Form 140 7000

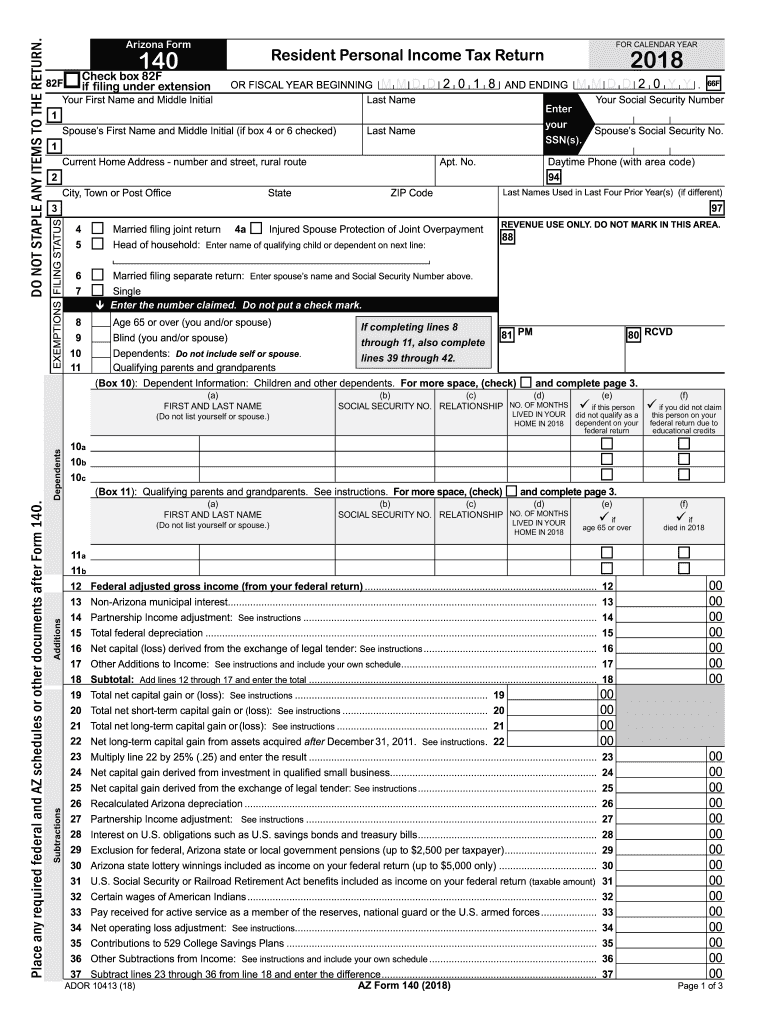

Form 140 7000 - Versacheck blank checks work perfectly. Web personal income tax return filed by resident taxpayers. How you know you owe the penalty You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. If so, can you send me a link. Web high volume check paper. Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. The latest technologies high quality electronic pubs and forms view u.s. Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income Until then, you can also use the 09/30/20 and 05/09/18 editions.

If so, can you send me a link. Web high volume check paper. Versacheck blank checks work perfectly. We are proud to offer the widest selection of check paper online with a variety of optional security options for additional security. You must use form 140 if any of the following apply: How you know you owe the penalty You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web army da administrative publications and forms by the army publishing directorate apd. Until then, you can also use the 09/30/20 and 05/09/18 editions. Army regulations and da forms.

Web high volume check paper. Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. Web the dishonored check or other form of payment penalty applies if you don’t have enough money in your bank account to cover the payment you made for the tax you owe. 7200m marble business voucher checks. Until then, you can also use the 09/30/20 and 05/09/18 editions. We are proud to offer the widest selection of check paper online with a variety of optional security options for additional security. You must use form 140 if any of the following apply: The latest technologies high quality electronic pubs and forms view u.s. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid. Army regulations and da forms.

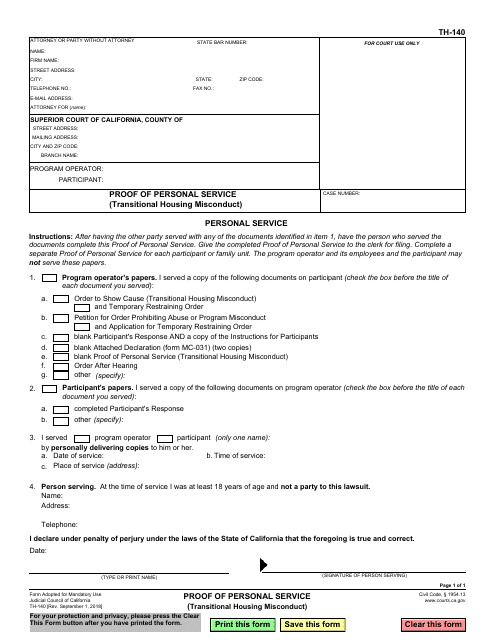

Form TH140 Download Fillable PDF or Fill Online Proof of Personal

Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income Army regulations and da forms. Versacheck blank checks work perfectly. Until then, you can also use the 09/30/20 and 05/09/18 editions. You must use form 140 if any of the following apply:

Fill Free fillable Insformi140 Form I140 PDF form

The latest technologies high quality electronic pubs and forms view u.s. Web high volume check paper. Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. Web the dishonored check or other form of payment penalty applies if you don’t have enough money in your bank account to.

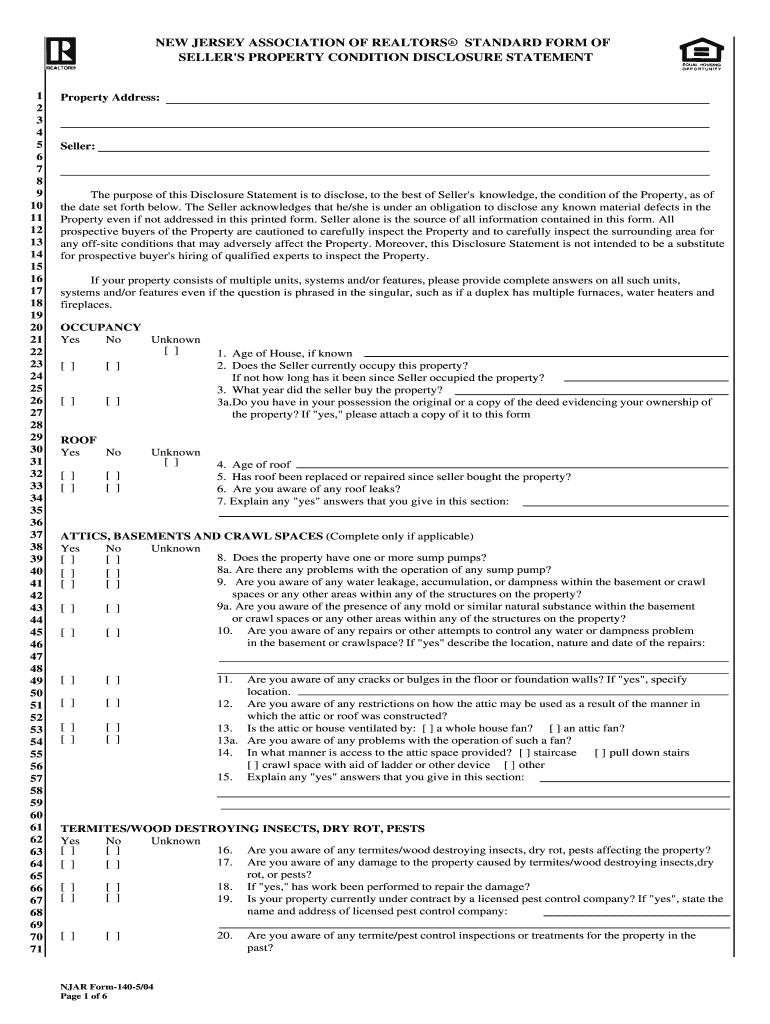

NJAR Form140 2004 Fill and Sign Printable Template Online US Legal

7200m marble business voucher checks. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid. Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. Web high volume check paper. Web personal income tax return filed by resident taxpayers.

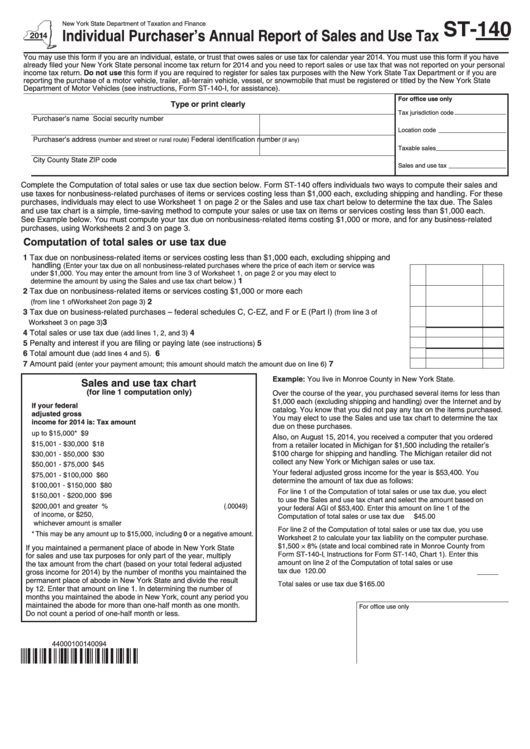

Form St140 Individual Purchaser'S Annual Report Of Sales And Use Tax

The latest technologies high quality electronic pubs and forms view u.s. Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. Web personal income tax return filed by resident taxpayers. Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income.

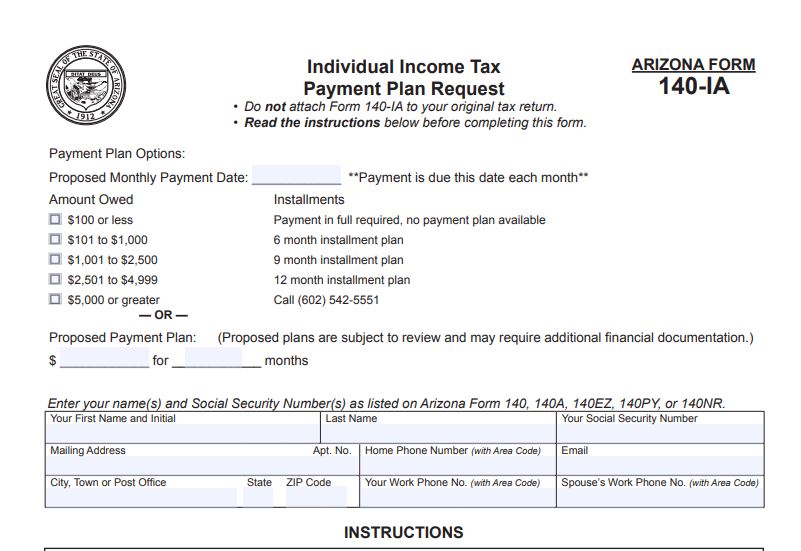

ADOR reminds taxpayers they have options to help them pay their state

Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. Web personal income tax return filed by resident taxpayers. If so, can you send me a link. Web the dishonored check or other form of payment penalty applies if you don’t have enough money in your bank account.

Ch 140 Printable Fill Online, Printable, Fillable, Blank pdfFiller

Until then, you can also use the 09/30/20 and 05/09/18 editions. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Army regulations and da forms. Please endorse here do not.

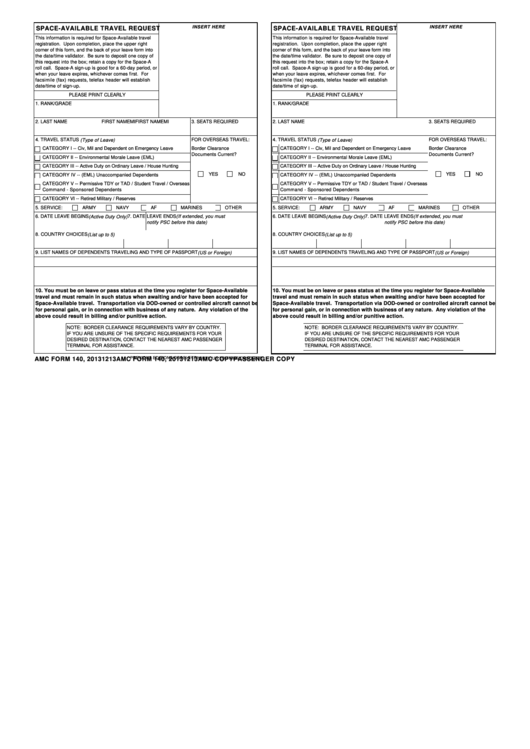

Fillable Amc Form 140 SpaceAvailable Travel Request printable pdf

If so, can you send me a link. We are proud to offer the widest selection of check paper online with a variety of optional security options for additional security. The latest technologies high quality electronic pubs and forms view u.s. Web army da administrative publications and forms by the army publishing directorate apd. Web the dishonored check or other.

Das 140 Forms amulette

Until then, you can also use the 09/30/20 and 05/09/18 editions. You must use form 140 if any of the following apply: Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income For checks printed with checksoft, order envelope. We are proud to offer the widest selection of check paper online with.

Printable Az 140 Tax Form Printable Form 2022

How you know you owe the penalty Until then, you can also use the 09/30/20 and 05/09/18 editions. The latest technologies high quality electronic pubs and forms view u.s. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid. You may file form 140 only if you (and your spouse, if married filing a.

Fill Free fillable I140 Form I140 PDF form

7200m marble business voucher checks. Web the dishonored check or other form of payment penalty applies if you don’t have enough money in your bank account to cover the payment you made for the tax you owe. Until then, you can also use the 09/30/20 and 05/09/18 editions. We are proud to offer the widest selection of check paper online.

Your Bank Dishonors And Returns Your Bad Check Or Electronic Payment And Declares The Amount Unpaid.

Web army da administrative publications and forms by the army publishing directorate apd. You may file form 140 only if you (and your spouse, if married filing a joint return) are full year residents of arizona. Web high volume check paper. The latest technologies high quality electronic pubs and forms view u.s.

7200M Marble Business Voucher Checks.

We are proud to offer the widest selection of check paper online with a variety of optional security options for additional security. Web the dishonored check or other form of payment penalty applies if you don’t have enough money in your bank account to cover the payment you made for the tax you owe. Please endorse here do not write, stamp or sign below this line reserved for financial institution use * this document includes the. Until then, you can also use the 09/30/20 and 05/09/18 editions.

For Checks Printed With Checksoft, Order Envelope.

You must use form 140 if any of the following apply: Versacheck blank checks work perfectly. If so, can you send me a link. Army regulations and da forms.

Web Personal Income Tax Return Filed By Resident Taxpayers.

How you know you owe the penalty Starting july 9, 2023, we will accept only the 05/31/22 edition. Your arizona taxable income is $50,000 or more, regardless of filing status you are making adjustments to income