Form 3520 Instructions 2022

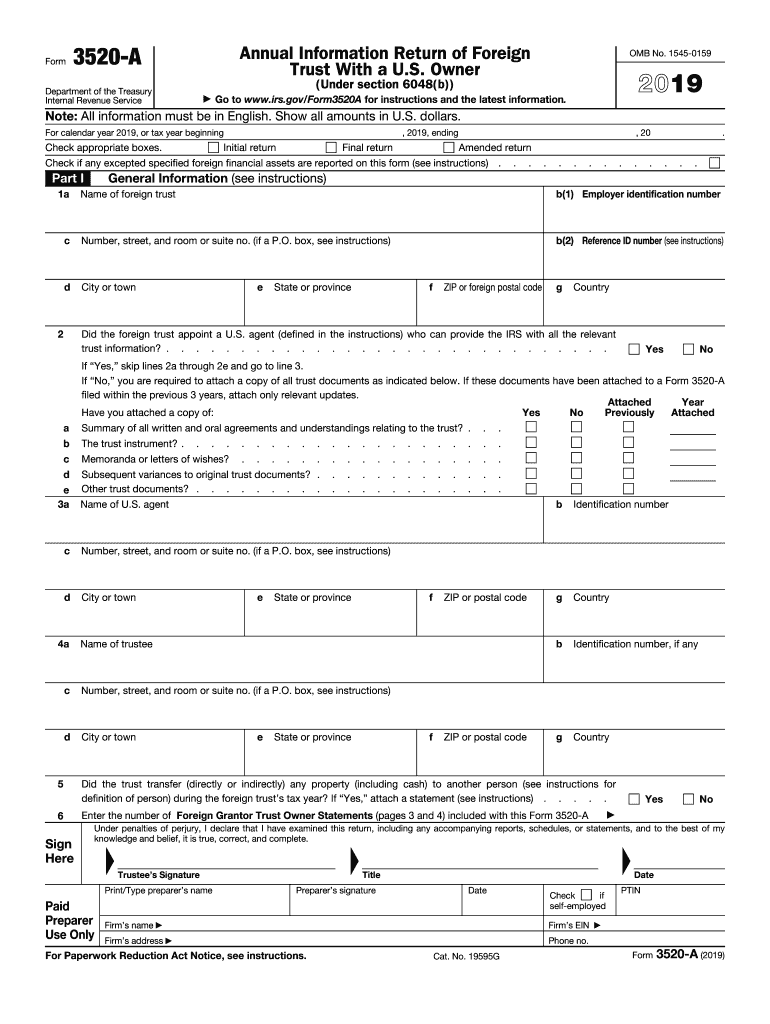

Form 3520 Instructions 2022 - Reminder exemption from information reporting under section. Web form 3520 & instructions: A calendar year trust is due march 15. Owner a foreign trust with at least one u.s. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Annual information return of foreign trust with a u.s. Web the form is due when a person’s tax return is due to be filed. It does not have to be a.

Instructions for form 3520, annual return to report. Reminder exemption from information reporting under section. Web california form 3520 power of attorney identification numbers. Annual information return of foreign trust with a u.s. Instructions for completing ftb 3520:taxpayer. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Web 2022 annual information return of foreign trust with a u.s. It does not have to be a. Owner files this form annually to provide information. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Web form 3520 & instructions: Instructions for form 3520, annual return to report. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain. Owner a foreign trust with at least one u.s. Web download or print the 2022 federal form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign gifts) for free from the federal internal. A calendar year trust is due march 15. Web the form is due when a person’s tax return is due to be filed. Instructions for completing ftb 3520:taxpayer.

Form 3520 (2020) Instructions for Foreign Gifts & Inheritance

Web download or print the 2022 federal form 3520 (annual return to report transactions with foreign trusts and receipt of certain foreign gifts) for free from the federal internal. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax.

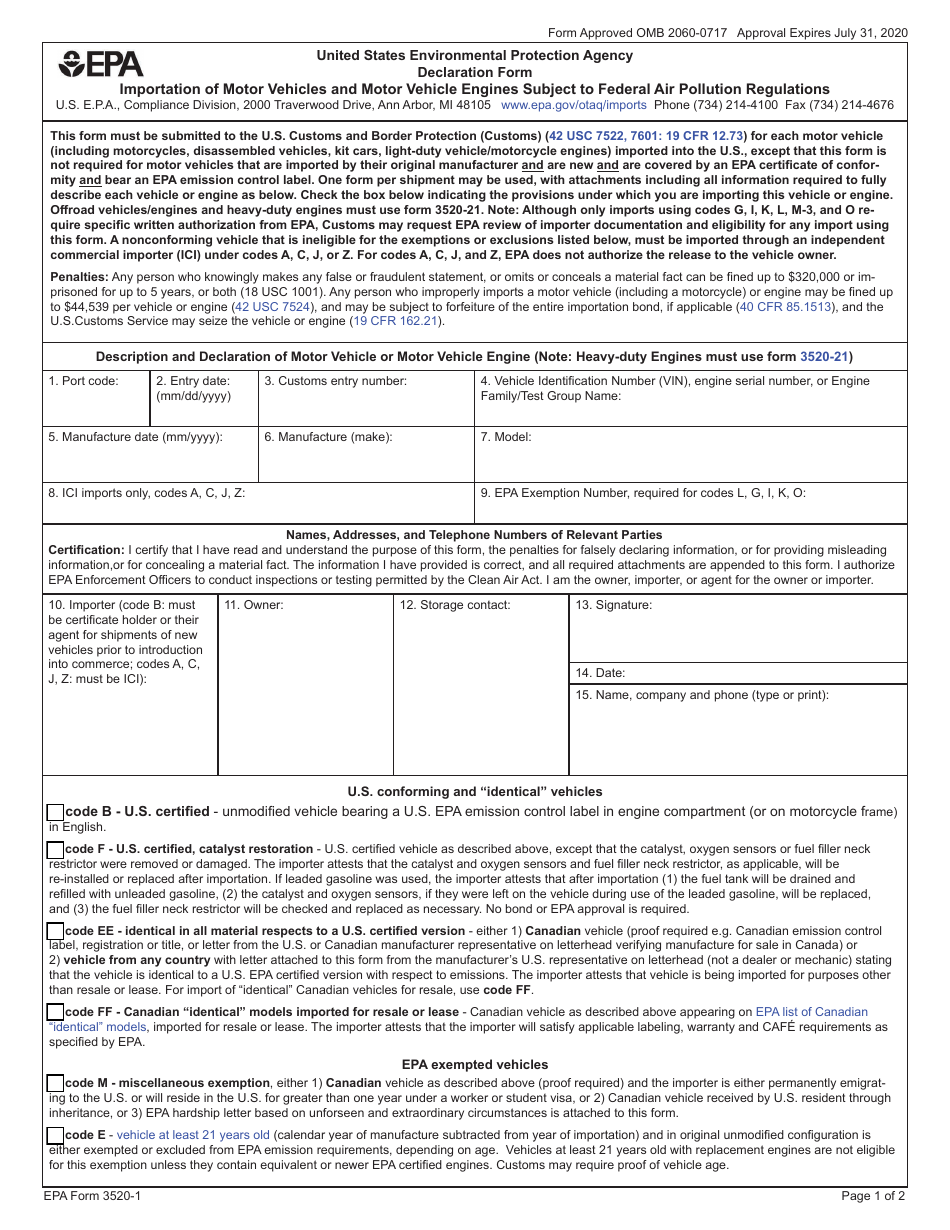

3520 1 Form Fill Online, Printable, Fillable, Blank pdfFiller

Instructions for form 3520, annual return to report. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Owner.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Web california form 3520 power of attorney identification numbers. Reminder exemption from information reporting under section. A calendar year trust is due march 15. Annual information return of foreign trust with a u.s.

Form 3520 Examples and a HowTo Guide to Filing for Americans Living Abroad

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Instructions for form 3520, annual return to report. Web california form 3520 power of attorney identification numbers. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Web 2022 annual information return.

Form 3520 Instructions Fill Out and Sign Printable PDF Template signNow

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person. Web the.

Form 3520 Fill out & sign online DocHub

Instructions for completing ftb 3520:taxpayer. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Owner files this form annually to provide information. Annual information return of foreign trust with a u.s.

Steuererklärung dienstreisen Form 3520

Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Reminder exemption from information reporting under section. Annual information return of foreign trust with a u.s. Owner a foreign trust with at least one u.s. Even if the person.

EPA Form 35201 Download Fillable PDF or Fill Online Declaration Form

Owner 2022 12/19/2022 inst 3520: Instructions for completing ftb 3520:taxpayer. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520. Web california.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

Even if the person does not have to file a tax return, they still must submit the form 3520, if applicable. Owner 2022 12/19/2022 inst 3520: It does not have to be a. Annual information return of foreign trust with a u.s. Web the form is due when a person’s tax return is due to be filed.

F3520 vehicle registration transfer application Australian tutorials

Instructions for completing ftb 3520:taxpayer. Reminder exemption from information reporting under section. Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Solved•by intuit•6•updated november.

Even If The Person Does Not Have To File A Tax Return, They Still Must Submit The Form 3520, If Applicable.

Instructions for form 3520, annual return to report. Reminder exemption from information reporting under section. Owner (under section 6048(b)) department of the treasury internal revenue service go to www.irs.gov/form3520a. Web form 3520 and its instructions, such as legislation enacted after they were published, go to irs.gov/form3520.

Web The Form Is Due When A Person’s Tax Return Is Due To Be Filed.

Solved•by intuit•6•updated november 14, 2022. It does not have to be a. Web form 3520 & instructions: The irs f orm 3520 is used to report a foreign gift, inheritance or trust distribution from a foreign person.

Web 2022 Annual Information Return Of Foreign Trust With A U.s.

Instructions for completing ftb 3520:taxpayer. Owner files this form annually to provide information. Owner a foreign trust with at least one u.s. Annual information return of foreign trust with a u.s.

A Calendar Year Trust Is Due March 15.

Web california form 3520 power of attorney identification numbers. Owner 2022 12/19/2022 inst 3520: Web taxes get your taxes done linyi1985 level 2 need help on filing form 3520 dear turbotax community, 2022 is coming very soon and i hope you will have a great. Web form 3520 is a tax form that us expats must file if they are owners of foreign trusts, make certain transactions with foreign trusts or receive large gifts or inheritances from certain.