Form 3853 Instructions

Form 3853 Instructions - Below, you will find detailed instructions and a sample of completed sides 1 and 3 of form 540 and a sample of side 1 and side 2 of. Web california resident income tax return. If the organization adheres to. Send california form 3853 via email, link, or fax. If you and/or a member of your applicable household are reporting any coverage or are. Read the instructions at the top of the form and fill out the required fields. Web up to $40 cash back download the form 3853 pdf and open it in a pdf viewer. Web share your form with others. Web this number is needed on form ftb 3853, health coverage exemptions and individual shared responsibility penalty, to prove that covered california granted you an. Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty.

Send california form 3853 via email, link, or fax. If the organization adheres to. Web this number is needed on form ftb 3853, health coverage exemptions and individual shared responsibility penalty, to prove that covered california granted you an. Web up to $40 cash back download the form 3853 pdf and open it in a pdf viewer. Web share your form with others. If you and/or a member of your applicable household are. If you and/or a member of your applicable household are reporting any coverage or are. Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Read the instructions at the top of the form and fill out the required fields. Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form.

If the organization adheres to. Indicate the date to the sample with the date function. Web the california franchise tax board april 1 issued the 2020 instructions for form ftb 3853, health coverage exemptions and individual shared responsibility. Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form. Web side 1 your name: Click on the sign icon and create a digital signature. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Coverage and exemptions claimed on your tax return for individuals. If you and/or a member of your applicable household are.

1997 california tax form 540 Fill out & sign online DocHub

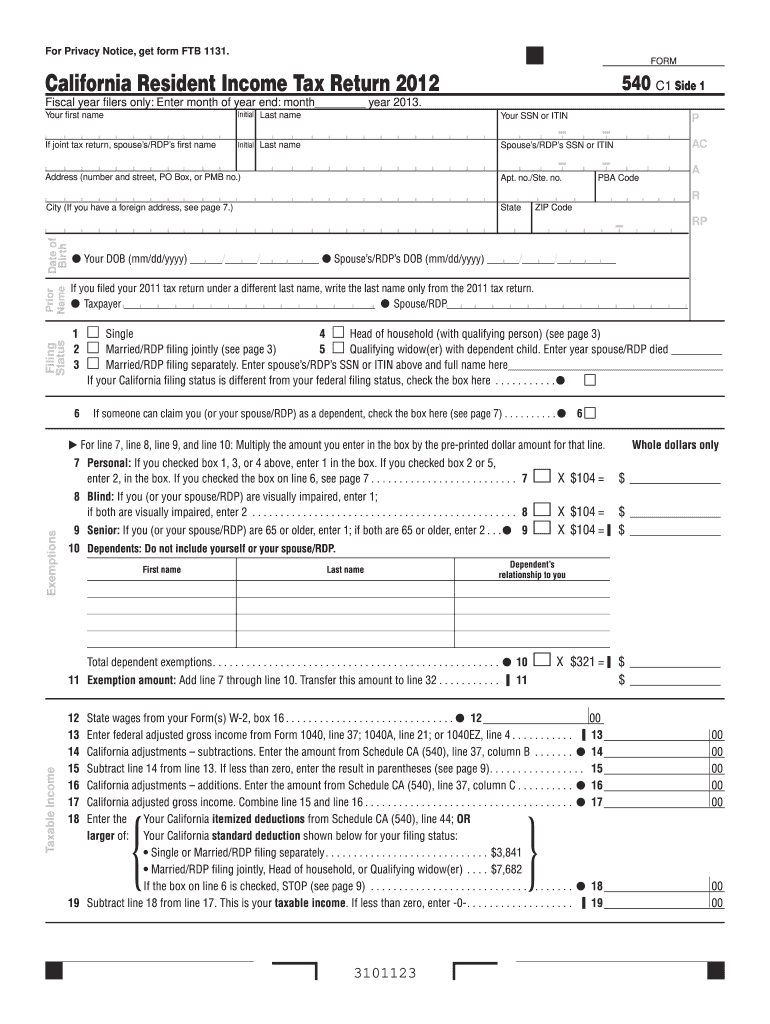

Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Indicate the date to the sample with the date function. Web california resident income tax return. Web side 1 your name: Below, you will find detailed instructions and a sample of completed sides 1 and 3 of form 540 and a sample of side 1.

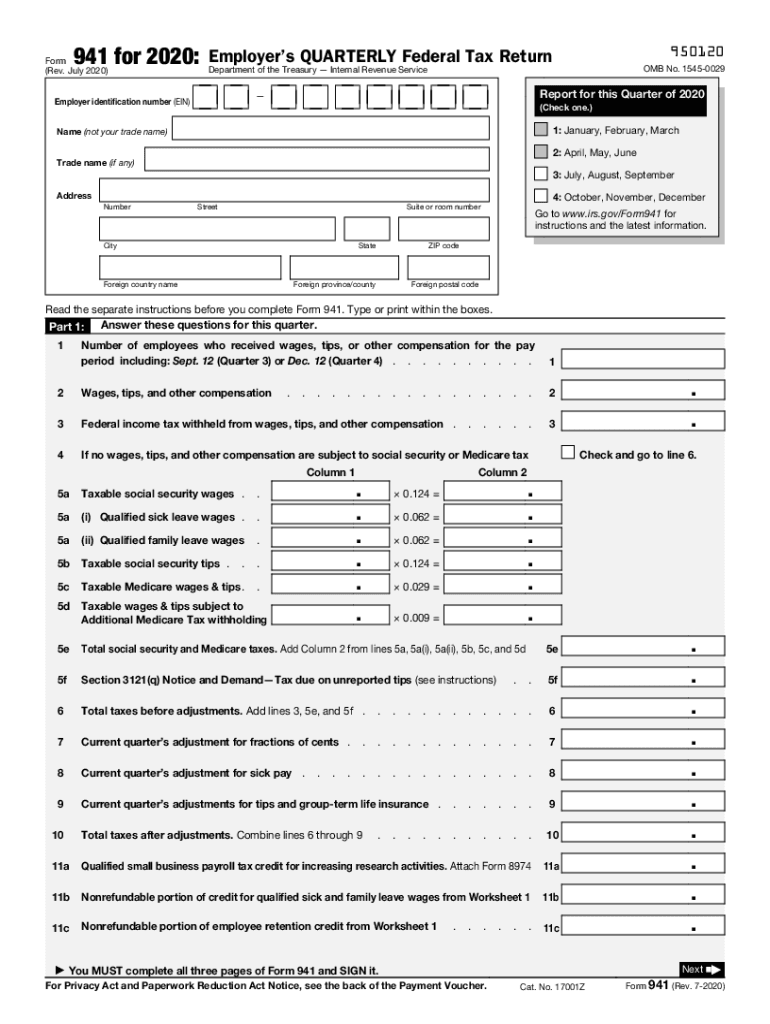

2020 Form IRS 941 Fill Online, Printable, Fillable, Blank pdfFiller

Indicate the date to the sample with the date function. Web this number is needed on form ftb 3853, health coverage exemptions and individual shared responsibility penalty, to prove that covered california granted you an. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. Click on.

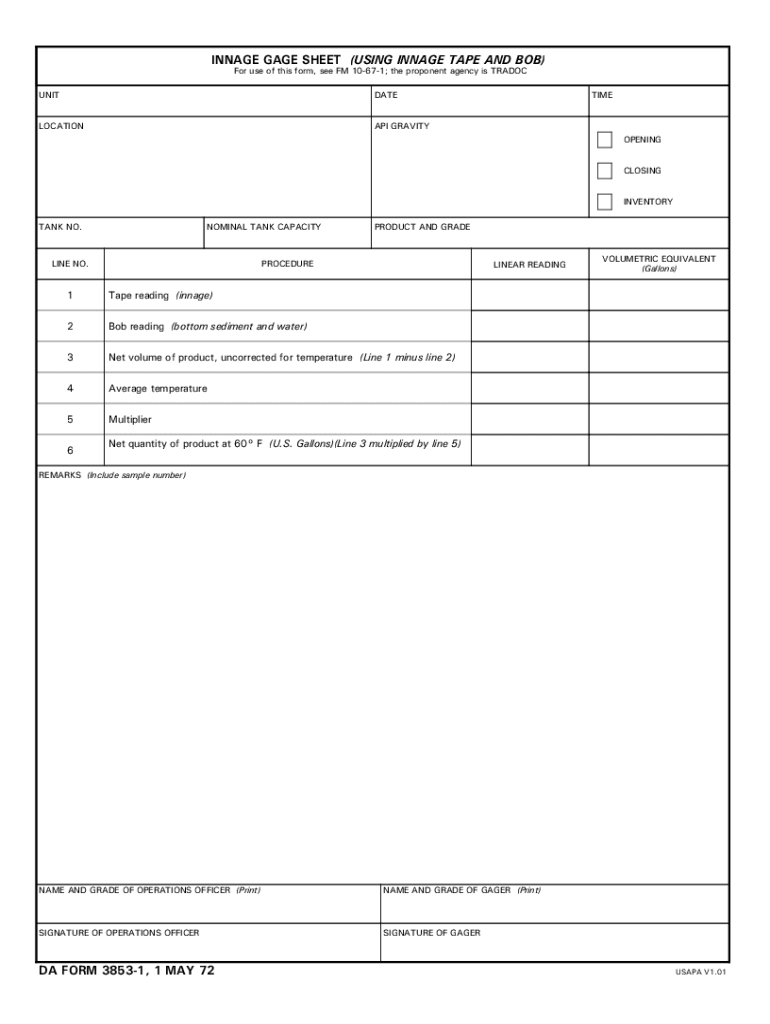

Da Form 3853 1 20202022 Fill and Sign Printable Template Online US

Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. In the “name of claimant”. 2 months and 15 days past the start of the tax year in which the election is to be effective. Coverage and exemptions claimed on your tax return for individuals..

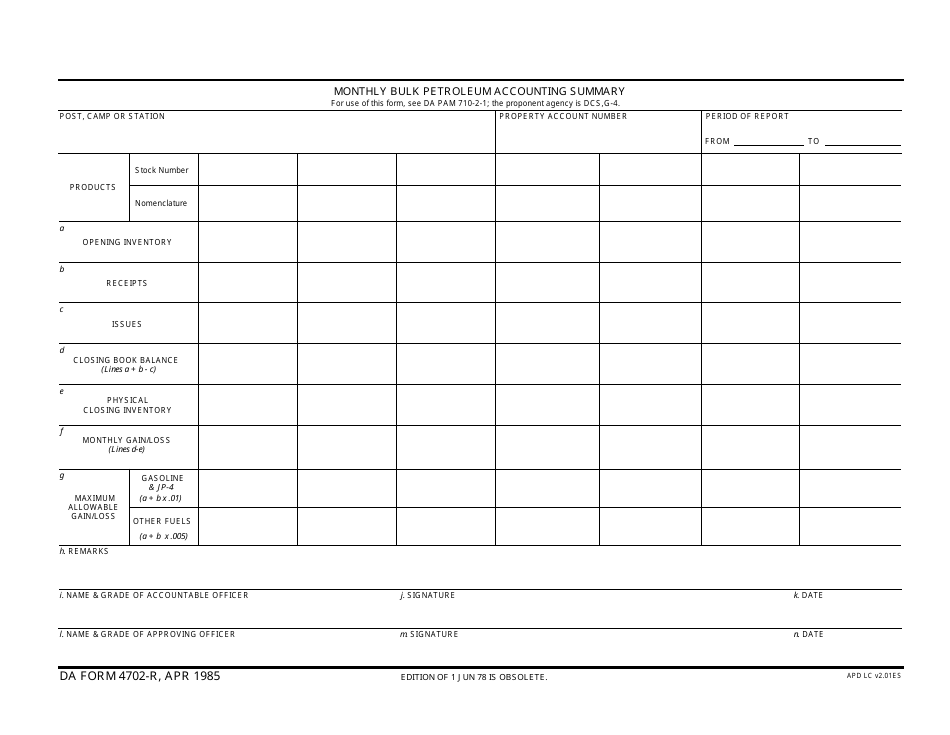

DA Form 4702R Download Fillable PDF or Fill Online Monthly Bulk

Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Web the organization should submit form 2553: 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. Web this number is needed on form ftb 3853, health coverage exemptions and individual shared.

3853 Form Fill Online, Printable, Fillable, Blank pdfFiller

If you and/or a member of your applicable household are. Web the organization should submit form 2553: Web 2022, 3853, instructions for form 3853, health coverage exemption and individual shared responsibility penalty. Edit your form 3853 online. Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with your form.

CA FTB 540X 20162022 Fill out Tax Template Online US Legal Forms

Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form. Web the organization should submit form 2553: If the organization adheres to. Edit your form 3853 online. Indicate the date to the sample with the date function.

Form 3853 1 ezvgqrk

This is only available by request. In the “name of claimant”. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Read the instructions at the top of the form and fill out the required fields. Choose either the 3853 or 3849 form (use the.

도로정비사업 준공검사원 샘플, 양식 다운로드

If the organization adheres to. If you and/or a member of your applicable household are reporting any coverage or are. If you and/or a member of your applicable household are reporting any coverage or are. Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with your form 540, california.

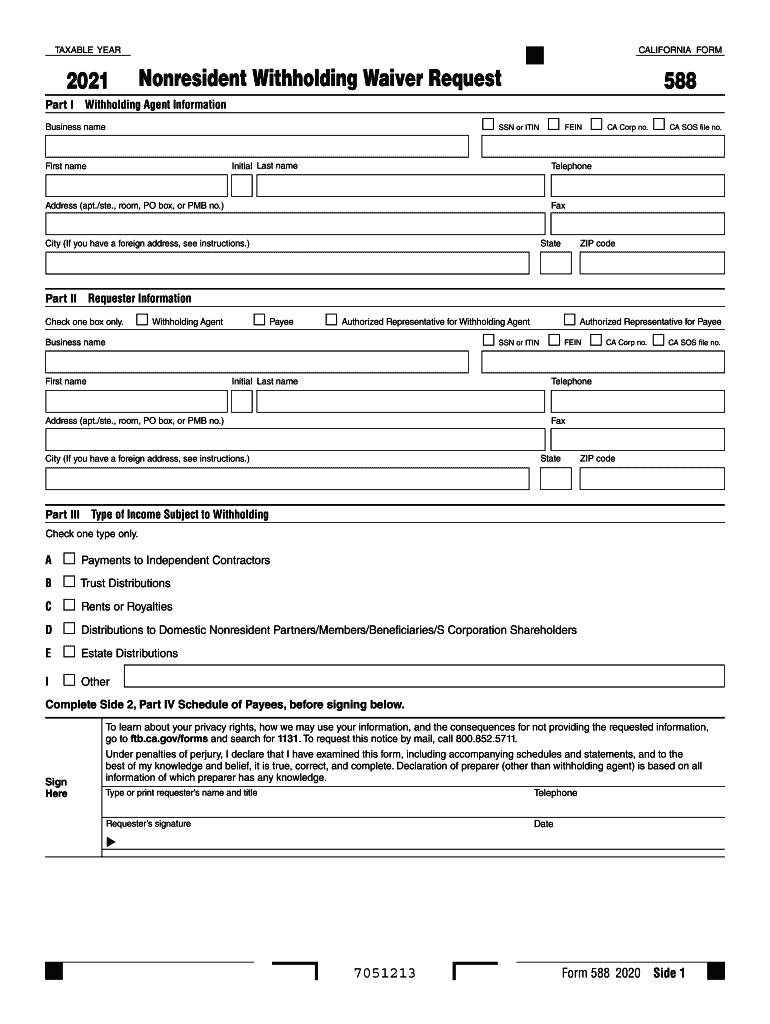

ftb ca 588 Fill out & sign online DocHub

Read the instructions at the top of the form and fill out the required fields. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. Indicate the date to the sample with.

Ca Ftb 540 Instructions Fill and Sign Printable Template Online US

Edit your form 3853 online. Web residents of california must provide this documentation by completing form ftb 3853, a tax form that must be enclosed with your form 540, california resident income tax. Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. Read the.

Edit Your Form 3853 Online.

If you and/or a member of your applicable household are reporting any coverage or are. Web use form ftb 3853 to determine if you owe an individual shared responsibility penalty or to claim exemptions from the state individual health coverage. Web be sure the data you fill in form 3853 is updated and accurate. Web side 1 health coverage exemptions and individual shared responsibility penalty taxable year 2020 california form 3853 attach to your california form.

Web Residents Of California Must Provide This Documentation By Completing Form Ftb 3853, A Tax Form That Must Be Enclosed With Your Form 540, California Resident Income Tax.

In the “name of claimant”. Web starting in 2020, californians who don't have health insurance and who don't qualify for an exemption are subject to pay an individual shared responsibility penalty, or isr. 8/2015 purpose to serve as the primary document to summarize finding of standards compliance monitoring for the community care for the aged and. Web california resident income tax return.

Send California Form 3853 Via Email, Link, Or Fax.

Part iii your ssn or itin: Read the instructions at the top of the form and fill out the required fields. This is only available by request. Web to complete form 3853 or form 3849, follow this navigation path:

Web Up To $40 Cash Back Download The Form 3853 Pdf And Open It In A Pdf Viewer.

Web the california franchise tax board april 1 issued the 2020 instructions for form ftb 3853, health coverage exemptions and individual shared responsibility. 2 months and 15 days past the start of the tax year in which the election is to be effective. Web side 1 part iii coverage and exemptions claimed on your tax return for individuals. Web the organization should submit form 2553: