Form 204 Colorado

Form 204 Colorado - Web form 104 is the general, and simplest, income tax return for individual residents of colorado. You may file by mail with paper forms or efile online (contains forms dr 0104, dr. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: Form dr 0077 certification of. Web this form and all supporting documents shall be submitted to the executive director of the department of revenue within 30 days from the payment date of the late fee. Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web colorado composite nonresident income tax return form dr 1316*—colorado source capital gain affidavit form dr 5785*—authorization for electronic funds transfer (eft). Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Start filing your tax return now :

Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Start filing your tax return now : Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web we last updated colorado form dr 0204 in january 2023 from the colorado department of revenue. Web this form and all supporting documents shall be submitted to the executive director of the department of revenue within 30 days from the payment date of the late fee. Generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web colorado composite nonresident income tax return form dr 1316*—colorado source capital gain affidavit form dr 5785*—authorization for electronic funds transfer (eft). You need to fill out form 204 to. Instructions | dr 0104 | related forms tax.colorado.gov.

Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web dmv forms and documents. In colorado, a person may be released early from probation at. Form dr 0077 certification of. You need to fill out form 204 to. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Instructions | dr 0104 | related forms tax.colorado.gov. Web printable colorado income tax form 204. Form dr 0716 statement of nonprofit church, synagogue, or organization;

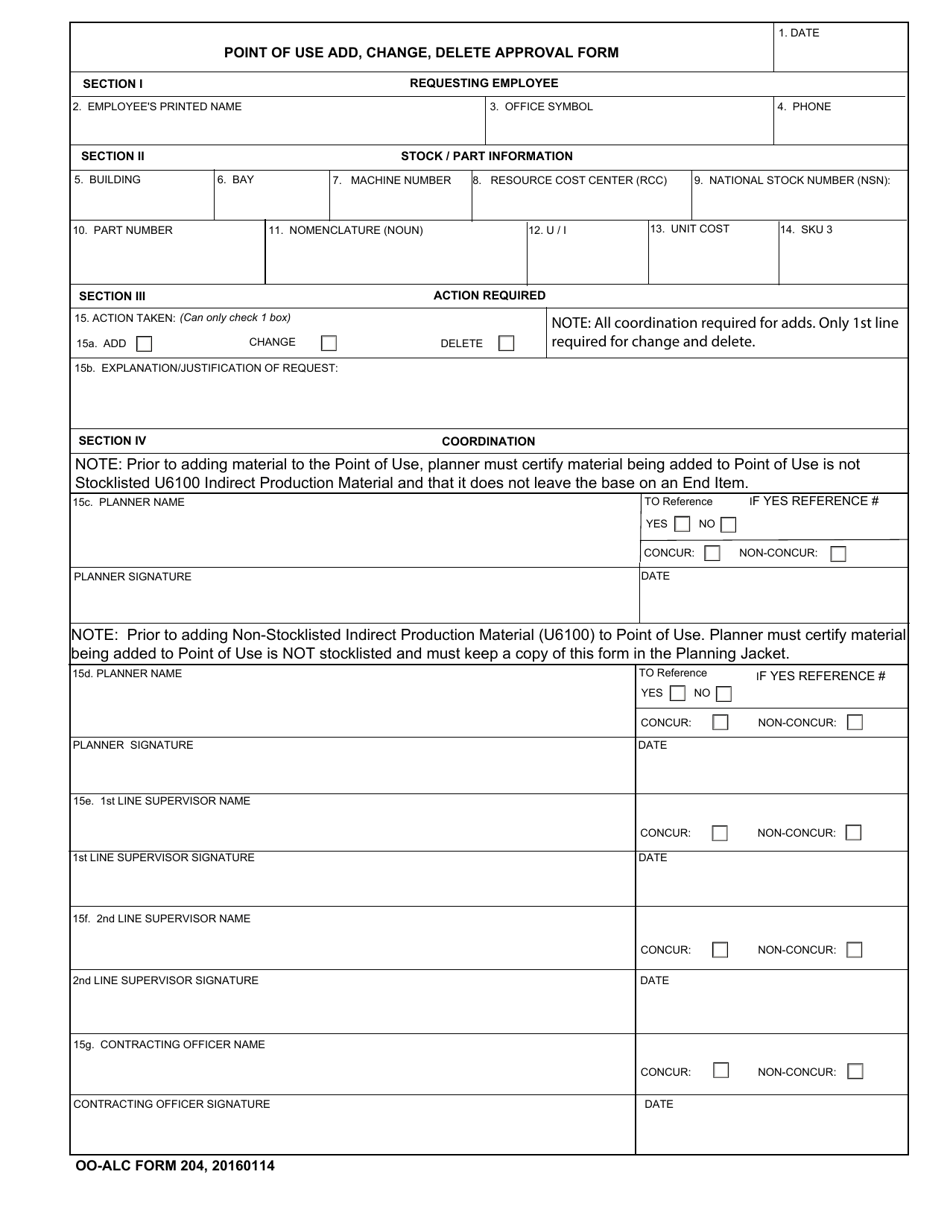

OOALC Form 204 Download Fillable PDF or Fill Online Point of Use Add

Form dr 0716 statement of nonprofit church, synagogue, or organization; This form is for income earned in tax year 2022, with tax returns due in april. Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web we last updated.

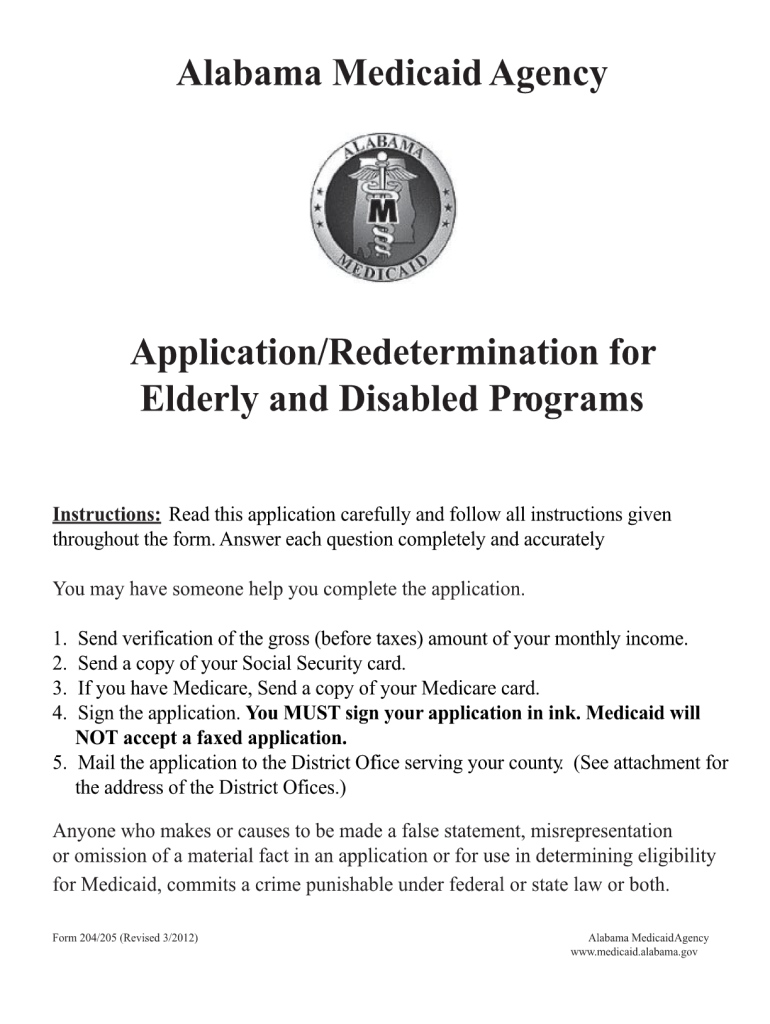

2012 AL Form 204/205 Fill Online, Printable, Fillable, Blank pdfFiller

Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022. Web printable colorado income tax form 204. Start filing your tax return now : Web this form and all supporting documents shall be submitted to the executive director of the department of revenue within 30 days from the payment date of the late fee..

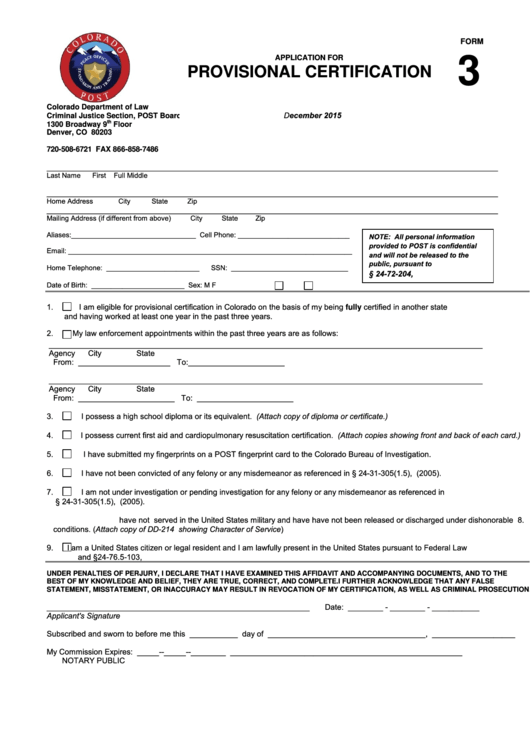

Fillable Form 3 Application For Provisional Certification Colorado

Web colorado department of revenue division of motor vehicles registration section www.colorado.gov/revenue fleet owners request for common registration expiration. Web dmv forms and documents. This form is for income earned in tax year 2022, with tax returns due in april. Web colorado secretary of state Web form 104 is the general, and simplest, income tax return for individual residents of.

2165 County Road 204, Durango, CO 81301 4 Bed, 4 Bath SingleFamily

License forms and documents by name. All forms and documents in number order. Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. The estimated tax penalty will not be. Web form dr 0004 is the new colorado employee withholding certificate that is available.

Historic Shooks Run Middle Shooks Run Neighborhood Association

License forms and documents by name. All forms and documents in number order. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Instructions | dr 0104 | related forms tax.colorado.gov. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes:

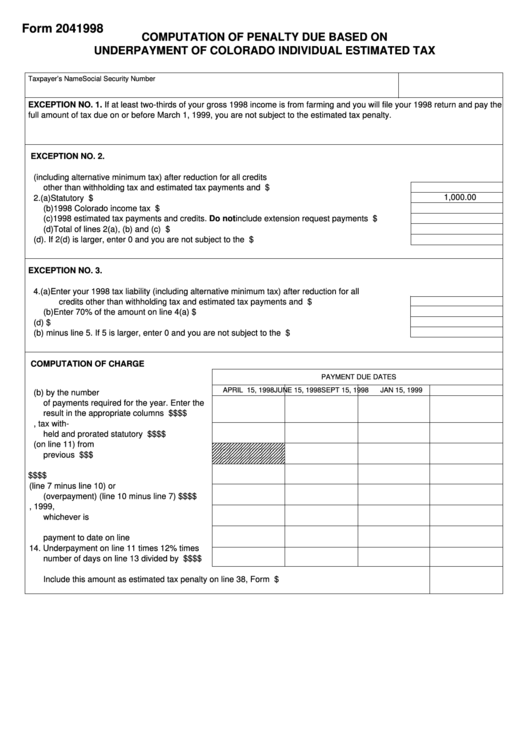

Fillable Form 204 Computation Of Penalty Due Based On Underpayment Of

If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web we last updated.

CROWNING GLORY BY ARIEL 5641 N Academy Blvd, Colorado Springs, CO Yelp

If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. You need to fill out form 204 to. In colorado, a person may be released early from probation at. Web we last updated colorado form dr 0204 in january 2023 from the colorado department.

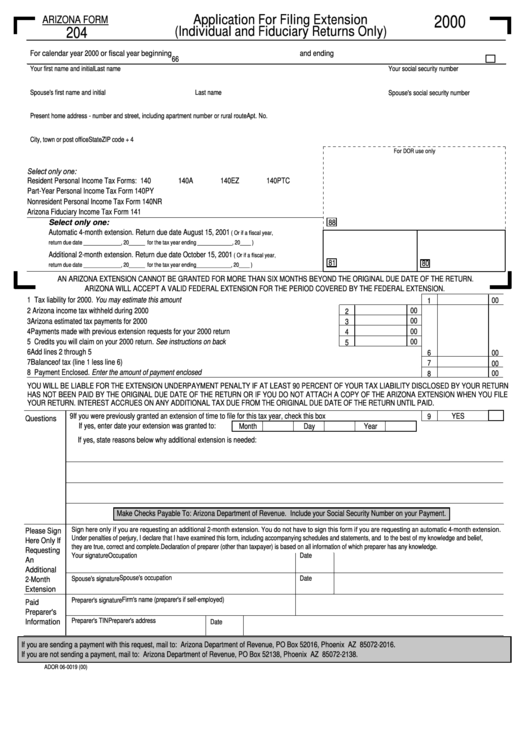

Form 204 Application For Filing Extension (Individual And Fiduciary

Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner. Web tax forms, colorado form 104. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: Web we last updated colorado form.

204 Colorado Blvd, Glendive, MT 59330 The Plainview Apartments

If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. The estimated tax penalty will not be. You may file by mail with paper forms or efile online (contains forms dr 0104, dr. All forms and documents in number order. Web instructions for dr.

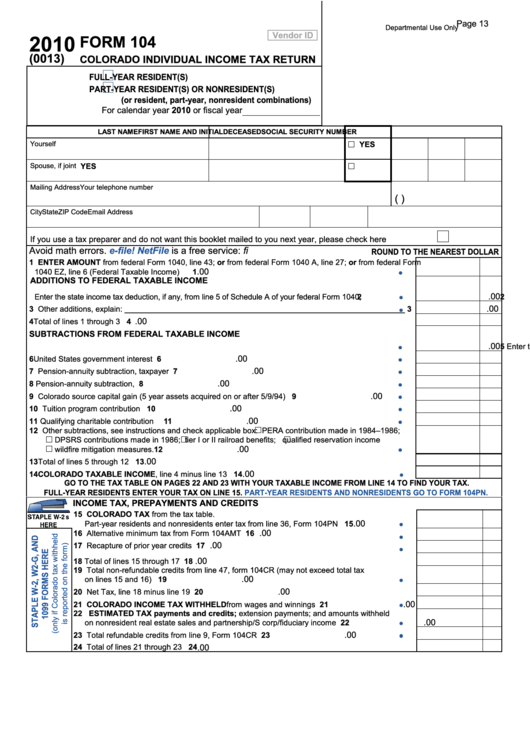

Form 104 Colorado Individual Tax Return 2010 printable pdf

Instructions | dr 0104 | related forms tax.colorado.gov. Form dr 0716 statement of nonprofit church, synagogue, or organization; Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. The estimated tax penalty will not be. Web tax forms, colorado form 104.

Instructions | Dr 0104 | Related Forms Tax.colorado.gov.

Web colorado secretary of state Web this form and all supporting documents shall be submitted to the executive director of the department of revenue within 30 days from the payment date of the late fee. Form dr 0716 statement of nonprofit church, synagogue, or organization; Web colorado composite nonresident income tax return form dr 1316*—colorado source capital gain affidavit form dr 5785*—authorization for electronic funds transfer (eft).

Start Filing Your Tax Return Now :

If you failed to pay or underpaid your estimated income taxes the previous tax year, you need to fill out form 204 to calculate and pay. The estimated tax penalty will not be. In colorado, a person may be released early from probation at. You need to fill out form 204 to.

Web Colorado Department Of Revenue Division Of Motor Vehicles Registration Section Www.colorado.gov/Revenue Fleet Owners Request For Common Registration Expiration.

You may file by mail with paper forms or efile online (contains forms dr 0104, dr. License forms and documents by name. Web individual taxpayers can use the following schedule, taken from part 4 of form 204, to calculate their required quarterly estimated payments using the annualized income. Web form dr 0004 is the new colorado employee withholding certificate that is available for 2022.

Generally You Are Subject To An Estimated Tax Penalty If Your Current Year Estimated Tax Payments Are Not Paid In A Timely Manner.

All forms and documents in number order. Web form 104 is the general, and simplest, income tax return for individual residents of colorado. Web colorado individual income tax filing guide mailing address for form dr 0104 104 book 2021 booklet includes: Web instructions for dr 0204 part 1 generally you are subject to an estimated tax penalty if your current year estimated tax payments are not paid in a timely manner.