Form 5227 E-File

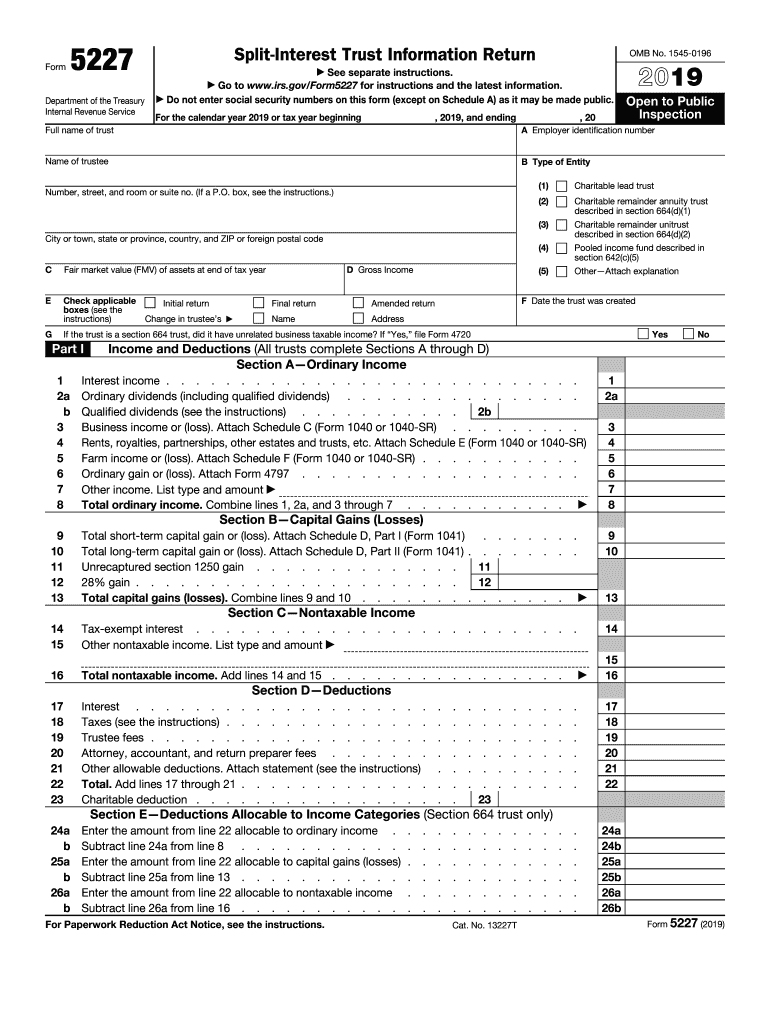

Form 5227 E-File - Used to report financial activities of charitable remainder trusts, pooled income funds, and charitable lead trusts. Download or email irs 5227 & more fillable forms, register and subscribe now! Web follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer: The tax return has schedules which track various ‘buckets’ or. Extension form 8868 for form 5227 can be electronically filed. Web use form 5227 to: Try it for free now! Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper.

Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online. Select the links below to see solutions for frequently asked questions concerning form 5227. However, they are not part of, nor do they have any special relationship with the internal revenue. Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. These instructions apply to such trusts unless the context clearly requires. Web simplify everything from the initial bridging of accounting data to the final printout and electronic filing of a completed tax or information return. Find more ideas labeled with. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. Ad upload, modify or create forms. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a).

Extension form 8868 for form 5227 can be electronically filed. Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. Form 5227 faqs the following includes answers to common questions about form 5227. Try it for free now! 5227 (2022) form 5227 (2022) page. Use form 8949 to list your. However, they are not part of, nor do they have any special relationship with the internal revenue. Web use form 5227 to: Used to report financial activities of charitable remainder trusts, pooled income funds, and charitable lead trusts. The tax return has schedules which track various ‘buckets’ or.

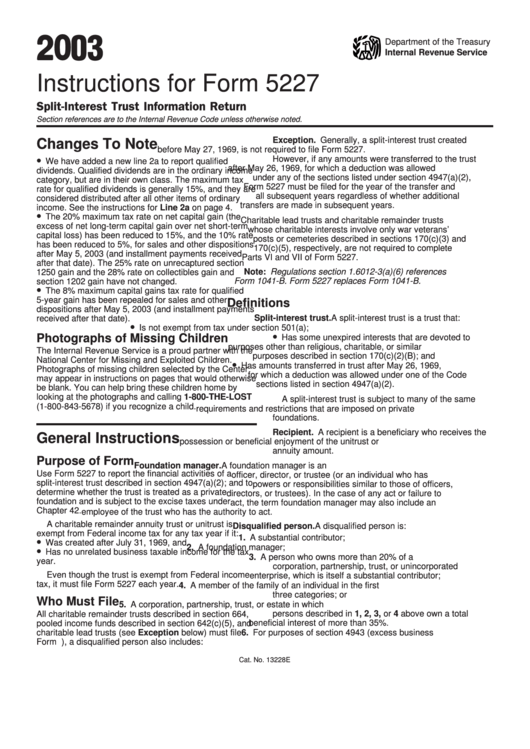

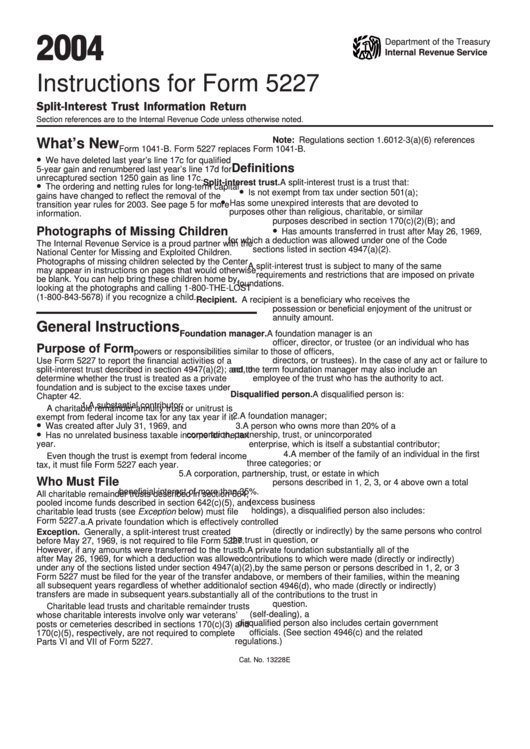

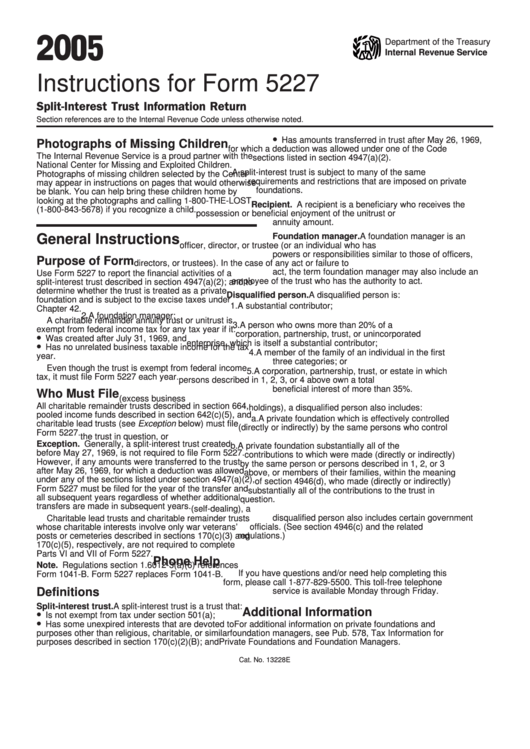

Instructions For Form 5227 printable pdf download

Web common questions about form 5227 in lacerte. Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income. Extension form 8868 for form 5227 can be electronically filed. The tax return has schedules which track various ‘buckets’ or. Web answer.

5227 Instructions Form Fill Out and Sign Printable PDF Template signNow

There are two different scenarios that need to be. Try it for free now! Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. Web common questions about form 5227 in lacerte. Web follow these steps to generate form 5227 for a charitable trust for tax year 2021 and newer:

Instructions For Form 5227 printable pdf download

There are two different scenarios that need to be. Find more ideas labeled with. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. Web use form 5227 to: Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper.

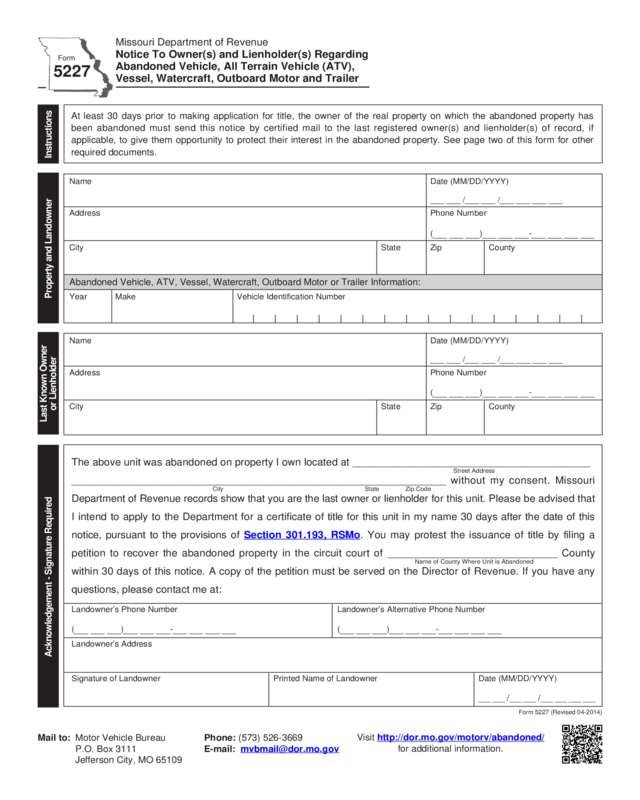

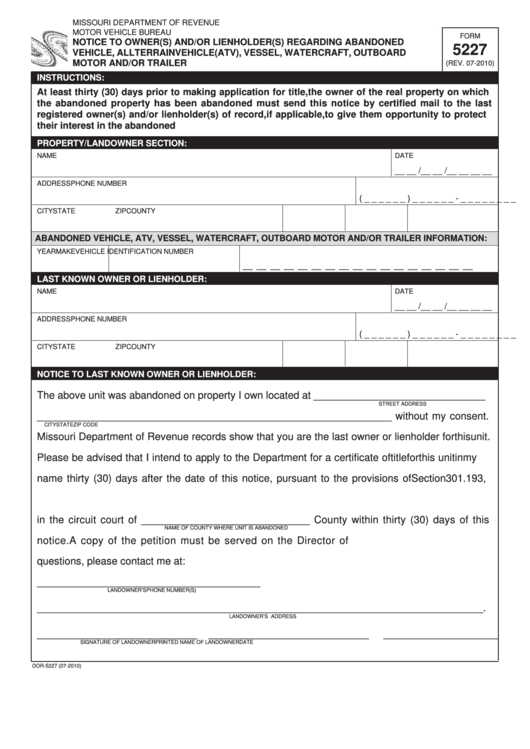

Form 5227 Missouri Department Of Revenue Edit, Fill, Sign Online

Used to report financial activities of charitable remainder trusts, pooled income funds, and charitable lead trusts. However, they are not part of, nor do they have any special relationship with the internal revenue. Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Ad upload, modify or create forms. These instructions apply to such trusts unless the context clearly requires. Extension form 8868 for form 5227 can be electronically filed. Try it for free now! Web use form 5227 to:

Fillable Form 5227 Notice To Owner(S) And/or Lienholder(S) Regarding

Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income. Web answer form 1041 may be electronically filed, but form 5227 must be filed on paper. Used to report financial activities of charitable remainder trusts, pooled income funds, and charitable.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Extension form 8868 for form 5227 can be electronically filed. Use form 8949 to list your. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a). 5227 (2022) form 5227 (2022) page.

Instructions For Form 5227 printable pdf download

Find more ideas labeled with. Used to report financial activities of charitable remainder trusts, pooled income funds, and charitable lead trusts. Ad upload, modify or create forms. Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income. Use form 8949.

Form 5227 SplitInterest Trust Information Return (2014) Free Download

Select the links below to see solutions for frequently asked questions concerning form 5227. 5227 (2022) form 5227 (2022) page. The tax return has schedules which track various ‘buckets’ or. Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income..

Form 5227 SplitInterest Trust Information Return (2014) Free Download

See the instructions pdf for more. These instructions apply to such trusts unless the context clearly requires. Use form 8949 to list your. Extension form 8868 for form 5227 can be electronically filed. Find more ideas labeled with.

Use Form 8949 To List Your.

See the instructions pdf for more. Beginning tax software year 2022, electronic filing is available for both forms 5227 and 1041 when the type of return being filed is a charitable lead trust or pooled income. Web the trustee will file form 5227 for the crt (crat or crut) using a calendar tax year. 2 part ii schedule of distributable income (section 664 trust only) (see instructions) accumulations (a).

Web Answer Form 1041 May Be Electronically Filed, But Form 5227 Must Be Filed On Paper.

Extension form 8868 for form 5227 can be electronically filed. Used to report financial activities of charitable remainder trusts, pooled income funds, and charitable lead trusts. 5227 (2022) form 5227 (2022) page. Web use form 5227 to:

Web Follow These Steps To Generate Form 5227 For A Charitable Trust For Tax Year 2021 And Newer:

Try it for free now! The form is available in the 1041 fiduciary return by completing applicable screens on the 5227 tab. However, they are not part of, nor do they have any special relationship with the internal revenue. The tax return has schedules which track various ‘buckets’ or.

Web Simplify Everything From The Initial Bridging Of Accounting Data To The Final Printout And Electronic Filing Of A Completed Tax Or Information Return.

Find more ideas labeled with. Ad upload, modify or create forms. There are two different scenarios that need to be. Web electronic filing of form 5227 is expected to be available in 2023, and the irs will announce the specific date of availability when the programming comes online.