Form 1042 2022

Form 1042 2022 - Web by admin | nov 7, 2022 | blog. This form will identify you, the gross amount of. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web use form 1042 to report the following: Web both nonresident withholding forms must be filed by march 15 of the following year. Web 1042 filing requirements. Source income of foreign persons, are due on march 15, 2022. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Web get federal tax return forms and file by mail. Complete, edit or print tax forms instantly.

This form will identify you, the gross amount of. Source income subject to withholding). You can file to report a recipient tax withheld by your withholding agent. This form, which is necessary to. Get paper copies of federal and state tax forms, their instructions, and the address for mailing them. Source income subject to withholding) for your 2022 tax filing. Web by admin | nov 7, 2022 | blog. Complete, edit or print tax forms instantly. Web use form 1042 to report the following: Use this form to transmit paper.

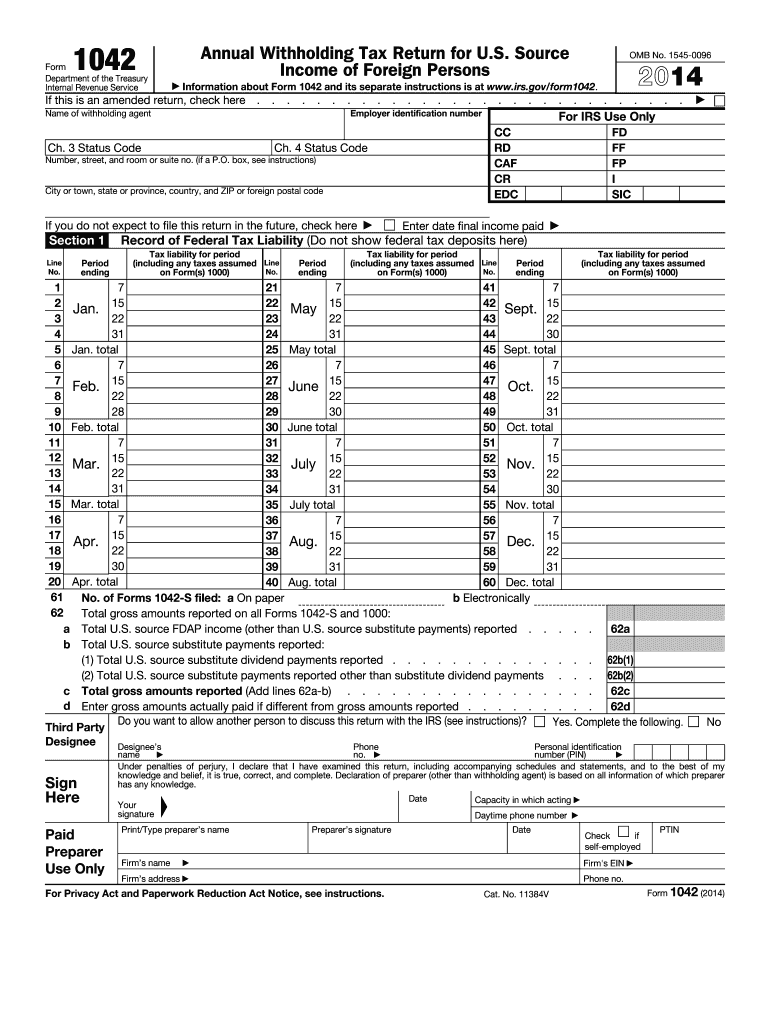

Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Source income of foreign persons; Source income subject to withholding to assess penalties and to send out notices for incorrectly filed forms 1042. You can file to report a recipient tax withheld by your withholding agent. Use this form to transmit paper. Get ready for tax season deadlines by completing any required tax forms today. Web both nonresident withholding forms must be filed by march 15 of the following year. Source income of foreign persons, are due on march 15, 2022. Web use form 1042 to report the following.

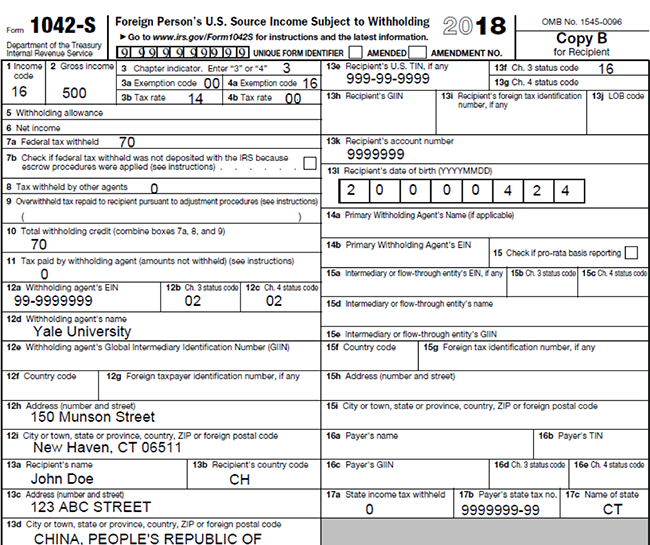

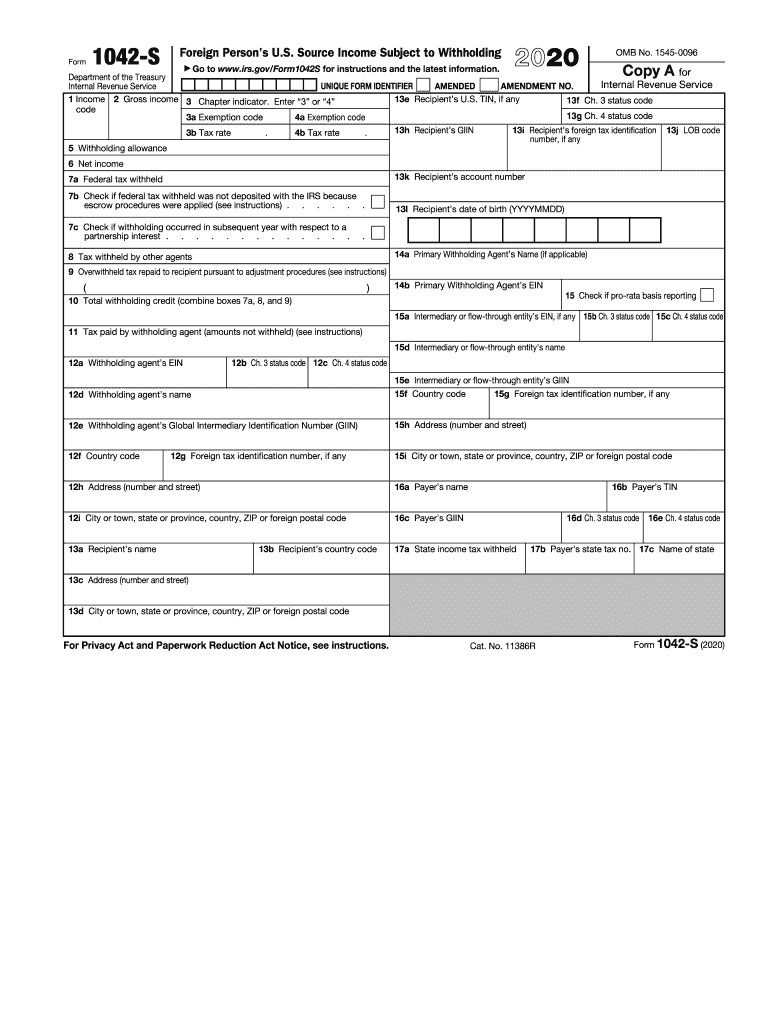

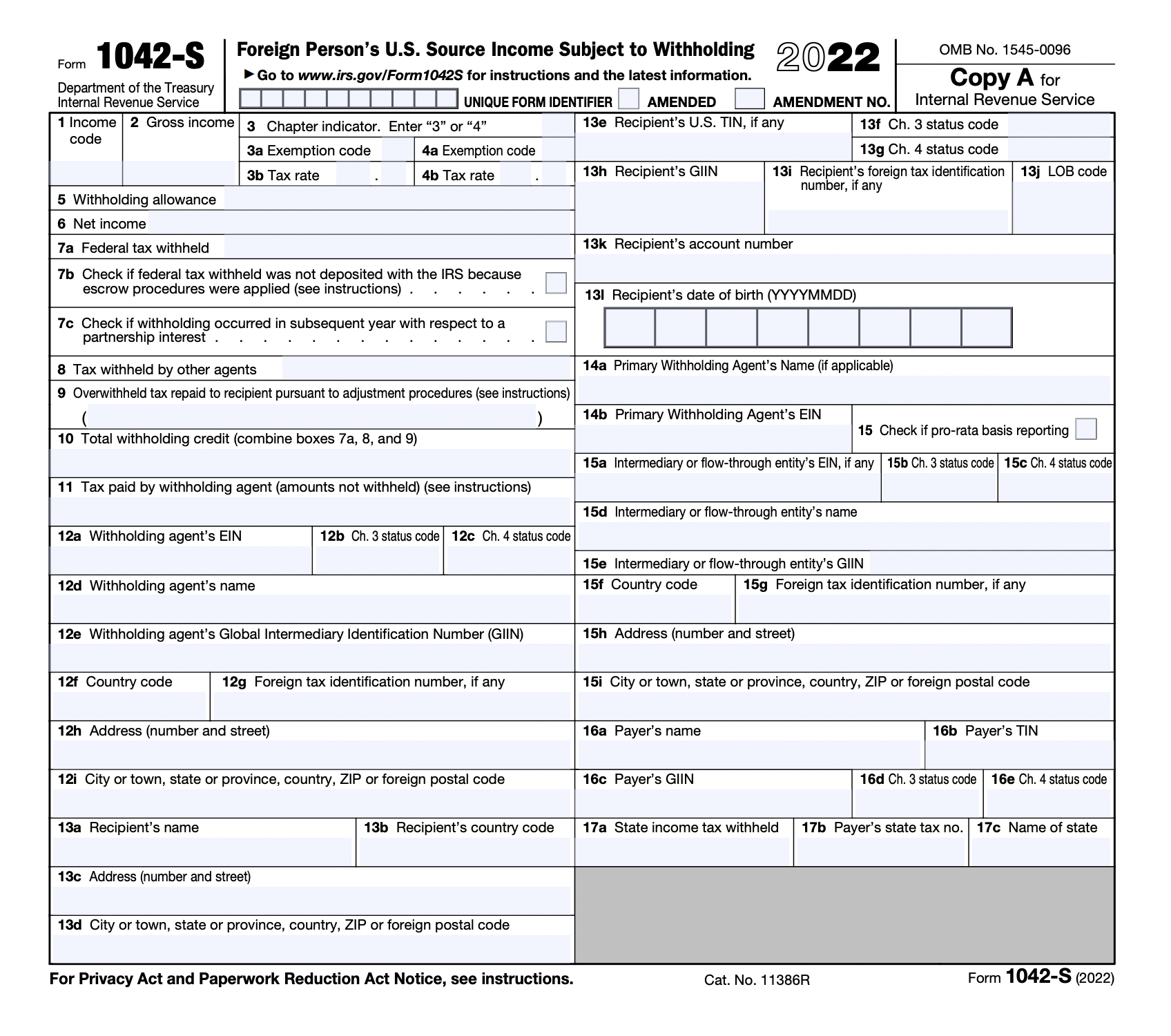

1042 S Form slideshare

Web get federal tax return forms and file by mail. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. You must file if the following applies: Get ready for tax season deadlines by completing any required tax forms today. Web use form 1042 to report the following.

Form 1042S It's Your Yale

This form, which is necessary to. Use this form to transmit paper. You can file to report a recipient tax withheld by your withholding agent. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding) for your 2022 tax filing.

2014 form 1042 Fill out & sign online DocHub

Web use form 1042 to report the following: Source income subject to withholding). Web 1042 filing requirements. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

Web by admin | nov 7, 2022 | blog. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Source income of foreign persons; Web 1042 form is one of the forms that you need to file as a foreigner working in the united states. This form will identify you, the gross.

What Is Form 1042 and What Is It Used For?

Source income of foreign persons, are due on march 15, 2022. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web use form 1042 to report the following. Web 1042 filing requirements. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign.

Tax Information · Career Training USA · InterExchange

Get ready for tax season deadlines by completing any required tax forms today. Web 1042 form is one of the forms that you need to file as a foreigner working in the united states. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income. Source income subject to withholding to.

2022 Master Guide to Form 1042S Compliance Institute of Finance

Get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons go to www.irs.gov/form1042 for. Web both nonresident withholding forms must be filed by march 15 of the following year. You must file if the following applies: Source income of foreign persons, are due on march 15, 2022.

1042 Fill out & sign online DocHub

Complete, edit or print tax forms instantly. Web forms 1042, annual withholding tax return for u.s. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. This form, which is necessary to. Web by admin | nov 7, 2022 | blog.

Actualizar 76+ imagen can you issue a 1099 to a non us citizen Ecover.mx

Web both nonresident withholding forms must be filed by march 15 of the following year. Source income of foreign persons; Source income of foreign persons, common errors on form 1042 and. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year.

[ベスト] tr570 instructions 705117Tr 570 instructions gasaktuntasneaa

Source income of foreign persons, are due on march 15, 2022. Web a partnership or trust that is permitted to withhold in a subsequent year with respect to a foreign partner's or beneficiary's share of income for the prior year may designate the. Use this form to transmit paper. Web 1042 form is one of the forms that you need.

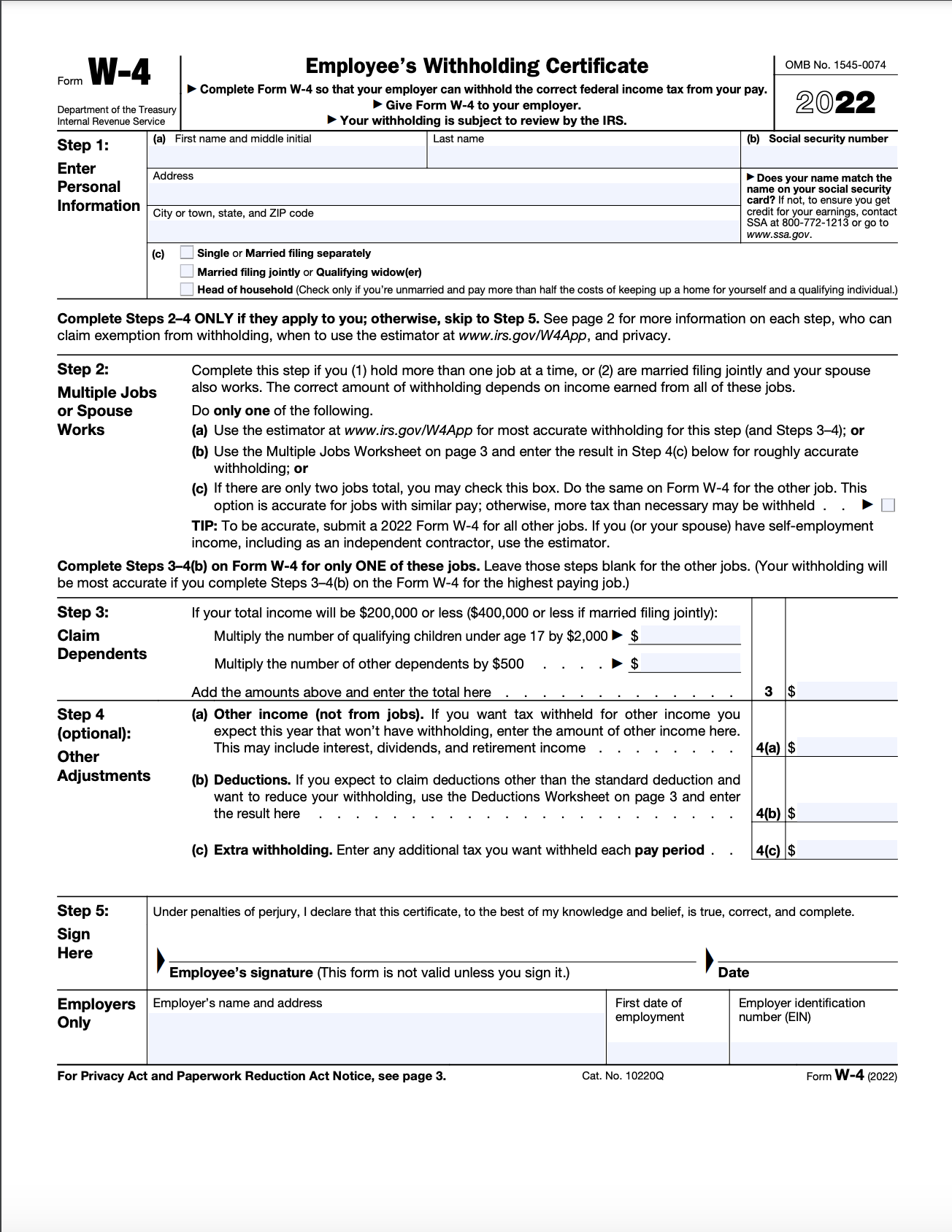

Web 1042 Form Is One Of The Forms That You Need To File As A Foreigner Working In The United States.

Web forms 1042, annual withholding tax return for u.s. Source income of foreign persons go to www.irs.gov/form1042 for. Source income subject to withholding). You must file if the following applies:

Get Paper Copies Of Federal And State Tax Forms, Their Instructions, And The Address For Mailing Them.

Web both nonresident withholding forms must be filed by march 15 of the following year. Use this form to transmit paper. Web form 1042 — annual withholding tax return for u.s. Source income of foreign persons, are due on march 15, 2022.

Source Income Subject To Withholding To Assess Penalties And To Send Out Notices For Incorrectly Filed Forms 1042.

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign. Web by admin | nov 7, 2022 | blog. Web 1042 filing requirements. The tax withheld under chapter 3 (excluding withholding under sections 1445 and 1446 except as indicated below) on certain income.

Complete, Edit Or Print Tax Forms Instantly.

Web get federal tax return forms and file by mail. Web use form 1042 to report the following: Get ready for tax season deadlines by completing any required tax forms today. Source income of foreign persons, common errors on form 1042 and.

![[ベスト] tr570 instructions 705117Tr 570 instructions gasaktuntasneaa](https://www.irs.gov/pub/xml_bc/34025766.gif)