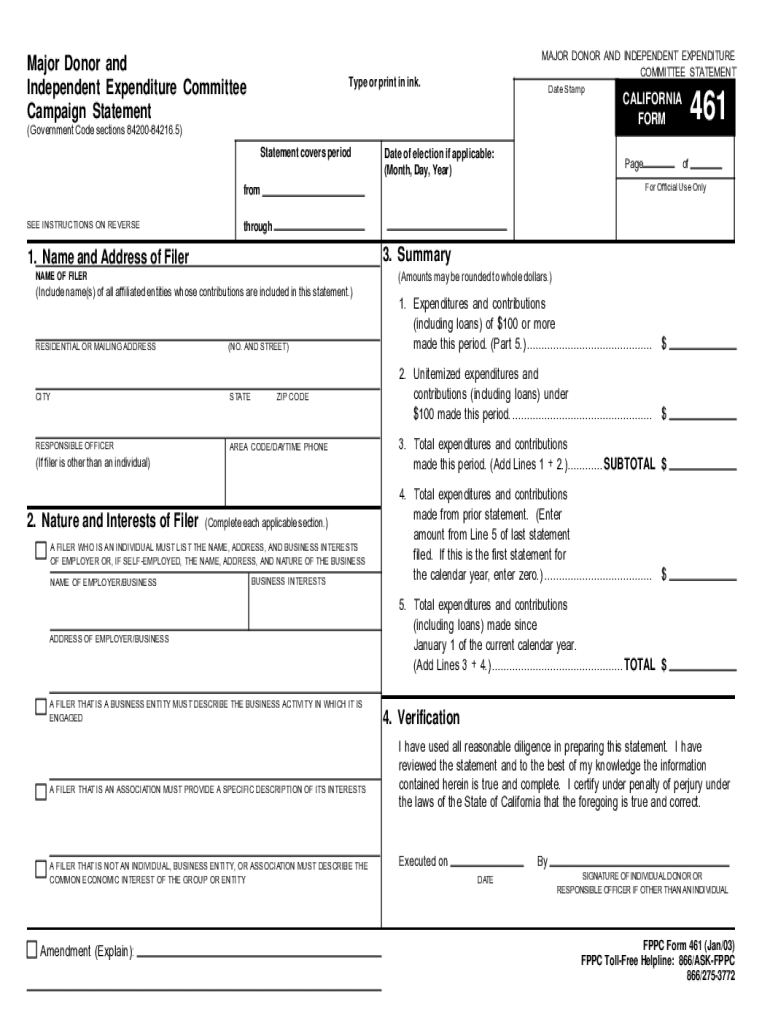

Form 461 California

Form 461 California - Web who uses form 461: Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a. Web form 461 department of the treasury internal revenue service limitation on business losses attach to your tax return. Form 461 has 5 sections. Web about form 461, limitation on business losses. Web form 461 major donor and independent exependiture committe campaign statement. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. Web complete form 461 if it has a loss attributable to its trade or business of more than $270,000.

Web form 461 major donor and independent exependiture committe campaign statement. Web about form 461, limitation on business losses. Form 461 has 5 sections. Web form 461 department of the treasury internal revenue service limitation on business losses attach to your tax return. Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. Web a trust subject to tax under section 511 should complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or. Web secretary of state must file form 461 electronically if they make contributions or independent expenditures totaling $25,000 or more in a calendar year. Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a. January 1, 2003] attachment to qualified domestic relations order (earnings.

Web who uses form 461: Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. Use form 461 to figure the excess business loss that is reported on your noncorporate tax return. Web a trust subject to tax under section 511 should complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Web when an individual or entity qualifies as an independent expenditure committee it must file the form 461 as a state, county or city committee. Web secretary of state must file form 461 electronically if they make contributions or independent expenditures totaling $25,000 or more in a calendar year. January 1, 2003] attachment to qualified domestic relations order (earnings. Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Web complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,.

Form 461 2022 2023 IRS Forms Zrivo

Go to www.irs.gov/form461 for instructions and the. The fair political practices commission (fppc) maintains the following comprehensive list of every fppc form with brief explanations of who must. Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. I certify under penalty of perjury under the. Statement period covered date period started date period.

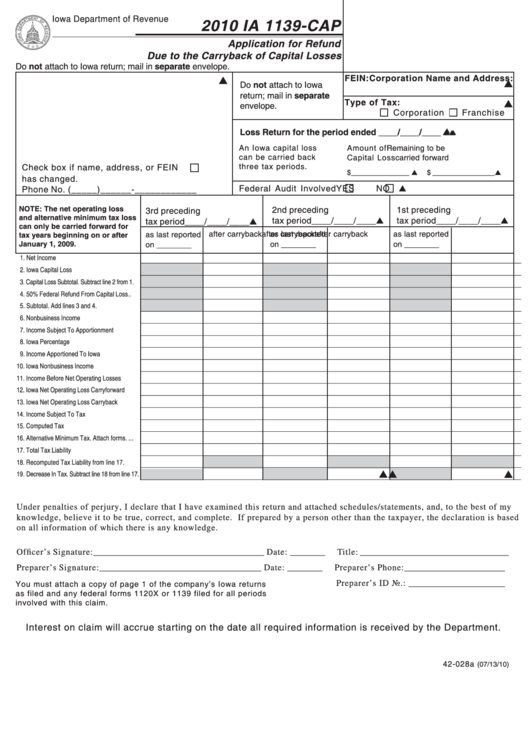

Form Ia 1139Cap Application For Refund Due To The Carryback Of

Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or. January 1, 2003] attachment to qualified domestic relations order (earnings. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Form 461 has 5 sections. I.

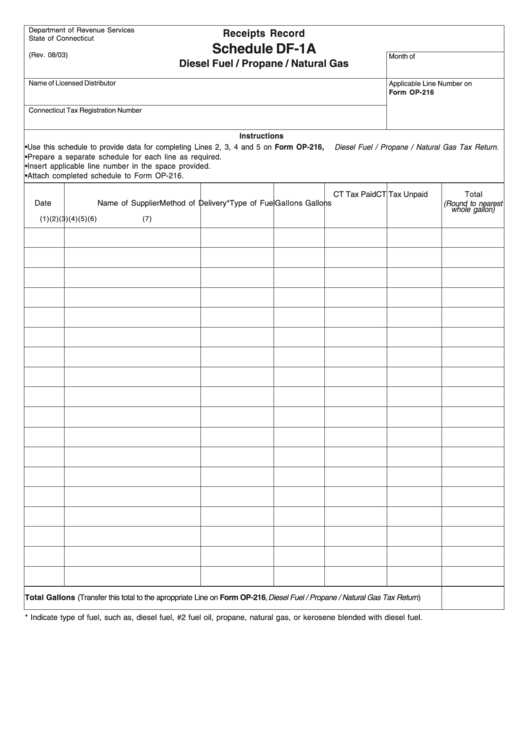

Schedule Df1a Receipt Record Diesel Fuel/propane/natural Gas

Go to www.irs.gov/form461 for instructions and the. January 1, 2003] attachment to qualified domestic relations order (earnings. Web who uses form 461: Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits. Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses.

PJI Form 461 Stamped

Go to www.irs.gov/form461 for instructions and the. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Web form 461 major donor and independent exependiture committe campaign statement. The fair political practices commission (fppc) maintains the following comprehensive list of every fppc form with brief explanations of who must. Web a trust subject to tax under.

Form 461 Instructions Fill Out and Sign Printable PDF Template signNow

Web tells the retirement plan information about the employee and the person receiving spousal or partner support. Web form 461 major donor and independent exependiture committe campaign statement. Form 461 has 5 sections. 2870, providing the information is necessary in order to. It is attached to qualified domestic relations order.

Fill Free fillable Form 461 Limitation on Business Losses (IRS) PDF form

Web for taxable year 2020, complete form ftb 3461, california limitation on business losses, if you are a noncorporate taxpayer and your net losses from all of your trades or. Web about form 461, limitation on business losses. Web form 461 major donor and independent exependiture committe campaign statement. The fair political practices commission (fppc) maintains the following comprehensive list.

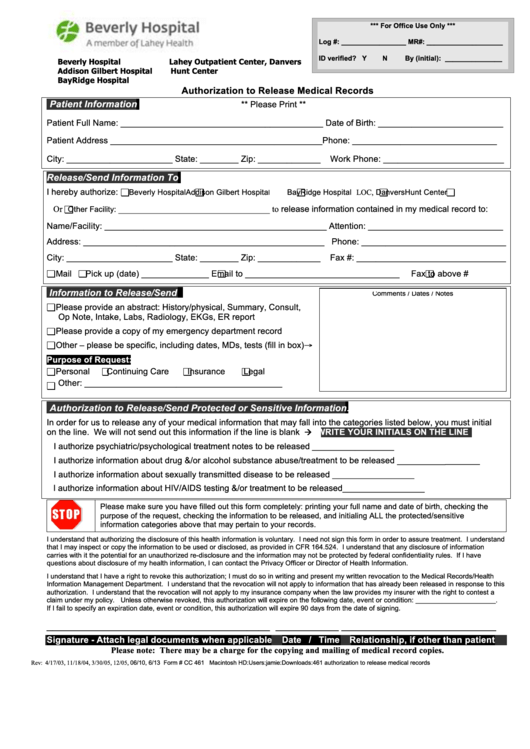

Form Cc 461 Authorization To Release Medical Records printable pdf

Web a trust subject to tax under section 511 should complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Web when an individual or entity qualifies as an independent expenditure committee it must file the form 461 as a state, county or city committee. Web file form ftb 3461 if you.

Da Form 461 5 ≡ Fill Out Printable PDF Forms Online

Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Web complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Web who uses form 461: Form 461 has 5 sections. Web about form 461, limitation on business losses.

Form 461 2022 2023 IRS Forms Zrivo

January 1, 2003] attachment to qualified domestic relations order (earnings. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. Web complete form 461 if it has a loss attributable to its trade or business of more than $270,000. The fair political practices commission (fppc) maintains.

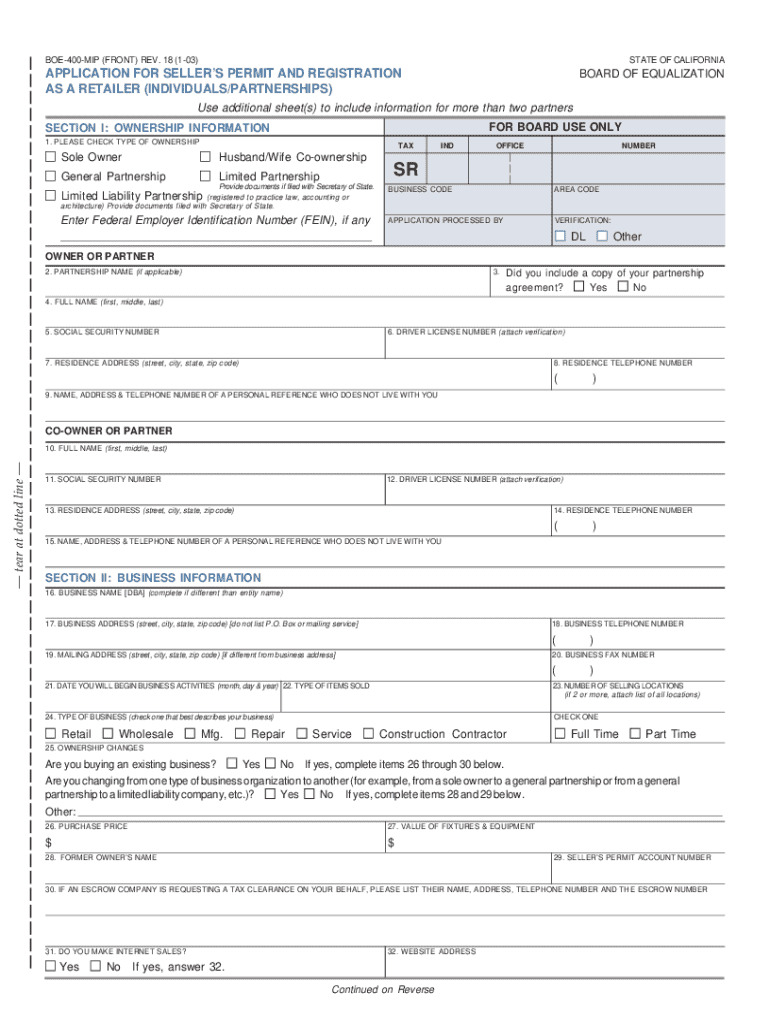

BOE 400 MIP REV 18 1 03 California Sellers Permit Fill Out and Sign

Web special filings unit, p.o. I certify under penalty of perjury under the. Web form 461 (major donor and independent expenditure committee campaign statement) secretary of state: Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Attach form 461 to the applicable tax return you file.

Web Form 461 (Major Donor And Independent Expenditure Committee Campaign Statement) Secretary Of State:

January 1, 2003] attachment to qualified domestic relations order (earnings. Web file form ftb 3461 if you are a noncorporate taxpayer and your net losses from all of your trades or businesses are more than $262,000 ($524,000 for married taxpayers filing a. The fair political practices commission (fppc) maintains the following comprehensive list of every fppc form with brief explanations of who must. Web form 461 is filed by major donors, independent expenditure committees and multipurpose organizations including nonprofits.

Web A Trust Subject To Tax Under Section 511 Should Complete Form 461 If It Has A Loss Attributable To Its Trade Or Business Of More Than $270,000.

Web about form 461, limitation on business losses. Web special filings unit, p.o. Web when an individual or entity qualifies as an independent expenditure committee it must file the form 461 as a state, county or city committee. It is attached to qualified domestic relations order.

Web Tells The Retirement Plan Information About The Employee And The Person Receiving Spousal Or Partner Support.

Web complete form 461 if it has a loss attributable to its trade or business of more than $270,000. Web form 461 major donor and independent exependiture committe campaign statement. Web form 461 department of the treasury internal revenue service limitation on business losses attach to your tax return. Go to www.irs.gov/form461 for instructions and the.

Web Secretary Of State Must File Form 461 Electronically If They Make Contributions Or Independent Expenditures Totaling $25,000 Or More In A Calendar Year.

I certify under penalty of perjury under the. Major donors an individual or entity that makes monetary or nonmonetary contributions (including loans) to state or local officeholders, candidates,. Web california form 461 for defi nitions and detailed information about completing form 461, refer to the fppc campaign disclosure manuals 5 and 6. Web california courts | self help guide.