Form 1042-S Instructions 2021

Form 1042-S Instructions 2021 - Source income subject to withholding go to. Web thomson reuters tax & accounting. 24 (exempt under section 892) updated: 3 status code 00!$ ch. Foreign tax identification number, if any. On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding. See the instructions for box 7c, later. Web for tax year 2022, please see the 2022 instructions. Upload, modify or create forms. Source income subject to withholding, were released jan.

• chapter 3 exemption code. Web thomson reuters tax & accounting. Complete, edit or print tax forms instantly. Web for tax year 2022, please see the 2022 instructions. Source income subject to withholding, were released jan. Complete, edit or print tax forms instantly. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Forms and instructions at irs.gov, at. Form 1042 is also required to be filed by a. Withholding agent’s global intermediary identification number (giin) 12f.

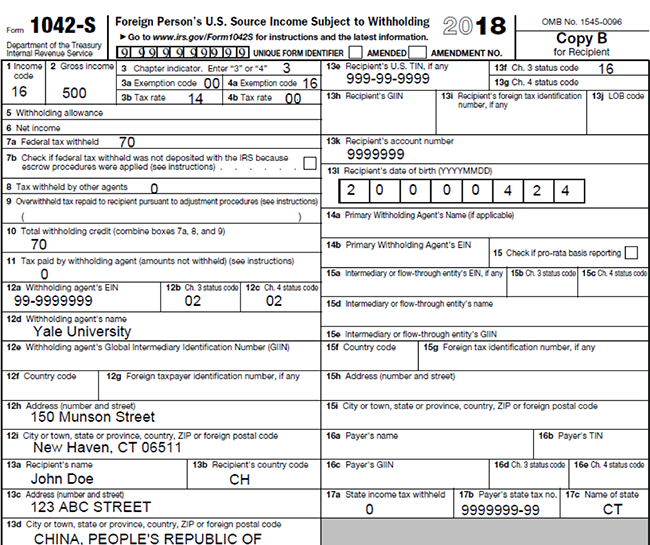

See the instructions for box 7c, later. Web thomson reuters tax & accounting. Source income subject to withholding, including recent updates, related forms, and instructions on how to file. Try it for free now! Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding go to. 3 status code 00!$ ch. Web the document shows the gross income received and any tax withheld (nil to 30%). Source income subject to withholding (pdf) reports amounts paid to foreign persons (including persons presumed. Foreign tax identification number, if any.

1042S Software WorldSharp 1042S Software Features

02 is updated to “exempt under irc.” changed the manner in which. Follow the link to review these new instructions. Complete, edit or print tax forms instantly. Foreign tax identification number, if any. Try it for free now!

1042 S Form Fill Out and Sign Printable PDF Template signNow

Web thomson reuters tax & accounting. Forms and instructions at irs.gov, at. • chapter 3 exemption code. See the instructions for box 7c, later. Withholding agent’s global intermediary identification number (giin) 12f.

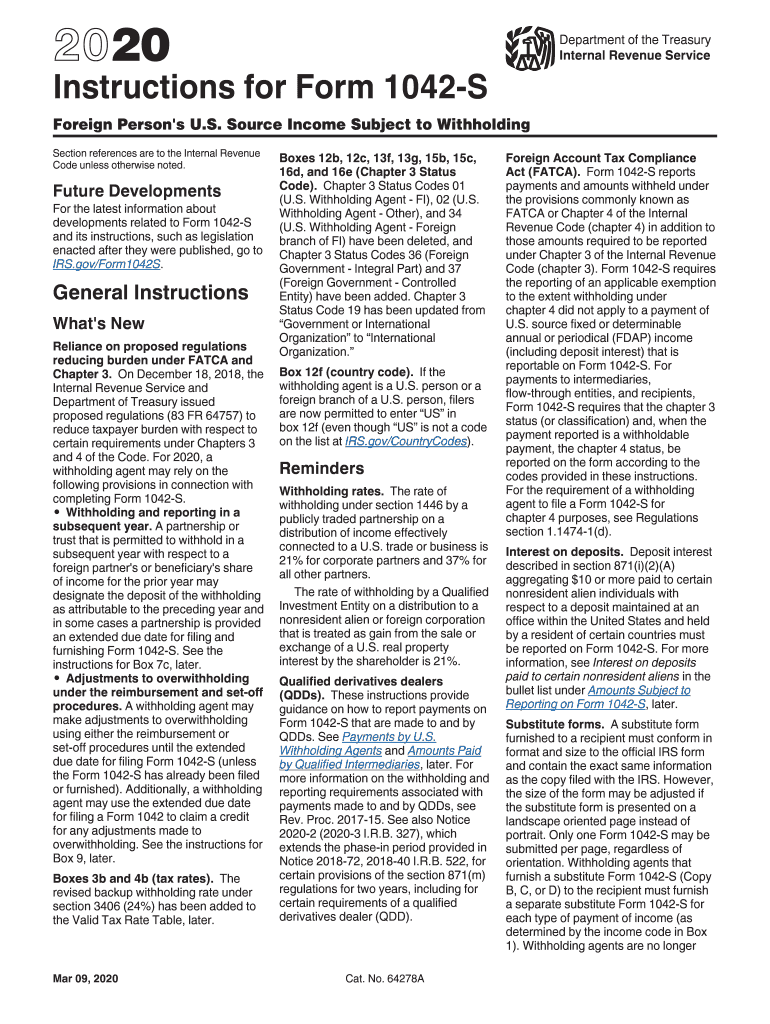

2021 Instructions for Form 1042S

Complete, edit or print tax forms instantly. Try it for free now! Withholding agent’s global intermediary identification number (giin) 12f. See the instructions for box 7c, later. Source income subject to withholding go to.

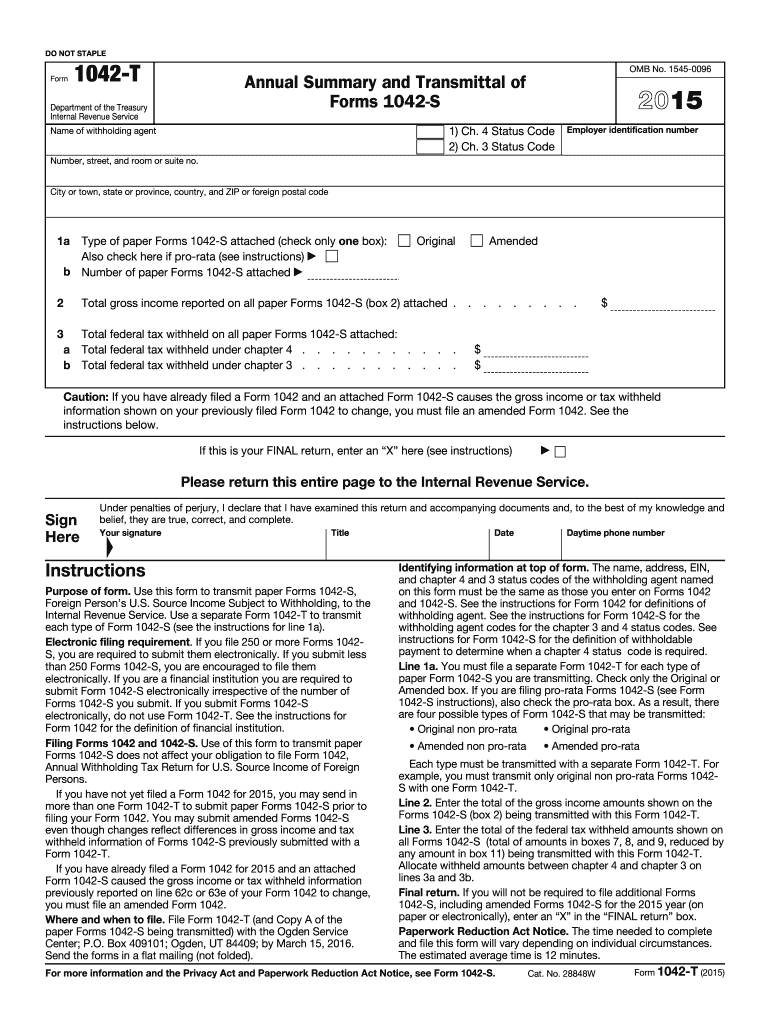

Form 1042 T Annual Summary And Transmittal Of Forms 1042 S Irs Fill

Web for tax year 2022, please see the 2022 instructions. Complete, edit or print tax forms instantly. Foreign tax identification number, if any. Try it for free now! 3 status code 00!$ ch.

Supplemental Instructions Issued for 2019 Form 1042S

Web for tax year 2022, please see the 2022 instructions. Follow the link to review these new instructions. Upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Foreign tax identification number, if any.

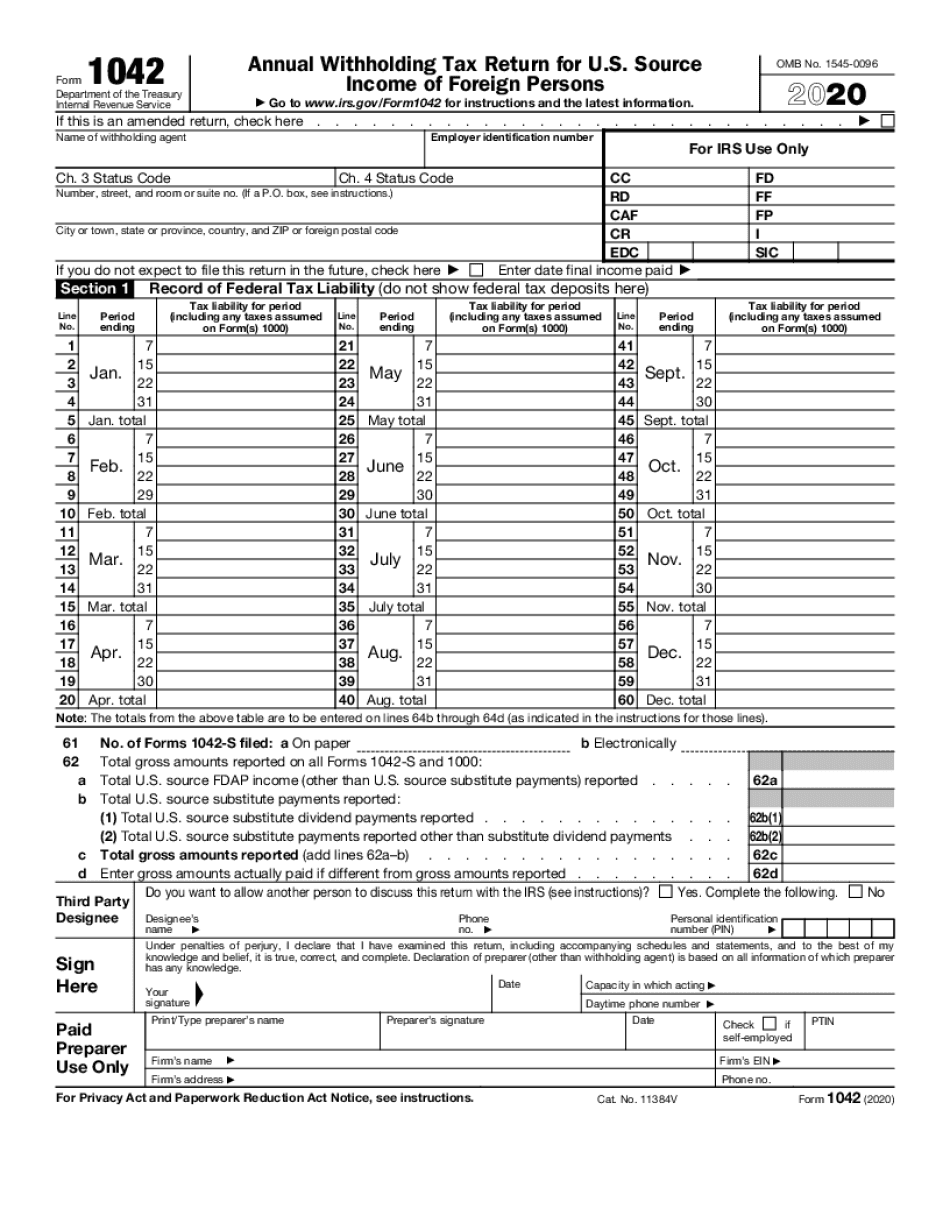

2020 Form 1042 Fill Out and Sign Printable PDF Template signNow

Source income subject to withholding go to. 02 is updated to “exempt under irc.” changed the manner in which. Get ready for tax season deadlines by completing any required tax forms today. Try it for free now! 3 status code 00!$ ch.

Form 1042 s instructions United States guide User Examples

Web the document shows the gross income received and any tax withheld (nil to 30%). 24 (exempt under section 892) updated: On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding. • chapter 3 exemption code. Form 1042 is also required to be filed by a.

2016 Instructions for Form 1042S Fill out & sign online DocHub

On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding. Upload, modify or create forms. 24 (exempt under section 892) updated: Complete, edit or print tax forms instantly. Follow the link to review these new instructions.

Form 1042T Annual Summary and Transmittal of Forms 1042S (2015

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Source income subject to withholding go to. Web thomson reuters tax & accounting. 3 status code 00!$ ch.

Upload, Modify Or Create Forms.

Web for tax year 2022, please see the 2022 instructions. Web thomson reuters tax & accounting. Web the document shows the gross income received and any tax withheld (nil to 30%). Withholding agent’s global intermediary identification number (giin) 12f.

Foreign Tax Identification Number, If Any.

Source income subject to withholding go to. 15 by the internal revenue service. Follow the link to review these new instructions. 24 (exempt under section 892) updated:

Complete, Edit Or Print Tax Forms Instantly.

Forms and instructions at irs.gov, at. Get ready for tax season deadlines by completing any required tax forms today. 3 status code 00!$ ch. • chapter 3 exemption code.

Source Income Subject To Withholding (Pdf) Reports Amounts Paid To Foreign Persons (Including Persons Presumed.

Try it for free now! On its website, irs has updated its general frequently asked questions (faqs) about the obligations of fatca withholding. Source income subject to withholding, were released jan. Source income subject to withholding, including recent updates, related forms, and instructions on how to file.