended Due Date 2022

Form 5227 Extended Due Date 2022 - Edit, sign and save irs 5227 form. Provide certain information regarding charitable deductions and. Extension form 8868 for form 5227 can be electronically filed. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. 17, 2022, to file a return. Web date the trust was created. Form 6069 returns of excise taxes shall be. Part i income and deductions. Web individuals and families. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Not everyone has to ask for more time,. Provide certain information regarding charitable deductions and. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Since april 15 falls on a saturday, and emancipation day. If you file on a fiscal year basis (a year. Go to www.irs.gov/form5227 for instructions and the latest information. Form 6069 returns of excise taxes shall be. Form 6069 returns of excise. Form 1040, 1040a, or 1040ez.

Web due to the federal emancipation day holiday observed on april 15, 2022, tax returns filed and payments mailed or submitted on april 18, 2022, will be considered timely. Not everyone has to ask for more time,. Form 6069 returns of excise taxes shall be. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax payments and any income, gift, or estate tax due dates —. Web individuals and families. Web 16 rows form 5227, split interest trust information return pdf. 2 part ii schedule of distributable income (section 664. Form 1040, 1040a, or 1040ez. Go to www.irs.gov/form5227 for instructions and the latest information. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020.

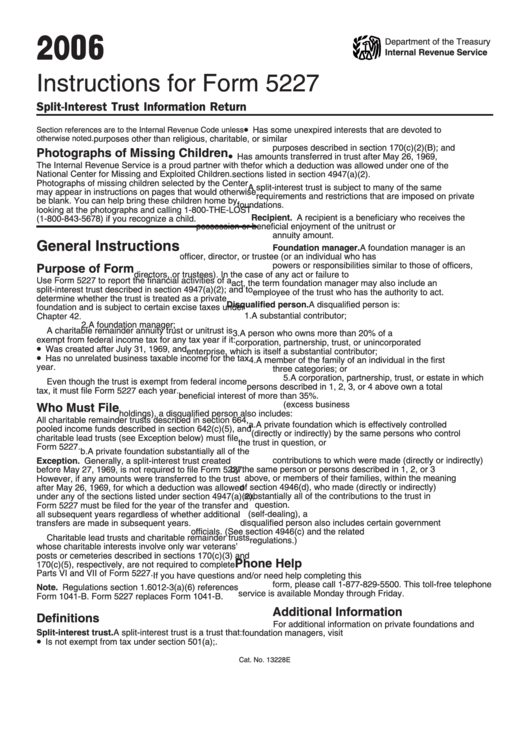

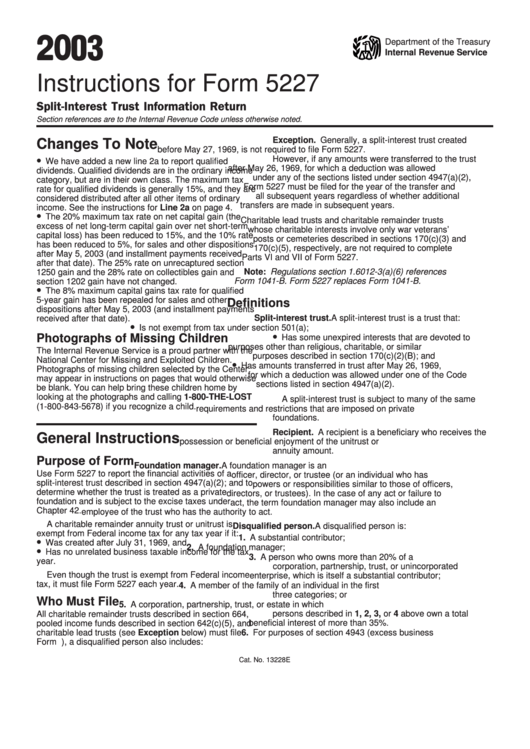

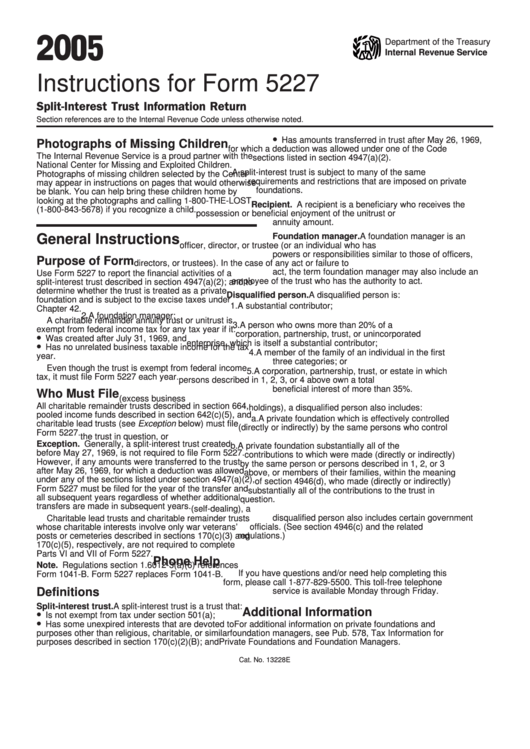

Instructions For Form 5227 printable pdf download

Form 1040, 1040a, or 1040ez. Web a calendar year form 5227 is due by april 15, 20yy. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020. Edit, sign and save irs 5227 form. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline.

Instructions For Form 5227 printable pdf download

Extension form 8868 for form 5227 can be electronically filed. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. Web date the trust was created. April 18, 2023 the due date for filing your calendar year return. Web due to the federal emancipation day holiday observed on april 15, 2022, tax returns filed and payments mailed or.

Instructions For Form 5227 printable pdf download

Part i income and deductions. Extension form 8868 for form 5227 can be electronically filed. Form 6069 returns of excise taxes shall be. Web date the trust was created. Form 1040, 1040a, or 1040ez.

Tax Return due Date extended 201920 TDS date extended Tax

Form 6069 returns of excise. Web 16 rows form 5227, split interest trust information return pdf. Web tax exempt bonds. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023. If you file on a fiscal year basis (a year.

Government Extends ESI Contribution Due Date for April 2021

Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. Web future developments for the latest information about developments related to form 5227 and its instructions, such as legislation enacted after they were published, go to. 17, 2022, to file a return. Form 6069 returns of excise taxes shall be. Web date the trust.

form 5227 Fill out & sign online DocHub

Form 1040, 1040a, or 1040ez. Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. Web 16 rows form 5227, split interest trust information return pdf. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web the due date for form 5227 originally due april 15, 2020, is postponed.

Official MCA Extended Due date for Filing of Form INC22A (ACTIVE) to

Web tax exempt bonds. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Form 1040, 1040a, or 1040ez. Edit, sign and save irs 5227 form. Web individuals and families.

Filters

Edit, sign and save irs 5227 form. 2 part ii schedule of distributable income (section 664. Since april 15 falls on a saturday, and emancipation day. If you aren't required to file any of. Web the due date for form 5227 originally due april 15, 2020, is postponed to july 15, 2020.

CTEVT Diploma/PCL Level Full Fee Paying Entrance Form 2077 Date

Since april 15 falls on a saturday, and emancipation day. Web 16 rows form 5227, split interest trust information return pdf. 5227 (2021) form 5227 (2021) page. Form 6069 returns of excise taxes shall be. Annual personal income tax filings (form 1040) due tuesday, april 18, 2023.

Edit, Sign And Save Irs 5227 Form.

Provide certain information regarding charitable deductions and. Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. If you file on a fiscal year basis (a year. Web date the trust was created.

Web The Due Date For Form 5227 Originally Due April 15, 2020, Is Postponed To July 15, 2020.

Web due to the federal emancipation day holiday observed on april 15, 2022, tax returns filed and payments mailed or submitted on april 18, 2022, will be considered timely. Web the most recent guidance released april 9, 2020, extends the july 15 tax filing and payment deadline for estimated tax payments and any income, gift, or estate tax due dates —. Not everyone has to ask for more time,. Part i income and deductions.

If You Aren't Required To File Any Of.

Since april 15 falls on a saturday, and emancipation day. 2 part ii schedule of distributable income (section 664. Form 1040, 1040a, or 1040ez. 17, 2022, to file a return.

Web A Calendar Year Form 5227 Is Due By April 15, 20Yy.

If an extension of time to file is. April 18, 2023 the due date for filing your calendar year return. Go to www.irs.gov/form5227 for instructions and the latest information. Form 6069 returns of excise.