Form 4797 Example

Form 4797 Example - Depreciable and amortizable tangible property used in your. Ad complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Web use form 4797 to report the following. Web form 4797, sales of business property is used to report the following transactions: Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building. Real property used in your trade or business; Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Web learn how to fill the form 4797 sales of business property. Web form 4797 is a tax form required to be filed with the internal revenue service (irs) for any gains realized from the sale or transfer of business property,.

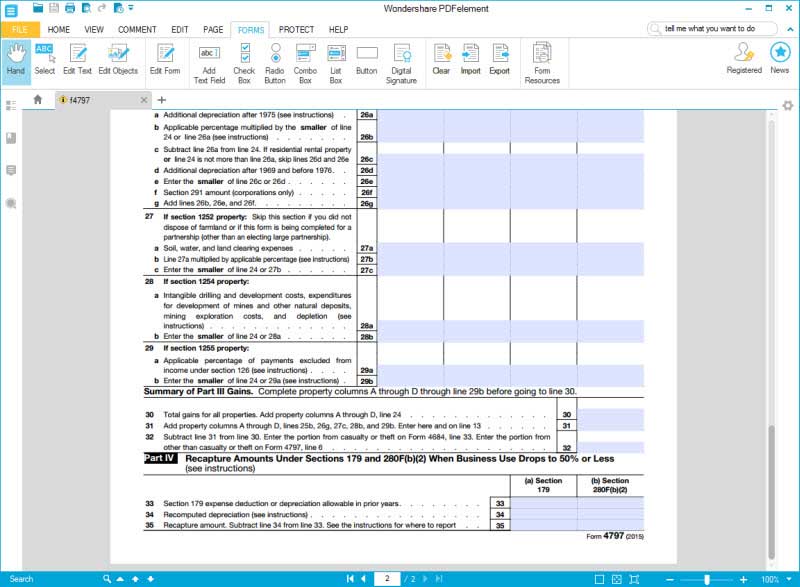

Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building. For example, gains or losses from section 179 deductions. Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Complete, edit or print tax forms instantly. Web if, for example, a property was put in service to generate cash flow or used as a business and then sold for a profit, the owner realizing the capital gains will be required to file irs. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the. Web form 4797, sales of business property is used to report the following transactions: Web cheryl, i have a similar but slightly different case with form 4797. Real property used in your trade or business; Complete, edit or print tax forms instantly.

Web the disposition of each type of property is reported separately in the appropriate part of form 4797 sales of business property (for example, for property held more than one. •the sale or exchange of: This is different from property that was used in a business, which might be the case if you are. Web cheryl, i have a similar but slightly different case with form 4797. Web form 4797 part iii: For example, gains or losses from section 179 deductions. Ad complete irs tax forms online or print government tax documents. Web learn how to fill the form 4797 sales of business property. Real property used in your trade or business; The sale or exchange of:

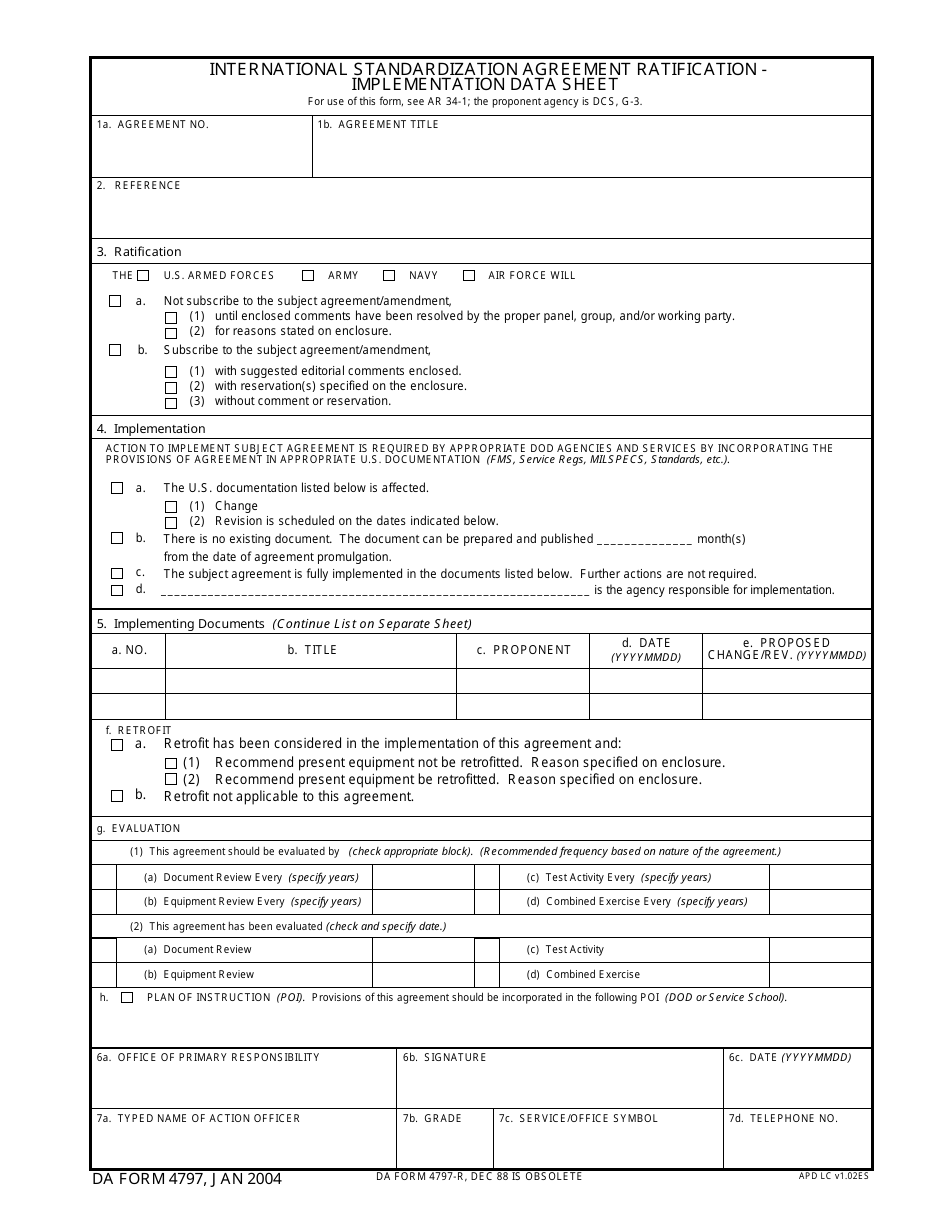

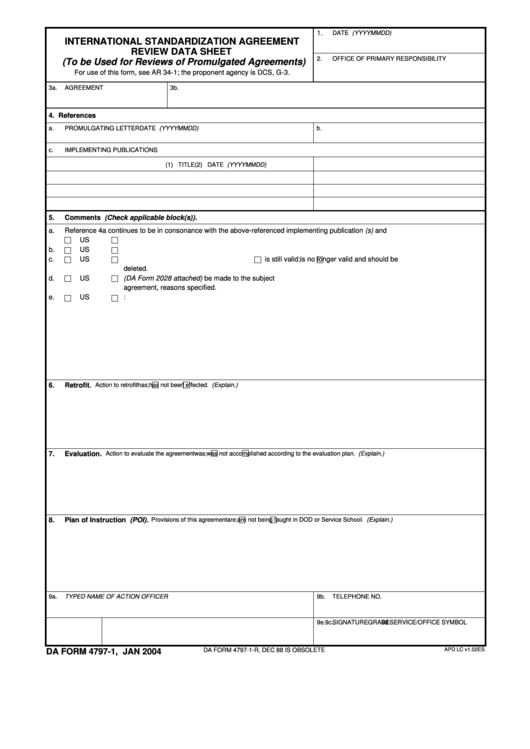

DA Form 4797 Download Fillable PDF or Fill Online International

Complete, edit or print tax forms instantly. Depreciable and amortizable tangible property used in your. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building. Web identify as from “form 4797, line 18a.” see instructions redetermine the.

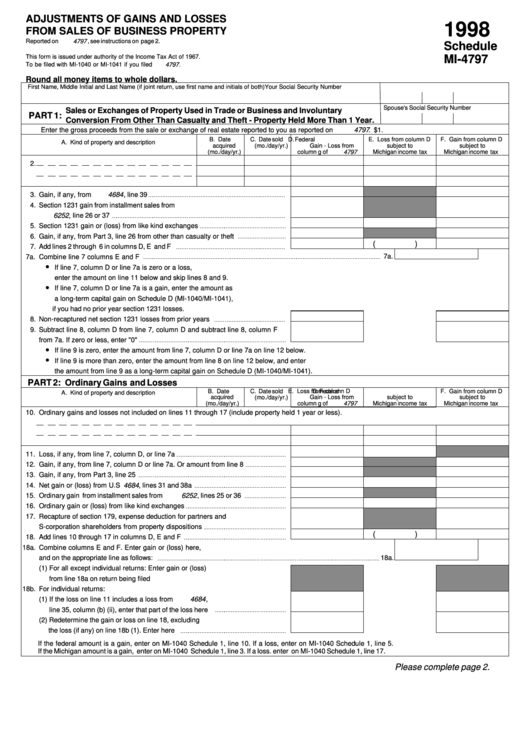

Fillable Schedule Mi4797 Adjustments Of Gains And Losses From Sales

Web cheryl, i have a similar but slightly different case with form 4797. Web form 4797 part iii: Ad complete irs tax forms online or print government tax documents. Property used in a trade or business. Web form 4797 can be confusing because it requires quite a bit of information, some of which you might not be familiar with.

Fillable Form Da Form 47971 International Standardization Agreement

Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the. Web if, for example, a property was put in service to generate cash flow or used as a business and then sold for a profit, the owner realizing the capital.

Publication 908 (02/2022), Bankruptcy Tax Guide Internal Revenue Service

Property used in a trade or business. Web form 4797, sales of business property is used to report the following transactions: 42k views 10 years ago. Web form 4797 can be confusing because it requires quite a bit of information, some of which you might not be familiar with. Web the disposition of each type of property is reported separately.

Form 4797Sales of Business Property

Inherited house + improvement basis=$218698 in 2014. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 sales of business property (for example, for property held more than one. Real property used in your trade or business; Web cheryl, i have a similar but slightly different case with form 4797. Web the.

TURBOTAX InvestorVillage

Real property used in your trade or business; Web use form 4797 to report the following. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building. As a result, when you sell this property at a gain,.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Depreciable and amortizable tangible property used in your. Web form 4797 can be confusing because it requires quite a bit of information, some of which you might not be familiar with. Ad complete irs tax forms online or print government tax documents. Web form 4797 is used when selling property that was used as a business. As a result, when.

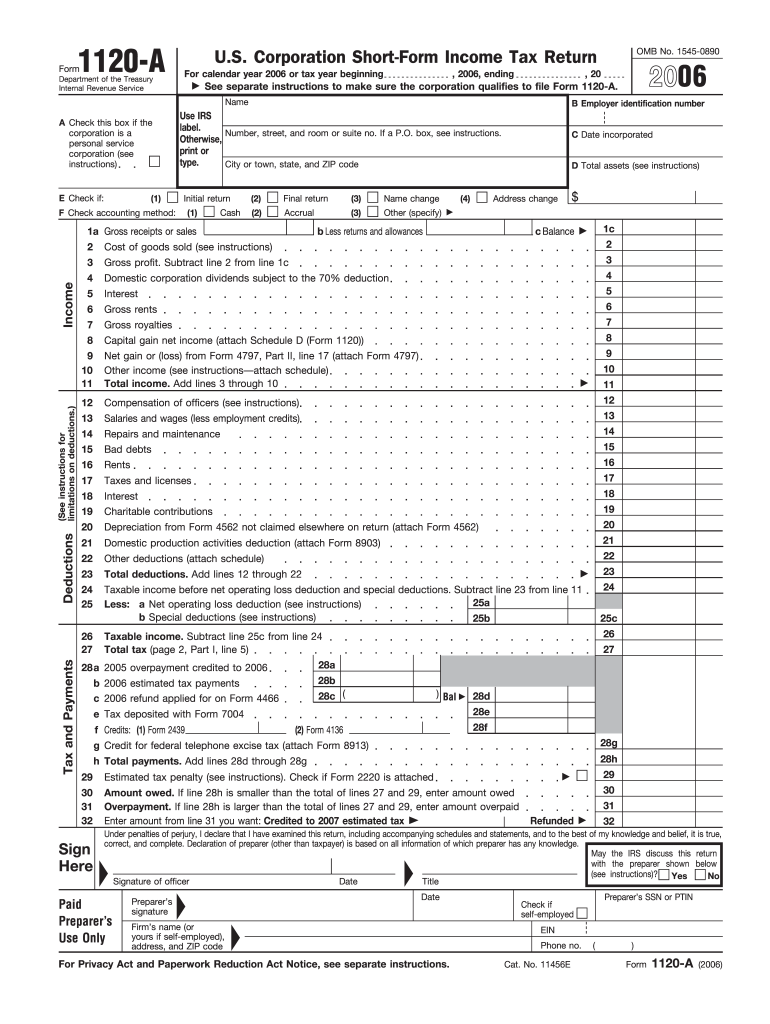

1120A Fill Out and Sign Printable PDF Template signNow

Web form 4797, sales of business property is used to report the following transactions: Web the disposition of each type of property is reported separately in the appropriate part of form 4797 sales of business property (for example, for property held more than one. Web three steps followed to report the sale of a rental property are calculating capital gain.

IRS Form 4797 Guide for How to Fill in IRS Form 4797

Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. For example, gains or losses from section 179 deductions. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web use form 4797 to.

How to Report the Sale of a U.S. Rental Property Madan CA

42k views 10 years ago. Web form 4797 can be confusing because it requires quite a bit of information, some of which you might not be familiar with. Inherited house + improvement basis=$218698 in 2014. Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line.

Web Cheryl, I Have A Similar But Slightly Different Case With Form 4797.

Ad complete irs tax forms online or print government tax documents. Web form 4797 is used when selling property that was used as a business. Complete, edit or print tax forms instantly. 42k views 10 years ago.

Enter Here And On Form 1040, Line 14 Form.

Complete, edit or print tax forms instantly. Web form 4797, sales of business property is used to report the following transactions: Web if, for example, a property was put in service to generate cash flow or used as a business and then sold for a profit, the owner realizing the capital gains will be required to file irs. For example, gains or losses from section 179 deductions.

Inherited House + Improvement Basis=$218698 In 2014.

Web identify as from “form 4797, line 18a.” see instructions redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building. Web the disposition of each type of property is reported separately in the appropriate part of form 4797 sales of business property (for example, for property held more than one. Web form 4797 can be confusing because it requires quite a bit of information, some of which you might not be familiar with.

Web Form 4797 Part Iii:

Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building. Web learn how to fill the form 4797 sales of business property. As a result, when you sell this property at a gain, you’ll report that. Web use form 4797 to report the following.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://www.calt.iastate.edu/system/files/resize/images-premium-article/4797_two-643x831.jpg)