Form 1120-F Due Date

Form 1120-F Due Date - How to create an electronic signature for putting it on the f 1120 in gmail. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; Who must use this form? Due to the fact that. For example, for a taxpayer with a tax year that ends. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. If the corporation has premises in the us,. Florida corporate income tax return filing dates. This form is to be used by a foreign corporation that has income that is. If the due date falls on a saturday, sunday, or legal holiday, the.

How to create an electronic signature for putting it on the f 1120 in gmail. Due dates for declaration of estimated tax. Web home forms and instructions about form 1120, u.s. Report their income, gains, losses, deductions,. Due to the fact that. If the due date falls on a saturday, sunday, or legal holiday, the. If a foreign corporation maintains a fixed. Income tax liability of a foreign corporation. If the due date falls on a saturday,. Web a corporation that has dissolved must generally file by the 15th day of the fourth month after the date it dissolved.

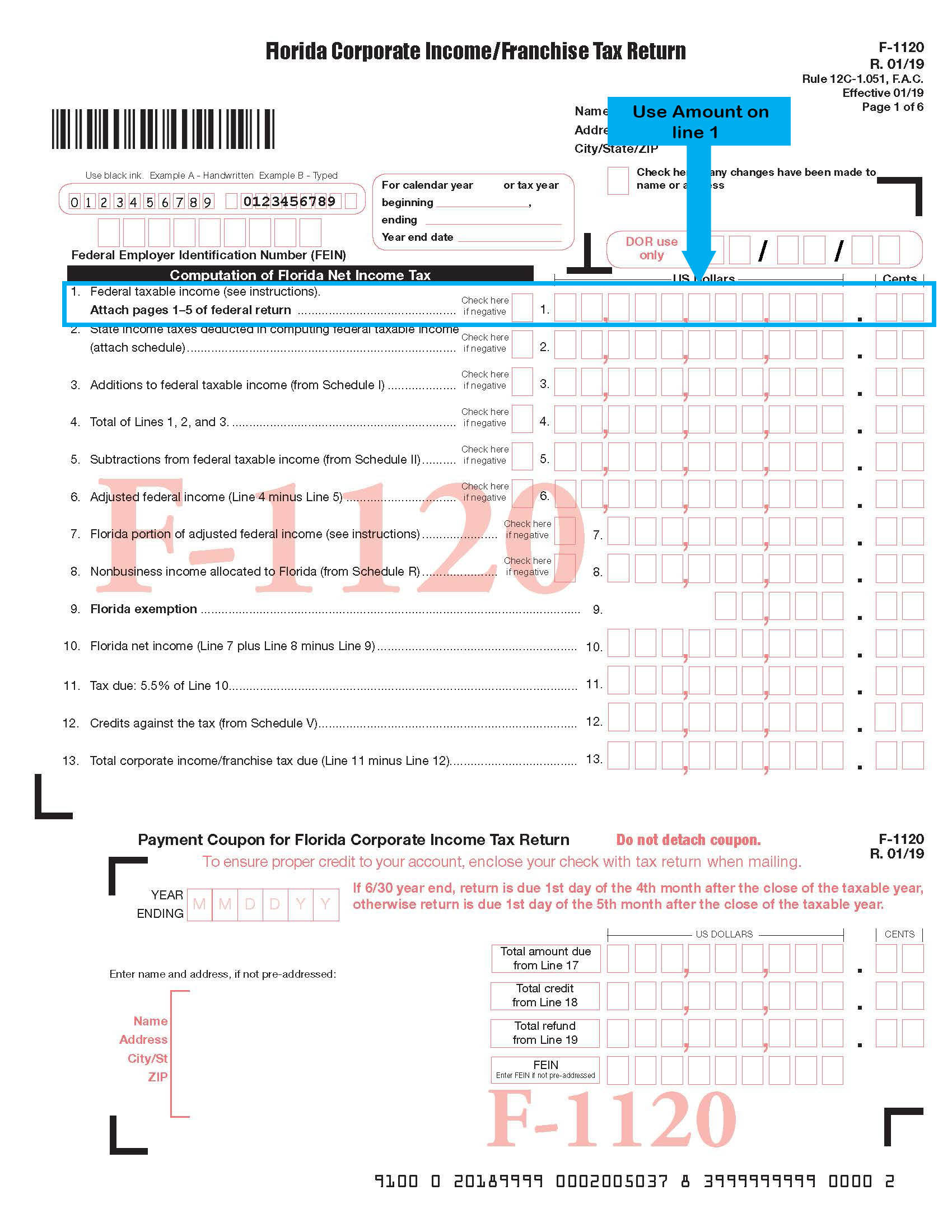

How to create an electronic signature for putting it on the f 1120 in gmail. If the corporation has premises in the us,. Report their income, gains, losses, deductions,. Florida corporate income tax return filing dates. This form is to be used by a foreign corporation that has income that is. If a foreign corporation maintains a fixed. If the due date falls on a saturday,. Income tax liability of a foreign corporation. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; Web a corporation that has dissolved must generally file by the 15th day of the fourth month after the date it dissolved.

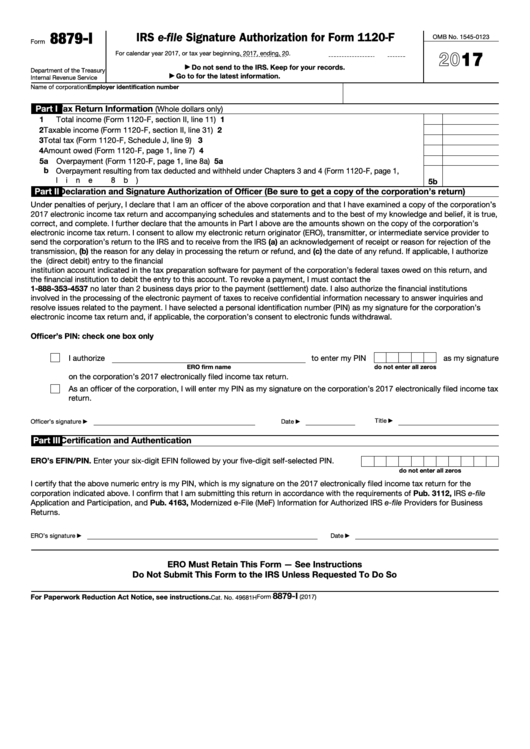

Fill Free fillable IRS efile Signature Authorization for Form 1120F

Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. Due dates for declaration of estimated tax. If the due date falls on a saturday, sunday, or legal holiday, the. Web for all other tax year endings, the due.

Fillable Form 8879I Irs EFile Signature Authorization For Form 1120

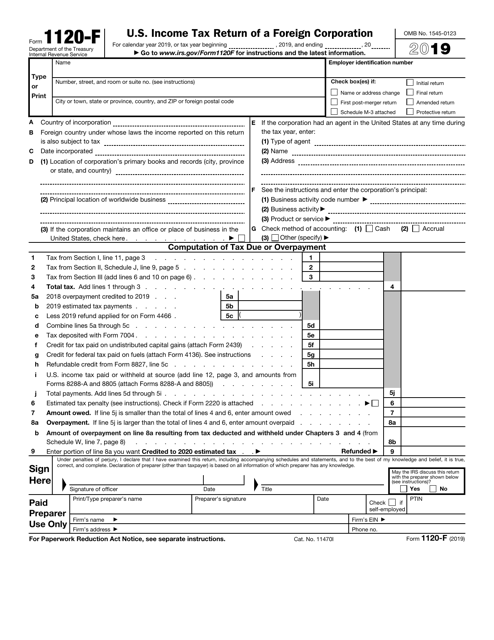

This form is to be used by a foreign corporation that has income that is. If the due date falls on a saturday, sunday, or legal holiday, the. Report their income, gains, losses, deductions,. Florida corporate income tax return filing dates. If the corporation has premises in the us,.

Form 1120F (Schedule S) Exclusion of from International

Web corporate income tax due dates. Due dates for declaration of estimated tax. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; Income tax liability of a foreign corporation. May 31, 2023 tax compliance is a major consideration for any.

Form 1120F (Schedule M3) Net Reconciliation for Foreign

Who must use this form? Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; This form is to be used by a foreign corporation that has income that is. How to create an electronic signature for putting it on the.

Form 1120F U.S. Tax Return of a Foreign Corporation (2014

Report their income, gains, losses, deductions,. If a foreign corporation maintains a fixed. For example, for a taxpayer with a tax year that ends. May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations. This form is to be used by a foreign corporation that has income that is.

Form 1120 Tax Templates Online to Fill in PDF

If the due date falls on a saturday,. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. For example, for a taxpayer with a tax year that ends. Florida corporate income tax return filing dates. May 31, 2023.

IRS Form 1120F Download Fillable PDF or Fill Online U.S. Tax

Web a corporation that has dissolved must generally file by the 15th day of the fourth month after the date it dissolved. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Report their income, gains, losses, deductions,. If the due date.

F 1120 Due Date

Due to the fact that. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. Who must use this form? Due dates for declaration of estimated tax. If the due date falls on a saturday,.

3.11.16 Corporate Tax Returns Internal Revenue Service

For example, for a taxpayer with a tax year that ends. Florida corporate income tax return filing dates. If a foreign corporation maintains a fixed. Report their income, gains, losses, deductions,. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer;

Form 8879I IRS efile Signature Authorization for Form 1120F (2015

Due to the fact that. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. If a foreign corporation maintains a fixed. Who must use this form? This form is to be used by a foreign corporation that has.

If A Foreign Corporation Maintains A Fixed.

Who must use this form? Income tax liability of a foreign corporation. Web a corporation that held a qualified investment in an advanced manufacturing facility that is placed in service after december 31, 2022, can elect to treat the credit for the advanced. This form is to be used by a foreign corporation that has income that is.

Web Home Forms And Instructions About Form 1120, U.s.

If the corporation has premises in the us,. Web corporate income tax due dates. May 31, 2023 tax compliance is a major consideration for any business owner, particularly when dealing with international tax obligations. Florida corporate income tax return filing dates.

Corporation Income Tax Return Domestic Corporations Use This Form To:

How to create an electronic signature for putting it on the f 1120 in gmail. If the due date falls on a saturday, sunday, or legal holiday, the. Web the due dates below reflect due dates relevant to filing tax returns or forms in 2023 with respect to the 2022 tax year (assuming a calendar year taxpayer; You must file a return, even if no tax is due.

If The Due Date Falls On A Saturday,.

Web a corporation that has dissolved must generally file by the 15th day of the fourth month after the date it dissolved. For example, for a taxpayer with a tax year that ends. Web for all other tax year endings, the due date is on or before the first day of the fifth month following the close of the tax year. Due to the fact that.