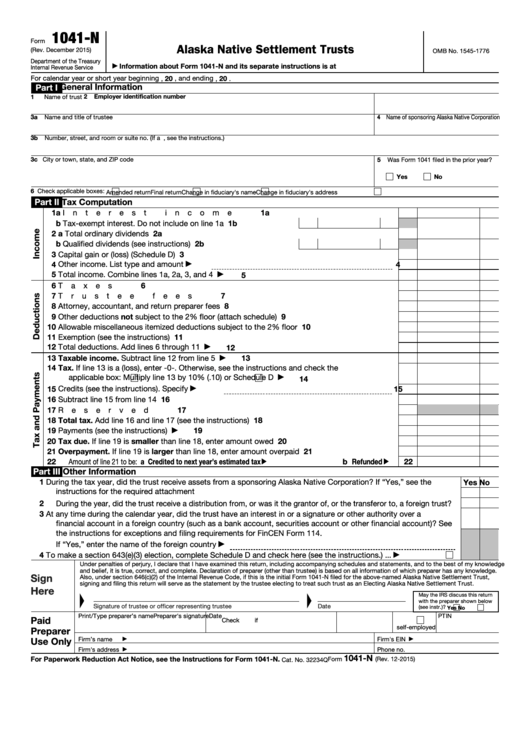

Form 1041 N

Form 1041 N - If you are located in. 2022 nebraska fiduciary income tax return, with schedules i, ii, and. 5/17/2022 for the calendar year or 15th day of the 5th. Income tax return for electing alaska native settlement trusts, to make the election. Ad access irs tax forms. Web get your form 1041 n, complete, edit, and sign it online. Complete, edit or print tax forms instantly. Web the income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Use your indications to submit established track record areas. Schedules i, ii, and iii;

Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year 2022 beginning , 2022 and ending , 20. And you are enclosing a check or money order. And you are not enclosing a check or money order. Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year 2020 beginning , 2020 and ending , 20. Web correction to the instructions for form 941 (rev. Web get your form 1041 n, complete, edit, and sign it online. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Income tax return for estates and trusts. Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2021 through december 31, 2021 or other taxable year 2021 beginning , 2021 and ending , 20.

Web 5/17/2021 for the calendar year or 15th day of the 5th month following the end of the organization’s taxable year. Web get your form 1041 n, complete, edit, and sign it online. Complete, edit or print tax forms instantly. Use your indications to submit established track record areas. Get ready for tax season deadlines by completing any required tax forms today. If you are located in. On the site with all the document, click on begin immediately along with complete for the editor. Web correction to the instructions for form 941 (rev. Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2021 through december 31, 2021 or other taxable year 2021 beginning , 2021 and ending , 20. And you are enclosing a check or money order.

2005 Form IRS 1041N Fill Online, Printable, Fillable, Blank pdfFiller

Ad access irs tax forms. And you are not enclosing a check or money order. Web the income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. 2022 nebraska fiduciary income tax return, with schedules i, ii, and. Any income tax liability of the estate or trust.

form 1041 Alternative Minimum Tax Tax Deduction

Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2020 through december 31, 2020 or other taxable year 2020 beginning , 2020 and ending , 20. Web correction to the instructions for form 941 (rev. Any income tax liability of the estate or trust. Web nebraska fiduciary income tax return form 1041n for the taxable.

Form 1041N U.S. Tax Return for Electing Alaska Native

Income tax return for electing alaska native settlement trusts, to make the election. If you are located in. Web correction to the instructions for form 941 (rev. Web form 1041 department of the treasury—internal revenue service. Schedules i, ii, and iii;

Form 1041 filing instructions

Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year 2022 beginning , 2022 and ending , 20. Web 5/17/2021 for the calendar year or 15th day of the 5th month following the end of the organization’s taxable year. Income tax return for electing alaska native settlement.

Fillable Form 1041N U.s. Tax Return For Electing Alaska

2022 nebraska fiduciary income tax return, with schedules i, ii, and. On the site with all the document, click on begin immediately along with complete for the editor. Web the income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Any income tax liability of the estate or trust. Income tax return for estates.

3.11.14 Tax Returns for Estates and Trusts (Forms 1041, 1041QFT

Schedules i, ii, and iii; Use your indications to submit established track record areas. Income tax return for electing alaska native settlement trusts, to make the election. 2022 nebraska fiduciary income tax return, with schedules i, ii, and. Ad access irs tax forms.

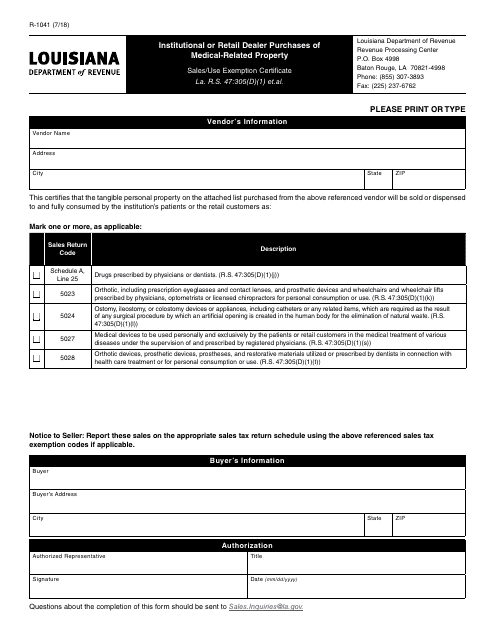

Form R1041 Download Fillable PDF or Fill Online Institutional or

Web get your form 1041 n, complete, edit, and sign it online. Web correction to the instructions for form 941 (rev. Schedules i, ii, and iii; 2022 nebraska fiduciary income tax return, with schedules i, ii, and. On the site with all the document, click on begin immediately along with complete for the editor.

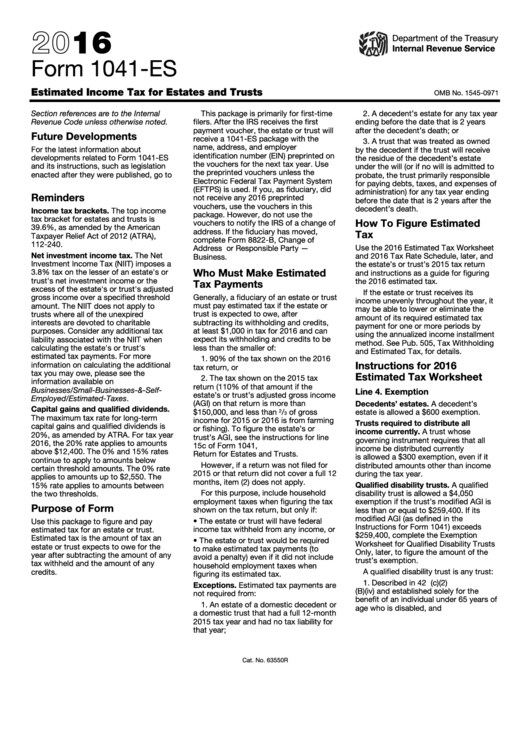

Fillable Form 1041Es Estimated Tax For Estates And Trusts

If you are located in. On the site with all the document, click on begin immediately along with complete for the editor. Ad access irs tax forms. And you are not enclosing a check or money order. And you are enclosing a check or money order.

Form 1041N U.S. Tax Return for Electing Alaska Native Settle…

Schedules i, ii, and iii; Complete, edit or print tax forms instantly. 5/17/2022 for the calendar year or 15th day of the 5th. Web 5/17/2021 for the calendar year or 15th day of the 5th month following the end of the organization’s taxable year. Web the income that is either accumulated or held for future distribution or distributed currently to.

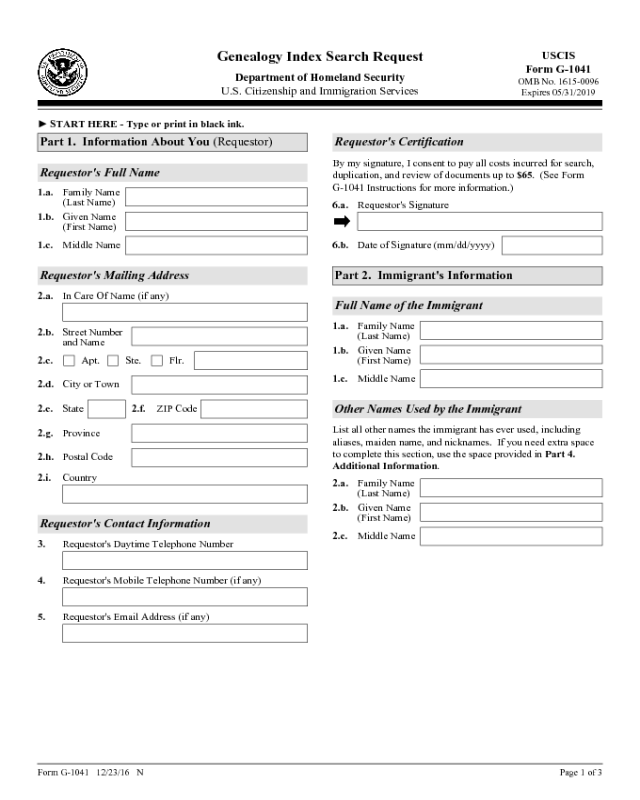

Form G1041 Edit, Fill, Sign Online Handypdf

Income tax return for electing alaska native settlement trusts, to make the election. Complete, edit or print tax forms instantly. Income tax return for estates and trusts. If you are located in. Use your indications to submit established track record areas.

Income Tax Return For Electing Alaska Native Settlement Trusts, To Make The Election.

Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2021 through december 31, 2021 or other taxable year 2021 beginning , 2021 and ending , 20. Web the income that is either accumulated or held for future distribution or distributed currently to the beneficiaries. Use your indications to submit established track record areas. Any income tax liability of the estate or trust.

And You Are Not Enclosing A Check Or Money Order.

Web 5/17/2021 for the calendar year or 15th day of the 5th month following the end of the organization’s taxable year. Get ready for tax season deadlines by completing any required tax forms today. Web nebraska fiduciary income tax return form 1041n for the taxable year january 1, 2022 through december 31, 2022 or other taxable year 2022 beginning , 2022 and ending , 20. On the site with all the document, click on begin immediately along with complete for the editor.

Income Tax Return For Estates And Trusts.

Complete, edit or print tax forms instantly. Web get your form 1041 n, complete, edit, and sign it online. 5/17/2022 for the calendar year or 15th day of the 5th. If you are located in.

And You Are Enclosing A Check Or Money Order.

Ad access irs tax forms. Web correction to the instructions for form 941 (rev. 2022 nebraska fiduciary income tax return, with schedules i, ii, and. Web form 1041 department of the treasury—internal revenue service.