Form 1099-Nec Download

Form 1099-Nec Download - Web what's new for 2021. Click view/edit, and then click find forms. Update quickbooks desktop to the latest release. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Fill in, efile, print, or download forms in pdf format. Upload, modify or create forms. Simply answer a few question to instantly download, print & share your form. Takes 5 minutes or less to complete. Download works with windows 10,. You can complete the form using irs free file or a tax.

However, we can reset the payroll update to check if it's. I'm also adding these guides for. Fill in, efile, print, or download forms in pdf format. Web at the moment, only supported versions of quickbooks desktop can generate and print the form 1099 nec. Web up to $32 cash back for tax year 2022, here are the due dates for each form. Try it for free now! Web what's new for 2021. Download works with windows 10,. Update quickbooks desktop to the latest release. Click view/edit, and then click find forms.

Here's a link for the steps: Click view/edit, and then click find forms. Try it for free now! Do not miss the deadline. Simply answer a few question to instantly download, print & share your form. Web what's new for 2021. Takes 5 minutes or less to complete. Update quickbooks desktop to the latest release. Sign in using the email and password associated with your account. Web this is to ensure you have the latest features and fixes.

Form 1099NEC Requirements, Deadlines, and Penalties eFile360

Update quickbooks desktop to the latest release. New box 2 checkbox (payer made direct sales totaling $5,000 or. Upload, modify or create forms. You can complete the form using irs free file or a tax. Do not miss the deadline.

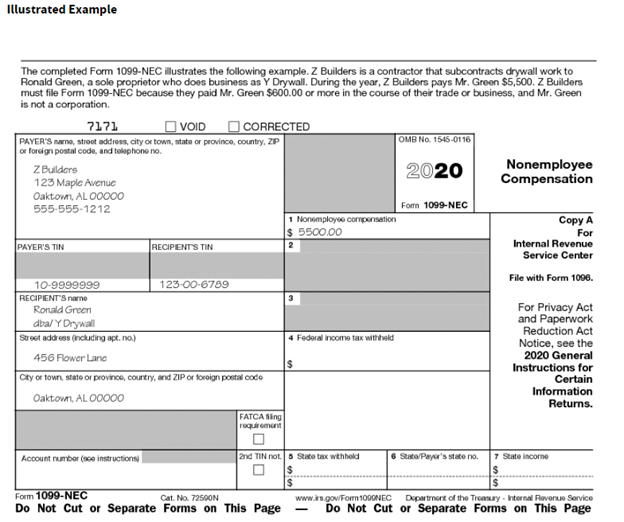

Form 1099MISC vs Form 1099NEC How are they Different?

Takes 5 minutes or less to complete. New box 2 checkbox (payer made direct sales totaling $5,000 or. Upload, modify or create forms. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. However, we can reset.

1099 NEC Form 2022

Web up to $32 cash back for tax year 2022, here are the due dates for each form. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to an attorney, or any amount of. Here's a link for the steps: You can complete.

What the 1099NEC Coming Back Means for your Business Chortek

I'm also adding these guides for. Fill in, efile, print, or download forms in pdf format. Download works with windows 10,. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. Web at the moment, only supported versions of quickbooks desktop can generate and print the form 1099 nec.

Understanding 1099 Form Samples

Takes 5 minutes or less to complete. Fill in, efile, print, or download forms in pdf format. Here's a link for the steps: Do not miss the deadline. Download works with windows 10,.

W9 vs 1099 IRS Forms, Differences, and When to Use Them

Takes 5 minutes or less to complete. Simply answer a few question to instantly download, print & share your form. Update quickbooks desktop to the latest release. Sign in using the email and password associated with your account. Do not miss the deadline.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

However, we can reset the payroll update to check if it's. Fill in, efile, print, or download forms in pdf format. Click view/edit, and then click find forms. Do not miss the deadline. Web report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services, payments to.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. Web at the moment, only supported versions of quickbooks desktop can generate and print the form 1099 nec. Web up to $32 cash back for tax year 2022, here are the due dates for each form. Here's a link for.

Form 1099NEC Instructions and Tax Reporting Guide

Simply answer a few question to instantly download, print & share your form. Web up to $32 cash back for tax year 2022, here are the due dates for each form. Click view/edit, and then click find forms. You can complete the form using irs free file or a tax. Update quickbooks desktop to the latest release.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

Do not miss the deadline. Click view/edit, and then click find forms. Fill in, efile, print, or download forms in pdf format. Sign in using the email and password associated with your account. Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms.

Simply Answer A Few Question To Instantly Download, Print & Share Your Form.

Update quickbooks desktop to the latest release. You can complete the form using irs free file or a tax. Click view/edit, and then click find forms. I'm also adding these guides for.

Web This Is To Ensure You Have The Latest Features And Fixes.

Ad register and subscribe now to work on irs nonemployee compensation & more fillable forms. Do not miss the deadline. However, we can reset the payroll update to check if it's. Upload, modify or create forms.

Web Report Payments Made Of At Least $600 In The Course Of A Trade Or Business To A Person Who's Not An Employee For Services, Payments To An Attorney, Or Any Amount Of.

Sign in using the email and password associated with your account. Web at the moment, only supported versions of quickbooks desktop can generate and print the form 1099 nec. Try it for free now! Fill in, efile, print, or download forms in pdf format.

Download Works With Windows 10,.

New box 2 checkbox (payer made direct sales totaling $5,000 or. Web up to $32 cash back for tax year 2022, here are the due dates for each form. Web what's new for 2021. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website.