Form 2290 Agricultural Vehicles

Form 2290 Agricultural Vehicles - Web and that question is: Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Regular vehicles are reported in the “vehicles except for logging” columns of form 2290. Do your truck tax online & have it efiled to the irs! Web farm vehicles are primarily used for farming and agricultural purposes. Tax season can be a stressful time of year for those who are required to file the form 2290. Web 1 day agophoto courtesty of j. Web irs form 2290: This form is used to report and pay the heavy highway. Agricultural vehicles are vehicles that are used exclusively for farming purposes.

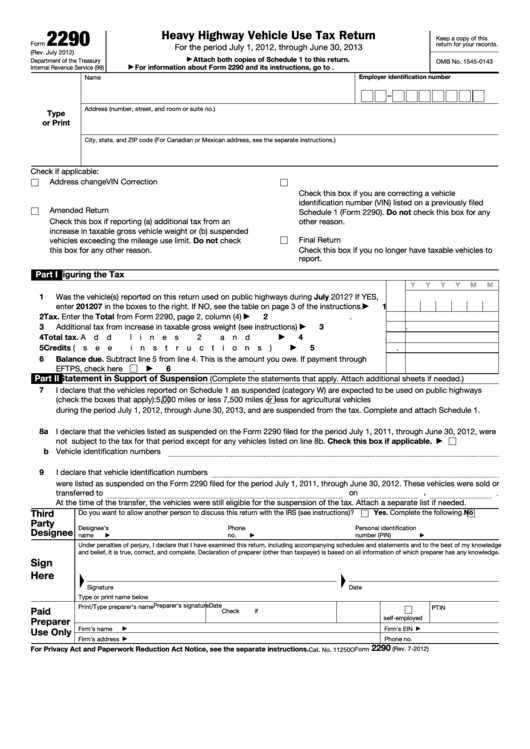

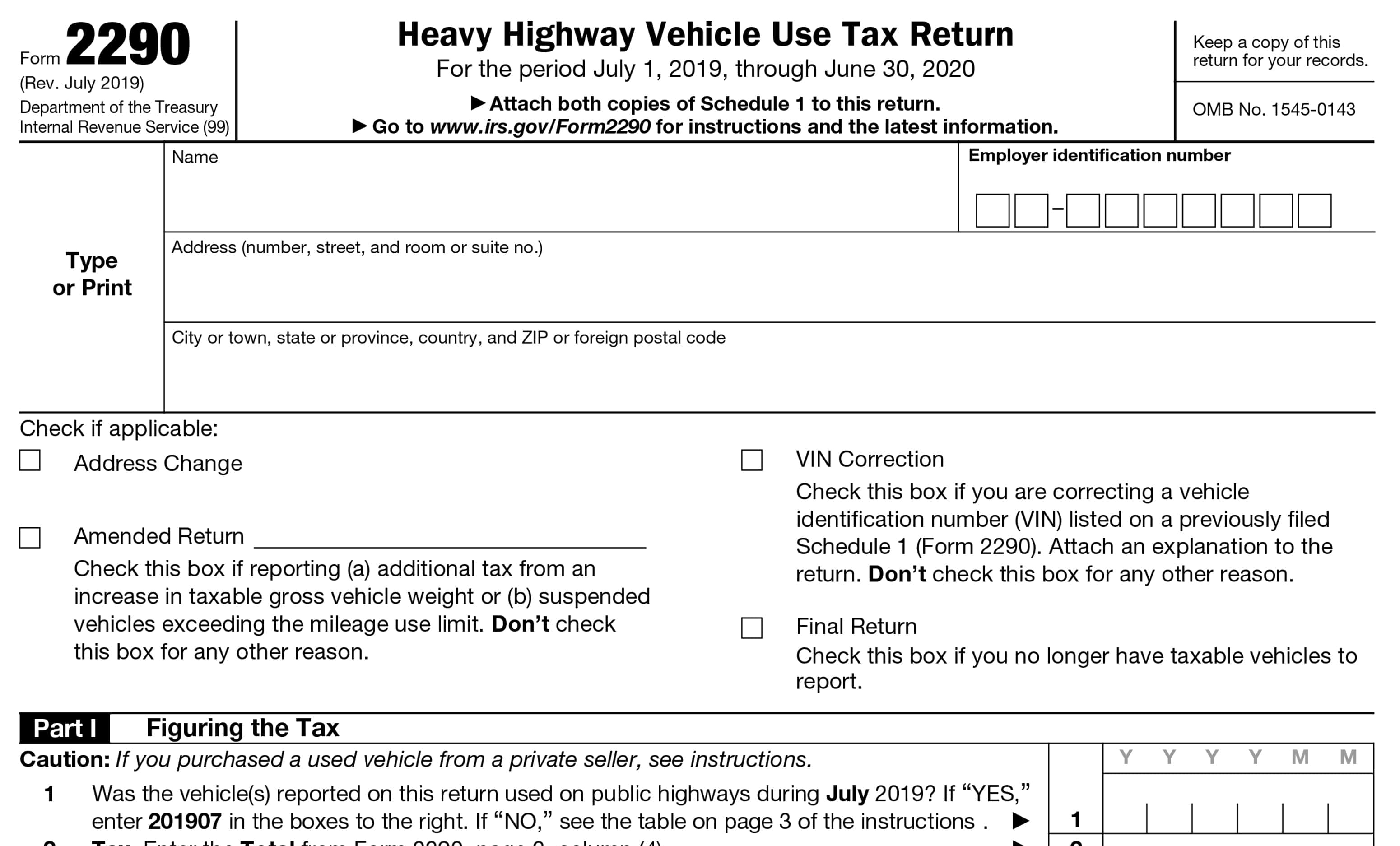

Web i declare that the vehicles reported on schedule 1 as suspended (category w) are expected to be used on public highways (check the boxes that apply): Web if your vehicle goes over, you must file a form 2290 amendment for a mileage increase. You must also report your suspended vehicles with your form 2290. Web and that question is: July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 You only pay taxes on the. Easy, fast, secure & free to try. Web 1 day agophoto courtesty of j. When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy vehicle use tax (hvut) due to agricultural. The amendment is due by the end of the month following the month in.

If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Easy, fast, secure & free to try. Regular hvut 2290 vehicles are used for transportation and commerce purposes. Web to file your vehicle under agricultural vehicle, skip the first “taxable vehicle” section of the 2290, and instead enter your vehicle’s information under the. A special tag or license plate identifying the vehicle is used for farming. Regular vehicles are reported in the “vehicles except for logging” columns of form 2290. Depending on your vehicle type and how you use it, the tax rates and filing requirements vary. Web you may also claim a credit for the tax paid on vehicles that were destroyed, stolen, sold or used 5,000 miles or less, or 7,500 miles or less for agricultural vehicles and use the. What is a form 2290 suspended vehicle? The amendment is due by the end of the month following the month in.

Report An IRS 2290 Suspended Vehicle In Three Easy Steps Blog

If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Web to file your vehicle under agricultural vehicle, skip the first “taxable vehicle” section of the 2290, and instead enter your vehicle’s information under the. Easy, fast, secure & free to try. Tax season can be a stressful.

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax

Web agricultural vehicles are reported in the “logging” columns of form 2290. Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Registered (under state laws) as a highway motor vehicle used for farming purposes for the entire period. Easy,.

Fillable Form 2290 20232024 Create, Fill & Download 2290

Regular vehicles are reported in the “vehicles except for logging” columns of form 2290. This form is used to report and pay the heavy highway. Web figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases and the vehicle falls into a new category; Web to file your vehicle under agricultural vehicle,.

Fillable Form 2290 Heavy Highway Vehicle Use Tax Return printable pdf

Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2022, through june 30, 2023 Easy, fast, secure & free to try. Web if your vehicle goes over, you must file a form 2290.

How to Efile Form 2290 for 202223 Tax Period

Regular vehicles are reported in the “vehicles except for logging” columns of form 2290. Web 1 day agophoto courtesty of j. Depending on your vehicle type and how you use it, the tax rates and filing requirements vary. Web figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases and the vehicle.

File 20222023 Form 2290 Electronically 2290 Schedule 1

Registered (under state laws) as a highway motor vehicle used for farming purposes for the entire period. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. July 2022) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1,.

Understanding Form 2290 StepbyStep Instructions for 20222023

Regular hvut 2290 vehicles are used for transportation and commerce purposes. A heavy vehicle that has been operated for less than 5000 miles (7500 for agricultural vehicles) during the tax year will be. Regular vehicles are reported in the “vehicles except for logging” columns of form 2290. Web 1 day agophoto courtesty of j. Web form 2290 is used to.

Efile Form 2290, for Vehicles first Used in February! Tax 2290 Blog

Web farm vehicles are primarily used for farming and agricultural purposes. Easy, fast, secure & free to try. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy vehicle use tax.

IRS Form 2290 Instructions How to Fill HVUT 2290 Form

Web figure and pay the tax due if, during the period, the taxable gross weight of a vehicle increases and the vehicle falls into a new category; Web irs form 2290: If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. What is a form 2290 suspended vehicle?.

Form 2290 Due Now for Vehicles First Used in August 2020! Tax 2290 Blog

Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Regular hvut 2290 vehicles are used for transportation and commerce purposes. Web 1.

Tax Season Can Be A Stressful Time Of Year For Those Who Are Required To File The Form 2290.

Regular hvut 2290 vehicles are used for transportation and commerce purposes. What is a form 2290 suspended vehicle? Web and that question is: Web file form 2290 for any taxable vehicles first used on a public highway during or after july 2022 by the last day of the month following the month of first use.

Ad Get Schedule 1 In Minutes, Your Form 2290 Is Efiled Directly To The Irs.

Web you may also claim a credit for the tax paid on vehicles that were destroyed, stolen, sold or used 5,000 miles or less, or 7,500 miles or less for agricultural vehicles and use the. 5,000 miles or less 7,500. Web if your vehicle goes over, you must file a form 2290 amendment for a mileage increase. When filing your form 2290, you'll need to indicate that your vehicle is exempt from the heavy vehicle use tax (hvut) due to agricultural.

Web Form 2290 Is Used To Report Vehicles With A Taxable Weight Of 50,000 Pounds Or More.

Regular vehicles are reported in the “vehicles except for logging” columns of form 2290. A heavy vehicle that has been operated for less than 5000 miles (7500 for agricultural vehicles) during the tax year will be. If your vehicle weighs 55,000 pounds or more, you may need to file a form 2290 and pay heavy vehicle use taxes. Do your truck tax online & have it efiled to the irs!

Web I Declare That The Vehicles Reported On Schedule 1 As Suspended (Category W) Are Expected To Be Used On Public Highways (Check The Boxes That Apply):

Web agricultural vehicles are reported in the “logging” columns of form 2290. Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Web 1 day agophoto courtesty of j. Web agricultural an agricultural vehicle is defined as a vehicle used exclusively for farming purposes and registered as a highway motor vehicle that is used.