Form 15G H

Form 15G H - Web tax will be deducted from the dividend at the time of payment by the company/mutual fund house if the total amount paid to the individual during the financial. Persons with a hearing or speech disability with access to. Web answer (1 of 13): Citizens aged above 60 years are. Form 15g/h are forms which customers can. Web form 15g and form 15h are self declaration forms that are required to be submitted for nil or lower deduction of tds on interest or certain other incomes. Web while form 15g is for individuals below 60 years, form 15h is for individuals above 60 years of age. 60 years or above at any time during the year but below the age of 80 years. Form 15g and form 15h are forms you can submit to make sure tds is not deducted on your income if you meet the conditions mentioned below. If you are unaware of your financial.

Form 15g and form 15h are forms you can submit to make sure tds is not deducted on your income if you meet the conditions mentioned below. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit form 15g before the. You must be a resident individual or senior citizen holding savings / salary account (s) and deposit (s). Web use form 15g or 15h to avoid tds if your total income is not taxable. If you are unaware of your financial. Web form 15g and form 15h are self declaration forms that are required to be submitted for nil or lower deduction of tds on interest or certain other incomes. Web answer (1 of 13): The latest form 15g and form 15h allows you to avoid tds deduction for the interest earned during the financial year. If your total income falls below the taxable limit and you. Persons with a hearing or speech disability with access to.

If your total income falls below the taxable limit and you. Web use form 15g or 15h to avoid tds if your total income is not taxable. Form 15g and form 15h are forms you can submit to make sure tds is not deducted on your income if you meet the conditions mentioned below. Web form 15g and form 15h are documents that declare your income is below the minimum tax slab for the particular financial year. Notably, pan is mandatory to avail the tax benefits. 60 years or above at any time during the year but below the age of 80 years. Web answer (1 of 13): Form 15g is for those who are. One can submit these forms only when the tax on the total. You must be a resident individual or senior citizen holding savings / salary account (s) and deposit (s).

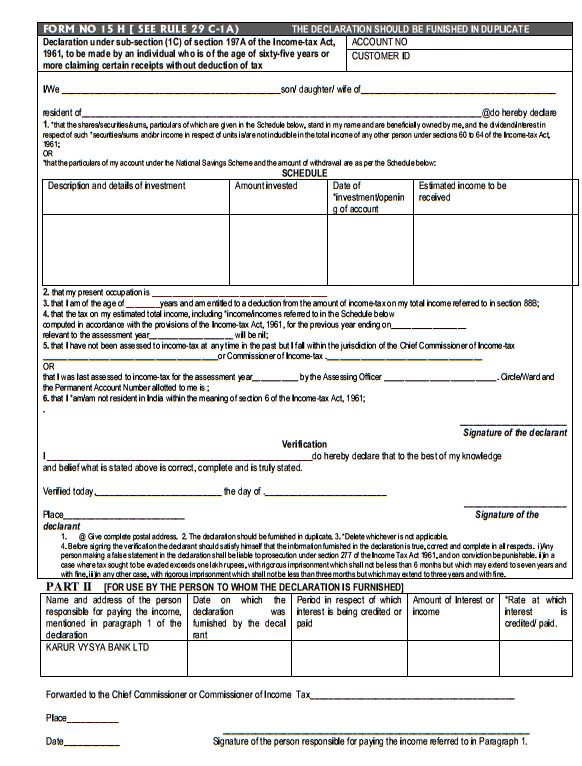

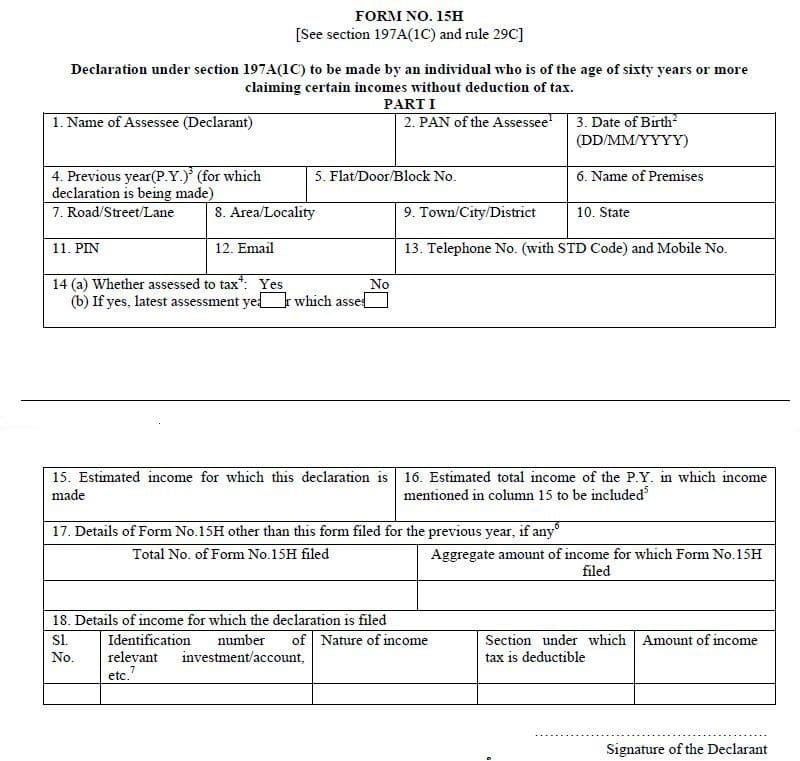

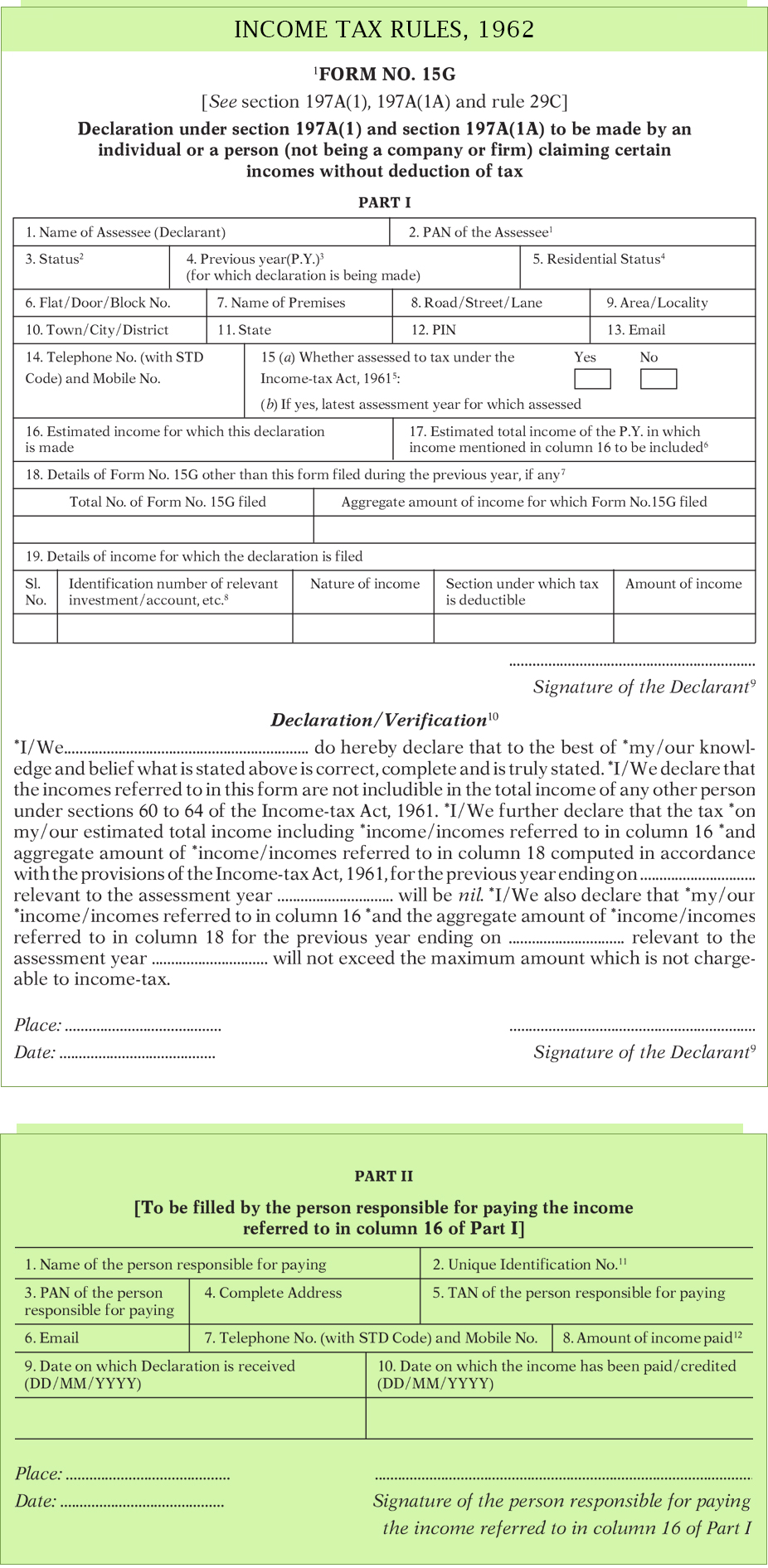

Form 15H (Save TDS on Interest How to Fill & Download

If you are unaware of your financial. Web forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income. 60 years or above at any time during the year but below the age of 80 years. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the.

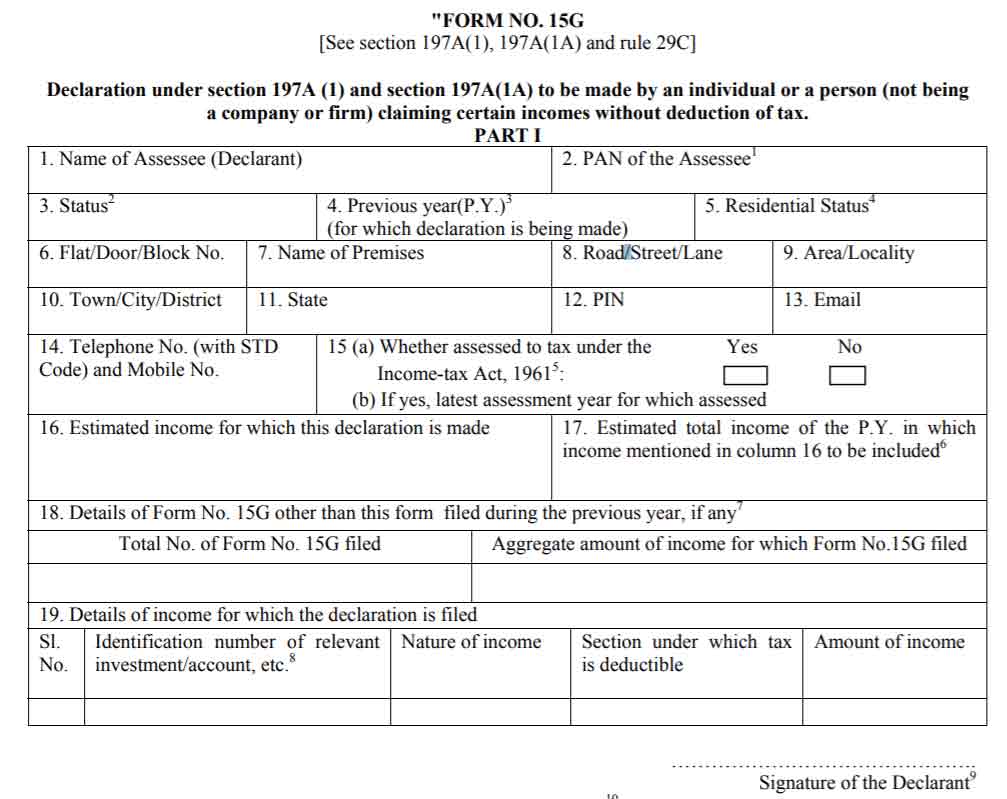

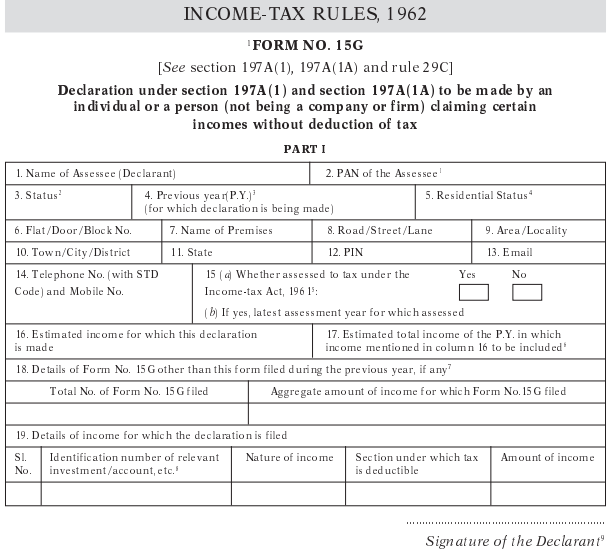

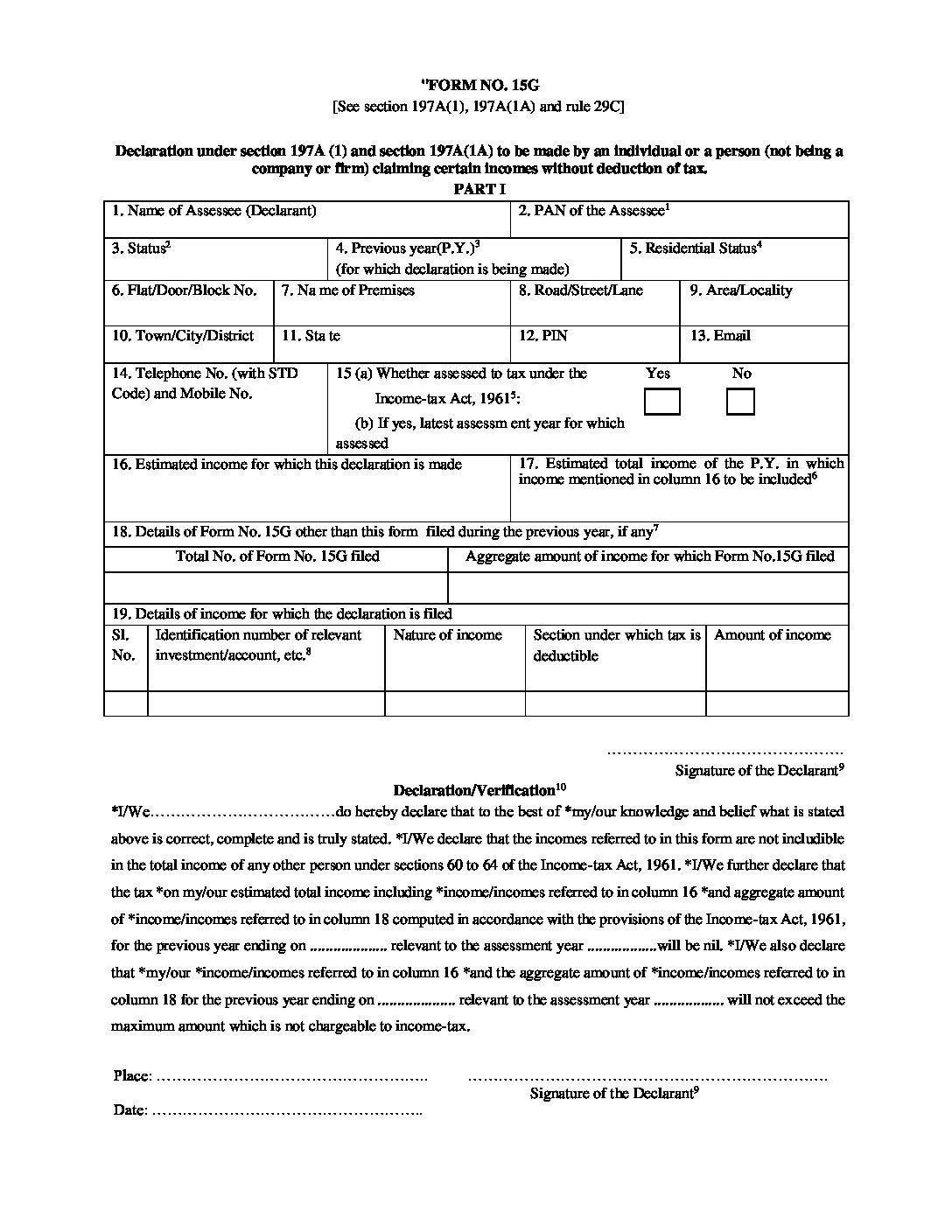

Free Download Form 15g In Word Format

Senior citizen (individual) indian resident. 60 years or above at any time during the year but below the age of 80 years. 2 min read 01 apr 2019, 06:45 am ist shaikh zoaib saleem. You must be a resident individual or senior citizen holding savings / salary account (s) and deposit (s). Web form 15g and 15h an indian citizen.

Form 15G/H Karur Vysya Bank 2021 2022 Student Forum

Web answer (1 of 13): Web form 15g and form 15h are documents that declare your income is below the minimum tax slab for the particular financial year. Web use form 15g or 15h to avoid tds if your total income is not taxable. 2 min read 01 apr 2019, 06:45 am ist shaikh zoaib saleem. Web form 15g and.

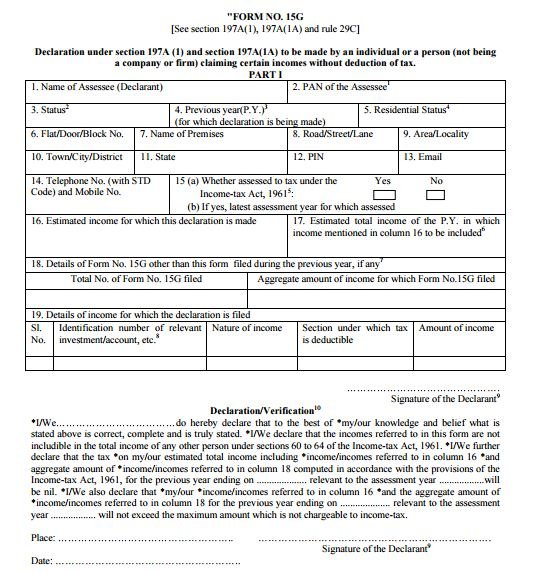

How To Fill Form 15G And 15H ★ Filled Form 15G Sample ★ Form 15H Sample

Citizens aged above 60 years are. Persons with a hearing or speech disability with access to. The latest form 15g and form 15h allows you to avoid tds deduction for the interest earned during the financial year. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit.

Form 15g In Word Format

The latest form 15g and form 15h allows you to avoid tds deduction for the interest earned during the financial year. Web use form 15g or 15h to avoid tds if your total income is not taxable. Web tax will be deducted from the dividend at the time of payment by the company/mutual fund house if the total amount paid.

KnowHow To Download and Fill Form 15G Online & Offline

Persons with a hearing or speech disability with access to. You must have an operational. Form 15g/h are forms which customers can. Form 15g is for those who are. Citizens aged above 60 years are.

Form 15G and 15H to avoid TDS My Career Growth

Web use form 15g or 15h to avoid tds if your total income is not taxable. Form 15g/h are forms which customers can. Persons with a hearing or speech disability with access to. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit form 15g before the..

Download Form 15G for PF Withdrawal 2022

Web tax will be deducted from the dividend at the time of payment by the company/mutual fund house if the total amount paid to the individual during the financial. One can submit these forms only when the tax on the total. 60 years or above at any time during the year but below the age of 80 years. Web forms.

Breanna Withdrawal Form 15g Part 2 Filled Sample

Citizens aged above 60 years are. Web answer (1 of 13): 2 min read 01 apr 2019, 06:45 am ist shaikh zoaib saleem. Web forms 15g & 15h. Web form 15g and 15h an indian citizen who wants exemption from tds deduction on the interest earned from their deposits should submit form 15g before the.

Web Answer (1 Of 13):

If you are unaware of your financial. Notably, pan is mandatory to avail the tax benefits. Web tax will be deducted from the dividend at the time of payment by the company/mutual fund house if the total amount paid to the individual during the financial. Form 15g and form 15h are forms you can submit to make sure tds is not deducted on your income if you meet the conditions mentioned below.

Web Forms 15G & 15H.

Senior citizen (individual) indian resident. The latest form 15g and form 15h allows you to avoid tds deduction for the interest earned during the financial year. Citizens aged above 60 years are. You must have an operational.

Web Form 15G And 15H An Indian Citizen Who Wants Exemption From Tds Deduction On The Interest Earned From Their Deposits Should Submit Form 15G Before The.

Web while form 15g is for individuals below 60 years, form 15h is for individuals above 60 years of age. Web form 15g and form 15h are documents that declare your income is below the minimum tax slab for the particular financial year. If your total income falls below the taxable limit and you. You must be a resident individual or senior citizen holding savings / salary account (s) and deposit (s).

60 Years Or Above At Any Time During The Year But Below The Age Of 80 Years.

Web form 15g and form 15h are self declaration forms that are required to be submitted for nil or lower deduction of tds on interest or certain other incomes. One can submit these forms only when the tax on the total. Form 15g/h are forms which customers can. Web forms 15g and 15h are declaration forms that can help you prevent tds on your fixed deposit interest income.