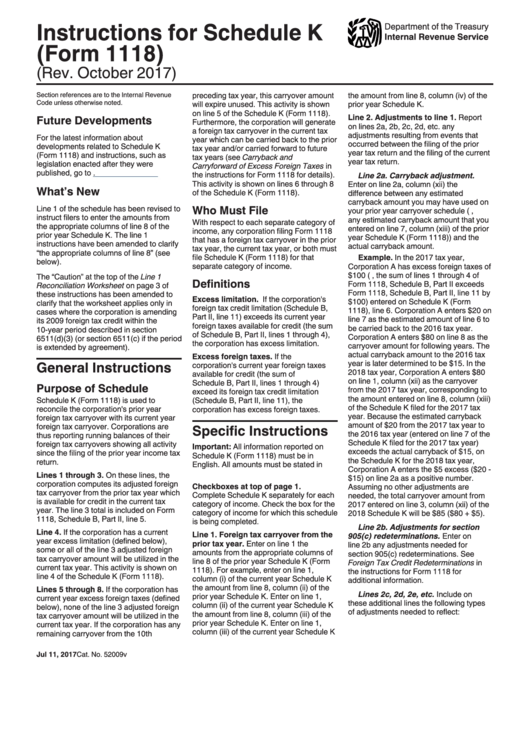

Form 1118 Instructions

Form 1118 Instructions - Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. The irs estimates that it will take about 25 hours to complete. This ensures the proper placement of each item appearing on the irs version. Web see the instructions for form 1118 for the definition of passive income. Corporations use this form to compute their foreign tax credit for certain taxes paid or. Use a separate form 1118 for each applicable category of income (see instructions). That’s because the form is fourteen pages long and requires extensive information about: When to make the election; Any income the corporation owes foreign taxes on; However, if a software program is used, it must be approved by the irs for use in filing substitute forms.

For section 863(b) income, leave column 1(a) blank. Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Corporations use this form to compute their foreign tax credit for certain taxes paid or. However, if a software program is used, it must be approved by the irs for use in filing substitute forms. The irs estimates that it will take about 25 hours to complete. In the separate instructions for form 1118. Web see the instructions for form 1118 for the definition of passive income. Any income the corporation owes foreign taxes on; Who must file any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach form 1118 to This ensures the proper placement of each item appearing on the irs version.

Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. Use a separate form 1118 for each applicable category of income (see instructions). Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. Who must file any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach form 1118 to Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) The irs estimates that it will take about 25 hours to complete. Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. Any income the corporation owes foreign taxes on; Web use form 1118 to compute a foreign tax credit after certain limitations. Web for instructions and the latest information.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. The irs estimates that it will take about 25 hours to.

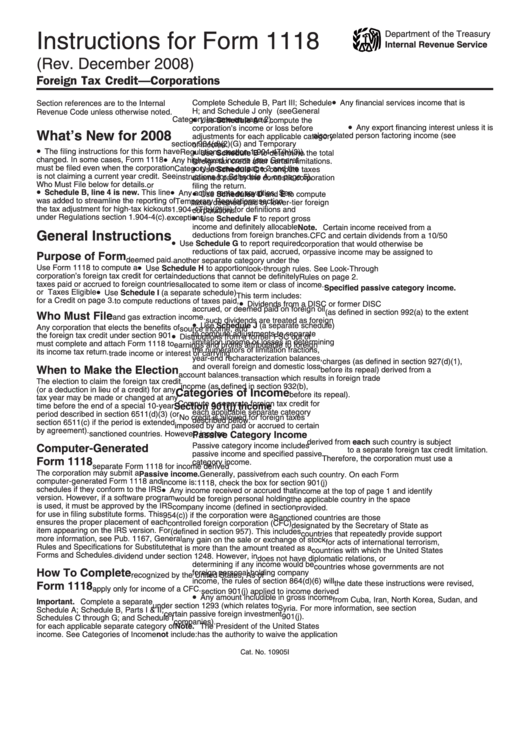

Instructions For Form 1118 Foreign Tax Credit Corporations 2008

This ensures the proper placement of each item appearing on the irs version. Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) The irs estimates that it will take about 25 hours to complete. That’s because the form is fourteen pages long and requires extensive information about: Use a separate form 1118 for each applicable category of income.

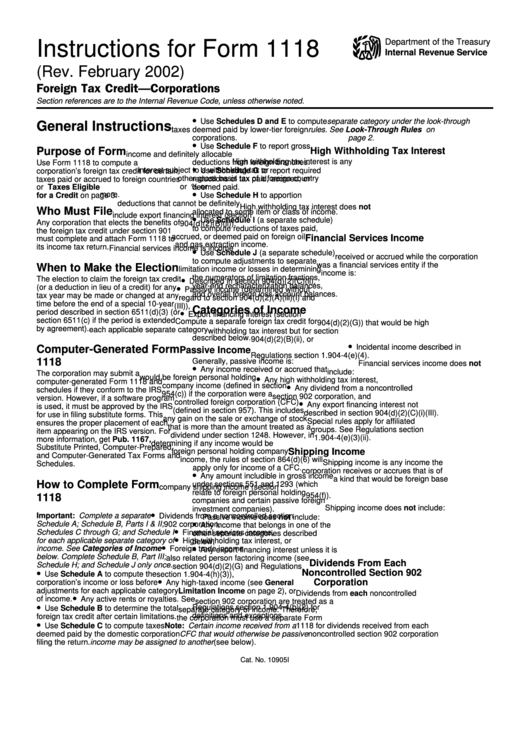

Instructions For Form 1118 Foreign Tax Credit Corporations 2002

For section 863(b) income, leave column 1(a) blank. However, if a software program is used, it must be approved by the irs for use in filing substitute forms. For calendar year 20 , or other tax year beginning , 20 , and ending. Web see the instructions for form 1118 for the definition of passive income. That’s because the form.

Inst 1118Instructions for Form 1118, Foreign Tax Credit Corporatio…

Any income the corporation owes foreign taxes on; Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) The irs estimates that it will take about 25 hours to complete. Corporations use this form to compute their foreign tax credit for certain taxes paid or. Web general instructions purpose of form use form 1118 to compute a corporation's foreign.

Form 1118 Foreign Tax Credit Corporations (2014) Free Download

Corporations use this form to compute their foreign tax credit for certain taxes paid or. For calendar year 20 , or other tax year beginning , 20 , and ending. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. The irs estimates.

Form 1118 (Schedule J) Adjustments to Separate Limitation

Any income the corporation owes foreign taxes on; Web see the instructions for form 1118 for the definition of passive income. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. When to make the election; For section 863(b) income, leave column 1(a).

Download Instructions for IRS Form 1118 Schedule J Adjustments to

The irs estimates that it will take about 25 hours to complete. In the separate instructions for form 1118. Any income the corporation owes foreign taxes on; For calendar year 20 , or other tax year beginning , 20 , and ending. Corporations use this form to compute their foreign tax credit for certain taxes paid or.

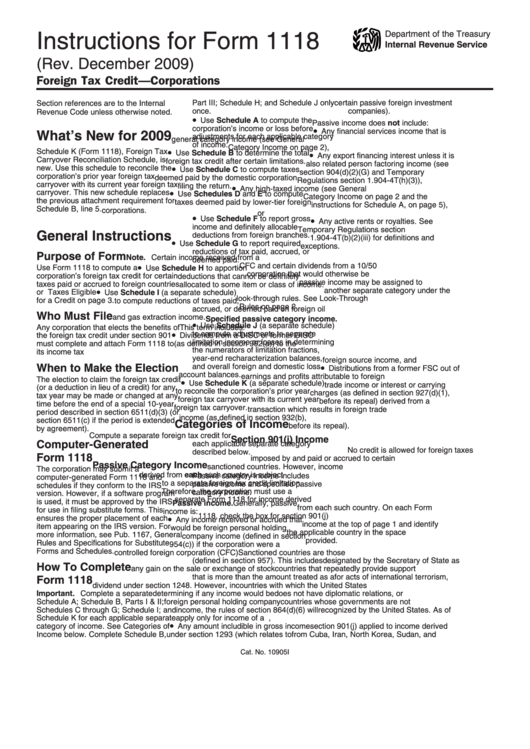

Instructions For Form 1118 (Rev. December 2009) printable pdf download

However, if a software program is used, it must be approved by the irs for use in filing substitute forms. Web use form 1118 to compute a foreign tax credit after certain limitations. Any income the corporation owes foreign taxes on; Web see the instructions for form 1118 for the definition of passive income. Category income on page 2 and.

Demystifying the Form 1118 Part 6. Schedule F1 Determining the Tax

Use a separate form 1118 for each applicable category of income (see instructions). The irs estimates that it will take about 25 hours to complete. Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) For section 863(b) income, leave column 1(a) blank. For information pertaining to the entry of eins and reference id numbers, see :

Top 26 Form 1118 Templates free to download in PDF format

See taxes eligible for a credit, later. Category income on page 2 and the corporation’s foreign tax credit for certain • use schedule c to compute taxes instructions for schedule a, on page 5), taxes paid or accrued to foreign countries deemed paid by the domestic corporation or or u.s. Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111.

Corporations Use This Form To Compute Their Foreign Tax Credit For Certain Taxes Paid Or.

Web for instructions and the latest information. Earned income credit worksheet (cp 09) 0323 01/26/2023 form 15111 (sp) Web schedule l (form 1118) is used to identify foreign tax redeterminations that occur in the current tax year in each separate category, the years to which they relate, and other information that satisfies the taxpayer’s obligation to notify the irs of foreign tax redeterminations related to prior years. For information pertaining to the entry of eins and reference id numbers, see :

When To Make The Election;

Web use form 1118 to compute a foreign tax credit after certain limitations. The irs estimates that it will take about 25 hours to complete. Web general instructions purpose of form use form 1118 to compute a corporation's foreign tax credit for certain taxes paid or accrued to foreign countries or u.s. Any income the corporation owes foreign taxes on;

Web See The Instructions For Form 1118 For The Definition Of Passive Income.

See taxes eligible for a credit, later. For calendar year 20 , or other tax year beginning , 20 , and ending. Use a separate form 1118 for each applicable category of income (see instructions). However, if a software program is used, it must be approved by the irs for use in filing substitute forms.

Category Income On Page 2 And The Corporation’s Foreign Tax Credit For Certain • Use Schedule C To Compute Taxes Instructions For Schedule A, On Page 5), Taxes Paid Or Accrued To Foreign Countries Deemed Paid By The Domestic Corporation Or Or U.s.

This ensures the proper placement of each item appearing on the irs version. Who must file any corporation that elects the benefits of the foreign tax credit under section 901 must complete and attach form 1118 to In the separate instructions for form 1118. For section 863(b) income, leave column 1(a) blank.