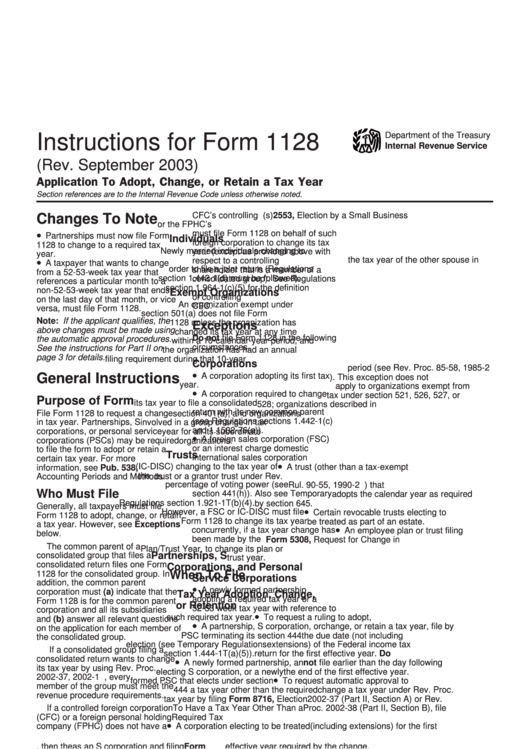

Form 1128 Instructions

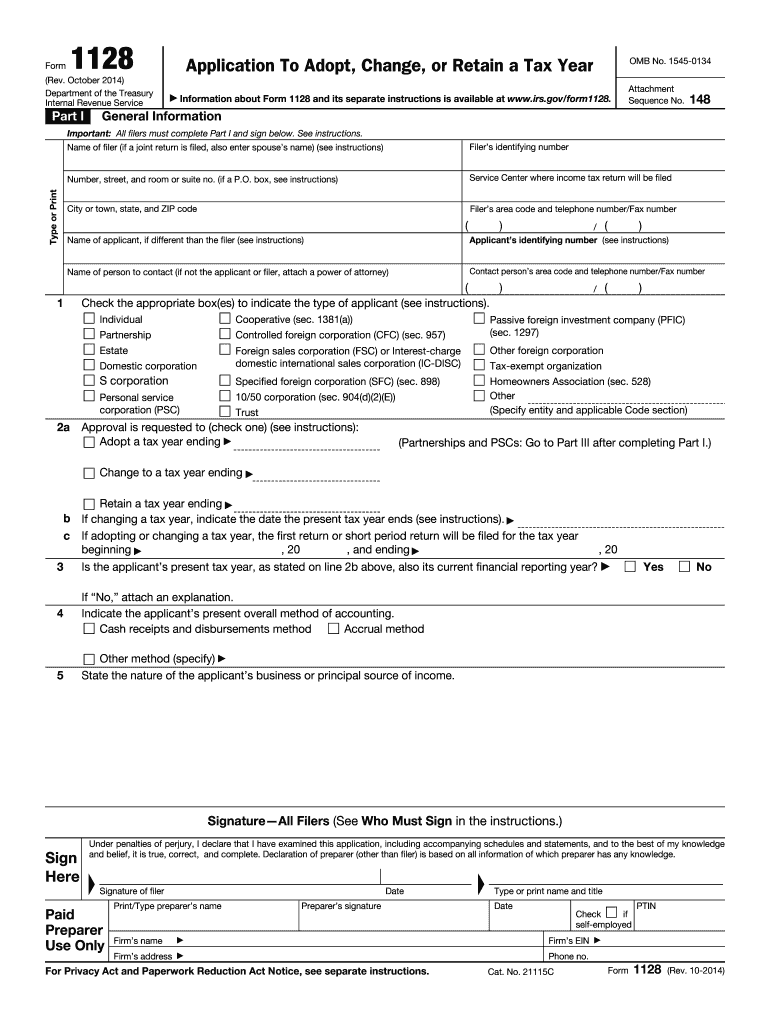

Form 1128 Instructions - Internal revenue service check the appropriate box(es) to indicate the type of applicant that is filing this form (see page 2 of the instructions). Web file form 1128 to request a change in tax year. Partnerships, s corporations, personal service corporations (pscs), or trusts may be required to file form 1128 to adopt or retain a certain tax year. Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. If the form does not have a valid signature, it will not be considered. Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Part ii is used for an automatic approval request. Web information about form 1128 and its separate instructions is available at. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent

Partnerships, s corporations, personal service corporations (pscs), or trusts may be required to file form 1128 to adopt or retain a certain tax year. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. Internal revenue service check the appropriate box(es) to indicate the type of applicant that is filing this form (see page 2 of the instructions). In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent The common parent of a consolidated group that files a consolidated return files one form 1128 for the consolidated group. A valid signature by the individual or an officer of the organization is required on form 1128. Web file form 1128 to request a change in tax year. Bank payment problem identification 1209 07/17/2012 form 8328: Web file form 1128 with: Web a tax year, you must file form 1128 by the 75th day of the beginning of the tax year that you want to retain.

Web file form 1128 with: Carryforward election of unused private activity bond volume cap 0822 09/01/2022 form 15028 All filers must complete part i. Web information about form 1128 and its separate instructions is available at. Web file form 1128 to request a change in tax year. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. A valid signature by the individual or an officer of the organization is required on form 1128. In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change. Internal revenue service check the appropriate box(es) to indicate the type of applicant that is filing this form (see page 2 of the instructions).

3.13.222 BMF Entity Unpostable Correction Procedures Internal Revenue

All filers must complete part i. If the form does not have a valid signature, it will not be considered. Web information about form 1128 and its separate instructions is available at. Web file form 1128 to request a change in tax year. Where the applicant's income tax return is filed.

Form C23 (BWC1128) Download Printable PDF or Fill Online Notice to

Part ii is used for an automatic approval request. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Bank payment problem identification 1209 07/17/2012 form 8328: Late applications.—if you.

Instructions For Form 1128 Application To Adopt, Change, Or Retain A

Carryforward election of unused private activity bond volume cap 0822 09/01/2022 form 15028 All filers must complete part i. Web information about form 1128 and its separate instructions is available at. Where the applicant's income tax return is filed. Web file form 1128 to request a change in tax year.

Form 1128 Application to Adopt, Change or Retain a Tax Year(2014

Carryforward election of unused private activity bond volume cap 0822 09/01/2022 form 15028 If this application is for a husband and wife, enter both names on the line, “applicant's name.” Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. The common parent of a consolidated group that files a consolidated return files one form.

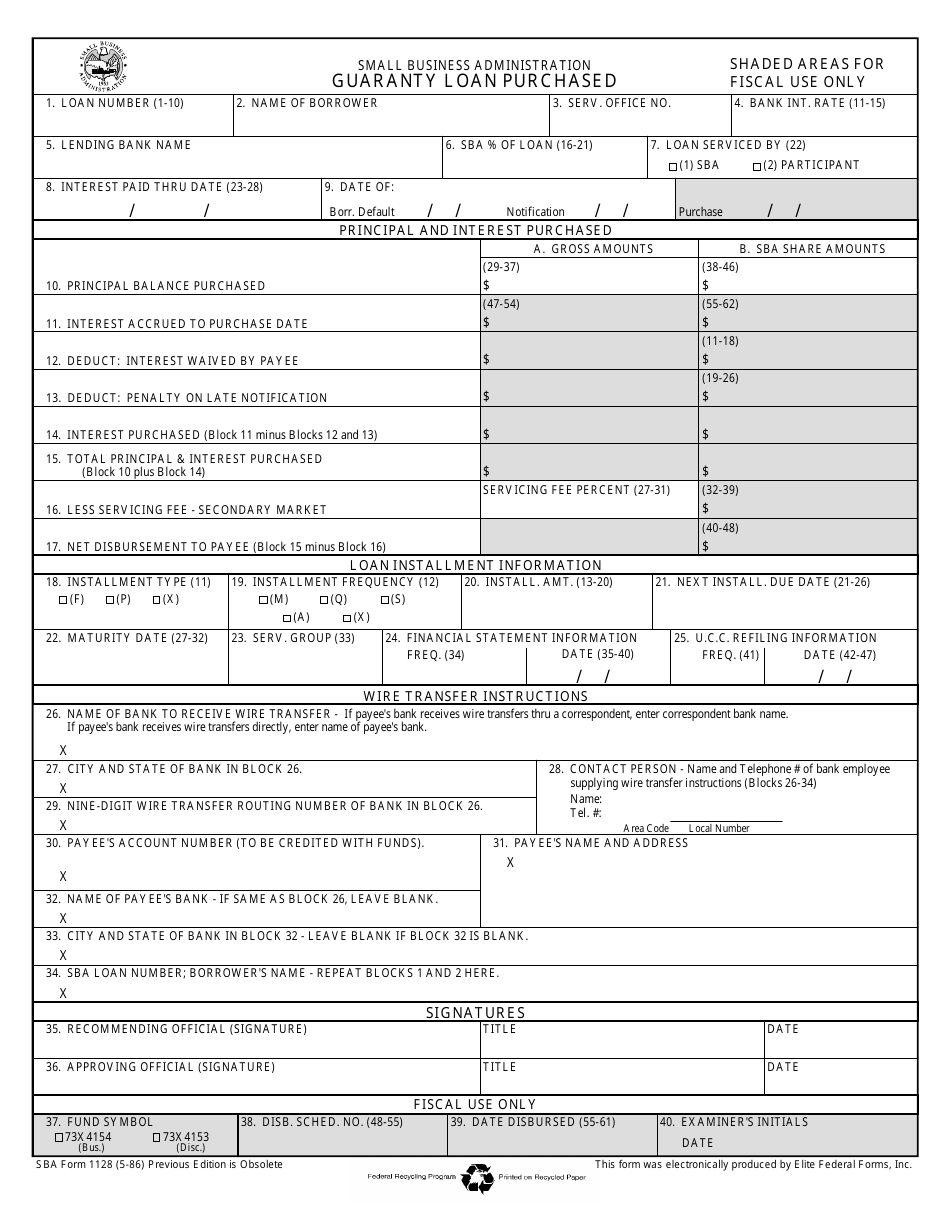

SBA Form 1128 Download Fillable PDF or Fill Online Guaranty Loan

A valid signature by the individual or an officer of the organization is required on form 1128. Web form 1128 application to adopt, change, or retain a tax year (rev. Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287: Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Web file.

Tax credit screening on job application

Bank payment problem identification 1209 07/17/2012 form 8328: Web a tax year, you must file form 1128 by the 75th day of the beginning of the tax year that you want to retain. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. Web generally,.

LASKO 1128 INSTRUCTIONS Pdf Download ManualsLib

Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287: If the form does not have a valid signature, it will not be considered. Form 1128 is used to request a change in tax year, and to adopt or retain a certain.

Form 1128 Fill Out and Sign Printable PDF Template signNow

Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change. Form 1128 is used to request a change in.

Instructions for Form 1128 (Rev. January 2008)

Web file form 1128 to request a change in tax year. Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Web information about form 1128 and its separate instructions is available at. If the form does not have a valid signature, it will not be considered. Carryforward election of unused private activity bond volume.

Instructions For Form 1128 Application To Adopt, Change, Or Retain A

Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287: Web form 1128 application to adopt, change, or retain a tax year (rev. The common parent of a consolidated group that files a consolidated return files one form 1128 for the consolidated group. Web information about form 1128, application to adopt, change or retain a tax year,.

Web Generally, Taxpayers Must File Form 1128 To Adopt, Change, Or Retain A Tax Year.

Bank payment problem identification 1209 07/17/2012 form 8328: If this application is for a husband and wife, enter both names on the line, “applicant's name.” Form 1128 is used to request a change in tax year, and to adopt or retain a certain tax year (partnerships, s corporations, or personal service corporations). A valid signature by the individual or an officer of the organization is required on form 1128.

Carryforward Election Of Unused Private Activity Bond Volume Cap 0822 09/01/2022 Form 15028

Web a tax year, you must file form 1128 by the 75th day of the beginning of the tax year that you want to retain. Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. Web information about form 1128 and its separate instructions is available at. Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287:

Web File Form 1128 To Request A Change In Tax Year.

Web file form 1128 with: If the form does not have a valid signature, it will not be considered. Partnerships, s corporations, personal service corporations (pscs), or trusts may be required to file form 1128 to adopt or retain a certain tax year. Part ii is used for an automatic approval request.

Web Form 1128 Must Be Signed By The Applicant As Discussed Below.

All filers must complete part i. The common parent of a consolidated group that files a consolidated return files one form 1128 for the consolidated group. The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file.