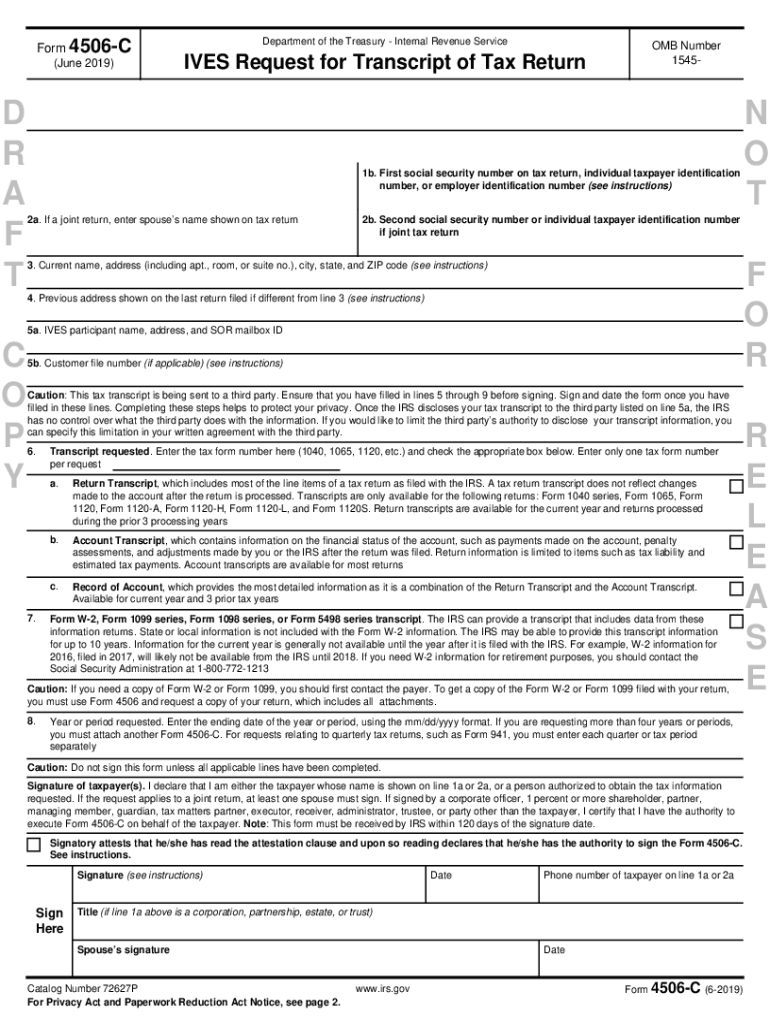

Form 4506-C Instructions

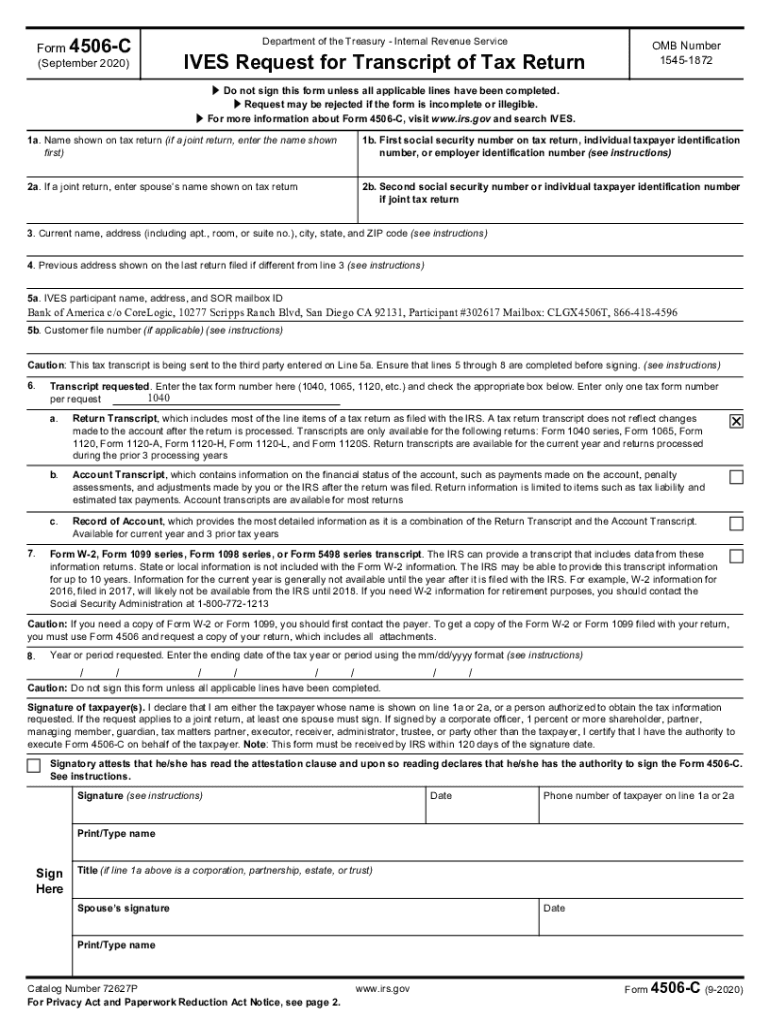

Form 4506-C Instructions - Form 4506 is used by. Fannie mae requires lenders to have each borrower whose income (regardless of income. You do not have to. Web execute form 4506 on behalf of the taxpayer. This form must be received by irs within 120 days of the signature date. Mm dd yyyy must be checked. The originator is responsible for. Hit ‘sign field’ at the end of the first page. Leave all of section 7 blank for business requests. Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2.

Web form cannot be sent to the irs with any missing fields do not check; However, effective may 1, 2021,. Leave all of section 7 blank for business requests. Fill in tax years needed: Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Carefully read and understand the instructions provided. You will designate (on line 5a) a third party to receive the information. Web up to $40 cash back begin by downloading the 4506 c form from the official website of the internal revenue service (irs). Follow example to complete form. Spouse’s current name line 3:

However, effective may 1, 2021,. Form 4506 is used by. Mm dd yyyy must be checked. A copy of an exempt or political organization’s return, report, or notice. Fill in tax years needed: You will designate (on line 5a) a third party to receive the information. Tap ‘add new signature’ when the signature wizard. Follow example to complete form. Web execute form 4506 on behalf of the taxpayer. This form must be received by irs within 120 days of the signature date.

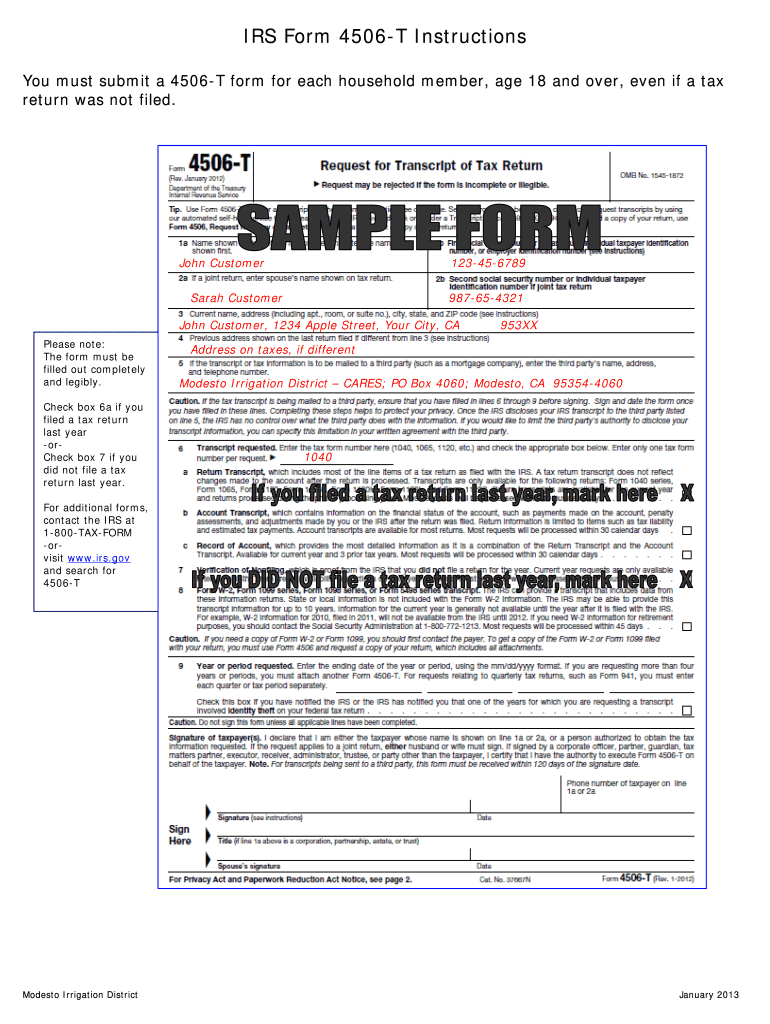

Form 4506T Instructions for SBA EIDL Loan, Covid19 EIDL Grant, or SBA

Signatures are required for any taxpayer listed. Signatory attests that he/she has read the. Web up to $40 cash back begin by downloading the 4506 c form from the official website of the internal revenue service (irs). However, effective may 1, 2021,. This form must be received by irs within 120 days of the signature date.

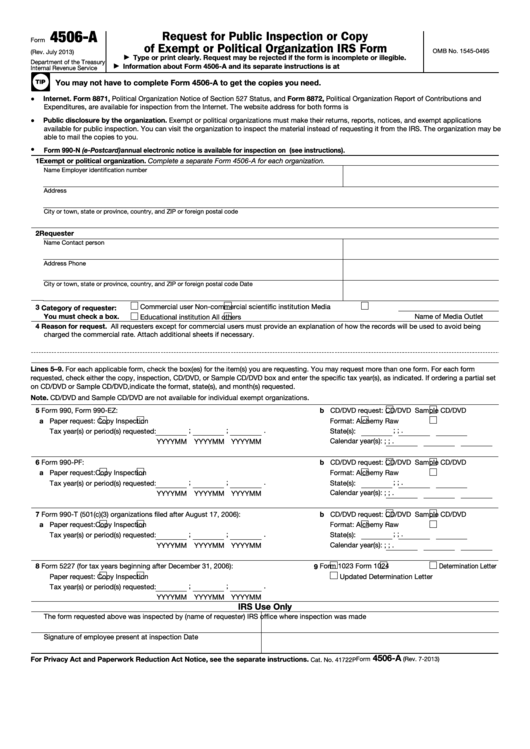

Fillable Form 4506A Request For Public Inspection Or Copy Of Exempt

Only list a spouse if their own. The originator is responsible for. Tap ‘add new signature’ when the signature wizard. Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2. You will designate (on line 5a) a third party to receive the information.

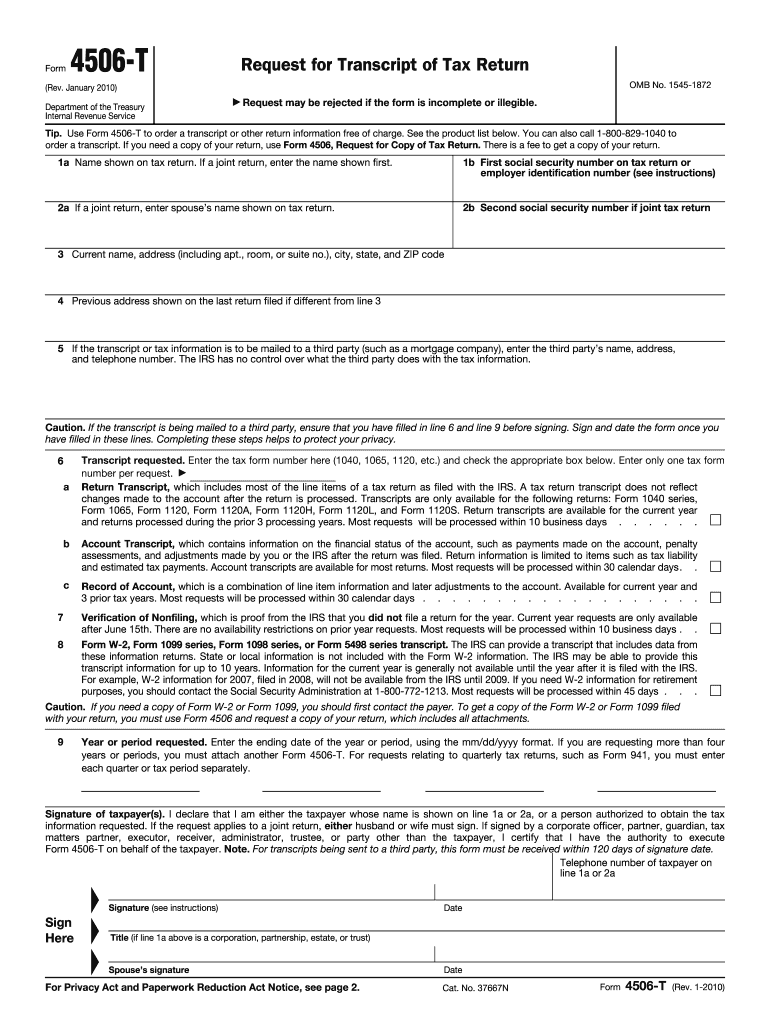

Fill Free fillable IRS FORM 4506T Form 4506T (Rev. 92018) PDF form

Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Fannie mae requires lenders to have each borrower whose income (regardless of income. Carefully read and understand the instructions provided. Spouse’s current name line 3: You will designate (on line 5a) a third party to receive the information.

4506 C Form Pdf Fill Online, Printable, Fillable, Blank pdfFiller

Fannie mae requires lenders to have each borrower whose income (regardless of income. A copy of an exempt or political organization’s return, report, or notice. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Fill in tax years needed: Signatory attests that he/she has read the.

4506T Form Instructions 📝 Get IRS Form 4506 T Printable Federal Tax

Mm dd yyyy must be checked. However, effective may 1, 2021,. Form 4506 is used by. Hit ‘sign field’ at the end of the first page. Fannie mae requires lenders to have each borrower whose income (regardless of income.

Form 4506t Fill Out and Sign Printable PDF Template signNow

Form 4506 is used by. Leave all of section 7 blank for business requests. Mm dd yyyy must be checked. Signatory attests that he/she has read the. Phone number of taxpayer on line 1a or 2a signature (see instructions) date for privacy act and paperwork reduction act notice, see page 2.

What Does the Signer S Need to Complete on the 4506 T Request for

Signatory attests that he/she has read the. This form must be received by irs within 120 days of the signature date. You do not have to. Only list a spouse if their own. Form 4506 is used by.

IRS Form 4506A 2018 2019 Fillable and Editable PDF Template

Web execute form 4506 on behalf of the taxpayer. Fannie mae requires lenders to have each borrower whose income (regardless of income. The originator is responsible for. Mm dd yyyy must be checked. A copy of an exempt or political organization’s return, report, or notice.

4506 C Fillable Form Fill and Sign Printable Template Online US

Fill in tax years needed: Leave all of section 7 blank for business requests. However, effective may 1, 2021,. Signatory attests that he/she has read the. You will designate (on line 5a) a third party to receive the information.

IRS releases new form 4506C

Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Form 4506 is used by. Carefully read and understand the instructions provided. Fannie mae requires lenders to have each borrower whose income (regardless of income. Phone number of taxpayer on line 1a or 2a signature (see instructions) date.

Phone Number Of Taxpayer On Line 1A Or 2A Signature (See Instructions) Date For Privacy Act And Paperwork Reduction Act Notice, See Page 2.

Follow example to complete form. Hit ‘sign field’ at the end of the first page. You will designate (on line 5a) a third party to receive the information. Signatory attests that he/she has read the.

This Form Must Be Received By Irs Within 120 Days Of The Signature Date.

Web up to $40 cash back begin by downloading the 4506 c form from the official website of the internal revenue service (irs). Mm dd yyyy must be checked. Fill in tax years needed: Carefully read and understand the instructions provided.

Web Execute Form 4506 On Behalf Of The Taxpayer.

Signatures are required for any taxpayer listed. Form 4506 is used by. However, effective may 1, 2021,. Tap ‘add new signature’ when the signature wizard.

Leave All Of Section 7 Blank For Business Requests.

Fannie mae requires lenders to have each borrower whose income (regardless of income. Web information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. Web form cannot be sent to the irs with any missing fields do not check; You do not have to.