Form 3520 Online

Form 3520 Online - Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Web form 3520 & instructions: Draw your signature, type it,. Send form 3520 to the. Decedents) file form 3520 with the irs to report: The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. As the title suggests, form 3520 is used by u.s. Web form 709, u.s. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s.

Ad talk to our skilled attorneys by scheduling a free consultation today. Web unlike a tax return, where a tax liability or refund is calculated, form 3520 is an informational return. Sign it in a few clicks. Web form 709, u.s. Decedents) file form 3520 with the irs to report: Type text, add images, blackout confidential details, add comments, highlights and more. The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section. Web what is form 3520? Currently, the irs does not offer an online filing option for form 3520. Certain transactions with foreign trusts, ownership of foreign trusts under the.

Web individual or fiduciary power of attorney declaration (ftb 3520 pit) form; Decedents) file form 3520 with the irs to report: Edit your form 3520 online. Persons (and executors of estates of u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Send form 3520 to the. A calendar year trust is due march 15. Type text, add images, blackout confidential details, add comments, highlights and more. Certain transactions with foreign trusts, ownership of foreign trusts under the. Complete, edit or print tax forms instantly.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Web individual or fiduciary power of attorney declaration (ftb 3520 pit) form; The form must be completed manually and submitted. Ad register and subscribe now to work on your irs form 3520 & more fillable forms. Many americans who interact with a foreign trust are required to file form 3520. Web unlike a tax return, where a tax liability or.

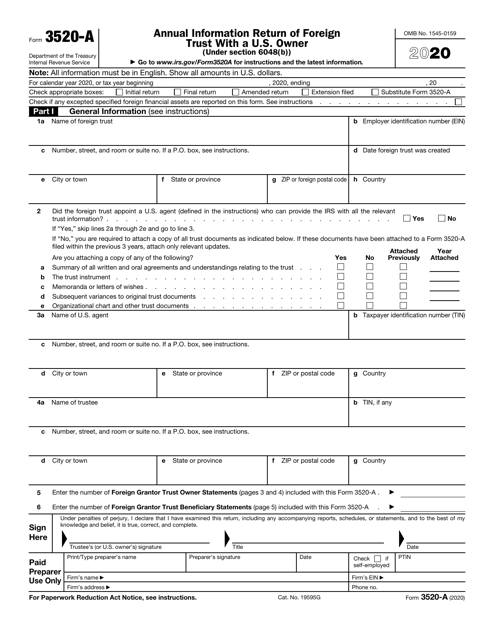

form 3520a 2021 Fill Online, Printable, Fillable Blank

Persons (and executors of estates of u.s. Get ready for tax season deadlines by completing any required tax forms today. Certain transactions with foreign trusts, ownership of foreign trusts under the. The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section. Web form 3520 is a.

Steuererklärung dienstreisen Form 3520

Web form 709, u.s. Web unlike a tax return, where a tax liability or refund is calculated, form 3520 is an informational return. Owner, including recent updates, related forms and instructions on how to file. Ad talk to our skilled attorneys by scheduling a free consultation today. Get ready for tax season deadlines by completing any required tax forms today.

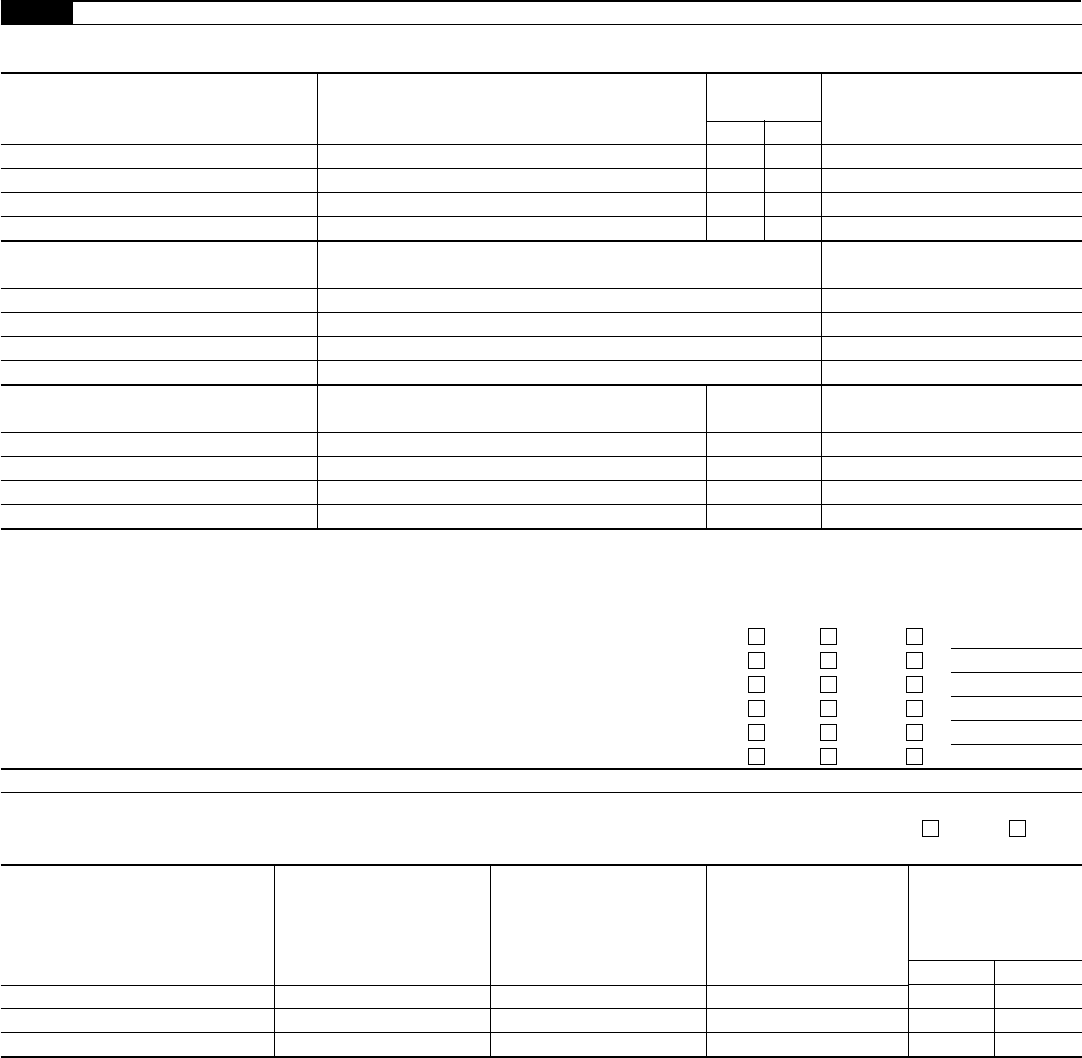

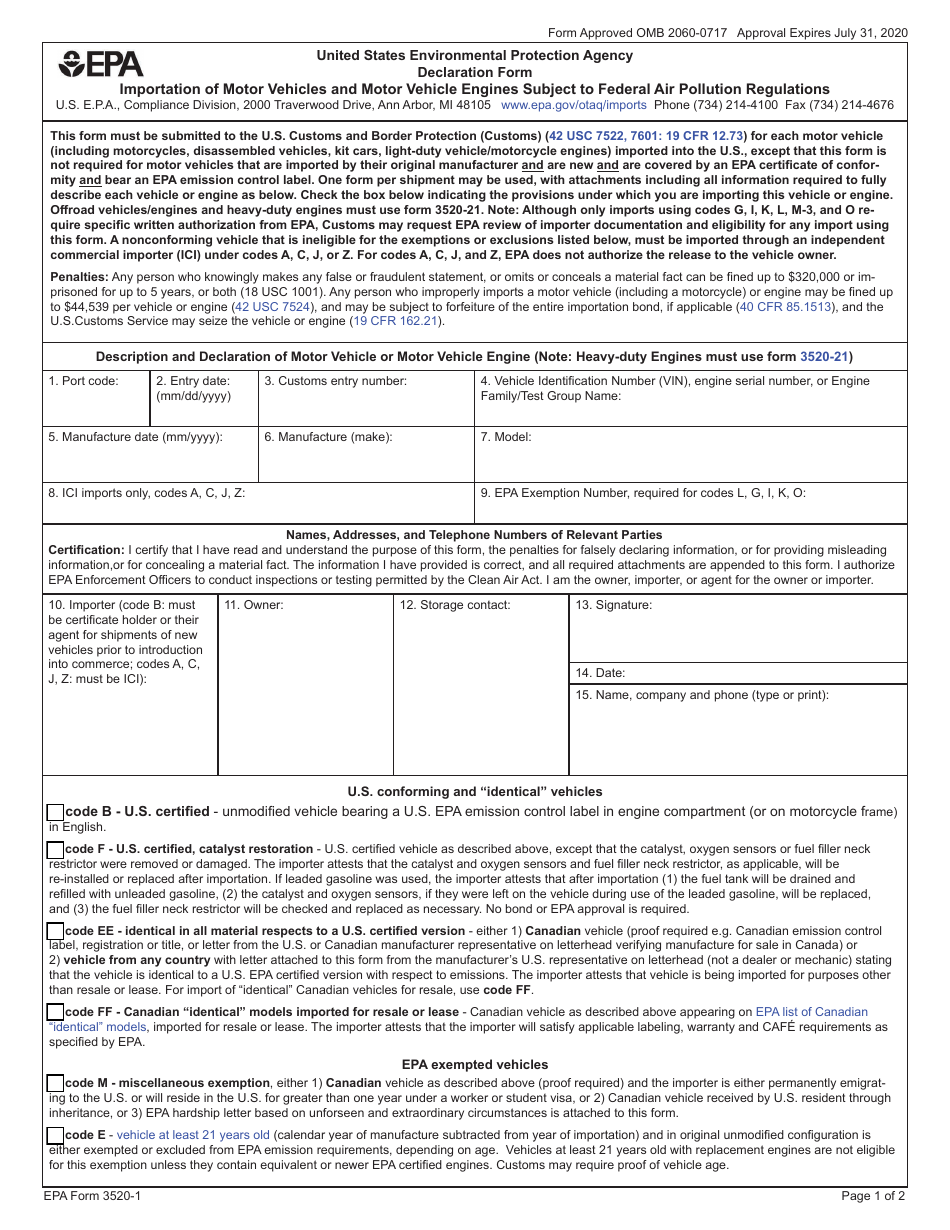

EPA Form 35201 Download Fillable PDF or Fill Online Declaration Form

Get ready for tax season deadlines by completing any required tax forms today. Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Edit your form 3520 online. It does not have to be a “foreign gift.” rather, if a..

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Ad talk to our skilled attorneys by scheduling a free consultation today. Get ready for tax season deadlines by completing any required tax forms today. Web how to file irs form 3520 online? Draw your signature, type it,. Persons (and executors of estates of u.s.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

The form provides information about the foreign trust, its u.s. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Type text, add images, blackout confidential details, add comments, highlights and more. Irs form 3520 is an informational document used to report particular transactions with ownerships of foreign trusts, foreign.

3.21.19 Foreign Trust System Internal Revenue Service

Decedents) file form 3520 with the irs to report: Web what is form 3520? Get ready for tax season deadlines by completing any required tax forms today. The form must be completed manually and submitted. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

IRS Form 3520A Download Fillable PDF or Fill Online Annual Information

The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section. It does not have to be a “foreign gift.” rather, if a. Web form 709, u.s. Sign it in a few clicks. Persons (and executors of estates of u.s.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Web unlike a tax return, where a tax liability or refund is calculated, form 3520 is an informational return. As the title suggests, form 3520 is used by u.s. Web if you have to file form 3520 this year (annual return to report transactions with foreign trusts and receipt of certain foreign gifts), you can do that manually, by. Draw.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Currently, the irs does not offer an online filing option for form 3520. Draw your signature, type it,. Irs form 3520 is an informational document used to report particular transactions with ownerships of foreign trusts, foreign trusts, or if you get some large gifts. Edit your form 3520 online. Owner, including recent updates, related forms and instructions on how to.

The Form Provides Information About The Foreign Trust, Its U.s.

Complete, edit or print tax forms instantly. As the title suggests, form 3520 is used by u.s. It does not have to be a “foreign gift.” rather, if a. Certain transactions with foreign trusts, ownership of foreign trusts under the.

Web Form 3520 & Instructions:

Web form 3520 is a tax form used to report certain transactions involving foreign trusts. The form must be completed manually and submitted. Persons (and executors of estates of u.s. Ad talk to our skilled attorneys by scheduling a free consultation today.

Web Unlike A Tax Return, Where A Tax Liability Or Refund Is Calculated, Form 3520 Is An Informational Return.

Owner, including recent updates, related forms and instructions on how to file. Web how to file irs form 3520 online? Currently, the irs does not offer an online filing option for form 3520. Draw your signature, type it,.

Ad Register And Subscribe Now To Work On Your Irs Form 3520 & More Fillable Forms.

Edit your form 3520 online. Send form 3520 to the. The irs form annual return to report transactions with foreign trusts and receipt of certain foreign gifts in accordance with internal revenue code section. Web individual or fiduciary power of attorney declaration (ftb 3520 pit) form;